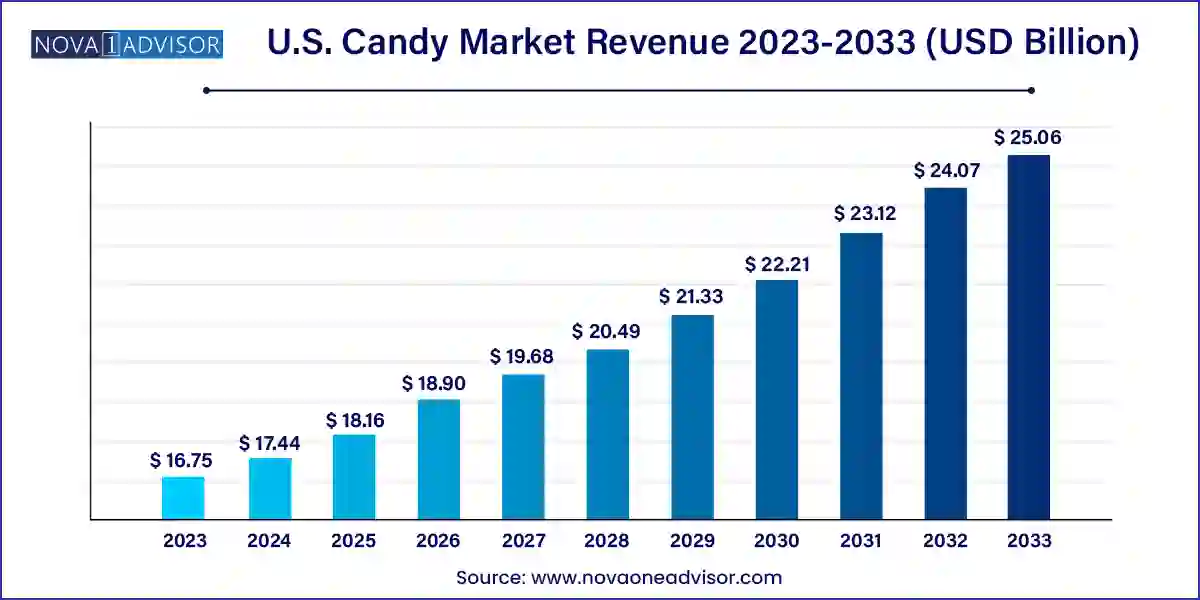

The U.S. candy market size was exhibited at USD 16.75 billion in 2023 and is projected to hit around USD 25.06 billion by 2033, growing at a CAGR of 4.11% during the forecast period 2024 to 2033.

The U.S. candy market stands as one of the most vibrant and expansive sectors within the broader confectionery industry. Characterized by deep-rooted cultural ties, seasonal spikes in demand, and continuous innovation, this market reflects not only consumer indulgence but also shifting preferences, health consciousness, and digital transformation in retail. In 2024, the market is estimated to be worth over USD 45 billion and is expected to grow steadily through 2034, driven by both traditional favorites and new-age wellness-enhanced candy products.

The American consumer's connection with candy is interwoven into lifestyle and traditions—from trick-or-treating during Halloween to Valentine’s Day chocolates and Easter baskets. However, this legacy market is not stagnant. It is undergoing a transformation fueled by rising demand for plant-based ingredients, sugar-free options, exotic flavors, and sustainable packaging. This evolution has made room for startups to challenge giants, while large-scale manufacturers are investing in product reformulation and premiumization strategies to remain competitive.

Additionally, the candy market is benefiting from strategic cross-category collaborations and the growing preference for convenience shopping. The fusion of nostalgic appeal and modern functional benefits (such as vitamin-infused candy) is setting a new tone for industry growth. With digital influence and direct-to-consumer channels accelerating, the U.S. candy market is no longer confined to conventional store aisles—it's a digital, experiential, and health-conscious landscape in motion.

Functional and Health-Forward Candy: Brands are increasingly developing products fortified with vitamins, adaptogens, and low-sugar or sugar-free alternatives to address the growing health awareness among consumers.

Premium and Artisanal Candy: There is a surge in demand for high-end, small-batch, and handcrafted candy varieties that offer unique textures, flavors, and stories—catering to the premiumization trend.

Sustainable and Ethical Sourcing: Consumers are prioritizing sustainability, leading to an increase in eco-conscious packaging, ethically sourced ingredients (such as Rainforest Alliance-certified cocoa), and transparency in supply chains.

Plant-Based and Vegan Alternatives: As part of the broader plant-based movement, candy brands are reformulating their products to exclude gelatin and animal-based colorants, resulting in a rising share of vegan offerings.

Nostalgia-Driven Marketing: Classic candies and legacy brands are experiencing a revival as millennials and Gen Xers seek familiar, retro experiences, reintroduced with modern branding.

Limited-Edition and Seasonal Launches: Timely product launches around holidays, movies, and pop culture events are capturing attention and driving short-term spikes in demand.

Increased Online Sales and Subscription Models: Online candy stores and monthly subscription boxes are becoming increasingly popular, especially post-pandemic, with brands like Candy Club capitalizing on this trend.

Cross-Industry Collaborations: Unique flavor innovations resulting from collaborations between candy brands and beverage, alcohol, or skincare companies are sparking consumer curiosity and driving trial purchases.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.44 Billion |

| Market Size by 2033 | USD 25.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | The Hershey Company; Ferrara Candy Co.; Mars Incorporated; Mondeléz International; DeMet’s Candy Co.; Nestlé S.A; Compartés; Vosges Haut-Chocolat; Fortnum &Mason; John Kelly Chocolates |

A primary growth driver of the U.S. candy market is the emergence of health-conscious indulgence. While candy has always been associated with sugar, fun, and celebration, today’s consumers are demanding products that align with their nutritional and lifestyle goals. This has led to a surge in sugar-free, organic, and functional candies—such as those containing collagen, CBD, or vitamins. Brands like SmartSweets have gained attention for offering low-sugar candies that mimic traditional treats but cater to keto, vegan, or diabetic-friendly diets.

This shift is particularly noticeable among millennials and Gen Z consumers, who want to balance indulgence with wellness. Candy companies that blend taste with transparency, such as labeling products with calorie counts, using natural ingredients, and offering small portion packs, are outperforming in niche segments. As a result, candy is no longer considered a guilty pleasure but can be part of a balanced lifestyle, significantly expanding its consumer base.

One of the significant restraints in the U.S. candy market is the escalating cost of raw materials and sustainable packaging. Essential ingredients like cocoa, sugar, and dairy are subject to global commodity price fluctuations, impacting profit margins for manufacturers. The increasing cost of transportation, energy, and labor also adds to the complexity of pricing strategies.

Furthermore, the growing consumer preference for eco-friendly packaging has forced companies to switch from plastic to biodegradable alternatives, which are often more expensive. For instance, companies that previously used traditional plastic wrappers are now investing in compostable films and recyclable cartons. These shifts, though aligned with long-term sustainability goals, add short-term financial pressure, particularly on small and medium-sized players.

The rapid digitization of retail has opened up massive opportunities for the U.S. candy market, particularly through e-commerce and direct-to-consumer (DTC) models. Post-pandemic shopping behaviors have changed dramatically, with consumers increasingly comfortable buying consumables online. Candy brands are leveraging this trend by launching exclusive products, bundle deals, and monthly subscription boxes through their online platforms.

DTC enables deeper consumer engagement, access to first-party data, and faster iteration based on feedback. For example, niche brands like Sugarfina have created luxury candy experiences online, offering curated gift boxes, wedding favors, and corporate gifting solutions. Online personalization, combined with influencer marketing and creative storytelling, has enabled even small brands to go national. As logistics and delivery services improve further, the DTC opportunity is set to remain a game-changer for the candy sector.

Chocolate candy dominated the U.S. candy market by revenue share in 2024, owing to its widespread popularity, variety in offerings, and seasonal demand spikes. Products like chocolate bars, truffles, and coated nuts continue to lead shelves and gift boxes, supported by strong brand equity from legacy brands such as Hershey’s, Mars, and Lindt. The emotional connection associated with chocolate—romantic gifting, comfort food, or holiday treats—drives repeated purchases. Furthermore, dark chocolate’s perceived health benefits have led to its inclusion in “better-for-you” portfolios, enhancing its appeal to older, health-conscious consumers.

On the other hand, non-chocolate candy is projected to be the fastest-growing type segment, driven by Gen Z’s preference for bold flavors, vibrant colors, and novelty items. Gummies, sours, hard candy, and lollipops are seeing strong demand, especially from brands focusing on fun and functionality. Innovative products such as vitamin-enriched gummies, plant-based jelly candies, and spicy-sweet flavor mashups are disrupting the traditional flavor profiles. Additionally, the rise in veganism has tilted product development in favor of gelatin-free and natural dye alternatives, helping this segment capture a new, younger audience.

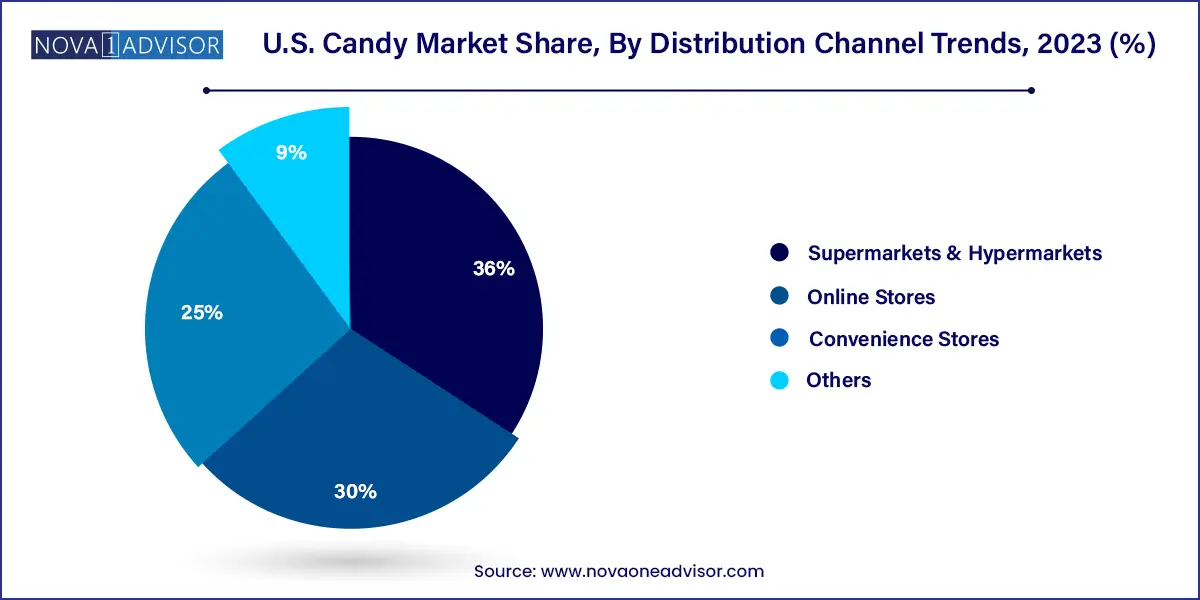

Supermarkets & hypermarkets currently dominate distribution due to their broad accessibility, impulse-driven placement near checkout counters, and bulk-buying advantages. Chains like Walmart, Kroger, and Target have extensive candy aisles and maintain long-standing relationships with top brands. These large-format stores also leverage promotions during holidays and offer private-label candy options, increasing consumer engagement. The trust and familiarity associated with shopping in these environments ensure high visibility and strong point-of-sale influence, especially for family-sized packaging and seasonal offerings.

Online stores are the fastest-growing distribution channel, spurred by convenience, exclusive offerings, and tech-enabled personalization. Online candy shopping has expanded from basic delivery to immersive digital experiences. Consumers can now build custom candy jars, opt into monthly mystery boxes, or gift digital vouchers for candy clubs. The ability to browse niche and international candies from the comfort of home has democratized candy access like never before. During the pandemic and beyond, candy e-commerce saw spikes not just in individual buyers but also in corporate orders for virtual event gifting and employee appreciation boxes.

The U.S. candy market is a mosaic of regional preferences, cultural habits, and consumer behaviors influenced by demographics and climate. For instance, Midwest and Southern states exhibit higher per capita candy consumption, partially due to traditional events, state fairs, and legacy brand loyalty. States like Pennsylvania, home to Hershey’s headquarters, and Illinois, a hub for candy manufacturing, are critical contributors to overall volume and innovation.

Seasonality plays a crucial role in demand generation across the country. Halloween remains the highest revenue-generating event for candy sales, followed by Christmas, Easter, and Valentine’s Day. Florida and California, with their large populations and tourism-driven footfall, show higher-than-average sales in travel retail and convenience store formats. Meanwhile, urban hubs like New York and San Francisco are strongholds for premium and artisanal candy, often sold in boutique stores or curated subscription boxes. Regional taste differences also matter—spicy and tropical flavors are more popular in the Southwest, while traditional fruity flavors dominate in the Northeast.

January 2025 – Mars Inc. launched a plant-based version of its iconic Snickers bar, made using oat milk instead of dairy. The move aligns with growing demand for vegan candy alternatives and received significant attention across retail media.

February 2025 – Hershey’s announced an investment of USD 100 million in expanding its U.S. manufacturing capabilities, with a focus on increasing capacity for low-sugar and organic chocolate lines.

March 2025 – Ferrero USA introduced a premium artisanal brand “Dolce & Nuts” targeting high-income millennials, featuring luxury packaging and exotic flavor combinations like saffron-almond and Himalayan salt truffle.

April 2024 – Candy Club, a rising DTC candy subscription company, secured USD 20 million in Series B funding to expand its digital footprint and product diversification, including sugar-free lines.

December 2024 – SmartSweets unveiled a new campaign focused on “Sweet Without the Sacrifice,” rolling out fruit chews with only 2 grams of sugar per serving and expanding shelf space in CVS and Whole Foods nationwide.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. candy market

Type

Distribution Channel