U.S. Brushless DC Motor Market Size and Trends

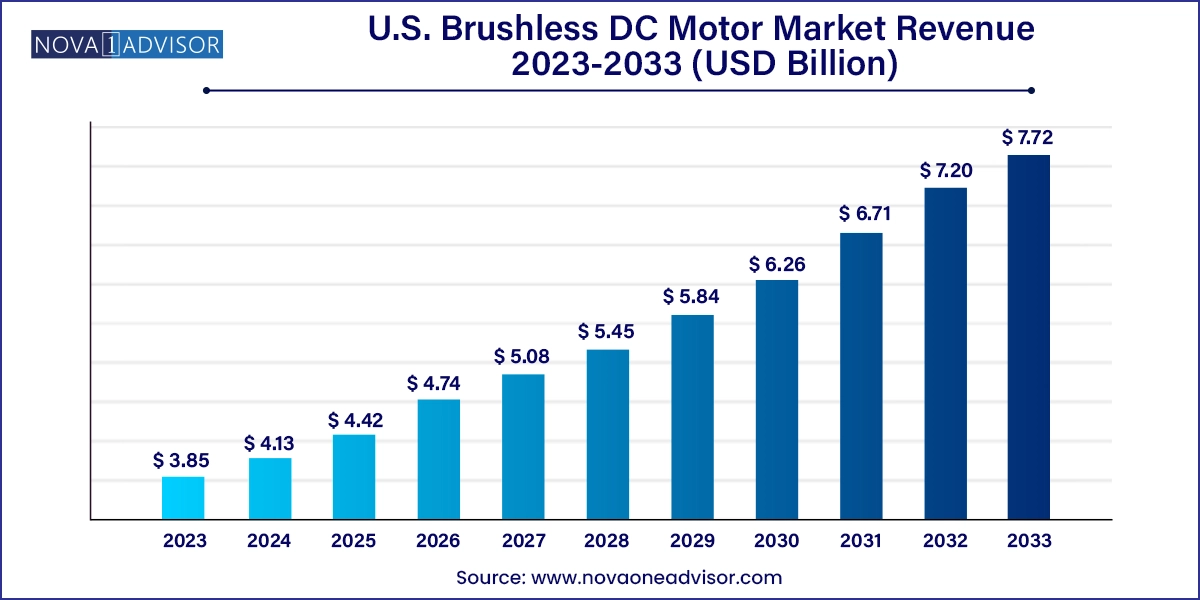

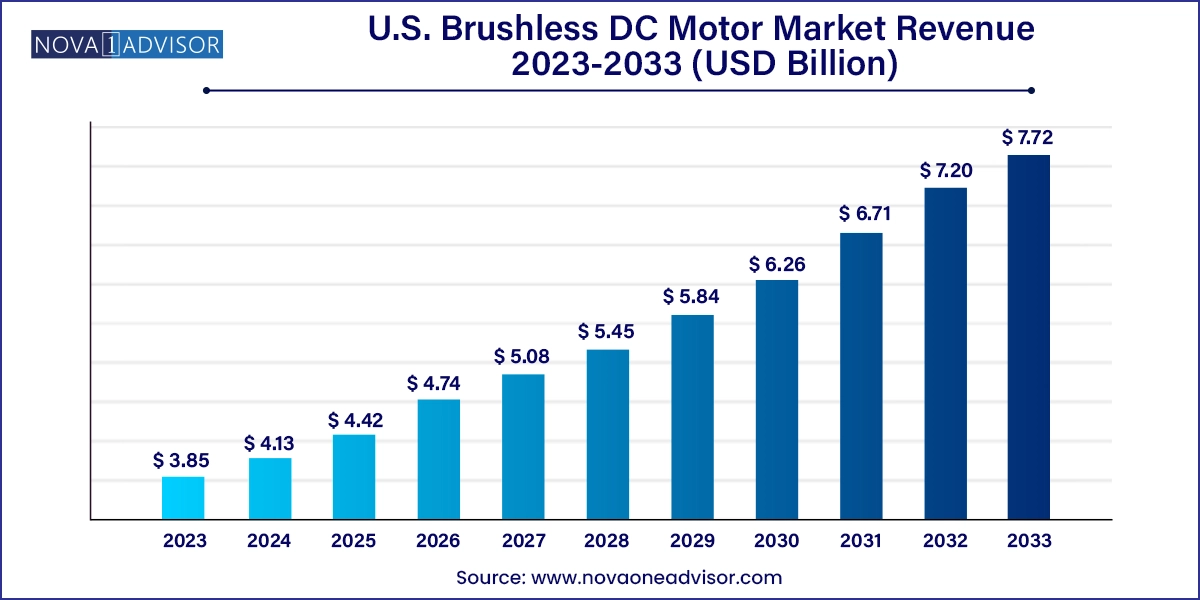

The U.S. brushless DC motor market size was exhibited at USD 3.85 billion in 2023 and is projected to hit around USD 7.72 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

U.S. Brushless DC Motor Market Key Takeaways:

- In terms of rotor type, the market is further bifurcated into inner rotor and outer rotor segments.

- In terms of revenue, the less than 750 watt segment dominated the market in 2023 with a revenue share of 47.86% and is also anticipated to grow at the fastest CAGR over the forecast period.

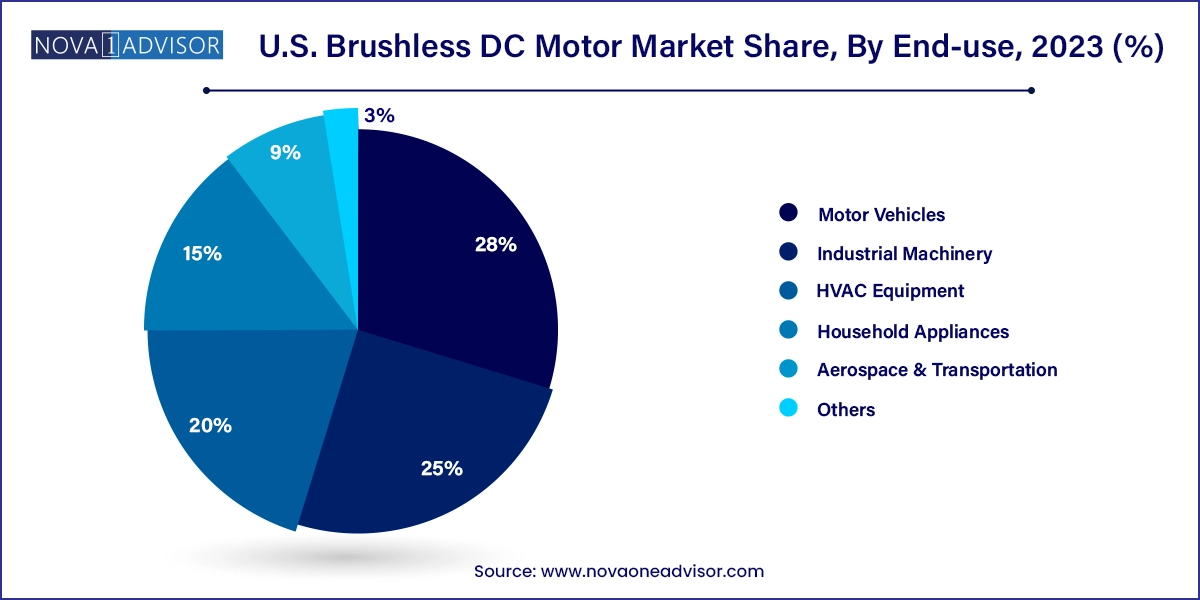

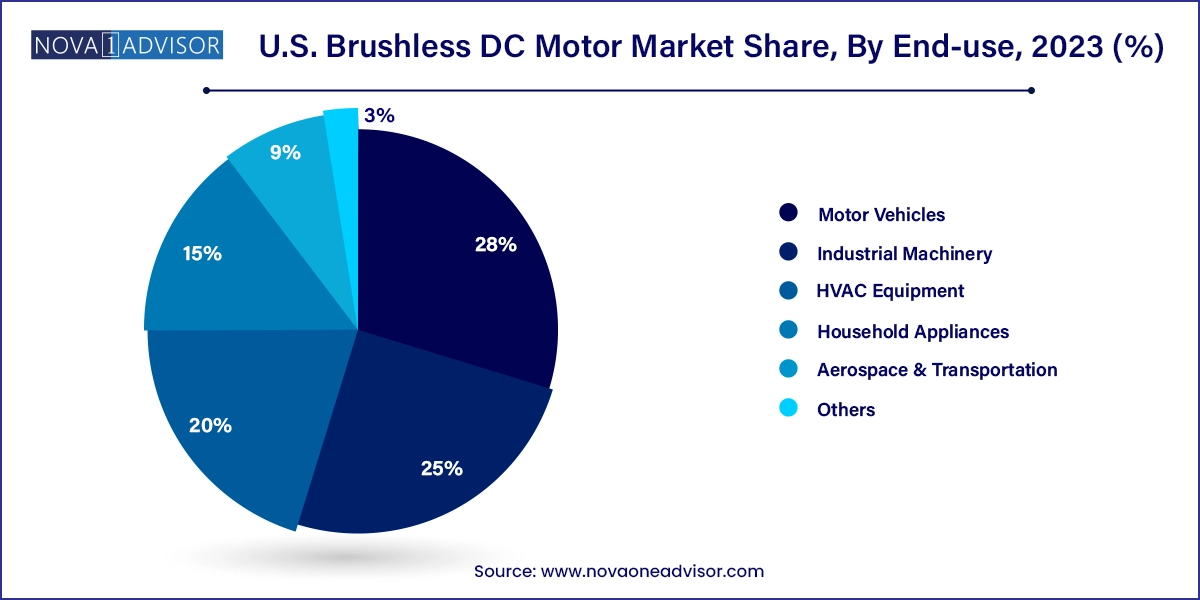

- In terms of revenue, the motor vehicle segment dominated the market in 2023 with a revenue share of 28.0%.

- The comfort segment held the largest revenue share in 2023 and is anticipated to witness the fastest CAGR by 2033.

- The industrial machinery segment held a substantial market share of more than 24% in 2023 and is anticipated to grow steadily from 2024 to 2033.

Market Overview

The U.S. brushless DC (BLDC) motor market has been steadily gaining momentum, powered by advances in automation, electric mobility, and energy-efficient technologies. Brushless DC motors have become the preferred choice across numerous applications due to their superior efficiency, compact design, reduced maintenance requirements, and ability to operate at high speeds. Unlike traditional brushed motors, BLDC motors eliminate the need for mechanical commutators, replacing them with electronic controllers that improve reliability and performance.

As industries such as automotive, aerospace, HVAC, industrial automation, and consumer electronics strive to meet increasingly stringent energy standards, the adoption of BLDC motors is accelerating. These motors are especially attractive in applications that require precision control, high torque density, and quiet operation. In the U.S., governmental policies and initiatives focusing on electrification and carbon reduction, particularly in transportation and manufacturing, are also fueling demand for these motors.

Furthermore, technological advancements in control systems, sensor integration, and miniaturization have expanded the scope of BLDC motor usage from traditional uses to emerging sectors such as drones, robotics, medical equipment, and electric scooters. U.S.-based manufacturers and end-users are leveraging the benefits of BLDC motors to enhance performance while reducing long-term costs and environmental impact. The market is poised for strong growth as electrification and automation remain central to the evolution of American industries.

Major Trends in the Market

-

Electrification of Automotive and Transportation Systems: BLDC motors are being widely adopted in EV drivetrains, power steering systems, and auxiliary components.

-

Rising Demand for Energy-efficient HVAC Solutions: High-efficiency motors are replacing traditional AC motors in air conditioners and ventilation systems.

-

Growth in Industrial Automation and Robotics: BLDC motors support high-precision movement and speed control, key for automated manufacturing systems.

-

Miniaturization and Integration with IoT: Compact BLDC motors with integrated sensors are being used in smart appliances and connected devices.

-

Increased Use in Aerospace and Drones: Lightweight and high-speed motors are being deployed in UAVs, aviation actuation systems, and satellite mechanisms.

-

Expansion of Household and Commercial Appliances: From vacuum cleaners to kitchen appliances, BLDC motors enhance performance with lower noise and better energy ratings.

-

Customization and Modular Designs: Manufacturers are offering modular BLDC motors to cater to application-specific torque, voltage, and mounting needs.

Report Scope of U.S. Brushless DC Motor Market

Key Market Driver – Push Toward Energy-efficient Technologies Across Industrial and Consumer Segments

One of the primary forces driving the U.S. BLDC motor market is the growing demand for energy-efficient solutions across multiple industries. With rising energy costs and increasing environmental concerns, both manufacturers and consumers are prioritizing technologies that reduce power consumption without compromising on performance. The Energy Independence and Security Act (EISA) and other federal initiatives encourage industries to shift toward high-efficiency motor systems.

BLDC motors provide significant energy savings by eliminating friction losses typical in brushed motors and offering better speed-torque characteristics. In HVAC systems, switching to BLDC motors can cut energy usage by up to 40%. Similarly, EVs benefit from these motors due to their low heat generation and regenerative braking capabilities. As the U.S. intensifies its transition toward sustainable energy and electrification, BLDC motors are becoming integral to new product development across sectors.

Key Market Restraint – High Initial Cost and Complex Electronic Controls

Despite their advantages, the high initial cost and complex control architecture of BLDC motors remain notable barriers to widespread adoption. Compared to traditional brushed motors or even AC induction motors, BLDC systems often require sophisticated electronic controllers to manage commutation and speed regulation. These controllers must be precisely matched to the motor, increasing both design complexity and cost.

For low-cost or mass-market applications, the additional investment may not always justify the performance gains. Furthermore, integration into existing systems can be challenging, particularly in retrofit environments where legacy infrastructure is still in place. For small and mid-sized enterprises (SMEs) or budget-conscious sectors, the upfront cost can slow the pace of adoption despite the promise of long-term operational savings.

Key Market Opportunity – Growth in Electric Vehicles and Micro-mobility

A significant opportunity for the U.S. BLDC motor market lies in the surging adoption of electric vehicles (EVs) and micro-mobility solutions such as e-bikes, electric scooters, and personal mobility devices. BLDC motors offer ideal performance characteristics for EV applications, including high efficiency, compact size, regenerative braking support, and low maintenance.

With the U.S. government investing billions in EV infrastructure and offering incentives for EV manufacturing and ownership, the demand for BLDC motors is expected to spike. These motors are not only used in propulsion systems but also in auxiliary components like seat actuators, HVAC compressors, pumps, and power steering units. The expanding urban mobility landscape, coupled with a growing startup ecosystem in personal mobility and logistics automation, is opening new frontiers for BLDC motor innovation.

U.S. Brushless DC Motor Market By Rotor Type Insights

Inner rotor motors dominated the U.S. BLDC motor market, owing to their compact design and high heat dissipation capacity. In this configuration, the rotor is located at the center of the motor, surrounded by the stator. This layout enables superior torque and speed performance, making them ideal for applications requiring high efficiency and precision, such as industrial automation, medical devices, and electric vehicles. Their structure allows for better thermal management, making them more reliable under continuous load conditions.

Outer rotor motors are the fastest-growing segment, particularly in applications like fans, HVAC systems, and drones, where lower speed and higher torque are preferred. These motors have the stator positioned inside and the rotor outside, increasing the moment of inertia. Their design leads to quieter operation and improved stability, which is especially valued in consumer electronics and ventilation applications. With the growth of smart homes and commercial cooling systems, outer rotor BLDC motors are expected to gain further traction.

U.S. Brushless DC Motor Market By Power Output Insights

The 750 Watts to 2.99 kW category was the dominant segment, as this range meets the requirements of numerous industrial, commercial, and automotive applications. Motors in this power range are commonly used in industrial automation systems, HVAC blowers, and mid-range electric vehicles. Their balance of power and efficiency makes them a reliable choice for both OEMs and retrofit applications.

Motors above 75 kW are the fastest-growing power segment, primarily due to their rising use in electric buses, heavy-duty electric trucks, and large-scale industrial equipment. As the electrification of heavy transportation gains momentum in the U.S., demand for high-power BLDC motors that deliver robust torque and efficiency is increasing. These motors are also critical in energy-intensive applications such as oil & gas equipment, high-speed rail, and defense machinery.

U.S. Brushless DC Motor Market By Speed Insights

The 2,001–10,000 RPM segment held the largest market share, offering a broad compatibility spectrum for applications like automotive propulsion systems, CNC machinery, and robotics. Motors in this speed range provide the necessary torque-to-speed ratio for medium-duty operations, balancing precision with power consumption.

Motors with speeds above 10,000 RPM are the fastest-growing, used in high-performance applications like drones, dental equipment, precision grinders, and aerospace actuators. These motors deliver exceptional responsiveness and are increasingly being adopted in sectors that require compact but high-speed drive systems. The miniaturization trend in electronics and medical devices is a key contributor to this segment's growth.

U.S. Brushless DC Motor Market By End-use Insights

Motor vehicles represented the dominant end-use segment, encompassing applications across safety, comfort, and performance. BLDC motors are now integral to EV drivetrains, power-assisted steering, window lifts, throttle control, air conditioning compressors, and more. Their quiet operation and low maintenance needs align perfectly with modern vehicle design trends emphasizing comfort and efficiency.

Aerospace and transportation are the fastest-growing end-use sectors, as electric actuation systems replace traditional hydraulic and pneumatic components. In aviation, drones, and space systems, BLDC motors offer a high torque-to-weight ratio, making them suitable for flight-critical applications. Their resistance to vibration and ability to perform reliably under fluctuating loads make them ideal for harsh operating environments. Increased defense spending and commercial space exploration initiatives in the U.S. are further accelerating this growth.

Country-Level Analysis

In the United States, the adoption of brushless DC motors is being shaped by three key pillars: technological innovation, electrification of transportation, and industrial automation. States like California, Michigan, and Texas are leading in BLDC motor consumption, thanks to their robust automotive, aerospace, and manufacturing sectors. The U.S. also serves as a major innovation hub, with startups and academic institutions pushing the boundaries in robotics, electric aviation, and clean energy systems—all of which rely on high-efficiency motor solutions.

Federal policies like the Inflation Reduction Act (2022) and Bipartisan Infrastructure Law are injecting funding into domestic EV production, renewable energy systems, and public transportation—all sectors where BLDC motors are vital. Furthermore, growing demand for smart HVAC systems, home automation, and consumer gadgets is boosting domestic consumption of BLDC-powered components. With a mature supply chain, a strong base of OEMs, and government backing, the U.S. remains a powerhouse in both demand and innovation for brushless DC motors.

Some of the prominent players in the U.S. brushless DC motor market include:

- ABB

- Ametek Inc.

- Regal Rexnord Corporation

- Johnson Electric Holdings Limited.

- NIDEC CORPORATION

- Allied Motion Technologies, Inc.

- Schneider Electric

- Siemens

- TECO Corporation

- WorldWide Electric (North American Electric, Inc.)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. brushless DC motor market

Rotor Type

Power Output

- Less than 750 Watts

- 750 Watts to 2.99 kW

- 3 kW - 75 kW

- Above 75 kW

Speed

- Less than 500 RPM

- 501-2,000 RPM

- 2,001-10,000 RPM

- More than 10,000 RPM

End-use

- Industrial Machinery

- Motor Vehicles

-

- Safety

- Comfort

- Performance

- HVAC Equipment

- Aerospace & Transportation

- Household Appliances

- Others