The U.S. bottled water market size was exhibited at USD 44.65 billion in 2023 and is projected to hit around USD 79.21 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033..webp)

The U.S. bottled water market stands as one of the most robust and consistently growing segments within the country’s broader non-alcoholic beverage landscape. Characterized by increasing consumer demand for healthy hydration, convenience, and premiumization, bottled water has evolved from a simple thirst quencher into a diversified product category encompassing natural spring water, sparkling water, mineral-enriched options, and value-added functional variants. Driven by health-conscious lifestyles, environmental awareness, and shifting beverage consumption habits, the market continues to expand across multiple fronts.

Over the past decade, bottled water has outpaced carbonated soft drinks in terms of volume and per capita consumption. According to industry data, bottled water became the most consumed packaged beverage in the U.S. by volume in the mid-2010s and has maintained this lead ever since. Consumers increasingly prefer bottled water as a calorie-free, sugar-free alternative to sodas, juices, and energy drinks, aligning with broader wellness trends. Furthermore, improvements in packaging sustainability, distribution logistics, and flavor innovation have enhanced accessibility and consumer engagement.

Premiumization of Bottled Water: Growth in demand for artesian, mineral-rich, and pH-balanced waters with high perceived health value.

Surge in Sparkling and Flavored Waters: Consumers seeking effervescent and subtly flavored options as alternatives to sugary beverages.

Eco-Friendly Packaging Innovations: Increased use of recycled PET, aluminum cans, and biodegradable containers to reduce plastic waste.

Personalization and Functional Additives: Infused waters with vitamins, electrolytes, or herbal extracts targeting hydration, immunity, and energy.

Private Label Expansion in Retail: Supermarkets and convenience chains launching proprietary bottled water brands to offer cost-competitive alternatives.

Growth of Canned Water and Boxed Water: New formats gaining traction among environmentally conscious consumers and in on-the-go scenarios.

Direct-to-Consumer (DTC) and Subscription Models: Emerging channels allowing consumers to receive home deliveries and customize their bottled water experience.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.28 Billion |

| Market Size by 2033 | USD 79.21 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Packaging, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; VOSS WATER; Mountain Valley Spring Water; National Beverage Corp.; Keurig Dr Pepper Inc. |

A pivotal driver in the U.S. bottled water market is the widespread shift toward health and wellness-driven consumption patterns. American consumers are increasingly aware of the risks associated with sugary and artificially sweetened drinks, such as obesity, type 2 diabetes, and cardiovascular disease. This awareness has catalyzed a long-term migration toward water as the preferred form of hydration.

Bottled water offers a natural, calorie-free alternative that seamlessly fits into fitness routines, office habits, and everyday mobility. The popularity of intermittent fasting, clean eating, and detox regimes further amplifies bottled water’s position as a neutral, health-promoting beverage. Bottlers have responded by developing enhanced waters with added electrolytes, pH balance, and trace minerals—appealing to consumers seeking both functionality and hydration. This health-centric orientation continues to be one of the most sustainable demand drivers in the U.S. beverage industry.

Despite its widespread consumption, the bottled water industry faces increasing scrutiny over plastic waste, carbon emissions, and resource usage, especially water sourcing. PET plastic bottles—while recyclable—often end up in landfills or oceans due to inadequate recycling infrastructure or consumer negligence. The carbon footprint associated with bottling, packaging, and transporting water across regions also contributes to environmental criticism.

Activists and environmental advocacy groups continue to campaign against single-use plastics, prompting municipalities and universities to ban or restrict bottled water sales in select public venues. These challenges have forced brands to invest in sustainable packaging, water stewardship programs, and supply chain transparency. However, these efforts add operational complexity and cost pressures, particularly for smaller and mid-sized bottlers. As environmental consciousness grows among U.S. consumers, addressing these issues will be essential for long-term industry resilience.

A growing opportunity in the U.S. bottled water market lies in the development of functional, value-added water products that provide health benefits beyond basic hydration. Functional waters—infused with vitamins, adaptogens, collagen, electrolytes, or probiotics—are gaining popularity among wellness enthusiasts, fitness users, and tech-savvy Gen Z consumers.

These products blur the line between bottled water and health supplements, making them ideal for consumers looking to simplify their wellness routines. For instance, brands like Essentia, Smartwater+, and Propel have found success with electrolyte-enhanced or pH-balanced waters targeting athletic performance and recovery. Similarly, start-ups are launching waters infused with CBD, nootropics, or sleep aids, tapping into niche yet rapidly growing demand clusters. This diversification opens new pathways for market penetration, premium pricing, and brand differentiation.

Spring water remains the dominant product category in the U.S. bottled water market, prized for its natural origin, mineral content, and mild taste. Sourced from protected underground aquifers, spring water is typically marketed as pure and minimally processed, resonating with consumers seeking natural health solutions. Major players such as Poland Spring (Nestlé), Crystal Geyser, and Deer Park continue to build brand trust around the notion of untouched purity and consistent quality. Spring water is also widely available in both small and large formats, making it a versatile choice for daily hydration and bulk consumption.

Conversely, sparkling water is the fastest-growing product segment, fueled by consumer interest in carbonation without calories or artificial ingredients. Sparkling water provides a sensory and flavorful alternative to soda, often with no added sugar. Brands like LaCroix, Spindrift, and Topo Chico (Coca-Cola) have led the charge, introducing unique flavors, stylish branding, and vibrant packaging. Sparkling water’s popularity is especially strong among younger consumers and urban dwellers who enjoy pairing it with meals or using it as a cocktail mixer. The segment is also experiencing premiumization with natural mineral sparkling water and international imports gaining shelf space.

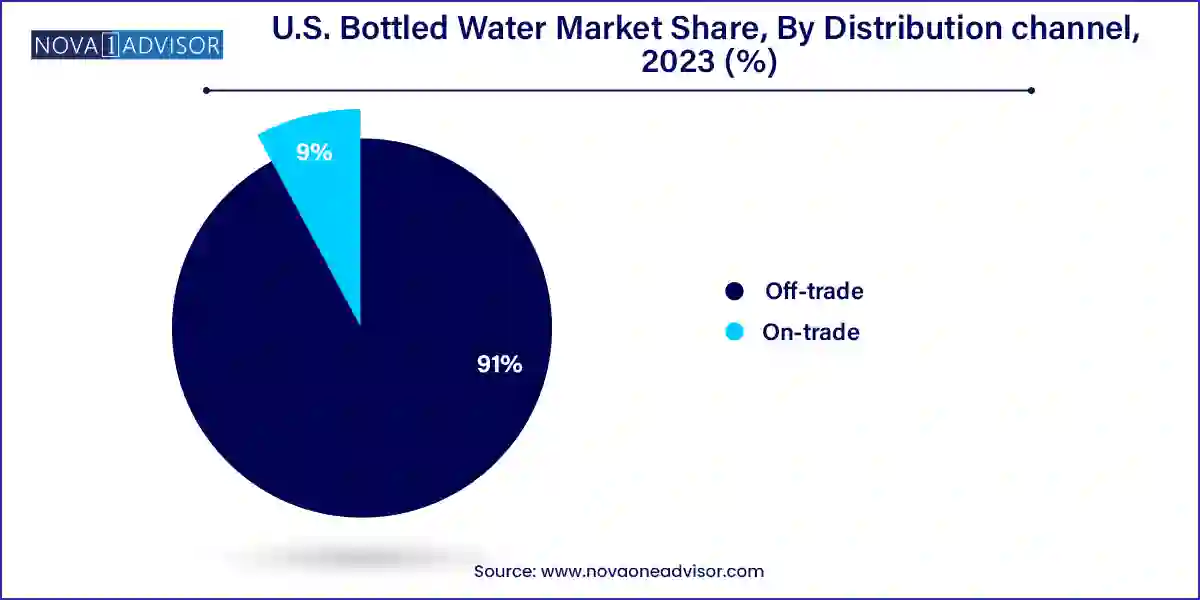

Off-trade consumption of bottled water accounted for a market share of over 91% in 2023. with supermarkets, hypermarkets, convenience stores, and grocery chains serving as the primary touchpoints for retail sales. Mass merchandisers like Walmart, Target, and Costco contribute significantly to bulk sales, while convenience outlets such as 7-Eleven and Circle K are favored for impulse purchases. Off-trade distribution benefits from promotions, multipack deals, and wide availability, contributing to its dominance across both urban and rural consumer bases.

The on-trade channel, while smaller, maintains steady growth, driven by restaurants, cafes, hotels, fitness centers, and entertainment venues. Premium bottled waters such as San Pellegrino, Fiji, and Voss often appear on beverage menus in upscale dining environments, contributing to the luxury image of bottled water. Additionally, the health-conscious push in gyms and wellness centers supports the sale of electrolyte or vitamin-enriched waters. As experiential dining and wellness tourism rebound, the on-trade segment offers opportunities for premium positioning and brand exposure.

PET bottles dominate the U.S. bottled water packaging segment, accounting for the majority of volume sold through retail and foodservice outlets. These bottles are lightweight, shatterproof, and cost-effective, making them suitable for bulk transport and everyday use. Available in various sizes—from personal 500ml bottles to multi-gallon containers—PET packaging serves all consumer demographics. Innovations such as lightweight bottle design, rPET (recycled PET), and tethered caps are being introduced to improve recyclability and meet regulatory targets.

At the same time, canned water is emerging as a fast-growing packaging format, appealing to environmentally conscious consumers and event-based consumption. Brands like Liquid Death and Open Water have disrupted the category by offering still and sparkling waters in sleek, recyclable aluminum cans with bold branding. Cans are viewed as more sustainable than plastic and more convenient than glass for outdoor or on-the-go scenarios. As single-use plastic restrictions tighten in some states, the growth of canned water is expected to accelerate, particularly in institutional and hospitality settings.

The United States represents a diverse and high-consumption market for bottled water, with significant variation in consumption patterns across states and demographics. California, Texas, New York, and Florida are the largest markets due to their population size, urban density, and retail infrastructure. In coastal and metropolitan regions, consumers are more likely to favor premium, flavored, or functional waters and eco-conscious packaging. Silicon Valley, Los Angeles, and Brooklyn are early adopters of niche water formats such as boxed water, hydrogen-infused water, and CBD-infused hydration.

In contrast, Midwestern and Southern states reflect strong demand for bulk-packaged spring water, especially in areas prone to extreme weather events or water infrastructure issues. Natural disasters and boil advisories often lead to spikes in bottled water demand, underlining its importance in emergency preparedness. Additionally, regions like the Mountain West and Southwest favor mineral and artesian waters due to perceived purity and wellness benefits.

On a demographic level, millennials and Gen Z drive innovation by favoring flavored, functional, and responsibly sourced products, while baby boomers maintain loyalty to trusted spring water brands. The emerging Hispanic and Asian-American populations also influence flavor trends and packaging choices, reflecting the increasing cultural diversity of bottled water preferences in the U.S.

March 2025 – PepsiCo announced a nationwide rollout of SodaStream Professional Hydration Stations in corporate offices and gyms, promoting customizable, on-demand flavored water with refillable bottles.

February 2025 – Liquid Death, the canned water disruptor, launched its first flavored still water line, including variants like mango chainsaw and berry it alive, marking its entry into enhanced hydration.

January 2025 – Nestlé Waters North America, now operating under BlueTriton Brands, expanded its rPET packaging initiative across all its spring water brands, committing to 100% recycled bottles by 2027.

November 2024 – Coca-Cola expanded its Topo Chico brand by introducing new functional sparkling water variants infused with magnesium and green tea extract.

October 2024 – Boxed Water Is Better introduced new flavored water SKUs in fully compostable packaging, targeting wellness retail chains and health food stores.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. bottled water market

Product

Packaging

Distribution Channel