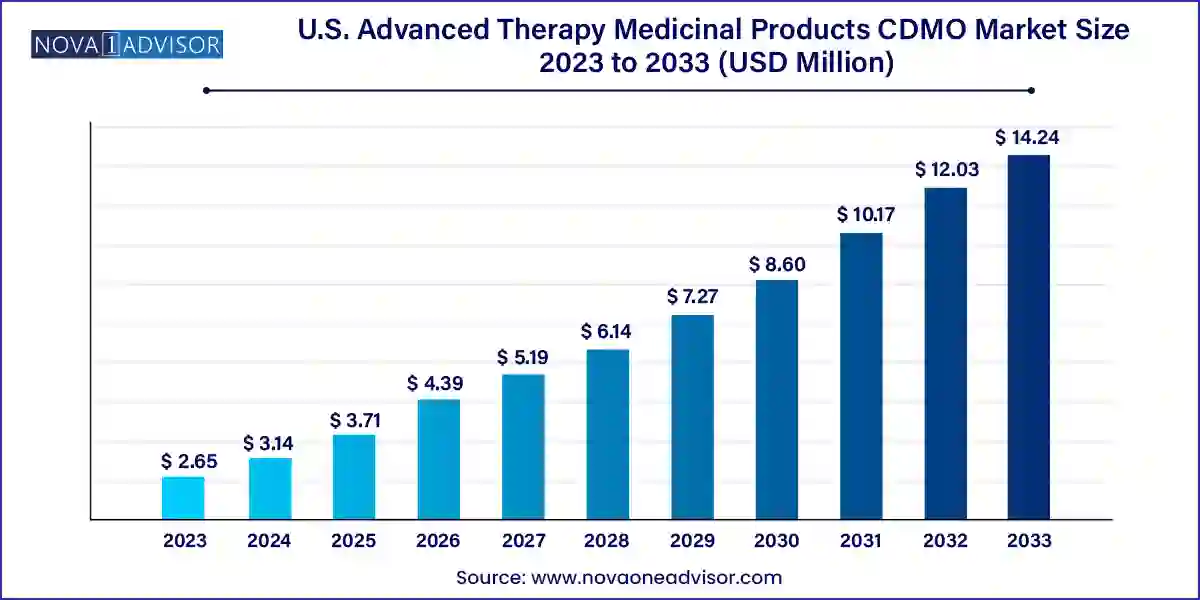

The U.S. advanced therapy medicinal products CDMO market size was exhibited at USD 2.65 billion in 2023 and is projected to hit around USD 14.24 billion by 2033, growing at a CAGR of 18.31% during the forecast period 2024 to 2033.

The U.S. Advanced Therapy Medicinal Products (ATMP) Contract Development and Manufacturing Organization (CDMO) market is emerging as a high-value, high-complexity segment within the broader pharmaceutical outsourcing industry. ATMPs comprising gene therapies, cell therapies, and tissue-engineered products represent the future of personalized and regenerative medicine, with the potential to treat previously untreatable or chronic conditions such as genetic disorders, cancer, autoimmune diseases, and degenerative conditions.

With the rapid increase in FDA designations for breakthrough and orphan drugs, the U.S. is witnessing a surge in the number of ATMPs entering clinical and commercial pipelines. However, the manufacturing of ATMPs presents unique challenges such as complex bioprocessing, cold chain logistics, short product shelf-life, regulatory scrutiny, and limited scalability. This has created an unprecedented demand for specialized CDMOs that can offer end-to-end development, manufacturing, and regulatory support tailored specifically for advanced therapies.

Unlike traditional small-molecule manufacturing, ATMP CDMOs must navigate stringent cGMP requirements for living cell or viral vector-based products. The U.S. market is being driven by a mix of emerging biotech startups with promising pipelines and big pharma players expanding their portfolios through partnerships or acquisitions. The outsourcing of ATMP production to experienced CDMOs enables sponsors to accelerate time-to-market, reduce capital expenditure, and tap into existing regulatory expertise.

Moreover, the U.S. government’s support through grants, fast-track approvals, and public-private partnerships is catalyzing investments into ATMP infrastructure. In particular, cell and gene therapy hubs such as Boston, Philadelphia, and California are at the forefront of this manufacturing revolution, housing numerous CDMOs that specialize in viral vector production, cell line development, and scale-up bioprocessing.

Increased Investment in Viral Vector Manufacturing: CDMOs are scaling up AAV, lentiviral, and retroviral production platforms to meet growing gene therapy demand.

Integration of End-to-End Services: Clients are increasingly seeking single-source CDMOs that offer discovery-to-commercialization capabilities, including regulatory support.

Adoption of Closed and Modular Manufacturing Systems: To improve sterility, efficiency, and scale, CDMOs are investing in modular cleanroom suites and automated bioreactor technologies.

Surge in Autologous and Allogeneic Cell Therapy Pipelines: CDMOs are expanding capabilities in CAR-T, TCR-T, NK-cell, and stem cell processing.

Emergence of Digital Manufacturing and AI Analytics: CDMOs are adopting digital twins and AI-driven analytics to enhance process control and reduce variability in ATMP manufacturing.

Consolidation and M&A Activity: Large CDMOs are acquiring smaller, niche players to enter or strengthen their ATMP capabilities, e.g., Thermo Fisher’s acquisitions in the viral vector space.

Growing Demand for U.S.-Based Facilities: Concerns over global supply chain risks have made domestic CDMO partnerships more attractive for U.S. biotech sponsors.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.14 Billion |

| Market Size by 2033 | USD 14.24 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 18.31% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Phase, Indication |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Celonic; Bio Elpida; CGT Catapult; Rentschler Biopharma SE; AGC Biologics; Catalent; Lonza; WuXi Advanced Therapies; BlueReg; Minaris Regenerative Medicine; Patheon |

A primary driver for the U.S. ATMP CDMO market is the unprecedented growth in the number of cell and gene therapy candidates progressing through clinical pipelines. According to FDA data, the number of investigational new drug (IND) applications for gene therapies has more than doubled over the past five years. The surge is particularly notable in oncology, hematology, and rare genetic disorders, where ATMPs have demonstrated curative potential.

This growth has created a bottleneck in manufacturing capacity, particularly in the areas of viral vector production, plasmid DNA manufacturing, and cell expansion. As a result, even major pharmaceutical companies are turning to CDMOs for flexible, scalable, and compliant infrastructure. Smaller biotech startups, lacking in-house capabilities, are entirely reliant on CDMOs to translate lab-scale innovations into clinical-grade and commercial-ready therapies. This high and growing demand is fueling rapid capacity expansion and technological investment in the U.S. CDMO landscape.

The most significant restraint to market growth is the technical and regulatory complexity associated with ATMP manufacturing. Unlike small molecules, ATMPs are often patient-specific (autologous) or derived from living cells (allogeneic), making process standardization, validation, and scale-up extremely challenging.

Moreover, ATMPs are subject to rigorous regulatory oversight by the FDA’s Center for Biologics Evaluation and Research (CBER), which has stringent guidelines for raw material sourcing, environmental monitoring, product sterility, and analytical testing. CDMOs must also manage cold chain logistics, short shelf-life, and contamination risks inherent in cell-based processing. These factors significantly raise operating costs, extend project timelines, and require highly skilled labor, all of which can act as barriers to entry for new CDMOs and deter investment from risk-averse stakeholders.

A transformative opportunity lies in the shift from autologous (patient-derived) to allogeneic (donor-derived) ATMPs, which can be mass-produced, stored, and shipped globally. Allogeneic cell therapies—especially induced pluripotent stem cells (iPSCs), NK-cell therapies, and gene-edited T-cells promise significant cost advantages and clinical scalability.

CDMOs that invest in platforms to support allogeneic manufacturing can capture the next wave of commercial ATMP products. These include universal donor cell banks, cryopreservation, advanced genome editing, and batch release automation systems. By supporting allogeneic therapies, CDMOs can reduce batch-to-batch variability and maximize facility utilization, enhancing profit margins and client appeal. The scalability of off-the-shelf ATMPs opens the door for broader therapeutic indications and payer reimbursement, signaling a substantial growth horizon.

Cell therapy dominated the U.S. ATMP CDMO market, largely due to the rise of CAR-T, TCR-T, and stem cell-based therapies, especially in oncology and hematology. The FDA has approved multiple CAR-T therapies since 2017, and hundreds more are in the clinical pipeline. Cell therapies often require patient-specific processing and rapid turnaround, necessitating CDMO capabilities in cryopreservation, apheresis management, cell culture, and closed-system bioprocessing.

Gene therapy is the fastest-growing product segment, fueled by the approval of landmark products like Zolgensma and Luxturna, and promising late-stage candidates for rare genetic and neuromuscular diseases. CDMOs in this space must specialize in viral vector manufacturing (AAV, lentivirus), plasmid DNA development, transfection technologies, and stringent QA/QC testing. The high-value nature of gene therapy projects often translates to longer contract durations and high-margin services.

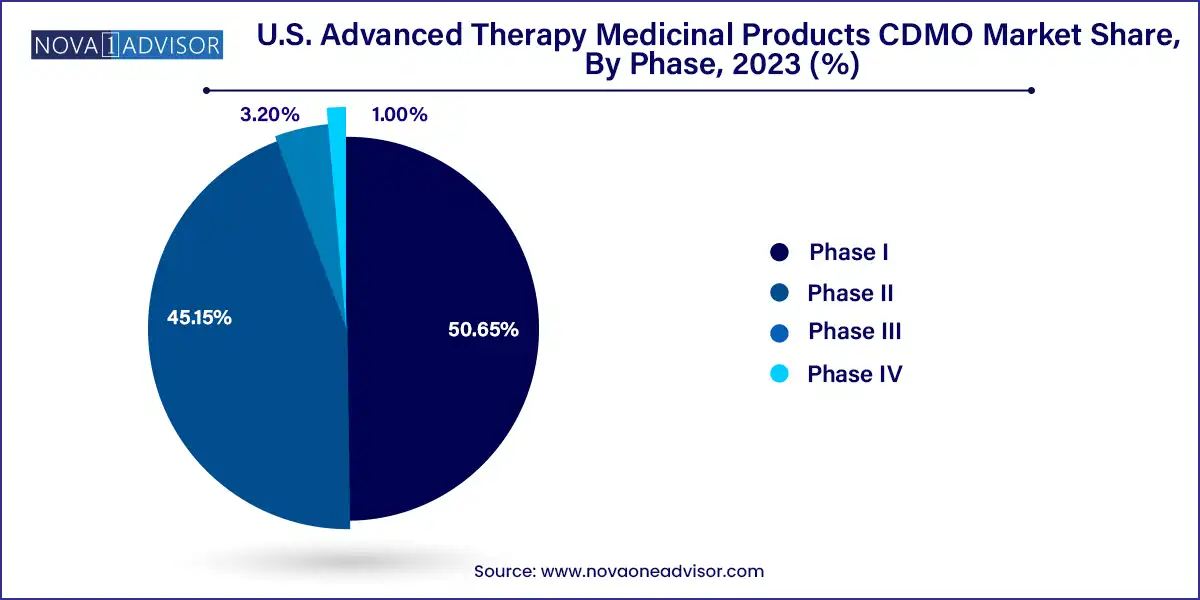

Phase II was the dominant phase for CDMO activity, reflecting the high concentration of ATMP candidates in mid-stage clinical development. At this phase, sponsors require GMP-grade manufacturing, process optimization, and regulatory filing support, making CDMO involvement critical. CDMOs offer scalability solutions and begin building documentation for eventual commercial supply, which leads to longer and more lucrative partnerships.

Phase III is the fastest-growing phase, driven by ATMPs advancing into pivotal trials for FDA approval. CDMOs supporting Phase III projects must manage tech transfer, analytical validation, large-batch production, and pre-commercial logistics planning. These late-stage projects often lead to multi-year commercial supply agreements, increasing revenue visibility and pipeline stability for CDMOs.

Oncology emerged as the leading indication segment, especially due to the clinical success of CAR-T therapies and tumor-infiltrating lymphocyte (TIL) platforms. CDMOs are providing manufacturing for autologous T-cell products and next-generation immunotherapies that require precise gene editing and target validation. These therapies demand custom manufacturing workflows and extensive regulatory support.

Central Nervous System (CNS) disorders are the fastest-growing indication, with increasing interest in gene therapy for conditions like spinal muscular atrophy (SMA), Parkinson’s, Huntington’s, and ALS. Manufacturing for CNS-targeted ATMPs requires high-purity viral vectors and specialized delivery systems, making it a niche but high-value CDMO service area.

Within the U.S., regional hubs have developed strong CDMO clusters:

The Northeast, particularly Boston and Cambridge, dominates the market due to its proximity to top research universities, funding centers, and biotech innovators. CDMOs here often support cutting-edge ATMPs backed by robust VC funding.

California (San Diego, Bay Area) is rapidly emerging as the fastest-growing region, driven by its world-class research ecosystem and growing number of clinical trials. CDMOs are scaling up to meet West Coast demand, especially in allogeneic and stem cell therapy projects.

These hubs benefit from access to talent, proximity to sponsors, and strong infrastructure, making them the epicenters of ATMP innovation in the U.S.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. advanced therapy medicinal products CDMO market

Product

Phase

Indication