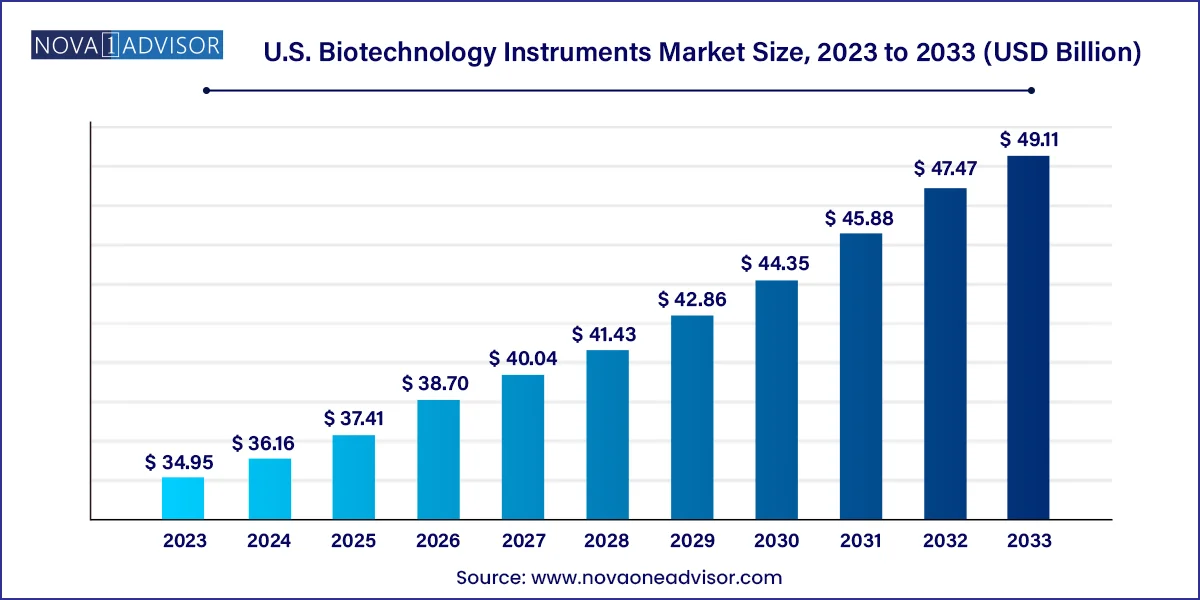

The U.S. biotechnology instruments market size was estimated at USD 34.95 billion in 2023 and is expected to be worth around USD 49.11 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 3.46% during the forecast period 2024 to 2033.

The U.S. biotechnology instruments market serves as a backbone to the nation’s life sciences research and biopharmaceutical industries. These instruments are integral in a wide range of scientific investigations, from basic biology to translational medicine and clinical diagnostics. Biotechnology instruments encompass an extensive array of analytical, cellular, and molecular tools—ranging from spectrometers and PCR machines to cell culture incubators and immunoassay analyzers.

Driven by technological innovation, increased R&D spending, and the growing complexity of biomedical research, the U.S. has emerged as a global leader in biotechnology instrumentation. Institutions such as the NIH, major pharmaceutical companies, academic research centers, and clinical labs continue to expand their equipment portfolios to enable faster, more accurate, and scalable experimentation and diagnostics.

Moreover, with the rise of genomics, proteomics, and personalized medicine, there is a notable shift toward instruments capable of high-throughput, multi-omic analysis. The COVID-19 pandemic accelerated the deployment of PCR systems, flow cytometers, and sequencing platforms across healthcare and research centers nationwide. In the post-pandemic era, these instruments are being adapted for cancer genomics, infectious disease surveillance, vaccine development, and precision diagnostics.

From automation and miniaturization to integration with AI and cloud platforms, biotechnology instruments are evolving into sophisticated systems that serve not only research but also clinical and commercial applications. As the U.S. continues to push the frontiers of biology, the demand for reliable, efficient, and high-performing instruments will continue to surge.

Rise in High-Throughput and Multi-Omic Instruments: Instruments capable of conducting multiple assays simultaneously, such as next-generation sequencing (NGS) and mass spectrometry platforms, are in high demand.

Integration of AI and Machine Learning: Data interpretation and predictive modeling integrated into instrument software to improve diagnostics and research outcomes.

Growth in Point-of-Care Molecular Diagnostics: Portable PCR and isothermal amplification tools gaining traction in diagnostics, especially post-COVID.

Automation in Sample Prep and Analysis: Robotic arms, smart incubators, and liquid handling systems are being adopted to reduce manual errors and increase speed.

Single-Cell Analysis Tools: Instruments like microfluidics-enabled cytometers and single-cell RNA sequencing systems are revolutionizing cellular biology.

Rise in Lab-on-a-Chip and Miniaturized Devices: Micro-scale analytical tools are becoming more common for low-volume, high-precision assays.

Increased Outsourcing to CROs and CDMOs: These organizations are purchasing biotechnology instruments to offer broader capabilities to clients.

Regulatory Compliance and Standardization: Demand for instruments that adhere to FDA, CLIA, and CAP standards is increasing in clinical environments.

Growth of Bioinformatics-Integrated Platforms: Instruments that generate and interpret large-scale biological datasets are becoming essential.

Sustainability and Energy Efficiency: Eco-friendly equipment designs are being preferred by laboratories conscious of carbon footprints.

| Report Attribute | Details |

| Market Size in 2024 | USD 36.16 Billion |

| Market Size by 2033 | USD 49.11 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.46% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific, Inc., Waters Corp., Shimadzu Corp., Danaher, Agilent Technologies, Inc., Bruker Corp., PerkinElmer, Inc., Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Inc., Illumina, Inc., Eppendorf SE, F. Hoffmann-La Roche AG, Sartorius AG, and Avantor, Inc. |

The most significant driver for the U.S. biotechnology instruments market is the explosive growth in genomics and molecular diagnostics. The application of sequencing, PCR, and microarray technologies in clinical and research settings has transformed disease detection, genetic screening, and personalized therapy development. Institutions such as NIH, private biotech firms, and academic centers are heavily investing in NGS platforms, digital PCR, and high-resolution microscopy for biomarker discovery, pharmacogenomics, and gene expression analysis.

The COVID-19 pandemic highlighted the vital importance of molecular diagnostics, with PCR systems becoming central to infection tracking and viral load analysis. Beyond infectious diseases, these instruments are being used for liquid biopsies in cancer, newborn screening for genetic disorders, and prenatal diagnostics. Moreover, the Biden administration’s Cancer Moonshot initiative and other genomics-led programs are accelerating the use of biotechnology instruments in identifying disease-specific mutations and therapeutic targets.

The ability of these instruments to generate vast, accurate data at speed supports the rise of big data analytics in healthcare and is fueling adoption across both public and private sectors.

While technological innovation is driving the market forward, a major restraint is the high cost associated with purchasing, maintaining, and operating biotechnology instruments. Advanced systems like mass spectrometers, automated sequencing machines, or cell analyzers can cost anywhere between $50,000 to $1 million. For smaller research centers, academic labs, and diagnostics startups, the capital expenditure involved can be prohibitive.

In addition, these instruments require regular calibration, software upgrades, and consumables (e.g., reagents, cartridges), leading to substantial operational costs. Service contracts and technician training further add to long-term ownership expenses. Moreover, integration with digital networks, laboratory information management systems (LIMS), and cybersecurity measures increases the technical complexity and costs.

These financial barriers often lead smaller players to lease or outsource services, limiting their capacity for in-house innovation and discovery.

A key opportunity for growth in the U.S. biotechnology instruments market lies in the escalating demand for personalized and precision medicine. The ability to tailor treatments based on individual genetic profiles relies heavily on instruments that can accurately analyze DNA, RNA, and protein markers. PCR machines, NGS platforms, mass spectrometers, and flow cytometers are all integral to achieving this clinical revolution.

Pharmaceutical companies are using these tools to identify novel drug targets, validate biomarkers, and stratify patient populations for clinical trials. On the diagnostic side, oncologists are increasingly using gene panels and liquid biopsy techniques to recommend patient-specific therapies. Instruments that support companion diagnostics and therapeutic decision-making are seeing fast adoption in both hospitals and research labs.

As more therapies become genomics-driven, and as the FDA increasingly approves biomarker-based drugs, the opportunity for biotechnology instrumentation providers to embed themselves into the clinical workflow continues to expand.

Analytical instruments dominate the U.S. biotechnology instruments market, particularly due to their centrality in genomics, proteomics, and clinical research workflows. PCR machines, flow cytometers, spectrometers, and chromatography systems are widely used across research, diagnostics, and pharmaceutical applications. Among them, PCR and sequencing tools saw massive growth during the pandemic and continue to thrive in oncology and infectious disease diagnostics. Instruments such as real-time PCR systems are now essential in many hospital and reference labs.

Cell culture instruments are the fastest-growing subsegment, driven by the rise of biologics, regenerative medicine, and cell therapy. Incubators, culture systems, cryopreservation tanks, and biosafety cabinets are in high demand among biotech startups and clinical research organizations involved in stem cell research, CAR-T therapies, and 3D tissue engineering. The growing complexity of biologics and demand for GMP-compliant production environments have accelerated investment in reliable, scalable cell culture systems.

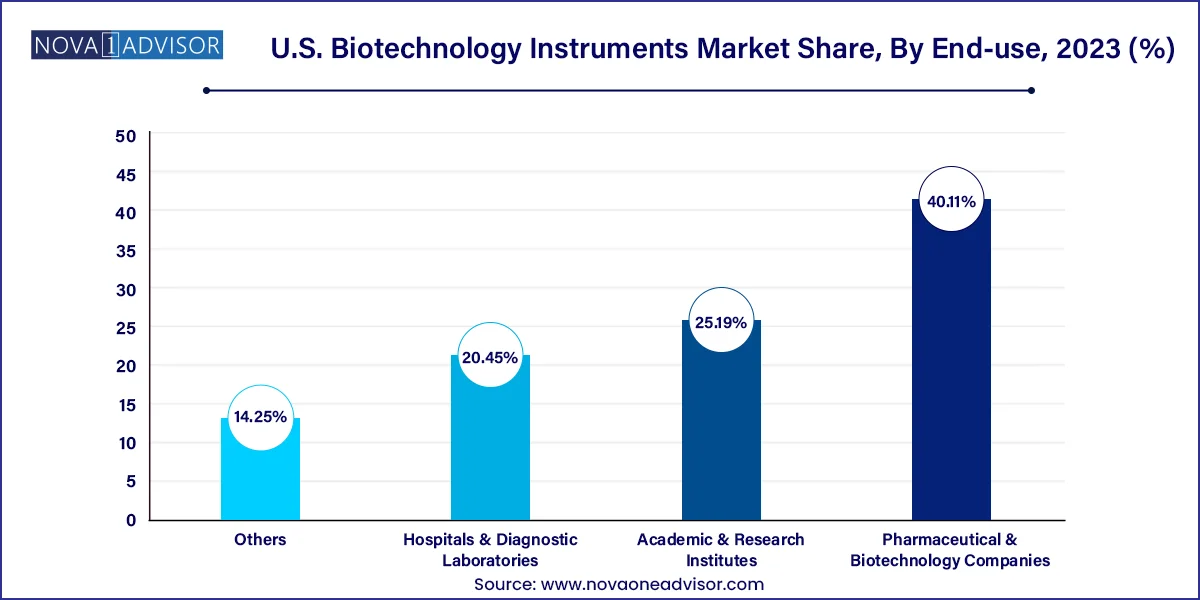

Pharmaceutical and biotechnology companies are the dominant end-users, owing to their expansive R&D pipelines, large-scale manufacturing needs, and regulatory obligations. These organizations require high-performance instruments for target discovery, lead validation, clinical trial assays, and biomarker development. Automation, throughput, and reproducibility are key metrics in selecting instrumentation, especially in biologic and biosimilar production.

Hospitals and diagnostic laboratories are the fastest-growing end-users, largely because of the surge in molecular diagnostics and companion diagnostic testing. Instruments such as immunoassay analyzers, digital PCR systems, and microarrays are increasingly used for early disease detection, prognostics, and treatment monitoring. The integration of these tools into electronic medical records (EMRs) and pathology workflows enhances their clinical utility and drives broader adoption.

The United States is the largest and most technologically advanced market for biotechnology instruments globally. The country’s dominance is rooted in its leading pharmaceutical industry, world-class research institutions, government funding for innovation, and a favorable regulatory landscape that supports biotech expansion.

Institutions such as the NIH, CDC, and Department of Defense invest billions annually in life sciences R&D, much of which flows into instrument procurement and development. Additionally, companies based in the U.S. including Thermo Fisher Scientific, Illumina, and Agilent lead the global instrumentation market and drive innovation through in-house research and strategic acquisitions.

The country also hosts over 1000 life sciences startups and academic incubators, all of which depend on advanced instrumentation for competitive advantage. With the convergence of big data, precision medicine, and biotech entrepreneurship, the U.S. is likely to retain its leadership in biotechnology instruments well into the next decade.

March 2025: Thermo Fisher Scientific launched its new QuantStudio 8 Flex PCR System, offering enhanced throughput and AI-powered analytics aimed at clinical labs conducting pharmacogenomic assays.

February 2025: Agilent Technologies acquired a U.S.-based single-cell analysis startup to expand its cell separation instrument portfolio and strengthen its oncology research offerings.

January 2025: Bio-Rad Laboratories introduced a new line of digital droplet PCR (ddPCR) instruments with multiplex capabilities for rare mutation detection in liquid biopsies.

December 2024: Illumina partnered with the NIH to deploy high-throughput sequencing systems for population genomics research under the All of Us program.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Biotechnology Instruments market.

By Product

By End-use