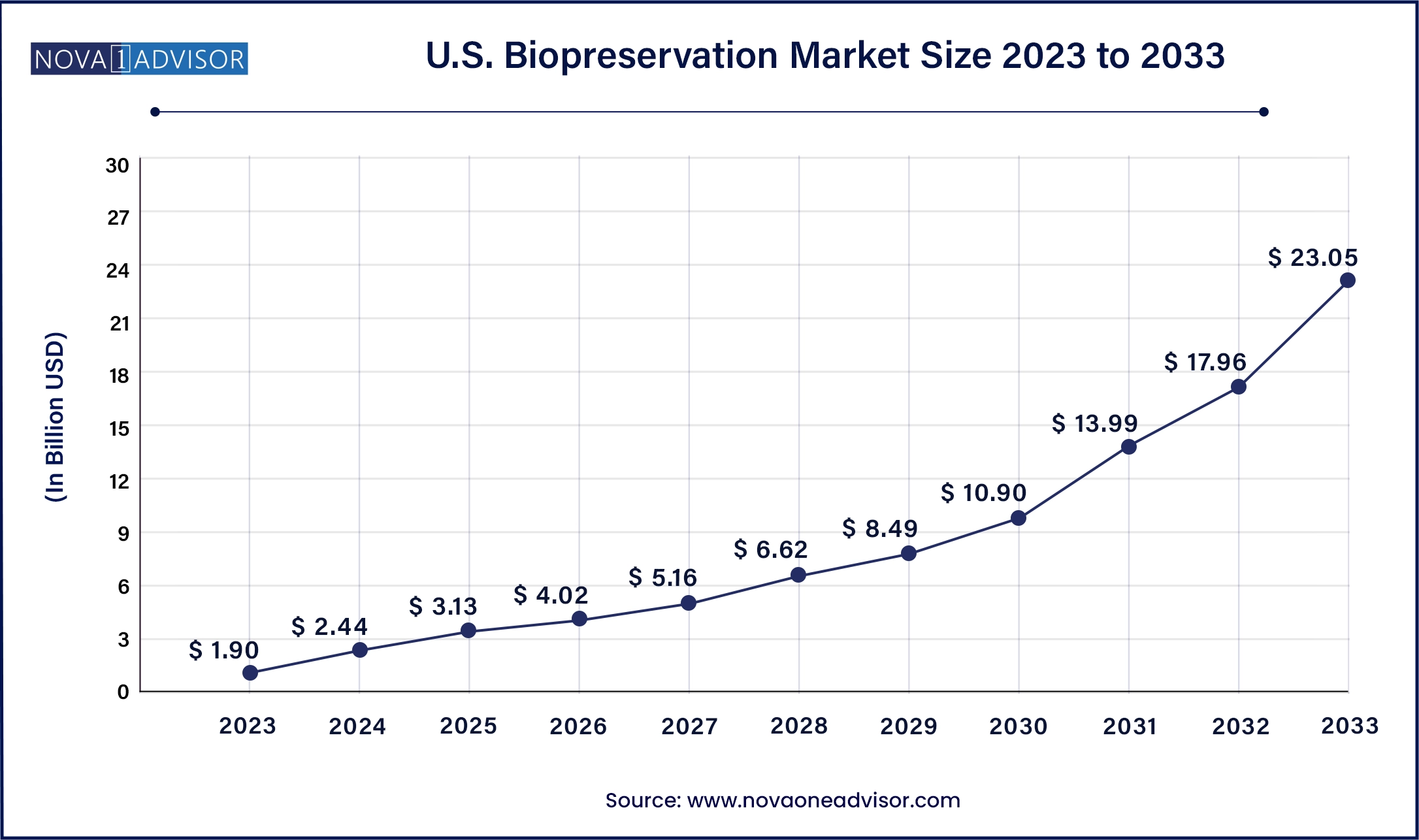

The U.S. biopreservation market size was valued at USD 1.90 billion in 2023 and is projected to surpass around USD 23.05 billion by 2033, registering a CAGR of 28.35% over the forecast period of 2024 to 2033.

The U.S. biopreservation market represents a rapidly growing sector within the broader biotechnology and life sciences industry, driven by the increasing demand for long-term storage and preservation of biological samples and materials. Biopreservation refers to the process of maintaining the integrity and functionality of biological products, such as cells, tissues, organs, DNA, and other biomaterials, by using specialized storage systems and preservation media. This is essential for research, therapeutic, and diagnostic applications across domains such as regenerative medicine, gene and cell therapy, assisted reproductive technologies (ART), and drug discovery.

With the rise of personalized medicine and advances in cellular therapies, there is a growing need to preserve biological specimens for future use. Institutions such as biobanks, fertility clinics, pharmaceutical companies, and research centers rely heavily on biopreservation solutions to store valuable samples under optimal conditions. The U.S., being at the forefront of biotechnological innovation, has witnessed a significant surge in the demand for high-performance biopreservation equipment, consumables, and preservation media.

The market is being shaped by factors such as the rising prevalence of chronic diseases, increased funding in biobanking infrastructure, expanding clinical trials for cell- and gene-based therapies, and the growing adoption of precision medicine. Regulatory agencies such as the FDA and NIH continue to provide guidance on the ethical use and storage of biological materials, supporting the establishment of standardized protocols for preservation. In this landscape, companies offering robust, scalable, and compliant biopreservation solutions are playing a crucial role in supporting life science innovation and healthcare delivery.

Rapid expansion of biobanking networks, both public and private, for storing human biospecimens.

Growing adoption of regenerative and cell-based therapies, necessitating the long-term storage of living cells and tissues.

Technological advancements in cryopreservation equipment, such as ultra-low temperature (ULT) freezers and smart cold storage solutions.

Shift toward pre-formulated media in cryopreservation, offering standardized, ready-to-use solutions with optimized performance.

Integration of Laboratory Information Management Systems (LIMS) for digital tracking and traceability of stored samples.

Increasing focus on fertility preservation, especially egg and sperm storage, due to delayed parenthood trends and rising cancer survivorship.

Use of liquid nitrogen as a critical consumable for ultra-cold biopreservation of temperature-sensitive materials.

Growth in veterinary IVF and assisted reproduction technologies, driving demand for biopreservation solutions in animal healthcare.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.44 Billion |

| Market Size by 2033 | USD 23.05 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 28.35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; Thermo Fisher Scientific, Inc.; Panasonic Corporation; X-Therma Inc.; PrincetonCryo; BioCision LLC; Lifeline Scientific Inc.; Merck KGaA; VWR International, LLC |

A primary driver fueling the growth of the U.S. biopreservation market is the increasing adoption of cell and gene therapies, which depend heavily on the preservation of viable biological materials. These therapies require the extraction, modification, and reinfusion of patient-specific cells or the administration of viral vectors and genetically engineered tissues. Throughout this process, biopreservation ensures that cells remain viable and functional until administered.

For instance, autologous CAR-T therapies involve collecting T cells from patients, engineering them to express tumor-targeting receptors, and storing them before reintroduction. Without proper biopreservation techniques and cryogenic storage infrastructure, these time-sensitive treatments would be impractical. As the number of clinical trials involving gene editing, regenerative medicine, and cell therapies grows, so does the demand for advanced biopreservation tools capable of maintaining high-quality biological assets. This trend is further supported by FDA-approved regenerative therapies and increasing public and private funding for biotech innovation.

Despite its robust growth potential, the U.S. biopreservation market faces a key challenge in the form of high initial investment costs associated with equipment, storage facilities, and operational infrastructure. High-performance freezers, cryogenic storage tanks, and LIMS software systems often require substantial capital expenditure, which can be a barrier to adoption, especially for smaller research institutions and startup biotechs.

In addition to equipment costs, the maintenance, calibration, energy consumption, and security protocols associated with biopreservation systems contribute to the total cost of ownership. Furthermore, ensuring compliance with evolving regulatory standards adds complexity and overhead for institutions engaged in large-scale biospecimen preservation. Although many vendors are addressing this issue by offering leasing options and modular systems, affordability remains a concern for many stakeholders in the research and healthcare ecosystem.

A compelling opportunity within the U.S. biopreservation market is the expansion of biobanking to support the growing field of personalized and precision medicine. Biobanks play a central role in collecting, storing, and distributing human biospecimens—including blood, tissues, DNA, and RNA for genomic and translational research. With the increasing use of omics-based approaches in clinical decision-making, biobanks have become critical resources for the development of tailored therapies and diagnostics.

Government programs like the NIH's All of Us Research Program and other population health initiatives are investing heavily in biobanking infrastructure to collect data from diverse populations. This growing ecosystem presents vast opportunities for companies that provide biopreservation equipment, consumables, and LIMS to support large-scale sample storage and analysis. Moreover, the integration of AI in biobank management and the interoperability between data systems offer new frontiers for technology-driven innovation in this domain.

Biobanking was the dominant application segment in 2023, owing to its foundational role in research, diagnostics, and personalized healthcare. Public and private biobanks across the U.S. store millions of samples to support genetic studies, clinical trials, and public health initiatives. The demand for secure, traceable, and long-term storage of biospecimens is driving the adoption of cryopreservation solutions, liquid nitrogen storage, and sophisticated LIMS platforms. Moreover, the need to comply with stringent ethical and regulatory frameworks around biosample use further elevates the importance of robust biopreservation systems in biobanking.

Gene therapy is currently the fastest-growing application, aligned with the surge in FDA-approved genetic treatments and growing pipeline of candidates. Gene therapies often require the preservation of viral vectors, nucleic acids, and genetically modified cells at ultra-low temperatures. Failure to maintain optimal storage conditions can compromise therapy efficacy, leading to safety risks or product recalls. Biopreservation solutions tailored to gene therapy pipelines—such as dual-chamber cryovials and smart temperature sensors—are becoming essential as these therapies scale from clinical to commercial deployment.

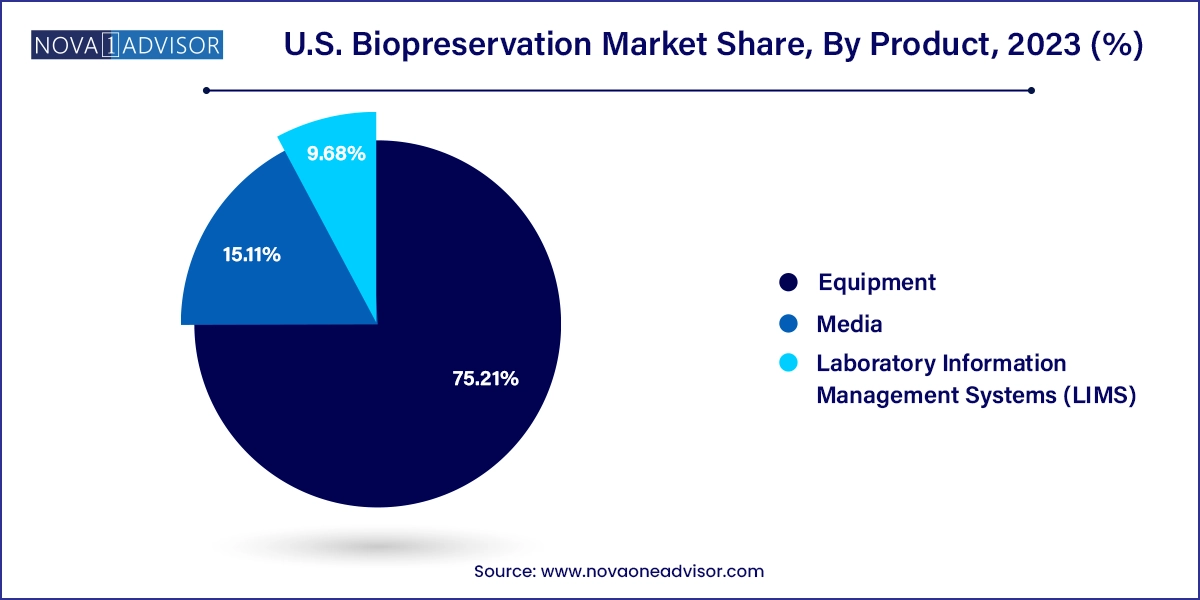

Equipment dominated the product segment in 2023, owing to its indispensable role in maintaining the integrity of biological specimens. This includes a wide range of products such as freezers, refrigerators, cryogenic tanks, and cold chain solutions used in clinical, research, and commercial environments. Among equipment types, freezers especially ultra-low temperature (ULT) freezers accounted for the highest share, enabling storage of samples at -80°C or lower. These are essential for long-term sample integrity and are widely used across hospitals, research centers, and fertility clinics. Demand for ULT freezers surged post-COVID, reinforcing their critical role in vaccine and sample storage.

On the other hand, pre-formulated media emerged as the fastest-growing product category, reflecting a shift toward standardized preservation reagents that ensure consistency and performance. These ready-to-use solutions are optimized for various applications be it stem cell preservation, embryo freezing, or DNA storage offering convenience and reliability. Compared to traditional home-brewed media, pre-formulated products reduce variability, simplify workflows, and comply with regulatory expectations. As more therapies move toward commercialization, the demand for GMP-grade and validated media is expected to escalate, further fueling growth in this segment.

The United States holds a leading position in the global biopreservation market, driven by its strong life sciences infrastructure, advanced biopharma ecosystem, and focus on innovation in cell-based and genomic medicine. States such as California, Massachusetts, Maryland, and North Carolina are home to world-class research institutions, biotechnology startups, and CDMOs that form the backbone of biopreservation demand.

Government initiatives such as NIH's All of Us, Operation Warp Speed, and federal cancer moonshot programs have emphasized the need for large-scale biological sample preservation. Meanwhile, private investment in biobanking, fertility centers, and regenerative medicine startups has expanded access to cryopreservation technologies across various sectors. The presence of major vendors and infrastructure for FDA-compliant clinical-grade storage further strengthens the country’s role as a hub for biopreservation innovation.

Additionally, increasing awareness around fertility preservation (both human and veterinary), donor gamete banking, and the importance of LIMS in compliance and traceability is making the U.S. a favorable market for end-to-end biopreservation solutions. Integration of AI and cloud-based management in LIMS is also a notable trend gaining traction in U.S.-based labs and repositories.

March 2025 – Thermo Fisher Scientific launched a new line of high-efficiency ULT freezers with AI-powered temperature control designed to optimize energy use in high-density biobanks.

February 2025 – BioLife Solutions Inc. announced the acquisition of a cloud-based LIMS company to integrate sample traceability into its suite of cryopreservation solutions.

January 2025 – STEMCELL Technologies introduced a GMP-compliant pre-formulated cryopreservation media targeting stem cell therapy developers in the U.S.

December 2024 – Merck KGaA’s MilliporeSigma division expanded its liquid nitrogen supply chain to support large-scale vaccine storage projects in collaboration with federal agencies.

November 2024 – Brooks Life Sciences partnered with a leading U.S. cancer research center to deploy robotic cold storage systems for automated sample retrieval and tracking.

The U.S. biopreservation market exhibits consolidation, characterized by continuous strategic collaborations and mergers & acquisitions. Companies actively pursue these moves to gain a competitive edge by seizing untapped opportunities in the market. Azenta US, Inc.; Biomatrica, Inc.; BioLife Solutions Inc.; MVE Biological Solutions; LabVantage Solutions, Inc.; Taylor-Wharton; and Thermo Fisher Scientific, Inc. are some key companies operating in the U.S. biopreservation market.

Companies in the U.S. biopreservation market are strongly motivated to broaden their service offerings, penetrate new markets, benefit from economies of scale, and fortify their competitive positions. These objectives drive their expansion strategies and contribute to the industry’s growth and diversification.

For instance, in January 2022, Ori Biotech Ltd., a CGT manufacturing technology leader, secured over USD 100 million in an oversubscribed Series B funding round, led by Novalis LifeSciences with Puhua Capital and Chimera Abu Dhabi as new investors. This platform, designed for automation and standardization, enhanced CGT manufacturing efficiency, quality, and cost-effectiveness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Biopreservation market.

By Product

By Application