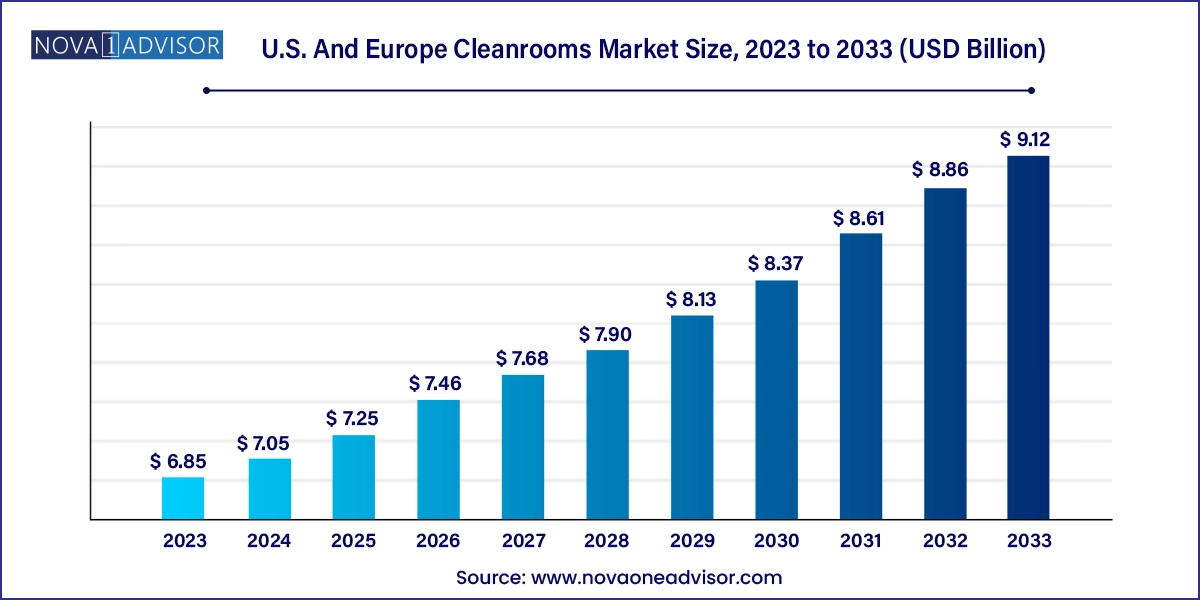

The U.S. and Europe cleanrooms market size was exhibited at USD 6.85 billion in 2023 and is projected to hit around USD 9.12 billion by 2033, growing at a CAGR of 2.9% during the forecast period 2024 to 2033.

The cleanrooms market in the U.S. and Europe serves as a foundational pillar for industries where environmental control is critical for product quality, safety, and regulatory compliance. Cleanrooms are specially designed environments with low levels of pollutants such as dust, airborne microbes, aerosol particles, and chemical vapors. These facilities are crucial in applications across pharmaceuticals, biotechnology, healthcare, semiconductors, and life sciences.

In both the U.S. and Europe, the cleanroom ecosystem has matured to accommodate stringent regulatory frameworks, particularly those set by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and various national health and safety bodies. Technological advancements, rising demand for sterile drug formulations, increasing incidence of hospital-acquired infections, and the expansion of personalized medicine are fueling market growth. Moreover, the COVID-19 pandemic significantly emphasized the importance of contamination control in drug compounding and clinical settings, prompting many healthcare institutions to either retrofit existing facilities or build new cleanroom spaces.

Cleanroom adoption is further catalyzed by growing investments in biopharmaceutical manufacturing, cell and gene therapies, and the growing trend of outsourcing drug development and production to contract manufacturing organizations (CMOs). Hospitals and compounding pharmacies, as critical end-users, are elevating the standards for sterile environments to comply with USP <797> and <800> standards in the U.S. and GMP requirements in Europe.

Rising investment in modular cleanroom construction for scalability and faster deployment

Increased implementation of cleanroom robotics and automation for contamination control

Growing integration of smart HVAC and real-time monitoring systems for environmental control

Heightened regulatory compliance pressure under updated USP and EU GMP standards

Adoption of mobile cleanrooms and hybrid clean zones in small-scale clinical settings

Shift toward ISO Class 5 and ISO Class 6 cleanroom configurations in compounding pharmacies

Increasing use of disposable cleanroom consumables to minimize cross-contamination

Development of energy-efficient cleanroom designs to reduce operational costs

| Report Coverage | Details |

| Market Size in 2024 | USD 7.05 Billion |

| Market Size by 2033 | USD 9.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 2.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; UK; Germany; France; Italy; Spain; RoE |

| Key Companies Profiled | ISOLTECH Srl; ALLIED CLEANROOMS; Angstrom Technology; Nicomac Srl; Terra Universal, Inc.; MECART; Clean Room Depot; Clean Air Products; Asgatech Holding Ltd. |

One of the primary drivers in the U.S. and Europe cleanrooms market is the enforcement of strict regulatory standards for sterility in pharmaceutical and healthcare environments. Regulatory bodies like the FDA, EMA, and national drug enforcement agencies mandate rigorous environmental controls for drug manufacturing, compounding, and clinical usage. The revised USP <800> standard, which became enforceable in the U.S., focuses on safe handling of hazardous drugs, demanding cleanroom facilities that protect both patients and healthcare workers.

Similarly, European GMP Annex 1 revisions are putting pressure on manufacturers and hospitals to upgrade their cleanroom facilities. These standards govern aseptic processing, air cleanliness, and environmental monitoring, making cleanrooms indispensable for compliance. Failure to meet these standards can lead to production halts, regulatory warnings, and reputational damage. Hence, compliance becomes not only a legal necessity but a competitive advantage for institutions adhering to the highest cleanroom standards.

Despite the critical need for cleanrooms, one of the most pressing restraints in the market is the high initial investment and ongoing operational costs associated with building and maintaining cleanroom infrastructure. Cleanroom facilities demand specialized design, advanced HVAC systems, pressure differential control, air filtration (HEPA/ULPA), and strict environmental monitoring systems. The cost of achieving ISO Class 5 or EU Grade A/B environments can be particularly high, especially for smaller hospitals or compounding pharmacies.

Moreover, operational expenses related to energy consumption, filter replacement, validation, and staff training continue to impact budgets. In regions like Europe, where energy costs are already high, cleanroom operations can be particularly cost-intensive. Smaller healthcare settings often find it challenging to justify or afford such investments unless mandated by regulatory authorities or driven by infection outbreaks.

A major opportunity in the cleanrooms market arises from the growing acceptance of modular and prefabricated cleanroom systems. These solutions offer flexibility, cost-efficiency, and scalability, making them especially attractive to healthcare institutions seeking rapid deployment or facility upgrades without major construction disruption. Modular cleanrooms are pre-engineered systems that can be assembled quickly and expanded or relocated as needed.

For compounding pharmacies and hospitals navigating rapid regulatory changes or new service demands (e.g., oncology compounding), modular cleanrooms offer a path to compliance without long downtime. These systems also align with sustainability goals, as newer modular units come with energy-efficient lighting, HVAC, and airflow systems. Suppliers offering turnkey modular cleanrooms that include installation, certification, and training are gaining traction, especially in the U.S. where regulatory timelines are tightening.

Hospitals dominate the cleanrooms market in both the U.S. and Europe, primarily due to their role in delivering critical care and handling immunocompromised patients. Cleanrooms are vital for operating theaters, bone marrow transplant units, intensive care units, and clinical pharmacies. The risk of healthcare-associated infections (HAIs) drives continuous investment in sterile environments, particularly in high-risk departments such as oncology, neonatology, and surgical wards.

In the wake of the COVID-19 pandemic, hospitals across the U.S. and Europe rapidly adapted to surge capacity by implementing portable cleanrooms and hybrid isolation zones. Hospitals are also leading in the adoption of automated cleanroom technology, such as UV-C disinfection robots, to reduce microbial burden. Larger health systems are integrating centralized compounding pharmacies with dedicated cleanroom suites to improve sterility assurance and reduce drug waste.

Compounding pharmacies are the fastest-growing segment, driven by regulatory changes and heightened safety expectations from prescribers and patients. In the U.S., compliance with USP <797> and <800> has prompted thousands of pharmacies to retrofit their facilities with ISO-classified cleanrooms. Cleanroom requirements apply particularly to hazardous drug compounding, parenteral nutrition, and ophthalmic formulations, where sterility and particulate control are critical.

Many independent pharmacies and hospital-affiliated outpatient services are seeking scalable, cost-effective cleanroom installations to meet demand for personalized therapies and biologics. The rise of 503B outsourcing facilities is also contributing to cleanroom expansion, as these facilities are required to meet stricter FDA standards than traditional retail compounding pharmacies. In Europe, the implementation of PIC/S guidelines and national pharmacopoeia regulations has triggered similar momentum, especially in countries like Germany and France.

United States: The U.S. cleanrooms market is heavily shaped by regulatory enforcement and the decentralized nature of healthcare delivery. The implementation of USP <800> and tightening inspection regimes by the FDA and Joint Commission have catalyzed cleanroom adoption in both hospital and compounding settings. Leading hospitals such as the Cleveland Clinic, Mayo Clinic, and MD Anderson Cancer Center have invested in state-of-the-art cleanroom infrastructures to support sterile compounding, surgical preparations, and clinical trials.

In addition, the U.S. continues to witness growth in specialized 503B outsourcing facilities and biologics manufacturing units, all of which require stringent cleanroom conditions. The federal government’s increasing emphasis on pharmaceutical manufacturing self-reliance has led to new investments in modular cleanroom setups for vaccine and drug production. Cleanroom technology providers in the U.S. are focusing on mobile, containerized solutions to meet the needs of emergency response and rural healthcare centers.

Europe (UK, Germany, France, Italy, Spain): In Europe, the cleanrooms market is influenced by pan-European regulations, particularly EU GMP Annex 1, which sets sterility standards for drug production. Germany leads the European market, driven by a large pharmaceutical manufacturing base and a strong hospital infrastructure. German hospitals such as Charité – Universitätsmedizin Berlin and LMU Klinikum are at the forefront of advanced cleanroom implementation.

The UK, post-Brexit, has maintained alignment with EU GMP standards, with added national oversight through the MHRA. The demand for cleanrooms in NHS hospitals and private clinics is driven by oncology services, sterile compounding, and infection control initiatives. France and Italy are also investing in cleanroom renovations to comply with emerging standards, while Spain is adopting modular cleanrooms to support hospital expansions. Overall, Europe’s diverse health systems are united in their push for sterility compliance, driving consistent demand for cleanroom technologies.

March 2025: AES Clean Technology launched a new modular cleanroom series in the U.S., tailored for USP <800> compliance in hospital pharmacies.

February 2025: Connect 2 Cleanrooms announced a strategic partnership with a major French pharmaceutical group to install energy-efficient cleanroom systems across five sites.

January 2025: ABN Cleanroom Technology expanded its operations into Spain, introducing hybrid cleanroom-lab modules for oncology departments.

November 2024: Clean Air Products released a new line of cleanroom pass-through chambers with RFID-enabled inventory management in the U.S.

September 2024: Germfree announced the delivery of mobile cleanrooms to rural clinics across the Midwest U.S. to support chemotherapy preparation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. and Europe cleanrooms market

End-use

Regional