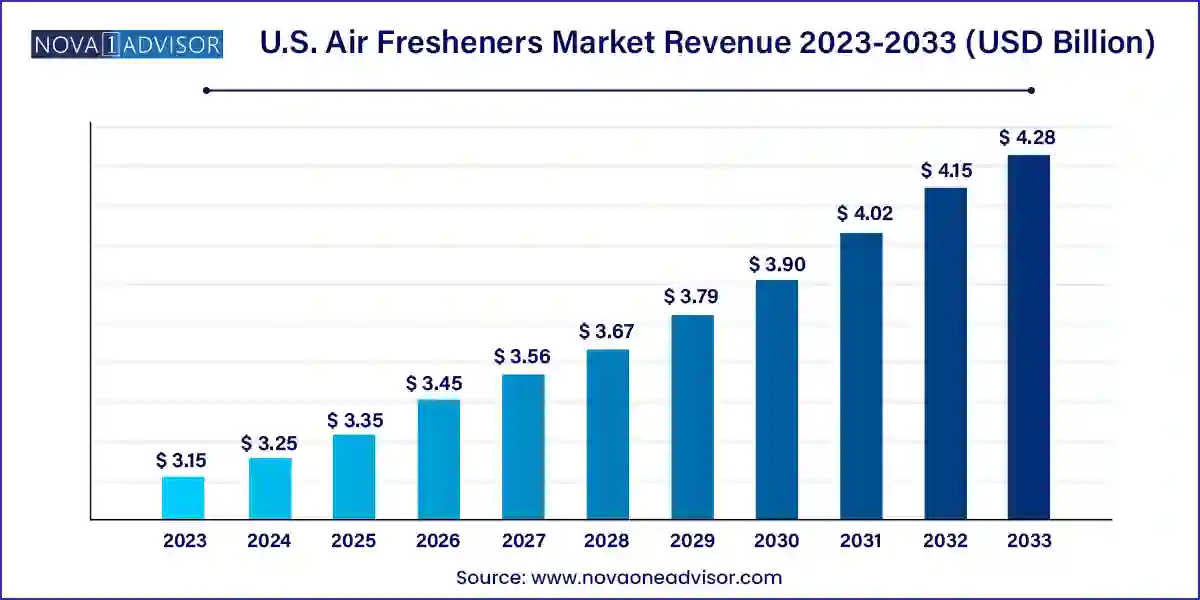

The U.S. air fresheners market size was exhibited at USD 3.15 billion in 2023 and is projected to hit around USD 4.28 billion by 2033, growing at a CAGR of 3.11% during the forecast period 2024 to 2033.

The U.S. air fresheners market stands as a critical segment within the broader home and personal care industry, defined by a dynamic blend of functionality, sensory appeal, and lifestyle influence. In 2024, the market surpassed a valuation of USD 3 billion and is projected to grow steadily through 2034, fueled by evolving consumer lifestyles, increasing attention to home aesthetics and hygiene, and innovations in scent delivery technologies. Air fresheners today are no longer simple odor masking agents—they are emotional enhancers, interior decor elements, and wellness companions.

This industry has expanded significantly beyond traditional formats, embracing a variety of product types and technologies including sprays, plug-ins, diffusers, gels, and even app-connected scent systems. Consumers across the U.S. are seeking air freshening solutions for diverse spaces such as homes, cars, offices, and public spaces. With pet ownership and urban living on the rise, air care products have become essential for odor management and mood improvement.

The pandemic era intensified attention on home environments, with people spending more time indoors and prioritizing cleanliness and ambiance. Air fresheners played a subtle yet crucial role in creating soothing, invigorating, or mood-enhancing atmospheres. As a result, demand has shifted toward multi-functional products—those that eliminate odors, provide aromatherapeutic benefits, and reflect personal taste. The growth of clean-label, eco-conscious, and allergen-free air care products further exemplifies the maturity and segmentation within the U.S. market.

Rising Demand for Natural and Organic Fragrance Ingredients: Consumers are becoming more sensitive to synthetic chemicals, pushing brands toward essential oils and botanical-based formulations.

Smart Air Fresheners and App-Connected Devices: Integration of IoT and app-controlled scent diffusers is gaining momentum, enabling real-time customization and scent scheduling.

Multi-functional and Mood-Enhancing Scents: Air fresheners that also offer relaxation, energy-boosting, or therapeutic effects are growing in demand, aligning with wellness trends.

Refillable and Sustainable Packaging Solutions: Eco-friendly packaging, refill pods, and recyclable materials are being adopted widely as sustainability becomes a top purchasing factor.

Hybrid Products and Experiential Aromas: The blending of scent and function—like scented candles that also repel insects or gels with temperature-sensitive release—is creating novelty appeal.

Expansion in Automotive Air Care: With increased time spent in personal vehicles and a rise in car ownership, automotive-specific air fresheners are seeing a significant spike.

Celebrity and Designer Collaborations: Luxury fragrance and lifestyle brands are entering the air care market with high-end, aesthetically crafted products, appealing to premium consumers.

Seasonal and Limited-Edition Launches: Scents themed around holidays, seasons, or pop culture references are engaging younger consumers and encouraging repeat purchases.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.25 Billion |

| Market Size by 2033 | USD 4.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Procter & Gamble; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; S. C. Johnson& Son, Inc.; Air-Scent International; Renegade Products USA.; Good & Well Supply Co.; The Yankee Candle Company, Inc.; Bath & Body Works Direct, Inc.; ILLUME Candles |

A major driver for the U.S. air fresheners market is the increasing consumer emphasis on indoor ambiance and mental well-being, especially post-pandemic. With remote work, home workouts, and staycations becoming part of daily life, American households have been reimagining their interior spaces for comfort and sensory balance. Scent, as a non-visual yet powerful element, plays a critical role in enhancing mood, relieving stress, and improving overall well-being.

The emotional connection between fragrance and mood has made air fresheners a staple in modern self-care and home-care routines. Products infused with lavender, eucalyptus, or citrus oils are often marketed for their calming, energizing, or purifying effects. Brands have capitalized on this trend by offering curated scent collections designed to transition with the time of day or to complement specific moods. This sensory personalization appeals to a broad demographic and encourages consumers to use air fresheners not just for odor elimination, but as everyday lifestyle enhancers.

A significant restraint affecting the market is the growing awareness and concern regarding volatile organic compounds (VOCs) and synthetic chemicals used in air fresheners. Scientific research and media reports have increasingly linked some conventional air freshener ingredients to respiratory problems, allergies, and potential endocrine disruption, especially when used in enclosed spaces over long periods.

In response, health-conscious consumers—particularly parents, pet owners, and individuals with asthma—are opting for fragrance-free, hypoallergenic, or natural alternatives. This shift has put traditional aerosol and synthetic plug-in products under scrutiny. Regulatory bodies are also tightening guidelines around ingredient disclosure and labeling. Companies that fail to reformulate or communicate their safety standards risk losing market share. Moreover, the cost of replacing chemical-heavy formulas with natural alternatives can be high, particularly for legacy brands with large product lines.

One of the most promising opportunities lies in the emergence of tech-driven and customizable air freshening systems, especially those that integrate with smart home ecosystems. The convergence of scent with technology has unlocked a new dimension for consumer engagement. App-connected air fresheners, programmable scent diffusers, and subscription-based pod systems offer convenience, personalization, and remote control.

Companies like Pura and Moodo have made significant inroads by offering devices that let users mix and match fragrances, schedule scent diffusion, and monitor usage from their smartphones. These innovations cater to younger, tech-savvy consumers who value convenience and customization. Moreover, integration with home assistants like Amazon Alexa and Google Home allows voice-activated scent control. The market is poised for rapid adoption of such products, especially as consumers continue to upgrade their home environments and adopt smart living trends.

Sprays and aerosols continued to dominate the U.S. air fresheners market in 2023, accounting for the highest market share due to their widespread availability, immediate effect, and affordability. These products are favored in both residential and commercial settings for quick odor elimination and flexible application. Spray-based products also appeal to price-sensitive consumers and offer a wide range of scent options—from fruity to floral to exotic blends. Established brands like Glade and Air Wick have maintained leadership in this space through seasonal launches and enhanced fragrance formulas.

However, electric air fresheners are emerging as the fastest-growing product category, owing to their ability to offer consistent, long-lasting scent diffusion with minimal effort. These products, often designed for plug-in or battery-operated use, are perceived as more sophisticated and convenient. Additionally, smart versions of electric air fresheners are gaining traction for their programmable and refillable features. Their appeal lies in aesthetic minimalism, energy efficiency, and the ability to set schedules or adjust intensity—features that resonate with urban and tech-forward consumers.

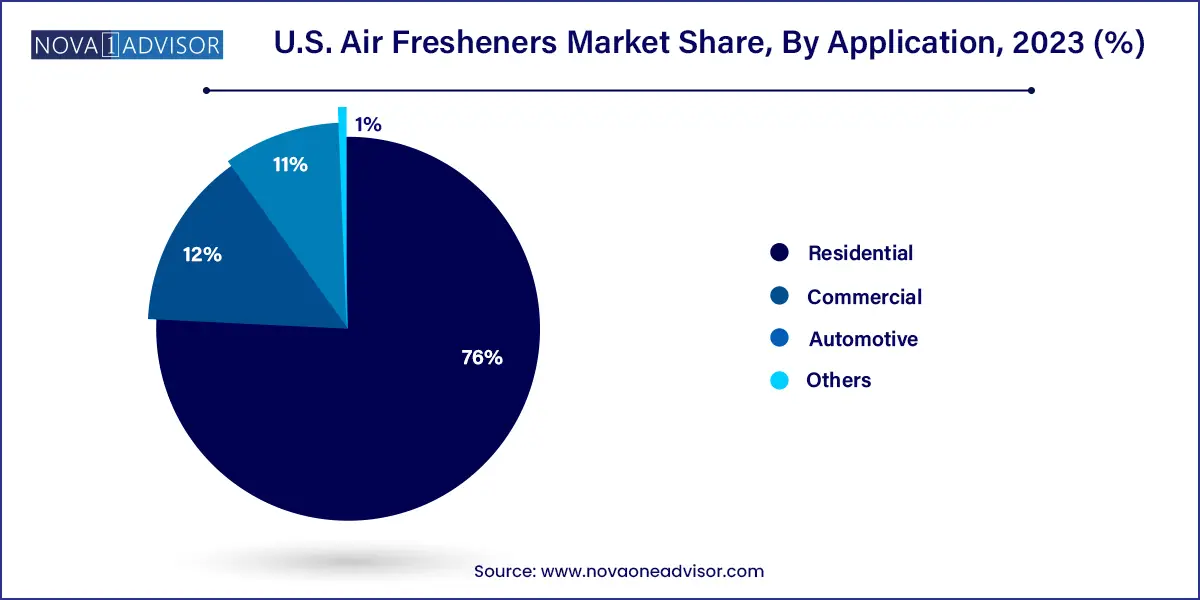

Residential applications led the U.S. air fresheners market by volume and value, driven by the widespread use of these products in bedrooms, bathrooms, living areas, and kitchens. Consumers increasingly see air fresheners as a part of their home’s overall sensory appeal and cleanliness. Seasonal purchases—such as cinnamon in winter or fresh linen in spring—are common, and personalized scent profiles are emerging as part of interior design. Residential demand also benefits from rising pet ownership, which contributes to odor control needs across households.

Automotive use is witnessing the fastest growth, fueled by extended time spent in personal vehicles, rideshare growth, and an increasing focus on vehicle hygiene. Car owners are investing in products like clip-on vent fresheners, gel-based dashboard units, and branded scent pads. Innovative collaborations—such as luxury fragrance brands offering car-specific lines—are elevating the automotive air freshener category. Additionally, with car-as-a-lifestyle-space becoming a norm, especially among gig workers and long commuters, air fresheners are viewed as essential comfort items.

In the United States, air freshener consumption reflects a blend of practicality and sensory luxury. Urban areas such as New York, San Francisco, and Los Angeles exhibit a high demand for aesthetically pleasing and tech-integrated air care solutions. Here, consumers are likely to gravitate toward smart plug-ins, boutique candles, and refillable pod-based systems. The emphasis is often on minimalistic design and subtle, complex fragrance profiles that enhance the mood and environment.

In contrast, suburban and rural areas show stronger uptake of traditional formats like aerosols and gels, largely due to cost efficiency and product familiarity. Multi-pet households, larger family homes, and garages tend to drive higher per-capita usage in these regions. Moreover, retailers such as Walmart, Target, and Home Depot remain dominant sales channels for value-based products in these geographies. Additionally, growing environmental consciousness is reflected in higher demand for eco-friendly packaging and natural scent formulations across all U.S. demographics.

March 2025 – Reckitt Benckiser (Air Wick) launched a new range of biodegradable plug-in refills under its “Fresh Earth” line, targeting environmentally conscious households. These refills are made with essential oils and come in 100% recyclable packaging.

February 2025 – Procter & Gamble (Febreze) introduced an AI-powered air freshener, “Febreze Smart Scent,” that adjusts intensity based on room occupancy and ambient temperature. The product also features app connectivity for tracking usage and reordering.

January 2025 – S.C. Johnson (Glade) collaborated with home decor brand Hearth & Hand™ to launch a limited-edition line of design-forward scented candles and gel pods, blending aesthetics with aroma.

December 2024 – Moodo announced a partnership with Marriott Hotels to install customizable scent diffusers in luxury suites, giving guests the option to select their preferred in-room aroma from a mobile app.

November 2024 – Pura secured $30 million in Series C funding to expand its range of smart home fragrance devices and develop exclusive scent partnerships with popular lifestyle influencers and premium fragrance houses.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. air fresheners market

Product

Application