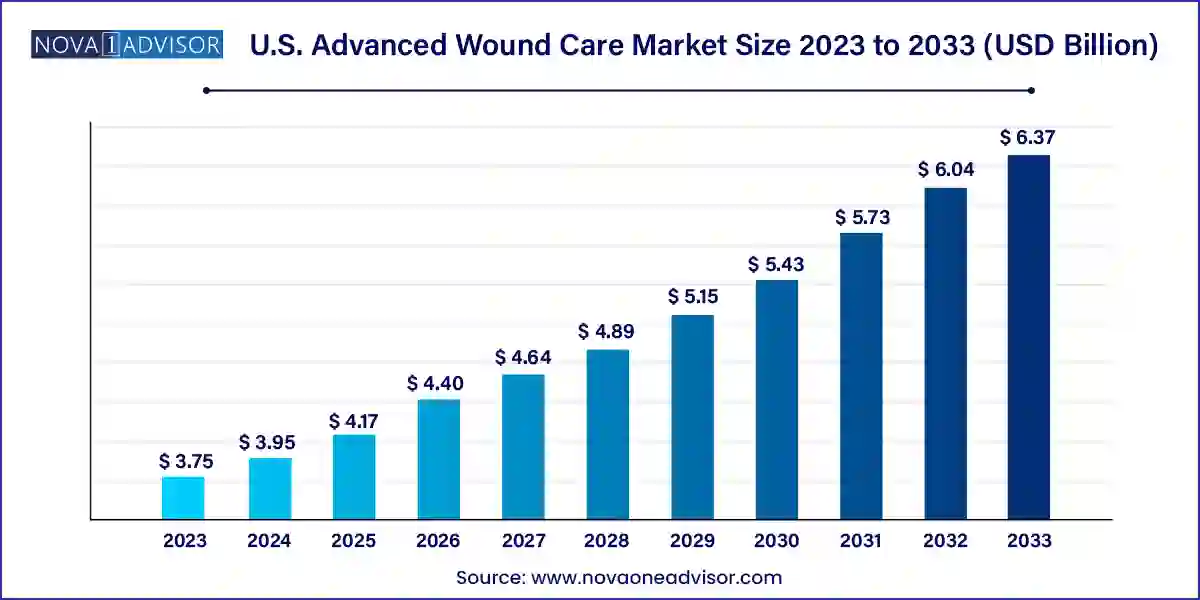

The U.S. advanced wound care market size was exhibited at USD 3.75 billion in 2023 and is projected to hit around USD 6.37 billion by 2033, growing at a CAGR of 5.44% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.95 Billion |

| Market Size by 2033 | USD 6.37 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.44% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Smith+Nephew; Mölnlycke Health Care AB; ConvaTec Group PLC; Ethicon (Johnson & Johnson); URGO; Coloplast Corp.; 3M; Integra LifeSciences; PAUL HARTMANN AG; McKesson; Hydrofera; Medline Industries, Inc.; Organogenesis; Kerecis |

Major factors contributing to the market growth are rising incidence of chronic wounds, increasing demand for reducing hospital stay, and rising number of surgeries in the U.S. Increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases are anticipated to increase the incidence rate of chronic wounds in the U.S. For instance, according to the international diabetes federation, there were about 32.2 million adults with diabetes in the U.S., the number is expected to reach 36.2 million by 2045.

Increasing incidence of accidents such as road accidents, and trauma events across the globe is anticipated to drive the market growth. For instance, as per the Association for Safe International Road Travel, approximately 1.35 million people die every year in a road crash, whereas on an average 3,700 people lose their life every day in RTA (road traffic accidents). Thus, rising number of accidents is expected to boost the demand for advanced wound care products, which is expected to boost market growth over the forecast period.

The rising number of surgeries is also one of the major factors driving the market growth. The number of surgeries is increasing owing to the rising prevalence of chronic conditions. Wound care products, thus, are increasingly being used to prevent surgical site infections. Most surgical wounds, post cancer surgery, are relatively large in size and deep, releasing exudates that require regular management. Advanced wound care products such as hydrogel, alginate, and foam help manage large wounds, thereby significantly reducing the risk of infection. Thus, rising incidence of chronic diseases is another factor which is expected to boost the demand for wound care products.

The prevalence of chronic disorders that affect skin integrity, such as diabetes and peripheral vascular disease (venous hypertension, arterial insufficiency), is growing with rising geriatric population. These disorders frequently result in skin disintegration, ulceration, and development of persistent wounds. Moreover, wound treatment becomes more difficult in the elderly due to increased risk of infection, weak immune system, especially in case of severe wounds, thereby boosting the need for advanced wound care products. For instance, elderly people (aged ≥65) are currently the fastest-growing group of the general population in the U.S. The National Population Projections by the US Census Bureau, states that, nearly one in four U.S. citizens are likely to be an older adult by 2060.

Technological advancements are also projected to have a significant impact on advanced wound care industry in the coming years. The quality of life of patients suffering from chronic wounds improves as technology advances and becomes more affordable. Traditional wound care and closure products are gradually being replaced by advanced wound care & closure products due to their efficacy and effectiveness in wound management by allowing quicker healing.

Some of the major technological innovations in this field that are expected to be commercialized soon include:

Moist dressings dominated the product segment in U.S. advanced wound care market by capturing a share of 59.83%. This segment is further subdivided into foam, hydrocolloid, film, alginate, hydrogel, collagen, and other. Foam dressings segment held the largest market share of 23.8% in terms of revenue in 2023.Foams dressings are made up of hydrophilic polyurethane material which is a highly absorbent material. Foams help in absorbing moisture that aids in maintaining the integrity of tissue.

The increasing cases of burns and trauma across the globe are expected to propel the segment growth. For instance, as per the American Burn Association (ABA) every year, 450,000 people are given medical treatment due to burn injuries in the U.S. It also reported that complications of infection have accounted to be highest in burn patients. Foams are majorly used to prevent and heal the exudation of burn injuries and hence the increasing cases of such incidents is expected to surge the segment growth over the forecast period.

Hydrocolloid dressings is anticipated to witness the fastest growth over the forecast period. These are made up of gel forming agents such as Carboxy Methylcellulose (CMC) and gelatin. These materials are occlusive in nature that helps in moisture retention. Furthermore, they help in rapid healing and are impermeable to any type of bacterial infection.

The chronic wounds segment held the largest market share of about 60% in 2023. Increase in number of chronic wounds such as diabetic foot ulcers, venous leg ulcers, pressure ulcers is expected to increase the demand for wound care products. Moreover, a rise in number of people suffering from diabetes is expected to further increase the number of diabetic foot ulcer patients, thereby propelling the segment growth. For instance, as per National Institute of Diabetes and Digestive Kidney Diseases, an estimated of 34.2 Million people have diabetes, which comprises of 10.5% of the U.S.

The acute wounds segment is anticipated to witness fastest growth of 5.54% over the forecast period.Rising incidence of burn and trauma injuries in the U.S. majorly contributes to the segment growth. For instance, according to Joye Law Firm, the following are the statistics about burn injuries in the US:

Similarly, the CDC also states that in the U.S. approximately 136 million patients visit emergency rooms per year, with around 30% visits associated with injuries. As a result, a dramatic increase in the number of hospitals and hospital admissions raises demand for wound care products, propelling market growth.

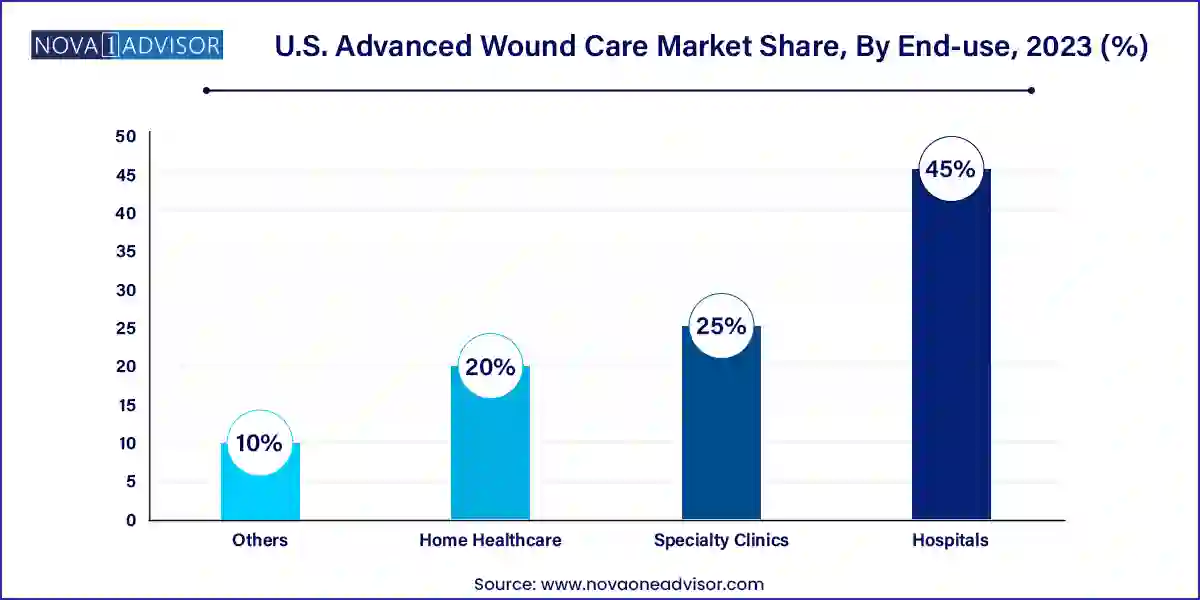

Based on end-use, the U.S. advanced wound care market has been segmented into hospitals, specialty clinics, home healthcare, and others. The hospitals segment held the largest market share of around 45.0% in 2023. The increasing cases of diabetic foot ulcers and venous leg ulcers are the major factors driving the segment growth. In addition, increasing cases of surgical wounds due to rising number of surgeries is also expected to boost the segment growth.

The home healthcare segment is expected to witness fastest growth with a CAGR of 6.14% over the forecast period.The introduction of single-use NPWT systems revolutionized wound care in homecare settings. These devices are lightweight, portable, canister-free, and are easy to use. In addition, cost-effectiveness of such therapy of treating wounds also encourages patients to adopt homecare settings over hospital stays. Furthermore, rising research & development related to such therapies by major market players to promote home healthcare is also anticipated to contribute to the segment growth over the forecast period. For instance, PICO and RENASYS GO are easy to use portable NPWT devices, manufactured by Smith & Nephew and are widely used at home.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. advanced wound care market

Product

Application

End-use

Chapter 1 Methodology and Scope

1.1 Market Segmentation and Scope

1.1.1 Estimates and forecast timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased database:

1.3.2 internal database

1.3.3 Secondary sources

1.3.4 Primary research

1.3.5 Details of primary research

1.4 Information or Data Analysis

1.4.1 Data analysis models

1.5 Market Formulation & Validation

1.6 List of Secondary Sources

1.7 Objectives

1.7.1 Objective 1: Understanding market dynamics in the given countries.

1.7.2 Objective 2: Understanding market estimates and forecasts

1.7.3 Objective 3: Understanding attributes to provide elaborate details on the market structure & strategic undertakings & their impact.

1.7.4 Objective 4: Understanding key Product, product, and application scopes to conclude on the market size.

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

Chapter 3 U.S. advanced wound care Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent market outlook

3.1.2 Ancillary market outlook

3.2 Penetration & Growth Prospect Mapping

3.3 Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Increasing prevalence of chronic disorders and conditions affecting wound healing capabilities

3.3.1.2 Introduction of innovative and advanced wound products

3.3.1.3 Rising geriatric population

3.3.1.4 Increasing number of road accidents, trauma cases, and burns

3.3.1.5 Increasing number of surgeries

3.3.2 Market restraint analysis

3.3.2.1 Rising treatment cost

3.3.2.2 Delayed diagnosis & delayed treatment rates in emerging nations

3.4 U.S. Advanced Wound Care: Market Analysis Tools

3.4.1 Industry analysis - Porter’s

3.4.2 PESTLE analysis

Chapter 4 U.S. advanced wound care Market: Segment Analysis, By Product, 2021 - 2033

4.1 Definition and Scope

4.2 Product Market Share Analysis, 2024 & 2033

4.3 Segment Dashboard

4.4 U.S. advanced wound care Market, by Product, 2021 to 2033

4.5 Market Size & Forecasts and Trend Analyses, 2021 to 2033

4.5.1 Moist

4.5.1.1 Moist Market, 2021 - 2033

4.5.1.1.1 Foam Dressings Market, 2021 - 2033

4.5.1.1.2 Hydrocolloid Dressings Market, 2021 - 2033

4.5.1.1.3 Film Dressings Market, 2021 - 2033

4.5.1.1.4 Alginate Dressings Market, 2021 - 2033

4.5.1.1.5 Hydrogel Dressings Market, 2021 - 2033

4.5.1.1.6 Collagen Dressings Market, 2021 - 2033

4.5.1.1.7 Other Advanced Dressings Market, 2021 - 2033

4.5.2 Antimicrobial

4.5.2.1 Antimicrobial Market, 2021 - 2033

4.5.2.1.1 Silver Market, 2021 - 2033

4.5.2.1.2 Non-silver Market, 2021 - 2033

4.5.3 Active

4.5.3.1 Active Market, 2021 - 2033

4.5.3.1.1 Biomaterials Market, 2021 - 2033

4.5.3.1.2 Skin-substitute Market, 2021 - 2033

Chapter 5 U.S. advanced wound care Market: Segment Analysis, By Application, 2021 - 2033

5.1 Definition and Scope

5.2 Application Market Share Analysis, 2024 & 2033

5.3 Segment Dashboard

5.4 U.S. advanced wound care Market, by Application, 2021 to 2033

5.5 Market Size & Forecasts and Trend Analyses, 2021 to 2033

5.5.1 Chronic Wounds

5.5.1.1 Chronic Wounds Market, 2021 - 2033

5.5.1.1.1 Diabetic foot ulcers market, 2021 - 2033

5.5.1.1.2 Pressure ulcers market, 2021 - 2033

5.5.1.1.3 Venous leg ulcers market, 2021 - 2033

5.5.1.1.4 Other chronic wounds market, 2021 - 2033

5.5.2 Acute Wounds

5.5.2.1 Acute Wounds Market, 2021 - 2033

5.5.2.1.1 Surgical & traumatic wounds market, 2021 - 2033

5.5.2.1.2 Burn wounds market, 2021 - 2033

Chapter 6 U.S. advanced wound care Market: Segment Analysis, By End-use, 2021 - 2033

6.1 Definition and Scope

6.2 End-use Market Share Analysis, 2024 & 2033

6.3 Segment Dashboard

6.4 U.S. advanced wound care Market, by End-use, 2021 to 2033

6.5 Market Size & Forecasts and Trend Analyses, 2021 to 2033

6.5.1 Hospitals

6.5.1.1 Hospitals Market, 2021 - 2033

6.5.2 Clinics

6.5.2.1 Clinics Market, 2021 - 2033

6.5.3. Home healthcare

6.5.3.1 Home Healthcare Market, 2021 - 2033

6.5.4. Others

6.5.4.1 Others Market, 2021 - 2033

Chapter 7 U.S. advanced wound care Market - Competitive Analysis

7.1 Company Profiles

7.1.1 Smith & Nephew

7.1.1.1 Company overview

7.1.1.2 Financial performance

7.1.1.3 Product benchmarking

7.1.1.4 Strategic Initiatives

7.1.2 Mölnlycke Health Care A

7.1.2.1 Company overview

7.1.2.2 Financial performance

7.1.2.3 Product benchmarking

7.1.2.4 Strategic Initiatives

7.1.3 ConvaTec Group PLC

7.1.3.1 Company overview

7.1.3.2 Financial performance

7.1.3.3 Product benchmarking

7.1.3.4 Strategic Initiatives

7.1.4 Ethicon (Johnson & Johnson)

7.1.4.1 Company overview

7.1.4.1 Financial performance

7.1.4.2 Product benchmarking

7.1.4.3 Strategic initiatives

7.1.5 Baxter International

7.1.5.1 Company overview

7.1.5.2 Financial performance

7.1.5.3 Product benchmarking

7.1.5.4 Strategic Initiatives

7.1.6 URGO Medical

7.1.6.1 Company overview

7.1.6.2 Financial performance

7.1.6.3 Product benchmarking

7.1.6.4 Strategic Initiatives

7.1.7 Coloplast Corp.

7.1.7.1 Company overview

7.1.7.2 Financial performance

7.1.7.3 Product benchmarking

7.1.7.4 Strategic Initiatives

7.1.8 Medtronic

7.1.8.1 Company overview

7.1.8.2 Financial performance

7.1.8.3 Product benchmarking

7.1.8.4 Strategic Initiatives

7.1.9 3M

7.1.9.1 Company overview

7.1.9.2 Financial performance

7.1.9.3 Product benchmarking

7.1.9.4 Strategic Initiatives

7.1.10 Integra LifeSciences

7.1.10.1 Company overview

7.1.10.2 Financial performance

7.1.10.3 Product benchmarking

7.1.10.4 Strategic Initiatives

7.1.11 Hollister Incorporated

7.1.11.1 Company overview

7.1.11.2 Financial performance

7.1.11.3 Product benchmarking

7.1.11.4 Strategic Initiatives

7.1.12 B. Braun Melsungen AG

7.1.12.1 Company overview

7.1.12.2 Financial performance

7.1.12.3 Product benchmarking

7.1.12.4 Strategic Initiatives

7.1.13 PAUL HARTMANN AG

7.1.13.1 Company overview

7.1.13.2 Financial performance

7.1.13.3 Product benchmarking

7.1.13.4 Strategic Initiatives

7.1.14 Johnson & Johnson Private Limited.

7.1.14.1 Company overview

7.1.14.2 Financial performance

7.1.14.3 Product benchmarking

7.1.14.4 Strategic Initiatives