The U.S. behavioral healthcare software and services market size was exhibited at USD 1.65 billion in 2024 and is projected to hit around USD 5.41 billion by 2034, growing at a CAGR of 12.6% during the forecast period 2024 to 2034.

The U.S. behavioral health care software and services market is undergoing a transformational expansion, driven by a growing recognition of mental and behavioral health as integral to overall well-being. Behavioral health conditions including anxiety, substance abuse, depression, PTSD, and schizophrenia affect millions of Americans, creating a need for timely, coordinated, and technology-enabled care.

In response to this demand, software solutions and digital services have emerged as essential tools to support mental health practitioners, institutions, and patients. These tools range from electronic health records (EHRs) tailored for behavioral health to telepsychiatry platforms, mobile mental health apps, and comprehensive care coordination systems. With increased government backing, including parity laws, Medicaid expansion, and telehealth reimbursement reforms, the sector is poised to continue its growth trajectory.

The COVID-19 pandemic further highlighted the fragility and importance of behavioral health infrastructure in the U.S. As isolation, financial instability, and fear intensified mental distress, the nation witnessed an unprecedented demand for remote mental health care and digital tools to manage patient records, therapy sessions, and medication regimens.

As healthcare systems increasingly integrate behavioral health with primary care, software platforms that can facilitate data sharing, automate workflows, and ensure HIPAA compliance are seeing rapid uptake. From community centers and private therapists to large health systems and payers, the demand for scalable, secure, and clinically robust digital solutions is propelling the market to new heights.

Increased Adoption of Telebehavioral Health: The pandemic normalized virtual care for mental health, and platforms are now evolving to include integrated video, chat, and asynchronous therapies.

Integration with EHRs and Primary Care Systems: Behavioral health tools are being designed to connect seamlessly with general medical records for whole-person care.

Rise of AI and Predictive Analytics: Tools using AI are helping clinicians forecast crises, personalize treatment plans, and automate documentation tasks.

Value-Based Reimbursement Models: Behavioral health software now supports outcome tracking, patient engagement, and quality reporting to align with VBC contracts.

Mobile Health (mHealth) Expansion: Patient-facing apps for CBT, mood tracking, and self-guided therapy are becoming common extensions of clinical platforms.

Focus on Care Coordination: Software solutions are enabling multi-disciplinary collaboration among therapists, case managers, and social workers.

Regulatory Compliance and Privacy Emphasis: Demand for robust HIPAA, 42 CFR Part 2, and state-level privacy regulation support is driving software design.

Increased Role of Consumer Feedback and UX: Platforms are increasingly prioritizing user experience, accessibility, and cultural relevance.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size by 2034 | USD 5.41 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 12.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Component, Delivery Model, Function, End-use, Disorder |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Oracle (Cerner Corporation); Core Solutions, Inc.; Epic Systems Corporation; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualifacts; Welligent; SimplePractice, LLC; TherapyNotes, LLC.; TheraNest |

One of the primary drivers of this market is the rising prevalence of behavioral health disorders in the United States. According to the National Institute of Mental Health (NIMH), nearly one in five U.S. adults lives with a mental illness. The demand for mental health services has outpaced the availability of qualified professionals, creating access challenges across rural and urban communities alike.

In this environment, behavioral health care software and services provide a scalable solution to bridge gaps in care. Through centralized scheduling, remote therapy delivery, automated care planning, and mobile outreach, providers can extend their reach and improve engagement. For example, integrated software platforms allow therapists to document sessions, prescribe medications electronically, and track patient progress from a single dashboard.

The ability of these platforms to facilitate collaboration between clinicians, enhance administrative efficiency, and improve patient outcomes makes them indispensable in today’s behavioral health ecosystem. Moreover, federal funding and private insurance coverage expansions have created financial incentives for the adoption of digital behavioral health infrastructure.

Despite technological advancements, interoperability challenges remain a key restraint for market expansion. Behavioral health data has traditionally been siloed from general medical systems due to privacy regulations (such as 42 CFR Part 2) and the historical separation of mental health from primary care. Many providers still rely on standalone, outdated systems that cannot easily share data with EHRs used by hospitals or primary care doctors.

This lack of integration hinders the ability to coordinate care across specialties, track outcomes, and manage population health effectively. Additionally, small practices and community-based providers may struggle with limited IT budgets, making it difficult to transition to more advanced, interoperable platforms.

Furthermore, concerns around data privacy, consent management, and compliance with overlapping federal and state mandates add complexity to system implementation and vendor selection. Overcoming these barriers will require greater standardization, collaborative regulatory efforts, and software vendors that can deliver scalable yet customizable solutions.

A significant opportunity in the U.S. behavioral health care software and services market lies in the proliferation of cloud-based, subscription-based platforms, especially those designed for small and mid-sized providers. These Software-as-a-Service (SaaS) models allow mental health practitioners, community clinics, and emerging digital health startups to access sophisticated tools without incurring large upfront infrastructure costs.

Subscription models are particularly attractive for practices with variable patient loads or those offering part-time or telehealth-based services. They typically include customer support, automatic updates, and regulatory compliance features. As the mental health workforce diversifies to include therapists, peer counselors, and digital care coordinators, flexible software offerings that can adapt to multiple workflows and roles will be in high demand.

Companies like SimplePractice, TherapyNotes, and Valant are leading this charge with modular, cloud-native solutions. The shift toward remote care, hybrid practice models, and decentralized behavioral health delivery creates an expanding market for these cost-effective, scalable software platforms.

Software solutions dominated the component segment, owing to their ability to drive efficiency, compliance, and remote care delivery in behavioral health settings. Integrated software platforms those combining clinical, administrative, and billing functionalities are especially in demand. They allow providers to handle patient scheduling, maintain EHRs, develop care plans, conduct telehealth sessions, and manage claims from a unified system. As behavioral health becomes more integrated with general healthcare, software systems must support cross-specialty communication and value-based metrics, further driving adoption.

Support services are the fastest-growing component, as providers seek expert help in navigating system configuration, onboarding, regulatory compliance, and cybersecurity. Many behavioral health organizations lack dedicated IT departments, creating demand for managed services, consulting, and training. As software vendors shift toward enterprise sales, support services particularly those tied to customization, workflow alignment, and user adoption—are becoming a critical component of market value.

Subscription-based models lead the delivery model segment, driven by their flexibility, affordability, and rapid deployment capabilities. Monthly or annual SaaS subscriptions are particularly popular among outpatient clinics, solo practitioners, and growing telehealth platforms. These models reduce upfront investment and offer scalability as organizations grow or adapt their care models. Additionally, cloud-hosted subscription tools support regular software updates, cybersecurity enhancements, and interoperability improvements without provider-side maintenance.

Ownership models are still significant, especially in hospital networks and large integrated care organizations that require deep customization, proprietary data control, and on-premise compliance protocols. Though not growing as fast as subscription models, these remain important for enterprise-level clients with internal IT resources and capital budgets.

Clinical functionalities dominate this segment, reflecting the centrality of EHRs, telehealth tools, care planning, and e-prescribing in behavioral health practice. These tools enable clinicians to assess, diagnose, document, treat, and monitor patients in both in-person and virtual settings. EHR adoption in behavioral health has been slower than in primary care, but recent policy incentives and pandemic-related demand have accelerated uptake. Telehealth platforms, often integrated into broader clinical software, saw exponential usage spikes during COVID-19 and are now considered a core capability in behavioral health delivery.

Administrative functions are the fastest-growing, especially in high-volume environments like community mental health centers. Tools like automated appointment scheduling, document storage, case management, and workforce allocation systems help organizations manage complexity and reduce burnout. Business intelligence tools that provide real-time operational and outcome data are also gaining traction, supporting analytics-driven decision-making in value-based care environments.

Substance abuse led the market by disorder, reflecting the opioid epidemic and associated federal and state-level funding for medication-assisted treatment (MAT), counseling, and harm-reduction programs. Behavioral health software platforms tailored for substance abuse treatment often include group therapy scheduling, urine screening tracking, and MAT medication logs.

Anxiety disorders are the fastest-growing application, fueled by their high prevalence and increasing social acceptance. CBT-based teletherapy, mindfulness apps, and online support programs have made treatment more accessible, particularly among younger and digitally native populations. Software platforms supporting anxiety management are being adopted in schools, universities, and workplace wellness programs, expanding the market beyond clinical settings.

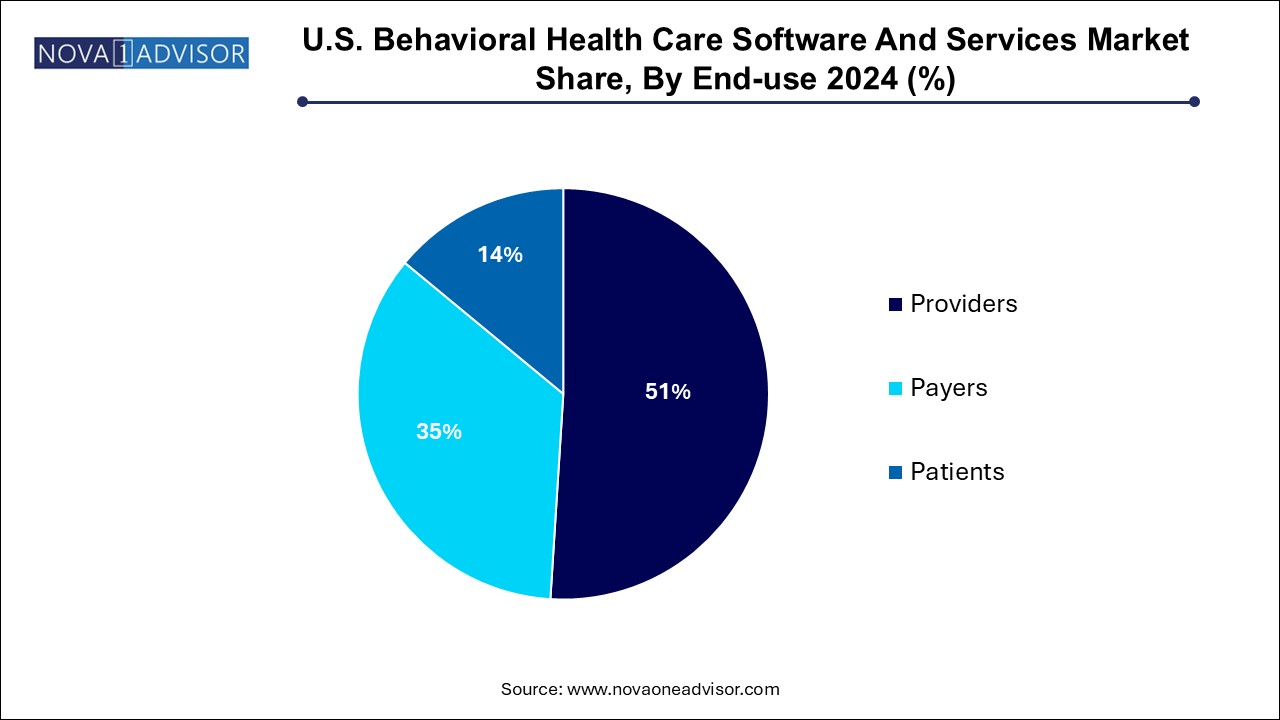

Providers dominate the end-use segment, with hospitals, clinics, and community health centers making up the largest share. These facilities require comprehensive platforms that include scheduling, billing, charting, compliance tools, and teletherapy integration. Many providers are participating in state-funded behavioral health integration initiatives, further boosting demand for enterprise-level platforms.

Patients are the fastest-growing end-users, especially with the rise of direct-to-consumer mental health apps and self-guided therapy platforms. Mobile apps that offer mood tracking, journaling, mindfulness exercises, or guided therapy are increasingly integrated with clinical workflows. Platforms that enable patients to schedule appointments, access educational content, or manage prescriptions also support increased patient autonomy and engagement.

The United States represents the epicenter of the behavioral health care software and services market, driven by policy innovation, private sector investment, and cultural shifts toward mental health normalization. With over 50 million adults in the U.S. experiencing mental illness annually (per NAMI), demand for accessible, scalable, and affordable behavioral health services has reached critical levels.

Federal initiatives such as the Cures Act, Mental Health Parity and Addiction Equity Act (MHPAEA), and HHS Telehealth Flexibilities during COVID-19 have removed long-standing reimbursement and regulatory barriers. Additionally, state-level programs (e.g., California’s Medi-Cal Behavioral Health Initiative or New York’s Behavioral Health Value-Based Payment Roadmap) have stimulated local software adoption.

U.S.-based tech startups and health systems have embraced behavioral health integration, leading to explosive growth in innovation and funding. Venture capital-backed firms like Lyra Health, Ginger (now part of Headspace Health), and Modern Health are leveraging software to bridge clinical and consumer services. Meanwhile, large EHR vendors like Epic and Cerner are adding behavioral health modules to their platforms to support whole-person care.

March 2025 – Valant launched a new AI-powered documentation assistant that reduces clinical note-taking time by 60%, tailored for therapists and counselors.

January 2025 – Cerner integrated behavioral health tracking into its EHR platform across several U.S. hospital systems, focusing on suicide risk and depression screening.

November 2024 – SimplePractice announced the expansion of its group practice platform with telehealth breakout rooms, supporting scalable virtual group therapy.

October 2024 – Kareo and PatientPop, now operating under Tebra, added enhanced analytics dashboards for behavioral health providers to support outcome-based contracting.

August 2024 – Headspace Health introduced a self-guided CBT program for anxiety, available via health plans and employers, in partnership with CVS Health.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. behavioral healthcare software and services market

By Component

By Delivery Model

By Function

By Disorder

By End-use