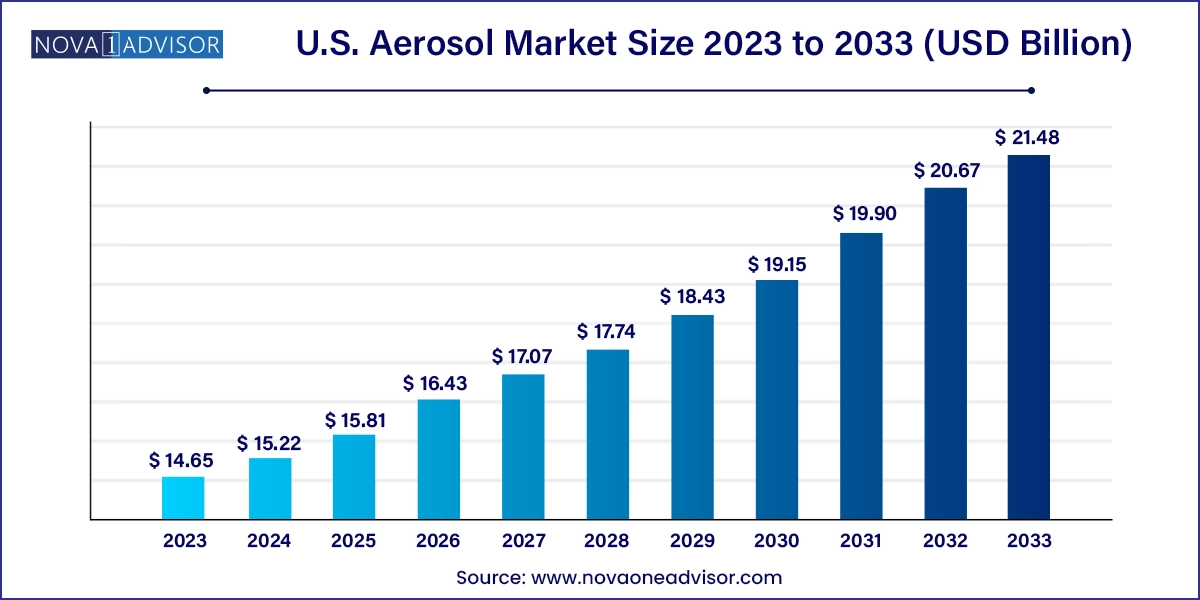

The U.S. aerosol market size was exhibited at USD 14.65 billion in 2023 and is projected to hit around USD 21.48 billion by 2033, growing at a CAGR of 3.9% during the forecast period 2024 to 2033.

The U.S. aerosol market is a mature yet rapidly evolving space, underscored by continuous innovation in packaging, growing sustainability efforts, and expanding application diversity. Aerosols pressurized containers used to dispense liquids or solids as fine sprays or foams are ubiquitous across consumer and industrial segments, from personal care and household products to automotive maintenance and medical applications.

What has historically been dominated by deodorants and household cleaners is now witnessing rapid diversification. The ability of aerosol technology to offer controlled application, longer shelf-life, hygienic usage, and product uniformity makes it invaluable across multiple industries. In the U.S., the demand for aerosol products has seen resurgence, especially post-pandemic, as consumers emphasize hygiene, cleanliness, and convenience.

With regulatory oversight from bodies like the U.S. Environmental Protection Agency (EPA) and the Consumer Product Safety Commission (CPSC), the industry has been adapting to shifting compliance landscapes particularly around volatile organic compounds (VOCs), recyclability, and flammable propellants. Domestic production continues to thrive, bolstered by innovation in formulations (such as water-based aerosols), packaging (like bag-in-valve systems), and increased focus on eco-friendly materials.

The U.S. consumer's high preference for time-saving, clean, and portable solutions ensures that the aerosol format remains an attractive choice. Whether it's dry shampoo, spray paint, cooking oil, or wound care sprays, the aerosol market continues to reinvent itself to meet changing lifestyle and industrial needs.

Surging demand for eco-friendly and recyclable aerosol packaging (aluminum cans, water-based propellants).

Rising adoption of bag-in-valve systems for pharmaceutical and personal care applications.

Growth in private-label aerosol products by major retail chains.

Increased demand for dry shampoo and no-rinse grooming aerosols in personal care.

Expansion of aerosol-based disinfectants and sanitizers post-COVID-19.

Integration of digital ink coding and smart packaging on aerosol cans.

Development of compressed gas aerosol technology to reduce carbon footprint.

| Report Coverage | Details |

| Market Size in 2024 | USD 15.22 Billion |

| Market Size by 2033 | USD 21.48 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Material, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | S. C. Johnson & Son, Inc.; Procter & Gamble; Colep Consumer Products; Estée Lauder Inc.; Honeywell International Inc.; Ball Corp.; Crown Holdings Inc.; Crabtree & Evelyn; PLZ Corp; Trivium Packaging |

One of the major driving forces for the U.S. aerosol market is the consumer’s strong preference for convenience, cleanliness, and ease of use. Aerosol formats are ideal for single-hand use, precise application, and extended shelf-life. In busy American households, aerosol cleaning products such as disinfectant sprays and oven cleaners offer a practical advantage over liquid or wipe alternatives. In the beauty industry, spray-on sunscreens, deodorants, and hair styling sprays provide time-saving solutions that align with on-the-go lifestyles.

Even in industrial settings, the aerosol form is valued for its utility and controlled delivery. Spray lubricants, anti-corrosion coatings, and touch-up paints reduce product wastage and enhance application efficiency. This blend of convenience and performance across both consumer and commercial domains continues to make aerosols a preferred packaging and delivery method in the U.S.

Despite their advantages, aerosols face increasing scrutiny due to environmental concerns and regulatory limitations, particularly regarding their contribution to VOC emissions and recyclability challenges. Many aerosol propellants are hydrocarbon-based or contain substances like butane and propane, which contribute to smog formation. The EPA has instituted regulations to limit the permissible VOC content in various product categories, compelling manufacturers to reformulate offerings or adopt alternative technologies.

Moreover, the recycling of aerosol cans is more complex than standard packaging materials due to pressurization and residual contents. Consumers often dispose of them incorrectly, adding to landfill and safety concerns. These environmental pressures not only drive up R&D costs but also challenge manufacturers to strike a balance between performance, compliance, and sustainability.

Amid regulatory challenges, a powerful opportunity has emerged in the form of green aerosols—products that are designed with environmentally responsible propellants and packaging materials. Companies are now turning to compressed air, nitrogen, and carbon dioxide as alternative propellants that pose less harm to the environment. Similarly, packaging innovation is transforming the market, with lightweight aluminum cans, refillable systems, and post-consumer recycled materials gaining traction.

Brands like Procter & Gamble and Unilever are investing in zero-waste goals, and retailers like Walmart are requiring their suppliers to adhere to stricter sustainability guidelines. This transition opens a lucrative path for aerosol manufacturers to reposition their portfolios and leverage eco-labels, appealing to a growing segment of environmentally conscious consumers. Green aerosol technology is not just a trend but a strategic imperative for long-term growth in the U.S. market.

Standard valve aerosols dominated the market due to their widespread usage across traditional consumer products.

Standard valve systems have long been the preferred choice for household and personal care applications, offering cost-effective functionality and reliable dispensing. From air fresheners to shaving creams, these valves are engineered for high-volume, mainstream usage. Their established manufacturing processes, ease of integration, and compatibility with a variety of products make them the go-to solution for legacy brands. Most deodorants, hair sprays, and cooking sprays in American homes rely on standard valves due to their simplicity and affordability.

However, the bag-in-valve segment is growing at a faster pace, driven by demand for pharmaceutical, cosmetic, and eco-friendly applications.

Bag-in-valve (BOV) systems offer several advantages over traditional valves, including the ability to use non-flammable propellants, complete product evacuation, and longer shelf-life. Their ability to prevent contamination and extend product purity is particularly beneficial in medical sprays (e.g., wound cleaners, nasal sprays) and premium skincare. Additionally, BOV technology supports air-based or nitrogen propellants, aligning with green product goals. Although more expensive, many premium brands and health-focused products are adopting this system as part of their clean-label and sustainability strategy.

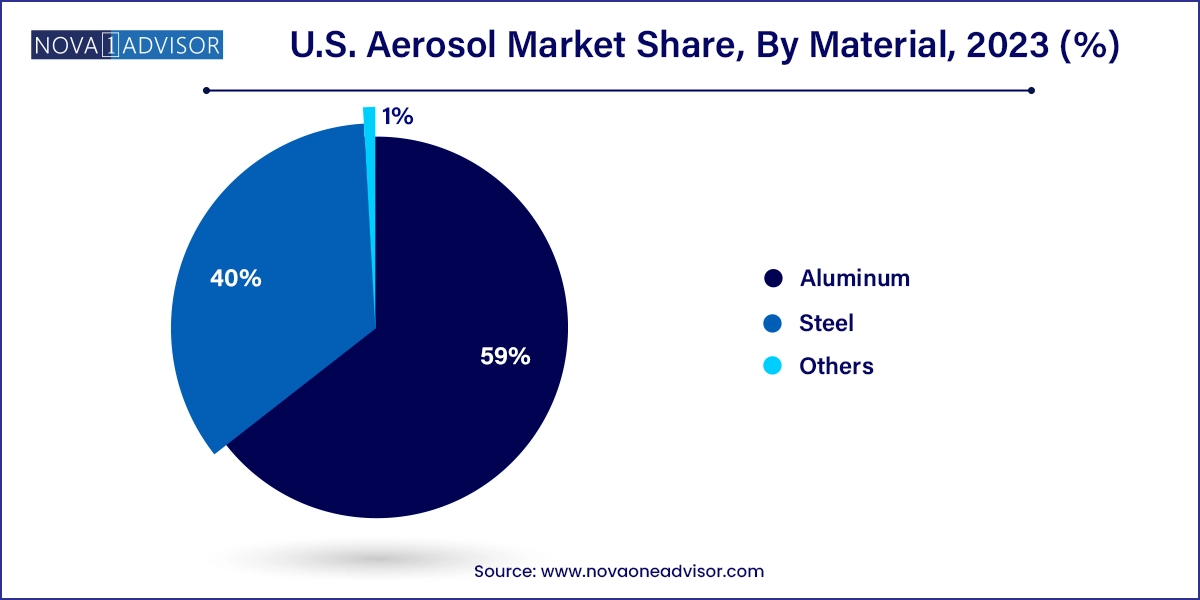

Aluminum emerged as the dominating material segment, favored for its lightweight, corrosion resistance, and recyclability.

Aluminum aerosol cans are widely used in the U.S. due to their lightweight properties, ability to withstand pressure, and superior aesthetic appeal. They are especially dominant in personal care applications, where packaging elegance and tactile experience influence consumer preferences. In addition, aluminum's infinite recyclability makes it an environmentally viable option, aligning with both brand and consumer sustainability objectives. The food and medical sectors also rely on aluminum for its hygienic properties and barrier capabilities.

Steel, while still significant, is seeing slower growth compared to aluminum due to heavier weight and limited recyclability.

Steel aerosol cans continue to hold ground in automotive and industrial sectors, where durability and strength are prioritized over appearance. However, these cans are gradually losing share in consumer applications, especially in personal care and household products, where the aesthetic, ergonomic, and sustainability advantages of aluminum are more compelling. Hybrid solutions and newer coatings are helping steel maintain its relevance in sectors requiring high-strength containers.

Personal care dominated the U.S. aerosol market, driven by the popularity of grooming products and skin/hair sprays.

The personal care segment leads the U.S. aerosol market due to the ubiquity of products like deodorants, dry shampoos, sunscreen sprays, hairsprays, and shaving foams. The grooming-conscious American consumer has driven consistent demand for aerosol-based beauty products. Innovations such as volumizing sprays, texture-enhancing dry shampoos, and micellar sprays have added depth to the segment. Premiumization, influencer marketing, and gender-neutral product development are further energizing this category.

Medical applications are emerging as one of the fastest-growing segments, owing to rising demand for pressurized inhalers and wound care sprays.

The medical segment is expanding rapidly as aerosols provide a sterile and convenient method for drug delivery and treatment application. Metered-dose inhalers (MDIs) for asthma and COPD are a cornerstone of this segment. Moreover, the pandemic emphasized the importance of portable disinfectants, antimicrobial sprays, and sanitizing aerosols for home healthcare. Newer technologies like sprayable dressings and aerosolized pain relief formulations are gaining momentum, particularly among aging populations and remote care users.

The U.S. stands as the single-largest and most influential market for aerosol products in North America. With an advanced manufacturing base, robust distribution networks, and consumer affluence, the U.S. has cultivated a deeply ingrained culture of aerosol product usage. The country leads in innovation across aerosol packaging, formulation development, and retail penetration. Urban lifestyles, a fast-paced work culture, and preference for portable hygiene and grooming solutions further support market growth.

Recent state-level regulations, particularly in California, have pushed companies to adopt low-VOC formulations and recyclable containers. This regulatory pressure has made U.S. manufacturers global pioneers in sustainable aerosol technologies. Additionally, American consumers are increasingly supporting local brands and environmentally responsible products, giving rise to homegrown labels offering organic dry shampoos, clean deodorants, and aluminum-free sprays. The combination of strong purchasing power and regulatory momentum makes the U.S. a bellwether for aerosol trends globally.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. aerosol market

Type

Material

Application