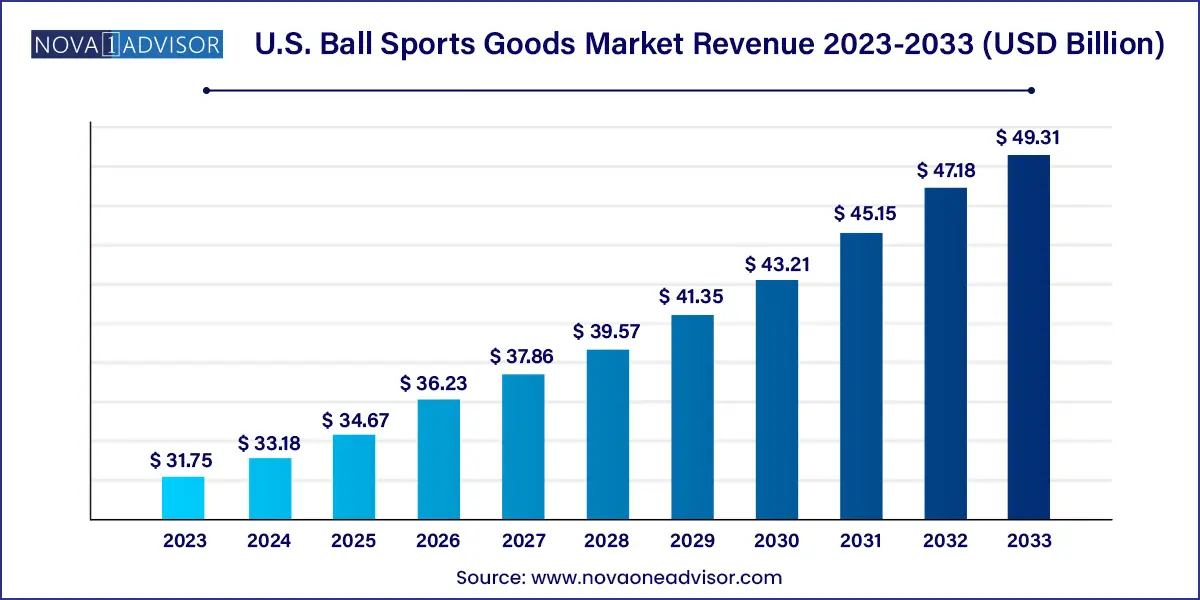

The U.S. ball sports goods market size was exhibited at USD 31.75 billion in 2023 and is projected to hit around USD 49.31 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 33.18 Billion |

| Market Size by 2033 | USD 49.31 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Sport, Product, Price Range, and Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Nike, Inc.; Adidas AG; PUMA SE; Under Armour, Inc.; Columbia Sportswear Company; lululemon athletica Inc.; New Balance Athletics, Inc.; Mizuno Corporation; Callaway Golf Company; ANTA Sports Products Limited |

The origination of ball sports in the U.S. can be traced back to Native Americans and immigrants from Europe. Growing emphasis on health and fitness, with an increasing number of Americans adopting active lifestyles, is positively influencing ball sports participation in the country. This has led to a surge in demand for ball sports equipment and facilities as individuals seek avenues for regular physical activity.

The rise of e-sports and the digitalization of sports content have profoundly impacted the ball sports goods market. Traditional sports are adapting to the changing media landscape with increased streaming options, virtual experiences, and interactive fan engagement. This shift expands the reach of ball sports and opens new revenue streams through partnerships, sponsorships, and digital content creation. For instance, in 2024, ESPN (a subsidiary of The Walt Disney Company), FOX, and Warner Bros. Discovery are collaborating to build an innovative direct-to-consumer (DTC) sports platform.

Social factors, such as inclusivity and diversity, are also influencing the ball sports goods market. Initiatives promoting accessibility and inclusivity in sports have gained momentum, fostering a more diverse and welcoming community. Leagues, teams, and brands recognize the value of promoting diversity in marketing, player recruitment, and overall sports culture.

The importance of sustainability and environmental consciousness is another notable movement in the U.S. ball sports goods market. Consumers increasingly seek eco-friendly and sustainable products, prompting manufacturers to innovate materials and production processes. This trend is evident in the development of eco-friendly sports equipment, stadiums adopting green practices, and leagues promoting environmental responsibility.

Manufacturers are increasingly partnering with professional ball sports players for endorsements and collaborations. This strategic approach leverages the credibility, influence, and popularity of athletes to promote products and drive sales in the ball sporting goods market. For instance, in May 2023, Kenny Beecham's Enjoy Basketball launched a new spring collection in partnership with The ICEE Company. This collaboration introduces a range of co-branded basketballs, apparel, and collector cups. Available exclusively online, the collection is offered through Enjoybball.com.

The football/soccer goods segment accounted for a revenue share of 30.04% in 2023. In the U.S., football/soccer is now ranked fourth in terms of popularity, following basketball, baseball, and football. According to a study by the Sports & Fitness Industry Association and the Sports Marketing Survey, 14.4 million Americans participated in soccer in 2021, up 0.6 million players from the 14-year low that was reached in 2018. Participation in soccer sport has risen for three consecutive years. In addition, more than 800,000 children played on high school soccer teams in 2021 and 2022, placing the sport fourth behind track and field, basketball, and football, according to the National Federation of State High School Associations (NFHS).

The cricket segment is estimated to grow at a CAGR of 15.1% from 2024 to 2033.The growing demand for cricket sports goods in the U.S. can be attributed to the sport's increasing popularity and participation across the country. As more Americans embrace cricket, whether through grassroots leagues, school programs, or international broadcasts, there is a corresponding surge in the need for cricket equipment and gear. This growing interest not only fuels demand among existing players but also attracts newcomers to the sport who require essential gear to participate. Consequently, retailers and manufacturers are responding to this expanding market by offering a wider range of cricket bats, balls, protective gear, and apparel to meet the diverse needs of players at all skill levels, driving growth in the cricket sports goods market in the U.S.

Apparel accounted for a revenue share of 47.86% in 2023. Athletes and sports enthusiasts regularly purchase sportswear, including jerseys, shorts, socks, and shoes, which are essential for both performance and comfort. Major sports apparel brands like Nike, Adidas, Dick’s Sporting Goods, New Balance, and Under Armour have a strong following. Their innovative designs, quality, and marketing efforts attract a large customer base. Moreover, their creative campaigns and targeted advertising strategies for launching ball sports-specific apparel in the U.S. market have opened up new opportunities and avenues for growth. In January 2024, Dick's Sporting Goods expanded its Calia private brand with the launch of Calia Inspire, a collection featuring a new versatile technical fabric. To promote this collection, the company introduced the "Calia Inspire: There’s Beauty in the Burn" campaign. The collection includes a range of activewear pieces such as leggings, bodysuits, dresses, shorts, tank tops, and sports bras.

The footwear for ball sports goods market is expected to grow at a CAGR of 4.6% from 2024 to 2033. Continuous innovation in shoe technology, such as improved cushioning, better support, and enhanced performance features, has driven consumer interest and demand. High-quality sports footwear is crucial for performance and injury prevention. Athletes and recreational players prioritize investing in good footwear to enhance their game and reduce the risk of injuries.

The mass priced ball sports goods segment accounted for a revenue share of 72.30% in 2023. The mass pricing segment of the U.S. ball sports goods market is known for its affordability and accessibility, appealing to a wide demographic. These products are specifically crafted to meet the needs of the everyday consumer by providing reasonable prices without compromising quality. Typically, items in this category are produced in larger quantities, allowing for economies of scale that result in more budget-friendly price points. The mass pricing segment is heavily influenced by factors such as price sensitivity, widespread availability, and its appeal to recreational players and families. Retail channels like big-box stores, department stores, and online marketplaces play a crucial role in distributing these products.

The premium priced ball sports goods market is expected to grow at a CAGR of 5.9% from 2024 to 2033. The premium segment is characterized by products that prioritize superior quality, advanced technology, and enhanced performance. Consumers in this category are often enthusiasts, professional athletes, or those seeking top-notch products for an optimal sports experience. Various factors, including continuous innovation, the established reputation of brands, and endorsements from professional athletes, shape the premium pricing segment. Specialized sports stores, exclusive brand outlets, and dedicated online platforms for sports equipment are pivotal in meeting the specific requirements of premium consumers.

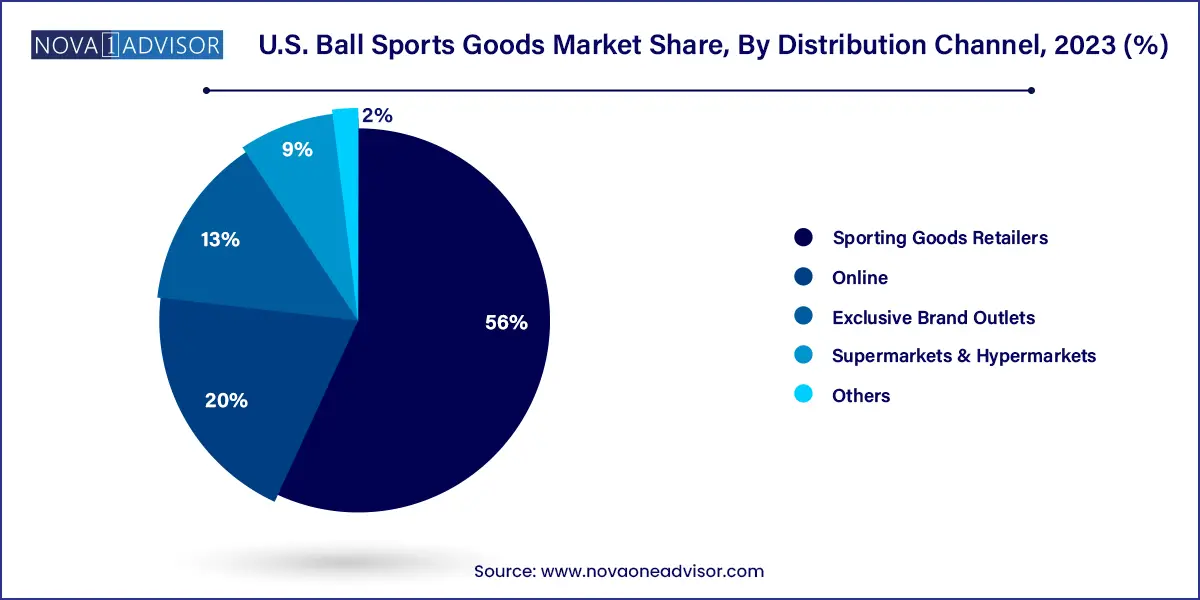

The sales of ball sports goods through sporting goods retailers accounted for a revenue share of 56.0% in 2023. Many sporting goods retailers have extensive brick-and-mortar store networks across the country. This physical presence allows customers to see, touch, and try out products before making a purchase, which enhances consumer confidence and satisfaction. These retailers provide a wide variety of ball sporting goods such as equipment, apparel, footwear, and accessories, meeting the diverse preferences and needs of consumers. Additionally, they emphasize offering rental options for their ball sporting goods before customers make a purchase.

In May 2023, Wilson Sporting Goods Co. launched its inaugural retail store in Santa Monica, U.S. The new store features an innovative "Equipment Room," allowing customers to rent specific products for playtesting outside the store before making a purchase. This unique program is available for a wide range of sporting goods including volleyball, tennis, football, pickleball, basketball, and other sports.

The sales of ball sports goods through online channels is expected to grow at a CAGR of 5.6% from 2024 to 2033. This growth is driven by evolving brand strategies that focus on online retail campaigns, emphasizing specific ball sports footwear and apparel to attract customers. Successful sporting goods brands effectively leverage their online marketing strategies to draw new customers to their websites, further fueling this rapid expansion.

In February 2024, DICK'S Sporting Goods launched a new e-commerce ad campaign titled "Click On DICKS.com," featuring actors Will Arnett and Kathryn Hahn. The campaign includes two 30-second spots that highlight the seamless and hassle-free shopping experience on DICKS.com. To achieve this, DICK'S infused humor by leveraging the comedic talents of Arnett and Hahn, who portray relatable characters with unique sporting goods needs. Arnett plays a frazzled father frantically searching for soccer cleats for his daughter, while Hahn embraces her role as a clueless aunt desperately trying to find the right basketball gear for her nephew's tryouts. Such initiatives will play a key role in augmenting the online channel growth during the forecasted period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ball sports goods market

Sport

Product

Price Range

Distribution Channel

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Sport Snapshot

2.3. Product Snapshot

2.4. Price Range Snapshot

2.5. Distribution Channel Snapshot

2.6. Competitive Landscape Snapshot

Chapter 3. U.S. Ball Sports Goods Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Sales/Retail Channel Analysis

3.3.2. Profit Margin Analysis

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Impact Analysis

3.5.2. Market Restraint Impact Analysis

3.5.3. Industry Opportunities

3.5.4. Industry Challenges

3.6. Industry Analysis - Porter’s Five Forces Analysis

3.7. Market Entry Strategies

Chapter 4. U.S. Ball Sports Goods Market: Consumer Behavior Analysis

4.1. Demographic Analysis

4.1.1. Number of Participants, 2018 – 2023 (Million)

4.1.2. Participants, by Age

4.1.3. Participants, by Gender

4.1.4. Participants, by Household Income

4.1.5. Participants, by U.S. Region

4.2. Consumer Trends & Preferences

4.3. Factors Affecting Buying Decision

4.4. Consumer Product Adoption

4.5. Observations & Recommendations

Chapter 5. U.S. Ball Sports Goods Market: Sport Estimates & Trend Analysis

5.1. Sport Movement Analysis & Market Share, 2024 & 2033

5.2. Basketball

5.2.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.3. Football/Soccer

5.3.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.4. Volleyball

5.4.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.5. Baseball

5.5.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.6. Ice Hockey

5.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.7. Cricket

5.7.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.8. Golf

5.8.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.9. Lacrosse

5.9.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.10. Rugby

5.10.1. Market estimates and forecast, 2021 - 2033 (USD Million)

5.11. Softball

5.11.1. Market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 6. U.S. Ball Sports Goods Market: Product Estimates & Trend Analysis

6.1. Product Movement Analysis & Market Share, 2024 & 2033

6.2. Apparel

6.2.1. Market estimates and forecast, 2021 - 2033 (USD Million)

6.3. Footwear

6.3.1. Market estimates and forecast, 2021 - 2033 (USD Million)

6.4. Equipment

6.4.1. Market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 7. U.S. Ball Sports Goods Market: Price Range Estimates & Trend Analysis

7.1. Price Range Movement Analysis & Market Share, 2024 & 2033

7.2. Mass

7.2.1. Market estimates and forecast, 2021 - 2033 (USD Million)

7.3. Premium

7.3.1. Market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 8. U.S. Ball Sports Goods Market: Distribution Channel Estimates & Trend Analysis

8.1. Distribution Channel Movement Analysis & Market Share, 2024 & 2033

8.2. Online

8.2.1. Market estimates and forecast, 2021 - 2033 (USD Million)

8.3. Sporting Goods Retailers

8.3.1. Market estimates and forecast, 2021 - 2033 (USD Million)

8.4. Supermarkets & Hypermarkets

8.4.1. Market estimates and forecast, 2021 - 2033 (USD Million)

8.5. Exclusive Brand Outlets

8.5.1. Market estimates and forecast, 2021 - 2033 (USD Million)

8.6. Others

8.6.1. Market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 9. Competitive Analysis

9.1. Recent developments & impact analysis, by key market participants

9.2. Company Categorization

9.3. Participant’s Overview

9.4. Financial Performance

9.5. Product Benchmarking

9.6. Company Market Share Analysis, 2023 (%)

9.7. Company Heat Map Analysis

9.8. Strategy Mapping

9.9. Company Profiles

9.9.1. Nike, Inc.

9.9.1.1. Company Overview

9.9.1.2. Financial Performance

9.9.1.3. Product Portfolios

9.9.1.4. Strategic Initiatives

9.9.2. Adidas AG

9.9.2.1. Company Overview

9.9.2.2. Financial Performance

9.9.2.3. Product Portfolios

9.9.2.4. Strategic Initiatives

9.9.3. PUMA SE

9.9.3.1. Company Overview

9.9.3.2. Financial Performance

9.9.3.3. Product Portfolios

9.9.3.4. Strategic Initiatives

9.9.4. Under Armour, Inc.

9.9.4.1. Company Overview

9.9.4.2. Financial Performance

9.9.4.3. Product Portfolios

9.9.4.4. Strategic Initiatives

9.9.5. Columbia Sportswear Company

9.9.5.1. Company Overview

9.9.5.2. Financial Performance

9.9.5.3. Product Portfolios

9.9.5.4. Strategic Initiatives

9.9.6. lululemon athletica Inc.

9.9.6.1. Company Overview

9.9.6.2. Financial Performance

9.9.6.3. Product Portfolios

9.9.6.4. Strategic Initiatives

9.9.7. New Balance Athletics, Inc.

9.9.7.1. Company Overview

9.9.7.2. Financial Performance

9.9.7.3. Product Portfolios

9.9.7.4. Strategic Initiatives

9.9.8. Mizuno Corporation

9.9.8.1. Company Overview

9.9.8.2. Financial Performance

9.9.8.3. Product Portfolios

9.9.8.4. Strategic Initiatives

9.9.9. Callaway Golf Company

9.9.9.1. Company Overview

9.9.9.2. Financial Performance

9.9.9.3. Product Portfolios

9.9.9.4. Strategic Initiatives

9.9.10. ANTA Sports Products Limited

9.9.10.1. Company Overview

9.9.10.2. Financial Performance

9.9.10.3. Product Portfolios

9.9.10.4. Strategic Initiatives