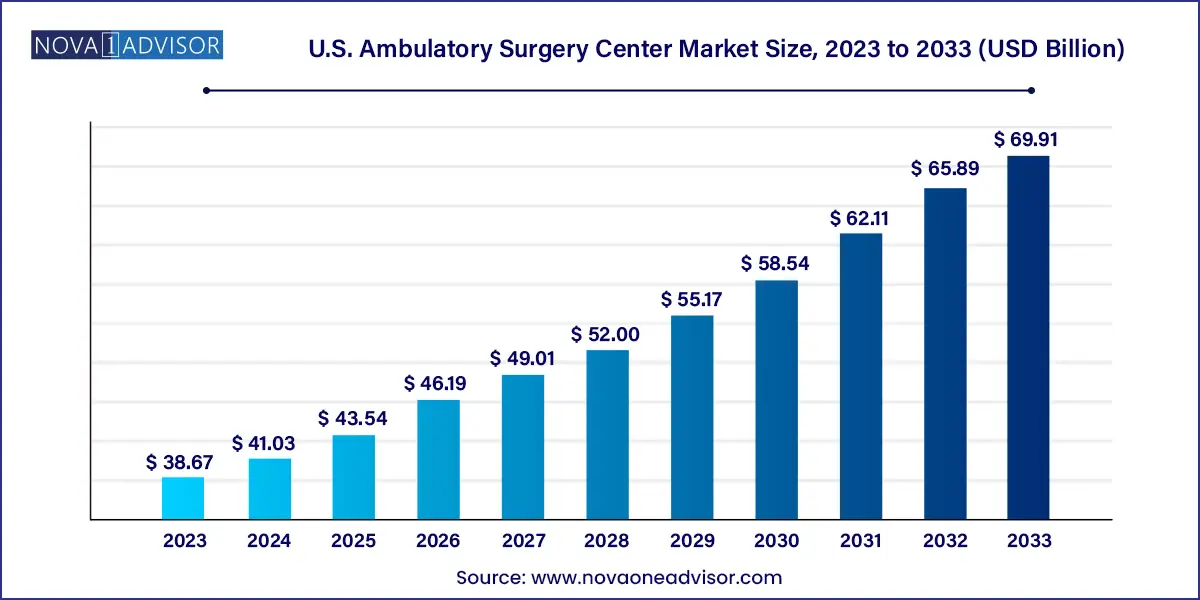

The U.S. ambulatory surgery center market size was estimated at USD 38.67 billion in 2023 and is projected to hit around USD 69.91 billion by 2033, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The U.S. Ambulatory Surgery Center (ASC) Market is a vital and rapidly evolving component of the American healthcare delivery ecosystem. ASCs are healthcare facilities that provide same-day surgical care, including diagnostic and preventive procedures, without the need for hospitalization. These centers offer cost-effective, convenient, and high-quality alternatives to inpatient hospitals for a wide range of surgical procedures.

With the push toward value-based care, minimally invasive surgeries, and reduced hospitalization times, ASCs have emerged as essential care delivery platforms. The market is propelled by multiple drivers—ranging from advances in surgical and anesthetic technology to payer incentives favoring outpatient care and increasing patient demand for convenience and transparency. In fact, CMS (Centers for Medicare & Medicaid Services) continues to add more procedures to the list of those approved for reimbursement in ASCs, enabling more complex surgeries to be performed outside of hospital settings.

The flexibility, specialization, and scalability of ASCs have attracted significant interest from investors, health systems, and surgeons. Physician-owned, hospital-affiliated, and corporate-operated ASCs are becoming commonplace, each leveraging different operational models to tap into local demand for outpatient surgical services. As healthcare costs continue to rise, and both providers and patients seek affordable solutions, ASCs offer a compelling blend of economic efficiency and clinical excellence.

Shift Toward Minimally Invasive and Outpatient Procedures: Technological advancements enable more surgeries to be safely performed outside hospitals.

Increase in Physician Ownership and Co-management Models: Surgeons are increasingly participating in the management and ownership of ASCs to gain autonomy and financial benefits.

CMS Policy Reforms Favoring ASCs: CMS continues to expand reimbursement policies that support outpatient procedures in certified ASCs.

Private Equity Investment in Corporate-Owned ASCs: PE firms are acquiring or establishing ASC chains, driving consolidation and regional expansion.

Technology Integration in ASCs: Adoption of electronic health records (EHR), AI-driven scheduling, and real-time analytics is improving ASC efficiency.

Patient-Centered Experience as a Competitive Differentiator: ASCs emphasize convenience, short waiting times, and transparency to enhance patient satisfaction.

Growing Specialization of ASCs: Single-specialty centers focused on orthopedics, ophthalmology, or gastroenterology are expanding due to procedure volume.

Staffing Optimization and Shortage Management: With a nursing and anesthesiology workforce shortage, ASCs are increasingly leveraging per diem and part-time clinical staff.

| Report Attribute | Details |

| Market Size in 2024 | USD 41.03 Billion |

| Market Size by 2033 | USD 69.91 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Specialty, ownership, center type, device type, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Envision Healthcare Corporation; Tenet Healthcare Corporation; Mednax Services, Inc.; TeamHealth; UnitedHealth Group; Quorum Health; Surgery Partners; Community Health Systems, Inc.; SurgCenter; Prospect Medical Systems; Edward-Elmhurst Health; MCKESSON CORPORATION, BD, Koninklijke Philips N.V.; 3M; Olympus America; Zimmer Biomet; GE HealthCare; Abbott; Medtronic; Henry Schein, Inc. |

A powerful driver behind the U.S. ASC market's growth is the cost advantage that these facilities offer compared to hospitals. ASCs provide up to 60% lower costs for comparable procedures performed in a hospital outpatient department (HOPD). This cost differential is particularly attractive to insurance providers, Medicare, and Medicaid, who are seeking to reduce overall healthcare spending.

Payers have responded by expanding coverage for outpatient surgeries, creating financial incentives for both providers and patients. For example, CMS has significantly increased the list of reimbursable procedures at ASCs over the last decade. Additionally, patients with high-deductible plans are choosing ASCs to save on out-of-pocket expenses. The combined effect of policy changes, financial incentives, and comparable clinical outcomes has made ASCs a preferred site for an increasing number of procedures, particularly in orthopedics, ophthalmology, and pain management.

Despite their advantages, ASCs face significant challenges, particularly in the realm of regulatory compliance and accreditation. ASCs must comply with federal, state, and payer-specific standards, which can vary significantly across jurisdictions. Meeting CMS conditions of participation and achieving certification through bodies like The Joint Commission or AAAHC requires ongoing investment in infrastructure, staff training, and documentation.

In addition, newer ASCs may find it difficult to negotiate favorable reimbursement rates without a strong hospital partner or established brand recognition. Certain states impose certificate-of-need (CON) laws that make it difficult to establish new ASCs, limiting access in underserved areas. The regulatory landscape remains complex and can hinder expansion or entry for smaller physician groups or startups lacking legal and compliance expertise.

One of the most exciting growth opportunities lies in expanding ASCs into high-complexity surgical specialties such as cardiology, spinal surgery, and oncology-related procedures. While historically limited to low-risk cases, advances in minimally invasive techniques, sedation protocols, and patient monitoring are allowing ASCs to handle procedures once deemed too risky for outpatient care.

For instance, same-day total joint replacements are becoming routine in orthopedic ASCs, and cardiac catheterization procedures are now being safely performed in freestanding facilities. Additionally, advances in robot-assisted surgery and remote patient monitoring are making more procedures possible within an ASC environment. As payer policies catch up with these clinical capabilities, ASCs can diversify services and tap into more lucrative procedure lines, especially in high-density urban markets.

Orthopedics dominates the ASC market by specialty, particularly with the rise of joint replacement surgeries transitioning from inpatient hospitals to outpatient facilities. Procedures such as arthroscopies, ACL reconstructions, and total knee/hip replacements are increasingly performed at ASCs due to the precision of minimally invasive techniques, reduced need for post-op hospitalization, and quicker recovery times. The economics also favor orthopedics in ASCs, with bundled payments and pre-op assessments that reduce complications and readmissions.

Cardiology is the fastest-growing specialty, reflecting an industry-wide push to move interventional cardiac procedures like stent placements and diagnostic angiographies out of the hospital setting. CMS’s 2020 decision to approve several cardiology procedures for ASC reimbursement has catalyzed investments in cardiology-specific ASCs. With growing demand for cardiovascular care among aging populations and the rise of specialty cardiology groups seeking independence from hospitals, this segment is set for rapid expansion.

Physician-owned ASCs dominate the market, making up the largest proportion of all centers across the U.S. Physicians typically prefer this model for its operational autonomy, streamlined workflows, and shared financial benefits. It allows surgeons to have a say in governance, quality control, and patient care practices, which in turn enhances efficiency and patient satisfaction. The physician-owned model is particularly prevalent in single-specialty ASCs where volume and specialization are tightly linked to individual provider expertise.

Corporate-owned ASCs are the fastest-growing ownership model, driven by aggressive private equity (PE) investment and hospital joint ventures. Corporate players such as United Surgical Partners International (USPI) and Surgery Partners are consolidating smaller ASCs and expanding their geographic footprint. These corporations offer centralized supply chains, standardized compliance frameworks, and scalable administrative infrastructure, making them attractive partners for physicians seeking exit strategies or broader reach.

Multi-specialty ASCs dominate the U.S. market, offering a range of procedures from gastroenterology and orthopedics to ENT and pain management. These centers appeal to broader patient bases and enjoy higher procedural throughput and better payer diversification. Multi-specialty centers are more likely to secure contracts with large insurers and are often integrated with hospital systems or physician management groups. Their flexibility and procedural diversity provide a hedge against volatility in any one specialty’s volume or reimbursement rates.

Single-specialty centers are the fastest-growing, especially in high-volume areas such as ophthalmology, GI endoscopy, and plastic surgery. These centers can achieve exceptional operational efficiency, standardized care protocols, and consistent outcomes. With rising demand for specialized care and consumer preference for focused service delivery, single-specialty ASCs are capturing niche markets with tailored experiences and brand differentiation.

The U.S. Ambulatory Surgery Center market is uniquely positioned due to its blend of private enterprise, payer diversity, and innovation-friendly healthcare policies. Over 9,200 ASCs operate across the country, with high densities in states like California, Texas, Florida, and New York. Urban and suburban regions benefit from higher population densities, payer diversity, and referral networks, while rural regions are increasingly targeted for expansion to reduce hospital burden.

U.S. payers including Medicare, Medicaid, and private insurers play a pivotal role in shaping the ASC landscape. Medicare's ASC Payment System, adjusted annually, sets reimbursement benchmarks for over 2,000 approved procedures. Meanwhile, commercial payers have begun designing ASC-specific benefit plans, incentivizing patients to choose outpatient surgery for elective procedures. The U.S. market also benefits from a relatively flexible legal framework, although Certificate of Need (CON) laws in some states continue to restrict ASC expansion.

The market is moderately fragmented. Key players are adopting several strategies, including launching new centers and raising funds from investors, to strengthen their position in the market. For instance, in February 2023, the University of Rochester Medical Center Rochester opened the country’s first Orthopedics and Physical Surgery Center in Henrietta. Some prominent players in the U.S. ambulatory surgery center market include:

April 2025 – USPI (United Surgical Partners International) announced the acquisition of 12 single-specialty ASCs in the Midwest, expanding its total footprint to over 440 centers.

March 2025 – Surgery Partners Inc. unveiled a $300 million joint venture with a national hospital system to develop multi-specialty ASCs across the Southeast U.S.

February 2025 – Envision Healthcare launched its "Digital ASC Suite," integrating AI-powered scheduling, patient intake, and supply chain management for its affiliated centers.

December 2024 – Tenet Healthcare Corporation announced the expansion of robotic-assisted outpatient surgical services across 20 ASCs, focusing on orthopedic and urologic procedures.

October 2024 – HCA Healthcare partnered with private equity firms to fund the launch of 15 cardiology-focused ASCs in metro and suburban areas.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Ambulatory Surgery Center market.

By Specialty

By Ownership

By Center Type

By Device Type

By Regional