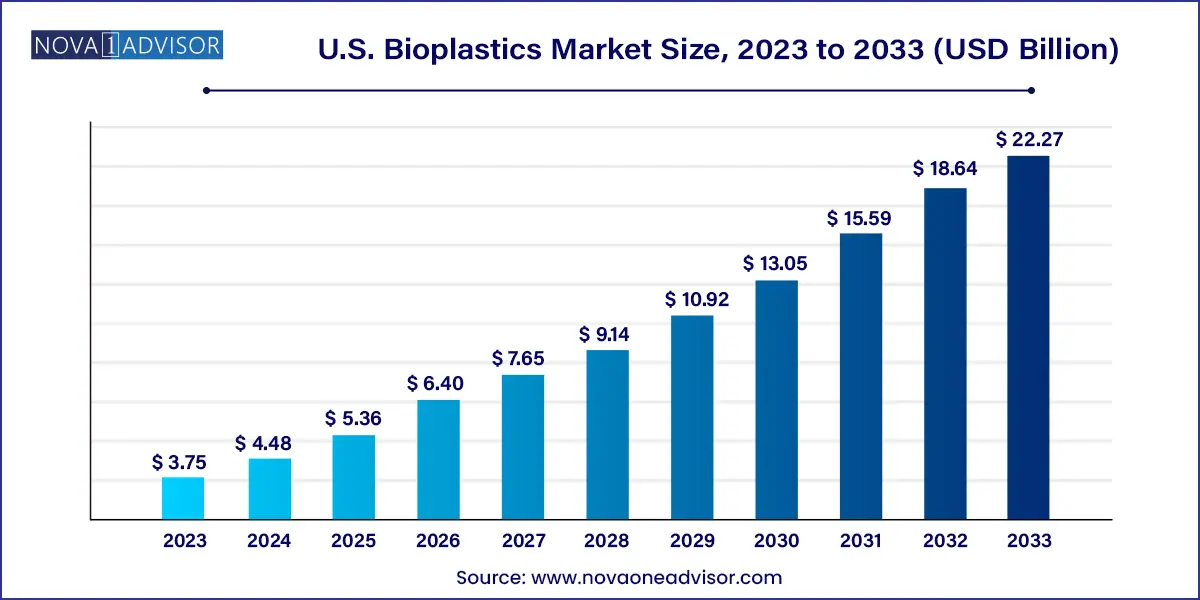

The U.S. bioplastics market size was exhibited at USD 3.75 billion in 2023 and is projected to hit around USD 22.27 billion by 2033, growing at a CAGR of 19.5% during the forecast period 2024 to 2033.

The U.S. bioplastics market is undergoing a transformative phase, fueled by increasing environmental concerns, consumer awareness, and regulatory measures aimed at reducing reliance on conventional plastics derived from fossil fuels. Bioplastics, a broad category encompassing both biodegradable and non-biodegradable materials derived from renewable resources, are rapidly becoming a sustainable alternative across various industries. As climate change and ecological degradation accelerate, the urgency to adopt sustainable materials has created fertile ground for the growth of bioplastics in the United States.

Traditionally, the U.S. has been one of the largest producers and consumers of petroleum-based plastics. However, the detrimental environmental impact of plastic waste has triggered a paradigm shift, encouraging industries to explore eco-friendly substitutes. This shift is being reinforced by policies such as single-use plastic bans, government incentives for sustainable product development, and increased investments in green technologies. As a result, bioplastics have emerged not only as a responsible choice but also as a commercially viable solution that meets both environmental and economic goals.

Bioplastics are gaining traction across a multitude of applications, including packaging, agriculture, consumer goods, textiles, automotive, and construction. Industry stakeholders, from raw material suppliers to end-product manufacturers, are investing heavily in R&D to develop innovative bioplastic materials with enhanced performance characteristics. The growing alignment between corporate sustainability strategies and consumer expectations further propels the adoption of bioplastics, positioning the U.S. as a significant contributor to the global bioplastics ecosystem.

Increased Adoption in Packaging: Sustainable packaging solutions are gaining momentum, with major FMCG brands incorporating bioplastics into their product lines.

Rise of Compostable Materials: Growing interest in compostable bioplastics, particularly in food service and agricultural applications, is driving product innovation.

Brand Commitments to Sustainability: Companies such as Coca-Cola, PepsiCo, and Nestlé have committed to increasing the bioplastic content in their packaging, enhancing market visibility.

Advanced Biopolymer Development: Ongoing R&D efforts are leading to the development of high-performance biopolymers like PLA and PBAT with improved thermal stability and strength.

Circular Economy Integration: Integration of bioplastics into circular economy models is gaining attention, emphasizing recyclability and compostability.

Public-Private Partnerships: Collaborations between government agencies and private firms are accelerating bioplastic adoption through pilot programs and funding.

Localized Manufacturing Hubs: Establishment of bioplastic manufacturing facilities closer to end markets to reduce transportation emissions and costs.

Customized Bioplastic Formulations: Increasing demand for tailor-made bioplastics suited to specific industry requirements.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.48 Billion |

| Market Size by 2033 | USD 22.27 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 19.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | NatureWorks LLC; Trinseo; Danimer Scientific; Dow Inc.; Hallstar Industrial; Genomatica; Amcor Rigid Plastics USA, LLC; Glycosbio; Lanzatech; Myriant |

One of the most pivotal drivers for the U.S. bioplastics market is the mounting pressure from federal and state-level regulations aimed at curbing plastic pollution. Regulatory actions, such as California's Plastic Waste Reduction Regulations and New York's single-use plastic bans, are pushing manufacturers to explore alternative materials. Additionally, the Biden Administration's climate strategy emphasizes clean technologies and sustainable practices, which indirectly fosters growth in bioplastics.

This regulatory momentum is complemented by corporate sustainability mandates that align with Environmental, Social, and Governance (ESG) frameworks. For example, Walmart has pledged to use 100% recyclable, reusable, or compostable packaging by 2025. Such initiatives highlight a systemic push toward bioplastics, making them a strategic material in achieving both compliance and sustainability objectives.

Despite the growing adoption, one of the primary restraints for the U.S. bioplastics market remains the high production cost compared to traditional plastics. Bioplastics, particularly biodegradable ones like PLA and PBS, often require specialized feedstock and processing technologies, which drive up manufacturing expenses.

Moreover, the petroleum-based plastics industry benefits from established infrastructure and economies of scale, giving it a cost advantage. Until bioplastic production achieves similar scale and resource efficiency, the price disparity will likely remain a hurdle for widespread adoption. However, as technology matures and economies of scale kick in, this gap is expected to narrow over time.

The food and beverage industry represents a significant growth opportunity for the bioplastics market in the U.S. With increasing consumer demand for eco-conscious products, companies are actively seeking alternatives to traditional plastic packaging. Bioplastics offer attributes like compostability, transparency, and barrier properties that are ideal for packaging perishables.

For instance, major players like Danone and Nestlé have already begun incorporating bioplastic packaging into their product portfolios. Moreover, quick-service restaurants such as Starbucks and McDonald’s are piloting bioplastic-based containers and utensils. This transition is not just a reflection of corporate ethics but also a response to consumer preference for sustainable packaging, making the sector a hotbed for innovation and growth.

Packaging remained the dominant application segment in the U.S. bioplastics market, accounting for the majority of consumption. This dominance stems from the widespread adoption of bioplastics in both rigid and flexible packaging formats for food, beverages, cosmetics, and pharmaceuticals. Companies are actively replacing conventional packaging materials with bioplastics to align with sustainability goals and consumer expectations. For instance, Coca-Cola's PlantBottle initiative, which uses bio-PET, is a well-known example of bioplastic integration in beverage packaging.

The textile segment is projected to witness the fastest growth over the forecast period. Increasing awareness about the environmental impact of synthetic fibers and the fashion industry's carbon footprint has prompted brands to seek sustainable alternatives. Bioplastics like PLA and bio-polyamides are being used in manufacturing biodegradable fabrics and nonwoven textiles. Eco-conscious fashion labels and sportswear brands are adopting these materials to create green product lines, thereby contributing to the segment's rapid expansion. Furthermore, bioplastics in textiles align with the growing trend of circular fashion, which emphasizes sustainable production and waste reduction.

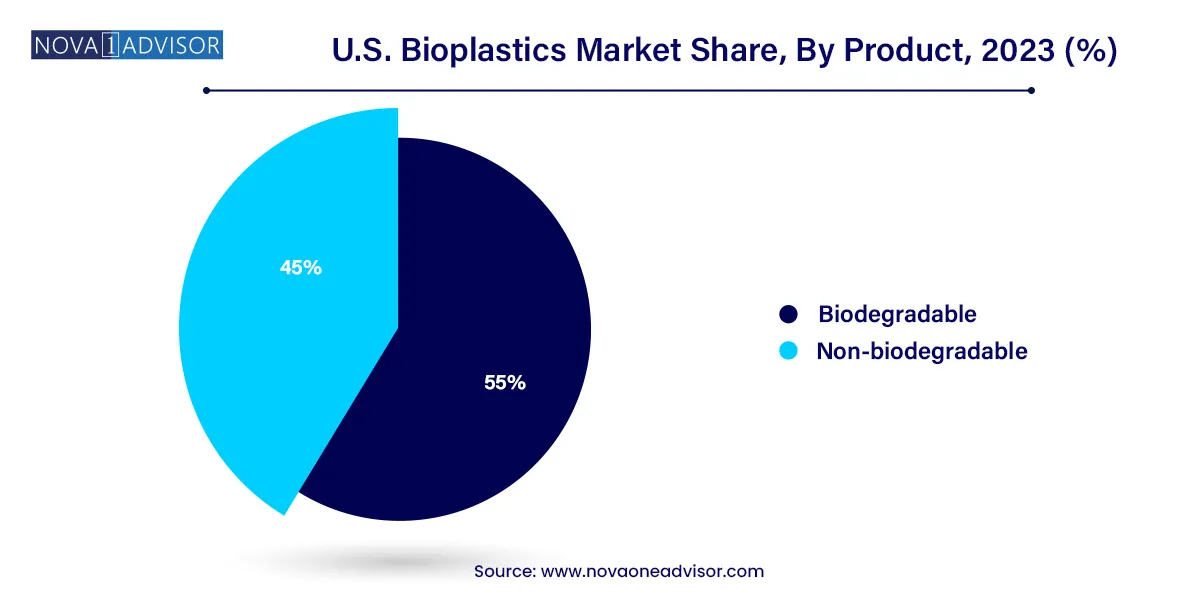

Biodegradable bioplastics dominated the U.S. market in 2024, driven primarily by the surge in demand for compostable materials in packaging and agriculture. Within this category, Polylactic Acid (PLA) held the largest share due to its ease of production, compostability, and compatibility with food-grade applications. PLA has found widespread use in disposable cups, trays, and clamshell containers. Its application in the food service sector, in particular, is a major contributor to its dominance. PBAT and starch blends follow closely, with PBAT being favored for its flexibility and starch blends for their cost-effectiveness in agricultural mulching films.

Polybutylene Succinate (PBS) and other biodegradable options, although currently niche, are rapidly gaining traction due to their high-performance attributes, such as heat resistance and mechanical strength. These materials are being explored in niche applications such as automotive components and textile fibers. As R&D investment increases, newer biodegradable polymers are expected to emerge with improved characteristics and cost structures, diversifying the segment further.

Non-biodegradable bioplastics are the fastest-growing segment, particularly due to their use in durable applications where biodegradability is not a requirement. Among these, bio-based Polyethylene (Bio-PE) and Polyethylene Terephthalate (Bio-PET) are leading the charge. These materials mimic the structural integrity of conventional plastics but are derived from renewable resources such as sugarcane and corn. Their compatibility with existing recycling infrastructure makes them appealing to industries such as automotive, construction, and electronics. Bio-based polyamides and Polytrimethylene Terephthalate (PTT) are also gaining attention in specialized applications like engineering plastics and textiles.

The U.S. bioplastics market is uniquely positioned due to its robust manufacturing ecosystem, regulatory support, and consumer-driven sustainability initiatives. States like California, Oregon, and New York are spearheading the movement with stringent legislation against single-use plastics and generous subsidies for green material development. These states serve as testbeds for new bioplastic applications, often setting benchmarks for the rest of the country.

Additionally, universities and research institutes across the U.S., such as MIT and Stanford, are actively involved in biopolymer research, fostering a collaborative innovation ecosystem. The presence of multiple start-ups and established firms ensures a dynamic and competitive landscape. The federal government’s increased focus on green innovation, as outlined in the Inflation Reduction Act, provides further incentives for bioplastics development. With rising consumer awareness and increased demand from key industries like food packaging, automotive, and agriculture, the U.S. bioplastics market is expected to maintain strong growth momentum.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. bioplastics market

Product

Application