The U.S. bedroom furniture market size was exhibited at USD 48.25 billion in 2023 and is projected to hit around USD 90.57 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

The U.S. bedroom furniture market is a significant segment within the broader home furnishings industry, deeply influenced by evolving lifestyles, interior design trends, and economic dynamics. Bedroom furniture includes essential and decorative pieces designed to enhance comfort, utility, and aesthetic appeal within sleeping spaces. Key components such as beds, wardrobes, dressers, mirrors, nightstands, and storage units have become more than just functional items—they are now integral to how consumers personalize and optimize their living spaces.

As housing trends shift—driven by factors like urbanization, smaller living spaces, multigenerational households, and homeownership patterns—the nature of bedroom furniture demand continues to evolve. Millennials and Gen Z, now entering the homeowner and renter markets, are particularly influential. Their preferences for modern, minimalist, and space-saving designs are reshaping product development and marketing strategies. Simultaneously, older demographics are driving demand for ergonomic, durable, and high-quality bedroom sets with classic aesthetics.

Another critical driver has been the rise in home improvement activities post-COVID-19. With more time spent indoors, many consumers prioritized upgrading their living spaces, especially bedrooms, which serve as sanctuaries for relaxation, work, and sleep. The surge in online shopping and home delivery services further expanded accessibility to a wide range of bedroom furniture across price tiers. Retailers responded with virtual room planners, 3D product views, and customized ordering interfaces to enhance the buying experience.

Additionally, environmental concerns, the trend of sustainability, and increased preference for multifunctional furniture have become prominent in purchasing decisions. These shifts are encouraging manufacturers to offer modular, eco-friendly, and design-driven products with long-term value.

Minimalist and Space-Saving Designs: Compact furniture with hidden storage and modular capabilities is gaining popularity, particularly among urban dwellers and younger consumers.

Sustainability and Eco-Conscious Materials: Consumers are increasingly opting for furniture made from reclaimed wood, bamboo, and sustainably sourced materials with low-VOC finishes.

Rise of Customization and Personalization: Furniture buyers are showing growing interest in custom finishes, fabric choices, configurations, and built-in tech features.

Smart Furniture Integration: Nightstands with wireless charging, beds with sleep-tracking sensors, and furniture integrated with lighting and voice controls are emerging in the premium category.

Increased Online Penetration and Direct-to-Consumer Models: Digital retail channels are surging, supported by immersive technologies like AR, virtual try-outs, and interactive 3D design tools.

Aesthetic Diversification: From mid-century modern to farmhouse rustic, consumer preferences are expanding, leading to wider product portfolios that cater to niche interior themes.

Emphasis on Wellness and Ergonomics: Beds with adjustable bases, mattresses with orthopedic benefits, and breathable materials are being marketed for health-conscious buyers.

Influencer Marketing and Social Commerce: Platforms like Instagram, Pinterest, and TikTok are shaping furniture choices, with brands leveraging influencer collaborations to reach younger consumers.

| Report Coverage | Details |

| Market Size in 2024 | USD 51.39 Billion |

| Market Size by 2033 | USD 90.57 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Price Range, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Williams Sonoma, Inc.; Inter IKEA Systems B.V.; Amazon; Target Brands, Inc.; Wayfair LLC; Ashley Furniture Industries, LLC; Crate and Barrel; Rooms to Go; Living Spaces; Restoration Hardware, Inc (RH); Raymour & Flanigan; Herman Miller Inc.; Article; THUMA Inc. |

A key driver propelling the U.S. bedroom furniture market is the steady rise in homeownership combined with growing home renovation activity. As more individuals, particularly millennials, transition into homeownership, they are likely to invest in long-term, aesthetically cohesive furniture. The bedroom, being a personal and private space, often becomes a primary target for initial furnishing efforts.

Simultaneously, the shift toward remote work and hybrid lifestyles has fueled investment in home environments, driving bedroom redesigns and additions of multi-functional elements. According to a 2024 survey by Houzz, nearly 65% of homeowners prioritized bedroom upgrades in their renovation plans. This trend has positively impacted demand for versatile furniture such as beds with storage drawers, wall-mounted wardrobes, and ergonomic nightstands, stimulating market growth across price segments.

While demand remains strong, the market faces operational constraints, particularly due to global supply chain disruptions and rising raw material prices. Lumber shortages, container delays, and import tariffs have driven up production costs for manufacturers, especially those dependent on international suppliers. Foam, metal hardware, and even textiles have faced pricing volatility over the past two years.

For retailers, these challenges translate into longer delivery lead times, stockouts, and price hikes—factors that can erode consumer satisfaction and brand loyalty. Small and mid-sized players without vertically integrated operations or strong inventory management systems are especially vulnerable, struggling to maintain consistent margins and service levels.

The rapid expansion of digital retail and online furniture platforms presents a significant opportunity for bedroom furniture vendors. With consumers now comfortable making large-ticket purchases online, companies are investing in AI-driven recommendation engines, customizable configuration tools, and flexible financing models to improve customer experience.

Startups and legacy brands alike are embracing direct-to-consumer (D2C) models, bypassing traditional showroom costs and providing curated online collections with virtual design assistance. Platforms like Wayfair, Overstock, and even Amazon have expanded their bedroom furniture offerings significantly. Furthermore, AR technology is empowering consumers to visualize furniture in their bedrooms before purchase, thereby reducing returns and improving buyer confidence. This shift opens the door for niche and regional brands to scale nationwide without investing in large physical footprints.

Beds dominated the product category, representing the centerpiece of any bedroom setup. The sheer variety of bed options—from king-sized to trundle, platform to storage-integrated—caters to nearly every demographic and spatial need. In the U.S., there is a strong cultural emphasis on quality sleep, with consumers often willing to invest in sturdy bed frames and comfort-enhancing features. Adjustable beds, upholstered headboards, and platform beds with drawers are seeing particular growth. Beds also increasingly serve aesthetic roles, acting as focal points for design themes such as modern industrial, bohemian, or coastal. With rising interest in smart home technology, some premium beds now include built-in speakers, massage settings, or under-bed lighting.

Wardrobe & storage furniture is the fastest-growing subsegment, especially in urban areas where maximizing space is a priority. With many American homes lacking large walk-in closets, standalone wardrobes, under-bed storage, and modular shelving units are becoming indispensable. The appeal lies in flexibility—consumers can expand, rearrange, or move units as needed. Furniture that combines storage with other functionality, such as bed bases with drawers or armoires with integrated mirrors and lighting, is especially popular. Customization options such as adjustable shelves, sliding doors, and mirrored exteriors further contribute to this segment’s rise.

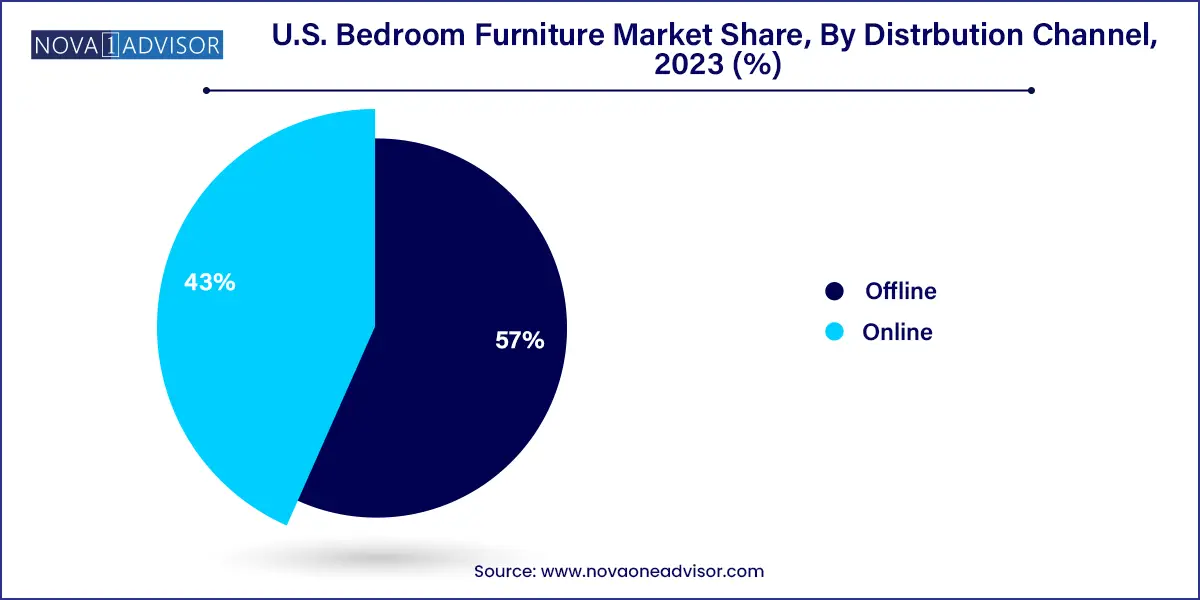

Offline channels dominated the market, particularly large furniture showrooms, department stores, and home décor retailers. These stores offer tactile engagement, design consultations, and room layouts that help consumers envision complete bedroom aesthetics. Customers shopping offline often seek immediate gratification, bundled services (delivery and assembly), and personal assistance. Chains like Ashley Furniture, Bob’s Discount Furniture, and Ethan Allen maintain strong offline networks across the U.S., catering to regional design preferences and providing localized marketing experiences.

Online distribution is the fastest-growing channel, fueled by digital-native brands, increased mobile shopping, and broader delivery logistics. E-commerce enables access to an expanded product range, including niche designs, customer reviews, and comparison tools. Companies like Wayfair, Article, and even Walmart and Target’s furniture divisions are capitalizing on this surge. The use of virtual showrooms, 3D modeling, AR overlays, and filter-based navigation enhances the online customer journey. Moreover, the popularity of influencer-led product endorsements and social media advertising is accelerating consumer confidence in making high-involvement furniture purchases online.

The USD 500 - USD 999 range dominated the market, striking a balance between affordability and quality. This segment appeals to a broad consumer base including first-time homeowners, renters furnishing new apartments, and mid-income families upgrading their interiors. Products in this range typically offer superior build quality, appealing finishes, and modest customization options. Retailers like IKEA, Ashley HomeStore, and Rooms To Go have extensive catalogs targeting this demographic, offering bundled bedroom sets or semi-modular combinations that enhance visual harmony without exceeding budget constraints.

The USD 1,000 & above range is the fastest-growing segment, driven by affluent consumers, design-conscious buyers, and the premiumization trend. High-end bedroom furniture emphasizes craftsmanship, rare wood species, eco-friendly lacquers, and advanced comfort features. These products often incorporate artisanal elements, heritage branding, or customizable finishes. American-made furniture is particularly strong in this segment, reflecting a consumer preference for durable, ethically produced items. Premium vendors are also exploring smart integrations such as wireless charging surfaces, LED-embedded headboards, and ergonomic mattress adjustability, turning traditional bedroom furniture into luxury lifestyle investments.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. bedroom furniture market

Product

Price Range

Distribution Channel