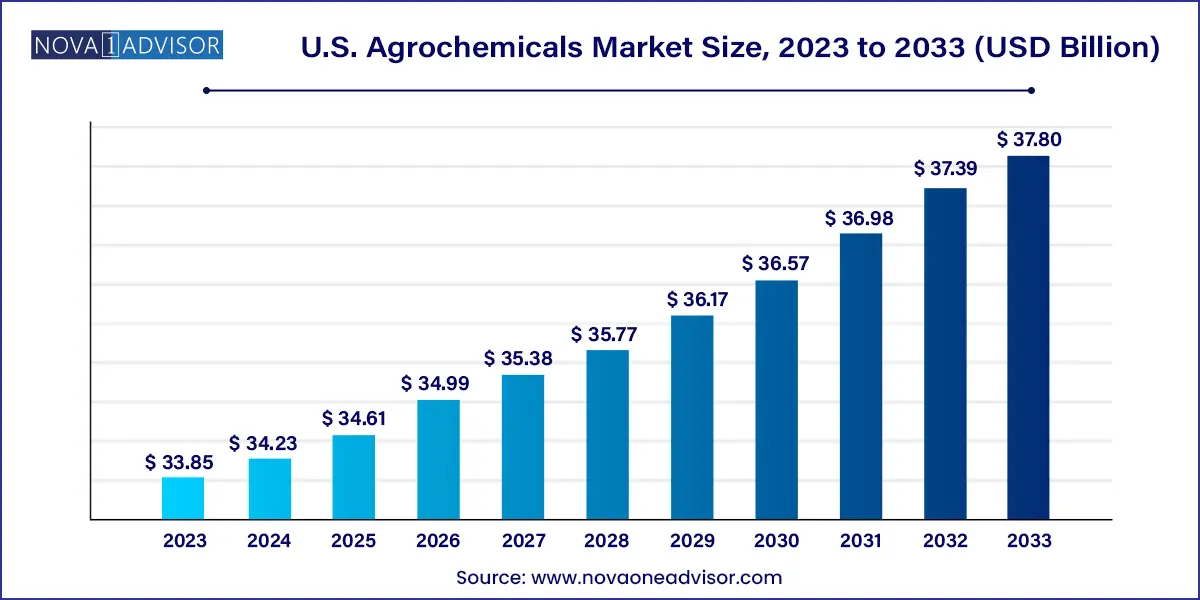

The U.S. agrochemicals market size was exhibited at USD 33.85 billion in 2023 and is projected to hit around USD 37.80 billion by 2033, growing at a CAGR of 1.11% during the forecast period 2024 to 2033.

The U.S. agrochemicals market plays a foundational role in supporting the country’s highly industrialized and technology-driven agricultural sector. Agrochemicals which encompass fertilizers, crop protection chemicals (pesticides), and plant growth regulators are essential for enhancing crop yields, mitigating pest-related losses, and ensuring the consistent quality of produce. As one of the largest agricultural producers globally, the U.S. relies heavily on agrochemical inputs to maintain high productivity levels across major crops such as corn, soybeans, wheat, and fruits and vegetables.

The market is deeply influenced by macroeconomic trends, including climate variability, commodity price fluctuations, land use changes, and advancements in biotechnology. In the past decade, the adoption of precision agriculture and genetically modified crops has significantly altered agrochemical usage patterns, with farmers seeking more targeted, efficient, and environmentally responsible solutions. The demand for customized nutrient management and integrated pest control strategies has elevated the importance of both conventional and next-generation agrochemical products.

The U.S. agrochemical landscape is highly competitive and consolidated, with multinational corporations like Bayer, Syngenta, Corteva Agriscience, and BASF dominating market share. However, an increasing number of domestic startups and regional players are innovating in niche segments such as bio-stimulants, nano-formulated pesticides, and slow-release fertilizers. Regulatory frameworks enforced by agencies like the Environmental Protection Agency (EPA) and the U.S. Department of Agriculture (USDA) are key drivers in shaping market dynamics, influencing product approvals, usage restrictions, and environmental impact assessments.

Precision agriculture fueling targeted chemical applications: Integration of GPS and sensor technologies enables precise agrochemical dosing, reducing waste and maximizing yield.

Surge in demand for sustainable and bio-based agrochemicals: Farmers and consumers alike are pushing for greener alternatives that minimize environmental and health risks.

Adoption of slow- and controlled-release fertilizers: These formulations are gaining traction to reduce nutrient leaching and improve plant uptake efficiency.

Resistance management reshaping pesticide portfolios: Herbicide and insecticide resistance is prompting innovation in formulation and active ingredient diversity.

Digitization of farm inputs and remote advisory services: Software platforms are helping farmers select optimal agrochemicals based on soil and crop data.

Mergers and acquisitions among key players: Consolidation continues as companies aim to strengthen product pipelines and expand regional reach.

Climate change influencing agrochemical usage patterns: Shifting pest zones and extreme weather events are increasing demand variability across seasons.

Regulatory scrutiny leading to bans and phase-outs: Certain chemicals, such as chlorpyrifos, are being restricted due to ecological and health concerns.

| Report Coverage | Details |

| Market Size in 2024 | USD 34.23 Billion |

| Market Size by 2033 | USD 37.80 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 1.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Crop, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | FMC Corporation, Nutrien Ltd, Bayer Crop Science, Gowan, Inc., Dow Agro Sciences, Syngenta, BASF, Corteva Agriscience, ADM, Yara International ASA. |

A core driver of the U.S. agrochemicals market is the pressing need to increase agricultural productivity amidst shrinking arable land and rising global food demand. With the U.S. being a major exporter of grains, oilseeds, and specialty crops, there is immense pressure on farmers to produce more from existing farmland while maintaining soil health and sustainability. Agrochemicals are indispensable in this context, enhancing soil fertility, preventing crop losses due to pests and diseases, and supporting longer growing seasons in diverse climatic zones.

Modern farming practices, particularly those in the Midwest Corn Belt, rely on nitrogen-intensive fertilizers to support high-yield corn production. Similarly, broad-acre soy and wheat cultivation depend on timely herbicide applications to prevent yield-robbing weed competition. Without efficient agrochemical use, average yields would fall significantly, undermining the economic viability of many farms. Therefore, the continued push for food security and export competitiveness reinforces demand for advanced agrochemical solutions.

Environmental and regulatory scrutiny remains a key restraint in the U.S. agrochemicals market. Federal and state-level regulations governing chemical usage, runoff management, and application timing significantly impact the commercial viability of agrochemical products. The EPA has taken increasingly firm stances against chemicals linked to groundwater contamination, non-target organism harm, and human health risks. Notable examples include the ban on chlorpyrifos (an organophosphate insecticide) and restrictions on neonicotinoids due to pollinator impact.

Additionally, increasing public and scientific concerns about the long-term ecological effects of agrochemical overuse have led to consumer-driven backlash. This has prompted food retailers and processors to adopt residue-free sourcing standards, placing further pressure on farmers to reduce chemical inputs. Compliance with complex regulatory requirements increases operational costs for manufacturers and may delay new product approvals, especially in the crop protection segment.

An emerging opportunity in the U.S. agrochemicals market lies in the growth of bio-based and environmentally friendly alternatives. Driven by sustainability concerns, regulatory mandates, and evolving consumer expectations, biopesticides, biofertilizers, and plant growth-promoting microbes are gaining acceptance as complementary or alternative solutions to synthetic chemicals. These products typically have lower environmental toxicity, shorter residue periods, and are often exempt from certain EPA registrations.

Companies like Marrone Bio Innovations and Pivot Bio are pioneering microbial and fermentation-based products that offer pest control and nitrogen fixation respectively, with minimal ecological disruption. As organic farming acreage in the U.S. continues to expand, and conventional farms seek to meet regenerative agriculture standards, demand for bio-based agrochemicals is expected to increase. The development of hybrid products that integrate both synthetic and biological components may also unlock performance improvements and market penetration.

Fertilizers represent the dominant product category in the U.S. agrochemicals market, especially nitrogenous fertilizers such as urea, anhydrous ammonia, and urea-ammonium nitrate (UAN). These products are heavily used across key grain-producing regions like Iowa, Illinois, and Nebraska to maximize yields of nitrogen-demanding crops like corn and wheat. U.S. farmers apply fertilizers in precision-managed cycles to enhance nutrient efficiency, combat leaching, and minimize greenhouse gas emissions from over-application. Secondary fertilizers containing calcium and magnesium are also used to correct soil pH and support micronutrient uptake in specialty crops.

Crop protection chemicals, however, are the fastest-growing segment due to rising pest resistance and the expansion of high-value crops susceptible to disease and insect pressures. Herbicides such as glyphosate and dicamba dominate usage in row crops, while fungicides and insecticides are increasingly applied in fruit and vegetable cultivation. Recent innovations in pre-mix formulations, dual-action modes, and drone-assisted application technologies have further improved efficiency and safety in chemical delivery. The segment also benefits from regulatory approvals of next-generation actives that address specific resistance or weather-related challenges.

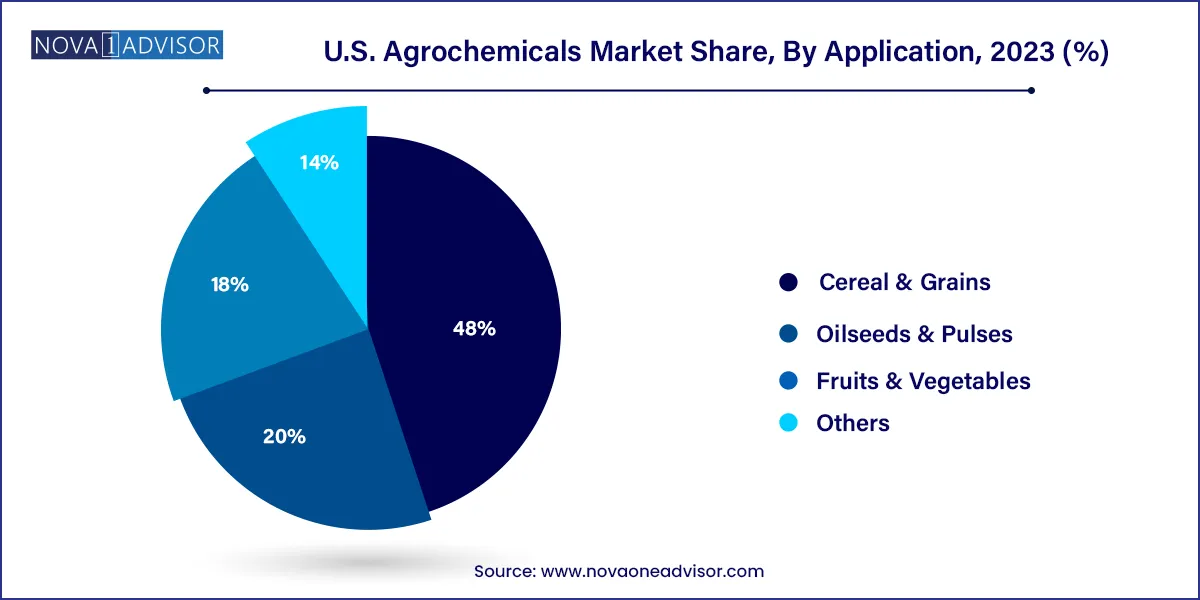

Cereal and grains dominated the agrochemical market application segments, reflecting the vast acreage dedicated to corn, wheat, and barley across the United States. These staple crops rely on a well-established agrochemical regimen involving herbicides for weed control, insecticides for borers and beetles, and nitrogen-based fertilizers for yield maximization. For example, cornfields in the Corn Belt routinely undergo split nitrogen applications and pre- and post-emergent herbicide treatments. Given their scale and economic significance, these crops receive priority in product development, field trials, and government support programs.

Fruits and vegetables are the fastest-growing application segment, particularly in California, Florida, and the Pacific Northwest, where specialty crops such as strawberries, grapes, citrus, and leafy greens are cultivated. These crops are highly susceptible to fungal, bacterial, and pest pressures and demand precise, often intensive agrochemical inputs. Growers use fungicides like copper hydroxide and systemic insecticides to ensure export-quality produce and shelf stability. With increasing demand for fresh produce, including organic variants, manufacturers are developing low-residue and bio-based options suited for this segment.

The U.S. agrochemicals market is defined by its vast and varied agricultural zones, robust R&D infrastructure, and responsive regulatory ecosystem. States such as Iowa, Illinois, Indiana, Nebraska, and Kansas are central to grain production and dominate fertilizer consumption. Meanwhile, California, Washington, and Florida represent major demand centers for crop protection products due to their climate-sensitive and high-value crop portfolios.

The role of universities (e.g., UC Davis, Purdue, and Texas A&M) in driving extension services and field-level testing ensures rapid dissemination of new product knowledge. Simultaneously, the USDA's data collection efforts help in modeling disease forecasts and fertilizer demand. Farm size and sophistication vary widely across regions from massive corn and soybean farms in the Midwest to small-scale, intensive vegetable operations on the coasts necessitating tailored agrochemical strategies.

Climate events such as drought in the Southwest or hurricanes in the Southeast periodically disrupt planting and chemical application schedules, highlighting the importance of adaptable products. In addition, the expanding focus on carbon sequestration, cover cropping, and regenerative farming is reshaping agrochemical input patterns, especially as major retailers and food brands begin enforcing sustainability-linked procurement policies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. agrochemicals market

Product

Application