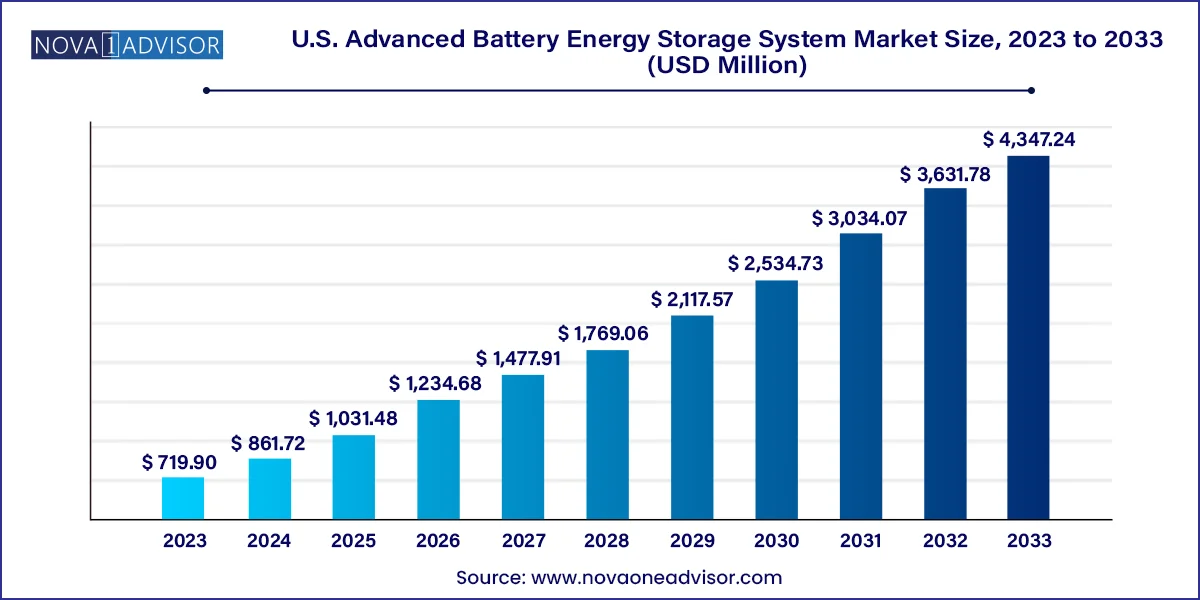

The U.S. advanced battery energy storage system market size was valued at USD 719.90 million in 2023 and is anticipated to reach around USD 4,347.24 million by 2033, growing at a CAGR of 19.7% from 2024 to 2033.

The U.S. advanced battery energy storage system market is emerging as a pivotal component in the transformation of the national energy infrastructure. With the country’s increasing commitment to decarbonization, renewable energy adoption, and modernization of aging grid infrastructure, advanced battery systems are becoming indispensable. These systems play a crucial role in supporting energy security, stabilizing grid operations, and enabling the broader integration of variable renewable energy sources like solar and wind.

Advanced battery energy storage systems (BESS) utilize cutting-edge battery chemistries and intelligent energy management systems to store energy during off-peak hours and dispatch it during peak demand periods. The United States has witnessed robust growth in the deployment of these systems, driven by federal energy policies, state-level incentives, and private sector investments. The Inflation Reduction Act (IRA) of 2022 has further accelerated this growth by including standalone energy storage systems in the Investment Tax Credit (ITC) scheme, providing a strong fiscal stimulus to stakeholders across the value chain.

In particular, the applications of these systems are expanding across diverse sectors such as grid-scale energy storage, uninterruptible power supply (UPS), electric vehicle charging infrastructure, and backup power for telecommunications. The market is expected to continue its growth trajectory over the next decade, driven by technological innovation, declining battery prices, and a growing need for energy resilience amid increasing climate-related power disruptions.

Growing deployment of grid-scale battery storage: Utilities across the U.S. are increasingly investing in large-scale battery energy storage to enhance grid reliability, manage peak loads, and support renewable integration.

Expansion of electric vehicle infrastructure: The rapid increase in electric vehicle (EV) adoption is boosting demand for lithium-ion batteries and distributed energy storage systems.

Integration with renewable energy sources: Advanced battery systems are increasingly paired with solar and wind projects to manage intermittency and improve energy dispatchability.

Emergence of second-life battery applications: The reuse of EV batteries for stationary storage applications is gaining traction, promoting sustainability and cost savings.

Technological advances in battery chemistries: Innovations in solid-state batteries, sodium-ion batteries, and hybrid flow systems are expanding the scope and performance of advanced BESS.

Policy-driven momentum: State mandates like California’s SB 100 and New York’s Climate Leadership and Community Protection Act (CLCPA) are setting aggressive storage targets that serve as models for other states, including Texas and Massachusetts.

Private-public partnerships and pilot projects: Initiatives such as DOE-funded pilot programs and collaborations between energy companies and research institutions are accelerating market maturity.

| Report Attribute | Details |

| Market Size in 2024 | USD 861.72 million |

| Market Size by 2033 | USD 4,347.24 million |

| Growth Rate From 2024 to 2033 | CAGR of 19.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Tesla; Fluence Energy; The AES Corporation.; Sonnen; LG Chem; Samsung SDI; Volta Grid; NextEra Energy; BYD Company; Hitachi Ltd.; Exide Technologies; AES Technologies; Samsung SDI, EnerSys |

A primary driver of the U.S. advanced battery energy storage market is the increasing integration of renewable energy sources into the grid. As wind and solar energy become central to national energy policy, their intermittency poses a challenge to grid stability. Battery energy storage systems offer a viable solution by storing excess generation during low-demand periods and releasing it when demand peaks or when renewable generation dips. For instance, in California—where solar power contributes significantly to daytime electricity—lithium-ion storage systems are crucial for shifting solar energy use into evening hours.

This dynamic has created significant demand for advanced storage solutions that can provide fast response times, high energy density, and long cycle lives. Grid operators, such as PJM Interconnection and ISO New England, are increasingly integrating battery systems into their energy markets, offering frequency regulation, spinning reserves, and voltage support services. This transformation is especially critical as the U.S. aims to achieve net-zero emissions by 2050, further elevating the role of advanced BESS as enablers of a clean energy future.

Despite their growing importance, advanced battery energy storage systems face a significant restraint in the form of high upfront capital costs. The installation of these systems—especially at grid scale—requires substantial investment not only in batteries but also in supporting hardware, software, and infrastructure. The cost includes energy management systems, power conversion systems, safety equipment, and integration with existing grid infrastructure.

While battery costs have declined considerably over the past decade, further reductions are necessary to make BESS economically viable for many stakeholders, particularly small-scale developers and municipal utilities. Additionally, the cost of raw materials such as lithium, cobalt, and nickel remains volatile, which can affect the pricing of batteries. Financing challenges, long payback periods, and uncertainty over long-term performance metrics further complicate widespread adoption.

One of the most promising opportunities in the U.S. advanced battery energy storage system market lies in the increasing need for energy resilience and backup power solutions. The growing frequency of climate-induced natural disasters—such as wildfires in California, hurricanes in the Gulf Coast, and winter storms in Texas—has exposed vulnerabilities in the U.S. electric grid. These events often result in extended power outages, which can cripple businesses and threaten public safety.

Advanced battery systems offer a decentralized and rapid-response backup solution for critical infrastructure, including hospitals, emergency services, telecom towers, and data centers. Furthermore, residential and commercial users are adopting home battery storage systems like Tesla Powerwall and LG Chem RESU to ensure power continuity during outages. With utilities like PG&E and Con Edison promoting microgrid development and resilience programs, the market is poised to benefit significantly from growing concerns over energy security and disaster preparedness.

Lithium-Ion dominated the market and accounted for a share of 78.49% in 2023. These batteries offer the best combination of energy density, efficiency, and cycle life, making them ideal for both grid-scale and behind-the-meter applications. Lithium-ion batteries are widely deployed in EV charging stations, residential energy storage, and commercial facilities. The rapid decline in their cost per kilowatt-hour (kWh)—falling by more than 85% since 2010—has further bolstered their adoption across the energy landscape. Companies such as Tesla, Fluence, and NextEra Energy rely extensively on lithium-ion chemistries like LFP (lithium iron phosphate) and NMC (nickel manganese cobalt) for their utility-scale storage projects.

The fastest-growing product segment is sodium sulfur (NaS) batteries, which are gaining popularity due to their high energy density, long discharge times, and superior thermal stability. These characteristics make them particularly suitable for long-duration storage applications and remote locations with limited grid infrastructure. American Electric Power and other utilities are exploring NaS systems for 6–12-hour discharge durations, which are ideal for shifting large amounts of solar or wind power. Moreover, research institutions are investing in advancing sodium-based chemistries to reduce reliance on critical minerals, positioning NaS batteries as a sustainable alternative in the coming years.

The grid storage segment dominated the market in 2023 and is expected to grow during the forecast period. With renewable capacity expanding rapidly and fossil fuel plants retiring, grid operators are turning to energy storage systems to maintain grid stability, manage peak demand, and ensure consistent power delivery. Grid storage systems offer services such as energy arbitrage, capacity reserves, and ancillary services. Major deployments such as Vistra Energy’s Moss Landing project in California and NextEra Energy’s storage facilities in Florida exemplify how large utilities are investing in BESS to replace or complement traditional power generation assets.

On the other hand, the fastest-growing application segment is transportation, driven by the surge in EV adoption and electrification of public transport. Electric vehicles require robust battery systems not only for propulsion but also for vehicle-to-grid (V2G) capabilities, wherein energy can be fed back to the grid during peak demand. The Biden administration’s target of 50% EV sales by 2030, coupled with federal investments in EV charging infrastructure, is stimulating demand for advanced battery systems across the transportation ecosystem. Moreover, fleet operators, logistics companies, and transit agencies are transitioning to electric buses and trucks, necessitating high-capacity, fast-charging, and durable battery storage solutions.

The United States remains at the forefront of the global battery energy storage revolution, owing to a confluence of policy support, technological innovation, and private sector dynamism. The U.S. Department of Energy’s Energy Storage Grand Challenge and Grid Deployment Office have catalyzed national efforts to boost domestic manufacturing of batteries and create a resilient supply chain. As of 2024, states like California, Texas, and Arizona are leading in battery storage installations, with utility-scale projects routinely crossing the 100 MW threshold.

At the consumer level, states such as New York and Massachusetts are incentivizing behind-the-meter storage to promote grid decentralization and energy equity. Furthermore, corporate buyers and data center operators (like Google and Microsoft) are investing in on-site battery storage to meet 24/7 carbon-free energy goals. The U.S. is also home to major battery manufacturers and integrators, including Tesla, Fluence Energy, and Powin Energy, which are expanding their domestic footprint to reduce dependency on foreign supply chains. With bipartisan support for grid modernization and clean energy, the U.S. market is poised for sustained growth through 2034 and beyond.

February 2024: Tesla announced an expansion of its Megapack production facility in Lathrop, California, aiming to double its annual output to meet rising utility-scale battery demand across the U.S.

January 2024: Fluence Energy unveiled a new AI-powered energy management software platform to optimize battery storage performance, targeting commercial and industrial users in the Northeast and Midwest.

December 2023: NextEra Energy Resources began operation of a 400 MW battery storage system in Florida, integrated with its solar generation capacity, marking one of the largest hybrid projects in the nation.

November 2023: LG Energy Solution signed a supply agreement with AES Corporation to provide lithium-ion battery modules for U.S.-based grid storage projects through 2028.

October 2023: Form Energy, a Massachusetts-based startup, initiated construction of a factory in West Virginia to manufacture its proprietary iron-air long-duration batteries, backed by DOE funding and state grants.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Advanced Battery Energy Storage System market.

By Product

By Application