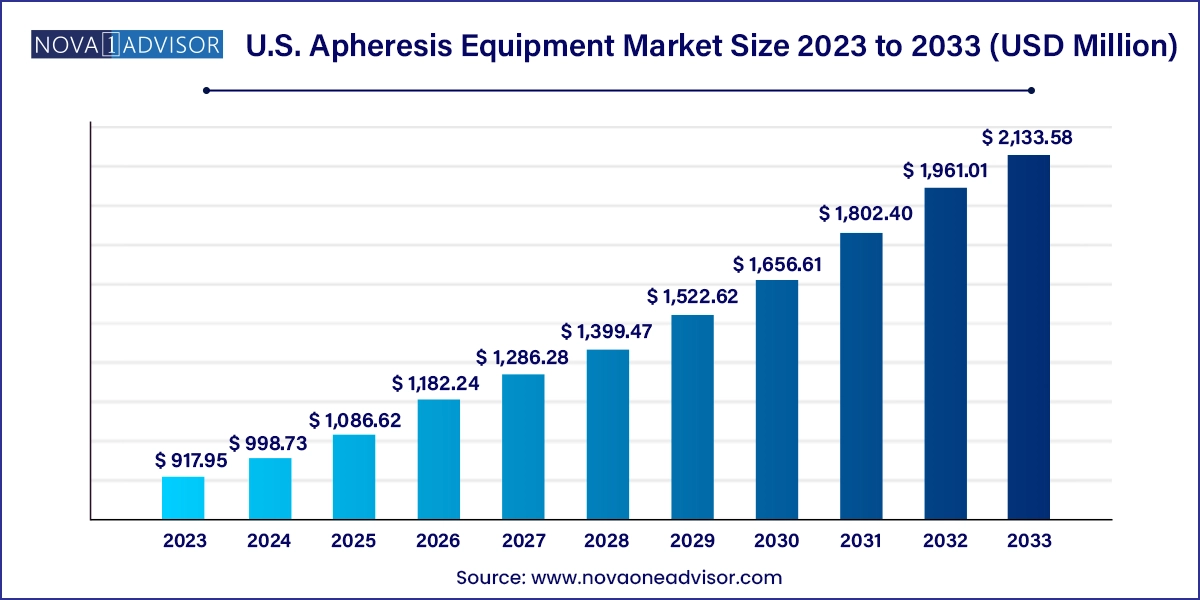

The U.S. apheresis equipment market size was exhibited at USD 917.95 million in 2023 and is projected to hit around USD 2,133.58 million by 2033, growing at a CAGR of 8.8% during the forecast period 2024 to 2033.

The U.S. apheresis equipment market has emerged as a vital component of modern healthcare delivery, enabling targeted blood component separation for therapeutic and donation purposes. Apheresis a process that involves the removal or collection of specific components from blood while returning the remainder to circulation is widely used in treating a range of conditions such as autoimmune diseases, neurological disorders, hematological abnormalities, and renal dysfunctions. In parallel, the technology plays a central role in blood component donation, supporting the growing demand for platelets, plasma, and leukocytes in transfusion medicine.

In the United States, the widespread adoption of apheresis is supported by a well-established infrastructure of blood banks, specialty clinics, and tertiary hospitals. Technological advancements in automated apheresis systems, along with increasing precision in blood separation techniques, have made the procedures safer, quicker, and more efficient. As patient-centric care models evolve, apheresis procedures are increasingly being delivered in outpatient settings, driving the need for portable, user-friendly equipment.

The U.S. market also benefits from a strong regulatory and reimbursement framework. The American Society for Apheresis (ASFA) provides clinical guidelines for therapeutic use, while agencies such as the FDA and CMS ensure safety, quality, and accessibility. In the context of personalized medicine, apheresis is becoming particularly relevant, as it enables cellular therapies, stem cell harvesting, and even treatments tailored to specific molecular or immunologic profiles. The result is a rapidly maturing market, characterized by innovation, expanding clinical indications, and rising procedural volumes across diverse healthcare settings.

Rising application of apheresis in cellular therapy and immunotherapy, particularly in stem cell transplantation and CAR-T cell collection.

Miniaturization of apheresis machines, making them suitable for bedside or mobile units in outpatient and homecare environments.

Adoption of AI-enhanced apheresis platforms for real-time monitoring and automated parameter adjustments.

Integration of cloud-based data tracking to document procedure efficacy, patient tolerance, and long-term outcomes.

Increased utilization of apheresis in neurology, especially for conditions like multiple sclerosis, myasthenia gravis, and Guillain-Barré syndrome.

Development of disposable, pathogen-reduced apheresis kits to reduce cross-contamination risks and meet infection control protocols.

Expansion of donor apheresis programs, enabling more efficient and higher-yield plasma and platelet collections.

Hybrid systems with multi-procedure capabilities, combining plasmapheresis, erythrocytapheresis, and leukapheresis into one device for complex clinical workflows.

| Report Coverage | Details |

| Market Size in 2024 | USD 998.73 Million |

| Market Size by 2033 | USD 2,133.58 Million |

| Growth Rate From 2024 to 2033 | CAGR of 8.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Procedure, Technology, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Haemonetics Corporation; Fresenius Kabi; B. Braun SE; Mallinckrodt Pharmaceuticals; Nikkiso Co., Ltd.; Asahi Kasei Medical Co., Ltd.; Terumo BCT |

A major driver of the U.S. apheresis equipment market is the increasing prevalence of autoimmune and hematologic disorders requiring therapeutic apheresis. Conditions such as thrombotic thrombocytopenic purpura (TTP), lupus nephritis, sickle cell anemia, and certain neurological diseases like chronic inflammatory demyelinating polyneuropathy (CIDP) often necessitate plasma exchange or red cell exchange as part of treatment.

These diseases are often chronic or relapsing in nature, requiring repeat procedures, which supports continuous demand for both devices and disposables. As more diseases receive FDA or ASFA guidance approvals for therapeutic apheresis, clinical acceptance is broadening. Moreover, many patients who are unresponsive to immunosuppressive drugs are turning to apheresis as a second-line or adjunctive therapy. This trend is reflected in increasing insurance coverage and institutional investment in apheresis units. In turn, equipment manufacturers are innovating with faster, patient-tailored machines that can be used for multiple indications, thus expanding their utility across departments.

One of the core restraints in the U.S. apheresis equipment market is the significant capital investment required to acquire and maintain advanced machines. Most apheresis devices involve sophisticated centrifugation or membrane filtration technology, real-time data processing, and sterile disposables. While large academic hospitals and urban health systems may easily justify such investments, smaller community hospitals, rural facilities, and standalone clinics may struggle with the financial and operational burden.

Additionally, the procedure itself requires highly trained nurses and apheresis specialists, often in short supply. A lack of proper training can limit the safe and effective execution of complex procedures, especially in non-traditional settings. While online certifications and ASFA training modules exist, scaling such expertise remains challenging. The shortage of experienced staff creates bottlenecks in service delivery and impedes wider adoption, particularly as the demand for apheresis grows in outpatient and specialty care.

A significant market opportunity lies in the expansion of apheresis services into outpatient and ambulatory care settings. Traditionally delivered in hospital-based units, apheresis is now being adapted for lower-acuity environments thanks to compact, automated systems and improved patient monitoring technologies. Chronic conditions such as familial hypercholesterolemia or autoimmune neurologic diseases require frequent treatment sessions that can burden hospital infrastructure and reduce patient convenience.

In response, specialized infusion and ambulatory care clinics are incorporating apheresis into their service offerings. The shift is also supported by payer interest in reducing the cost of care delivery by avoiding hospitalization for repetitive treatments. Portable devices, disposable kits, and real-time connectivity for remote oversight now allow procedures to be performed outside the inpatient setting without compromising safety. This decentralization presents untapped potential for device manufacturers, service providers, and clinicians to grow the market through convenience-driven care models.

Disposable Apheresis Kits Dominate the U.S. Market

Disposable apheresis kits hold the largest market share due to their high-volume, repeat-use nature and essential role in every procedure. These kits which include tubing, separation filters, centrifuge chambers, and collection bags—are single-use components that ensure sterility and reduce the risk of cross-contamination. Given that each apheresis session requires a new kit, the demand for disposables is directly tied to procedural volume. As treatment indications grow and the number of repeat patients increases, this segment enjoys a reliable and recurring revenue stream.

Moreover, increasing awareness around infection control, especially in the post-COVID healthcare environment, has led institutions to prioritize pathogen-reduced, pre-sterilized kits. Manufacturers are also offering customized kits tailored for specific procedures (e.g., plateletpheresis vs. plasmapheresis), increasing clinical efficiency. These innovations have further cemented disposable kits as the most revenue-generating product category in the market.

Devices Are the Fastest-Growing Segment Due to Automation and Multipurpose Use

While disposables dominate in volume, apheresis devices are experiencing the fastest growth due to innovations in automation, portability, and multi-application versatility. Modern machines can perform multiple apheresis techniques—such as plasmapheresis, photopheresis, and leukapheresis on a single platform, making them highly attractive for busy hospital departments or outpatient infusion centers.

Advanced models now feature touchscreen interfaces, automated flow regulation, and real-time feedback mechanisms, reducing operator dependency and procedural time. The U.S. market is also seeing a surge in demand for portable and bedside-friendly devices, enabling expansion into smaller clinics and home care. With growing clinical evidence supporting apheresis for new indications, investments in cutting-edge equipment are increasing, making this the most dynamic product segment in terms of innovation and adoption.

Hematology Leads the Application Segments

Among applications, hematology is the dominant sector, given the critical role of apheresis in managing conditions such as sickle cell anemia, hemolytic uremic syndrome, TTP, and certain leukemias. Red blood cell exchange (erythrocytapheresis), platelet reduction, and leukocyte removal are standard-of-care interventions in many hematologic emergencies and chronic conditions. These treatments are often life-saving and require specialized machines with precision filtration.

Moreover, hematology applications are supported by well-established protocols and reimbursement pathways in the U.S., making them easier to implement across care settings. Pediatric hematology, in particular, has seen growth in apheresis usage, as children with inherited blood disorders often benefit from early, proactive interventions. This wide range of conditions, combined with recurring treatment cycles, ensures hematology remains the cornerstone of the apheresis market.

Neurology Is the Fastest-Growing Application Segment

In recent years, neurology has emerged as the fastest-growing application, driven by increased clinical evidence supporting apheresis in autoimmune neurologic disorders. Conditions such as Guillain-Barré syndrome, multiple sclerosis, and myasthenia gravis are increasingly treated with plasmapheresis or immunoadsorption techniques. As more neurologists recognize the potential of these therapies, the number of neuro-apheresis units across the U.S. is rapidly expanding.

Technological advancements now allow tailored plasma removal while preserving beneficial components, making the procedures safer and more tolerable for patients. Additionally, partnerships between neurologists and apheresis specialists in outpatient settings are accelerating access and reducing procedural costs. With growing prevalence and acceptance, neurology is set to become a major growth engine within the application landscape.

Plasmapheresis Dominates Due to Its Versatile Applications

Plasmapheresis stands as the most commonly performed apheresis procedure across the U.S., owing to its use in a broad spectrum of indications including TTP, CIDP, lupus, and transplant rejection management. The procedure removes harmful antibodies, immune complexes, and toxins by exchanging the patient’s plasma with a replacement fluid. Hospitals frequently rely on plasmapheresis in critical care settings, often as a first-line or rescue therapy.

The method is well-documented in clinical literature and supported by ASFA guidelines, giving clinicians confidence in its use. Its adaptability to multiple specialties including nephrology, neurology, rheumatology, and hematology—further reinforces its market-leading position. The demand for plasmapheresis is expected to remain strong, especially as newer autoimmune diseases are added to the treatment repertoire.

Photopheresis and Leukapheresis Are Rapidly Gaining Momentum

Among other procedures, photopheresis and leukapheresis are witnessing the fastest growth. Photopheresis is increasingly used in treating cutaneous T-cell lymphoma and graft-versus-host disease post-transplant, offering immunomodulation with fewer side effects. As new immunologic pathways are explored, photopheresis is gaining attention as a precision therapy.

Leukapheresis, meanwhile, plays a pivotal role in stem cell harvesting, CAR-T cell collection, and hematologic oncology protocols. With the expansion of personalized medicine and cell therapy trials in the U.S., leukapheresis is becoming a gateway to advanced therapeutics. Both procedures require high-end machines and trained staff, contributing to premium pricing and greater value per session.

Centrifugation remains the dominant technology, employed in the majority of apheresis devices due to its precision and long-standing clinical trust. This method separates blood components based on density differences, allowing for targeted extraction of plasma, platelets, leukocytes, or erythrocytes. Continuous innovation has improved the speed, safety, and accuracy of centrifuge-based devices, making them suitable for complex multi-component procedures.

.webp)

Although currently smaller in market share, membrane filtration is the fastest-growing technology, offering a gentler alternative for plasma separation without requiring high-speed spinning. Filtration is particularly favored in pediatric settings, outpatient clinics, and when dealing with patients at risk of clotting or vascular damage. The lower extracorporeal volume and automated fluid balancing make it ideal for fragile or elderly patients. With manufacturers investing in disposable filtration modules, this segment is expected to gain further momentum.

The United States remains the most advanced and mature market for apheresis equipment globally. Factors such as a robust healthcare infrastructure, advanced blood bank networks, high insurance coverage, and widespread availability of trained clinicians contribute to high procedural volumes. Major academic centers and research hospitals continuously explore new therapeutic uses, fueling device innovation and clinical validation.

The U.S. also leads in clinical trials involving cellular therapies, immunotherapies, and plasma-based interventions, all of which utilize apheresis for cell harvesting or component collection. Health policies encouraging value-based care and home-based treatments are driving device adaptation for non-hospital environments. Reimbursement models for chronic apheresis treatment have also become more comprehensive, making the U.S. fertile ground for market expansion, particularly in neurology and immunology.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. apheresis equipment market

Product

Application

Procedure

Technology

Regional