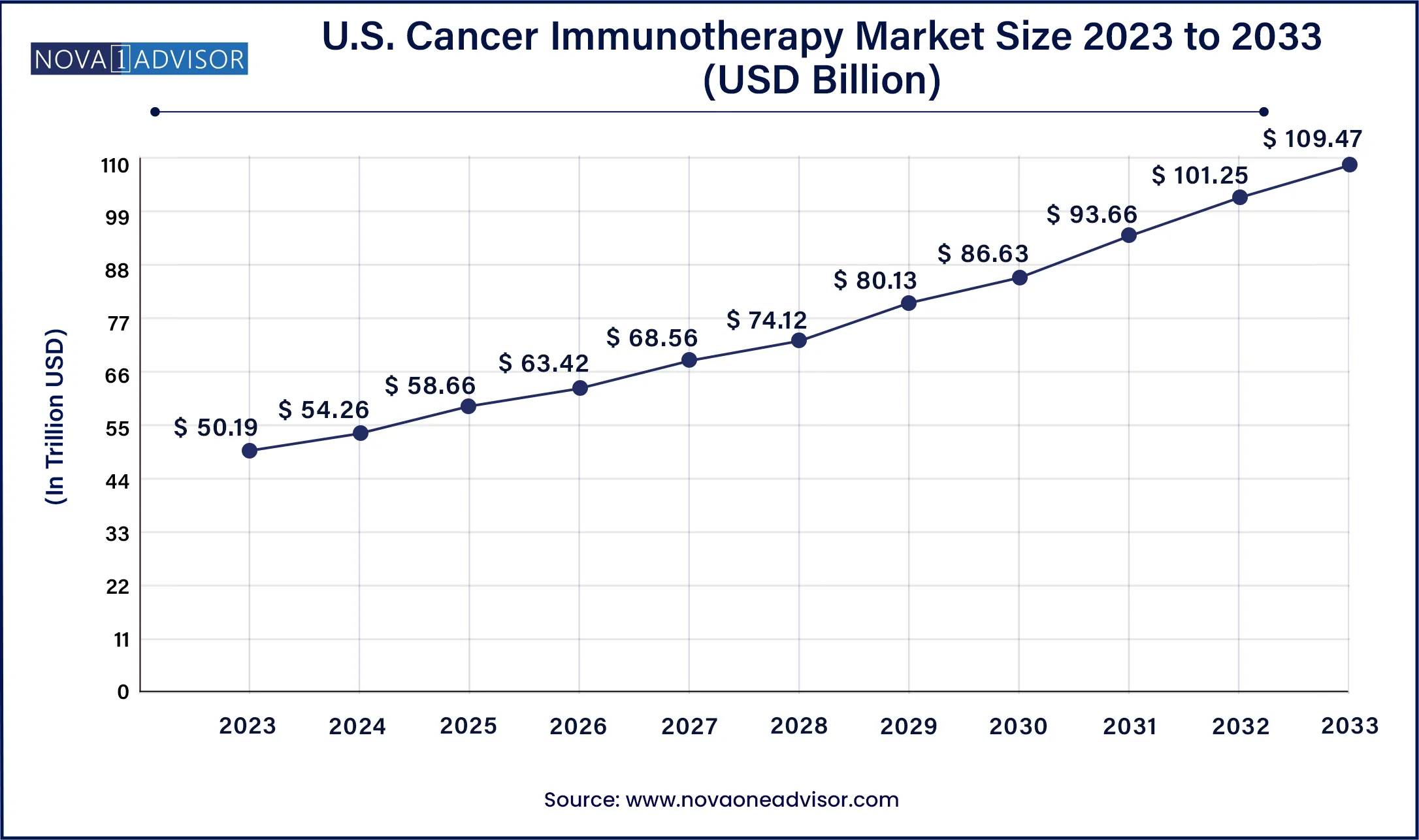

The U.S. Cancer Immunotherapy market size was valued at USD 50.19 billion in 2023 and is projected to surpass around USD 109.47 billion by 2033, registering a CAGR of 8.11% over the forecast period of 2024 to 2033.

The U.S. cancer immunotherapy market represents one of the most dynamic and revolutionary segments of the oncology landscape. As cancer continues to pose a significant healthcare challenge in the United States, immunotherapy has emerged as a game-changing approach that leverages the body’s immune system to combat malignancies more precisely and effectively than traditional treatments like chemotherapy or radiation. Unlike conventional methods that indiscriminately target healthy and cancerous cells, immunotherapy activates the immune system to recognize and eliminate tumor cells selectively, offering a higher therapeutic index and prolonged remission in many cases.

This market has been growing exponentially over the past decade, driven by a convergence of scientific breakthroughs, regulatory accelerations, and patient demand for more targeted and tolerable therapies. Immunotherapies are now approved and used for a broad spectrum of cancers, including lung, breast, melanoma, and hematologic malignancies, and are being incorporated as first-line treatments in many protocols. The United States, being the global epicenter of biotech innovation, leads this space in terms of product development, clinical trials, regulatory approvals, and commercial sales.

From the introduction of checkpoint inhibitors like nivolumab and pembrolizumab to the rise of CAR-T cell therapies and cancer vaccines, the U.S. market has witnessed an unprecedented evolution. The presence of large pharmaceutical firms, academic research powerhouses, and a robust network of cancer centers and clinical infrastructure has enabled accelerated immuno-oncology (IO) research. In addition, public-private partnerships, government initiatives such as the Cancer Moonshot, and substantial investments in biotech innovation have further amplified the scope and scale of immunotherapy across the country.

As of 2025, cancer immunotherapy continues to push the boundaries of medicine, offering not just treatment, but a hope for potential cures in certain indications.

Adoption of Combination Therapies: Pairing immunotherapy with chemotherapy, radiation, or other targeted therapies is becoming standard in many cancer protocols to enhance efficacy.

Rapid Growth of CAR-T and Cell-based Therapies: Customized cellular immunotherapies are showing success in blood cancers and are under evaluation for solid tumors.

AI and Big Data Integration: Machine learning tools are being used to predict patient responses and optimize immunotherapy regimens.

Emergence of Neoantigen-based Cancer Vaccines: Personalized cancer vaccines based on patient-specific tumor mutations are gaining attention.

Expansion of PD-1/PD-L1 and CTLA-4 Inhibitors: Immune checkpoint inhibitors are being approved for more cancer types and earlier lines of treatment.

Rise of Biomarker-driven Therapies: Genomic and proteomic markers are guiding therapy selection, improving response rates.

Growth in Outpatient Infusion Centers: As immunotherapies become routine, care is shifting from hospitals to outpatient settings for convenience and cost savings.

FDA Fast-Tracking of Breakthrough Therapies: Regulatory bodies are increasingly providing accelerated approval pathways for promising immunotherapies.

Tele-oncology Integration: Virtual platforms are supporting patient monitoring and follow-ups for those receiving immunotherapies.

Partnerships and Licensing Deals: Pharmaceutical giants are collaborating with startups and academic institutions to develop novel immunotherapeutic assets.

| Report Attribute | Details |

| Market Size in 2024 | USD 54.26 Billion |

| Market Size by 2033 | USD 109.47 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.11% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Application, By End User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Bristol-Myers Squibb, Merck & Co., Inc., Novartis International AG, Roche Holding AG, AstraZeneca plc, Amgen Inc., and others. |

The primary driver of the U.S. cancer immunotherapy market is the rising incidence of cancer and the need for more effective and safer treatment options. According to the American Cancer Society, over 1.9 million new cancer cases were diagnosed in the U.S. in 2024, with lung, breast, prostate, and colorectal cancers among the most prevalent. Despite advances in surgery and radiation, the five-year survival rate for many late-stage cancers remains suboptimal.

Immunotherapies offer a compelling alternative by enabling long-lasting immune responses and, in some cases, complete remissions. For instance, checkpoint inhibitors like pembrolizumab (Keytruda) have demonstrated substantial survival benefits in non-small cell lung cancer patients with high PD-L1 expression. Moreover, immunotherapy has emerged as a viable option for patients who relapse after standard treatments, further highlighting its clinical value.

In addition, public awareness, patient advocacy, and increasing access to clinical trials have created a strong demand pull, encouraging hospitals, research centers, and pharmaceutical firms to expand immuno-oncology programs nationwide.

While immunotherapy is transformative, one of its most significant restraints is its high cost and related access disparities. Many immunotherapeutic agents, especially CAR-T therapies and monoclonal antibodies, come with six-figure price tags. For example, CAR-T therapies like Yescarta and Kymriah can cost upwards of $400,000 per patient. Even more commonly used checkpoint inhibitors can cost $10,000–$15,000 per month.

Although Medicare and many private insurers cover these therapies, patients often face substantial out-of-pocket costs, especially when multiple rounds or combination therapies are required. Additionally, access is limited in rural or underfunded healthcare facilities, where infrastructure and staff to administer these treatments are lacking.

These cost and access challenges hinder broader adoption, particularly among underprivileged populations, raising equity concerns and slowing market penetration.

A major opportunity in the U.S. cancer immunotherapy market lies in the increasing ability to personalize treatment using genomic and proteomic profiling. As technologies like next-generation sequencing (NGS), single-cell analysis, and transcriptomics become more affordable and accessible, they are being used to tailor immunotherapies based on individual patient tumor profiles.

For example, tumor mutational burden (TMB), microsatellite instability (MSI), and PD-L1 expression levels are already influencing immunotherapy eligibility. Emerging research is now investigating the role of gut microbiota and immune gene signatures in predicting response to immune checkpoint inhibitors. Companies such as Foundation Medicine and Tempus are pioneering comprehensive biomarker panels to guide oncologists in selecting the most suitable immunotherapies for each patient.

This personalized approach not only improves outcomes but also minimizes adverse effects and unnecessary treatment costs, creating a strong clinical and economic case for adoption.

Checkpoint inhibitors dominate the U.S. cancer immunotherapy market, primarily due to their established efficacy across multiple cancer types and broad FDA approvals. PD-1/PD-L1 inhibitors like pembrolizumab and nivolumab have become first-line or second-line standards in cancers such as melanoma, lung cancer, head and neck squamous cell carcinoma, and bladder cancer. Their mechanism of reactivating T-cells to target tumor cells has proven effective in both monotherapy and combination settings. This class is also frequently used in metastatic and advanced cancer cases, giving it significant market share.

Meanwhile, cancer vaccines are emerging as one of the fastest-growing segments, particularly with advances in personalized neoantigen vaccines and mRNA technologies. Several therapeutic cancer vaccines are in late-stage trials for melanoma, glioblastoma, and pancreatic cancers. The success of mRNA platforms during the COVID-19 pandemic has renewed confidence in applying similar strategies to oncology. Companies such as Moderna and BioNTech are leading efforts to create individualized cancer vaccines that train the immune system to recognize patient-specific tumor antigens.

Lung cancer remains the leading application for cancer immunotherapy in the U.S., due to its high incidence and mortality rate. Immunotherapies have significantly altered the treatment landscape for non-small cell lung cancer (NSCLC), with PD-1/PD-L1 inhibitors often used as frontline therapies. Drugs such as atezolizumab and durvalumab have also gained traction in the adjuvant setting for resectable lung cancers. With lung cancer accounting for nearly 25% of cancer deaths in the U.S., the need for more effective and less toxic therapies has ensured continued dominance of this application segment.

On the other hand, melanoma is the fastest-growing application area, benefiting from deep immunogenicity and high response rates to checkpoint inhibitors. Treatments like ipilimumab (anti-CTLA-4) and nivolumab have shown unprecedented survival benefits in advanced melanoma cases. Additionally, ongoing trials are evaluating the effectiveness of combining immunotherapy with oncolytic viruses, vaccines, and other biologics to enhance response durability. The relatively small yet high-growth nature of melanoma treatments makes it an attractive segment for innovative IO solutions.

Hospitals dominate the end-user segment of the cancer immunotherapy market, owing to their access to comprehensive oncology departments, advanced infusion centers, and multi-disciplinary care teams. Immunotherapy often requires sophisticated patient monitoring, biomarker testing, and adverse event management—resources that are more readily available in hospital settings. Major cancer centers such as Memorial Sloan Kettering, MD Anderson, and Dana-Farber lead the way in implementing and evaluating novel IO regimens.

Ambulatory surgical centers (ASCs) and cancer specialty clinics are the fastest-growing end-user segment, particularly for checkpoint inhibitor infusions and follow-up care. These centers offer lower-cost, convenient, and accessible alternatives for patients, especially in suburban and urban fringe regions. With immunotherapies becoming more standardized and less toxic than chemotherapy, many are being administered in outpatient environments, helping reduce hospital dependency and improving patient quality of life.

The U.S. holds a commanding position in the global cancer immunotherapy market, attributed to its advanced healthcare ecosystem, high healthcare expenditure, and strong life sciences infrastructure. According to the National Cancer Institute (NCI), U.S. federal spending on cancer research surpassed $7 billion in 2024, much of which is channeled into immuno-oncology studies. More than 500 clinical trials related to cancer immunotherapies are ongoing across the country, often in collaboration with biotech startups and academic institutions.

The presence of flagship institutions like NIH, FDA, and CDC has created a supportive regulatory and innovation framework that encourages rapid development and deployment of breakthrough therapies. Additionally, the U.S. pharmaceutical industry benefits from strong intellectual property protection, favorable reimbursement models, and strategic partnerships with venture capital firms and CROs, accelerating immunotherapy commercialization.

The high awareness among patients, proactive diagnostic programs, and a relatively high rate of private insurance coverage contribute to market growth. States like California, Texas, and Massachusetts serve as hubs for immunotherapy research, clinical trials, and patient access, reinforcing the national market’s dominance.

March 2025: Bristol Myers Squibb announced promising Phase III results for its CTLA-4 and PD-1 combination therapy in metastatic colorectal cancer, aiming for FDA filing later this year.

February 2025: Moderna unveiled interim clinical data from its personalized cancer vaccine trial for melanoma, showing robust T-cell activation and favorable safety profiles.

January 2025: Merck & Co. expanded its immuno-oncology pipeline through a $2.1 billion acquisition of Harpoon Therapeutics, which specializes in T-cell engagers.

December 2024: BioNTech opened its first U.S. cancer vaccine manufacturing facility in Cambridge, Massachusetts, to support clinical and commercial scale production.

November 2024: Gilead Sciences and Arcus Biosciences entered a strategic partnership to co-develop next-generation checkpoint inhibitors for hard-to-treat solid tumors.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cancer Immunotherapy market.

By Type

By Application

By End User