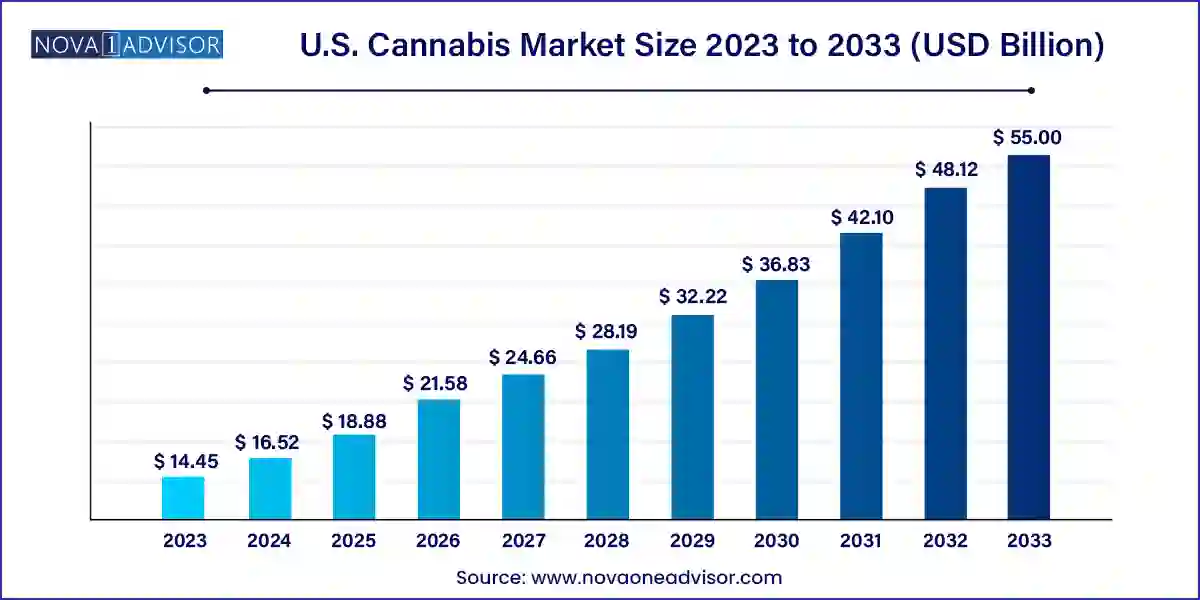

The U.S. cannabis market size was exhibited at USD 14.45 billion in 2023 and is projected to hit around USD 55.00 billion by 2033, growing at a CAGR of 14.3% during the forecast period 2024 to 2033.

The U.S. cannabis market is undergoing an extraordinary evolution, transitioning from an illicit underground economy to a regulated, multi-billion-dollar legal industry. Sparked by shifting social norms, broadening legalization, and increased consumer awareness, the cannabis market in the United States is now a potent force within the broader health, wellness, and recreational sectors. The market encompasses a range of applications medical, recreational, and industrial supported by a complex infrastructure of cultivators, processors, manufacturers, and dispensaries.

Medical cannabis has played a central role in mainstreaming the industry. Initially adopted in states like California and Colorado, therapeutic use has expanded significantly as mounting scientific evidence and patient testimonials highlight its efficacy for conditions such as chronic pain, cancer-related symptoms, anxiety, epilepsy, and multiple sclerosis. As of 2025, over 38 states have legalized medical cannabis in some form, while 24 states and Washington D.C. have approved recreational use. Federal legalization is still pending, but there is growing bipartisan support for reforms that could decriminalize cannabis or open pathways for broader commercial activity.

Recreational cannabis has witnessed explosive growth, driven by adult-use consumption, lifestyle trends, and increased dispensary accessibility. Products have diversified well beyond traditional joints, including edibles, concentrates, tinctures, topicals, and beverages—catering to both seasoned consumers and newcomers seeking wellness-focused benefits without psychoactive intensity. Meanwhile, industrial hemp is carving out its own space, with cannabidiol (CBD) making significant inroads in beauty, wellness, pet care, and pharmaceutical markets.

The U.S. cannabis economy is poised to grow further as legalization widens and consumer demographics broaden. The convergence of medical science, consumer behavior, and policy change is creating a fertile environment for innovation, job creation, and investment. Despite ongoing regulatory and operational hurdles, the U.S. cannabis market represents one of the most dynamic and high-potential sectors of the decade.

Normalization of Cannabis Use in Wellness and Lifestyle: Cannabis is increasingly seen as part of a balanced lifestyle, with CBD and microdosing THC becoming common in wellness routines.

Expansion of Cannabis-infused Food and Beverage Products: Edibles and cannabis-infused drinks are among the fastest-growing product categories, favored for convenience, discretion, and varied formulations.

Innovation in Delivery Mechanisms: From vape pens to transdermal patches and nano-emulsions for faster absorption, technological advancements are reshaping how consumers experience cannabis.

Rise of Low-THC, High-CBD Products: As interest in non-psychoactive benefits increases, the demand for high-CBD and hemp-derived products continues to expand, even among first-time users.

State-Level Policy Progression: States are increasingly passing progressive cannabis legislation, filling the void left by federal inaction and pushing for expungement of past cannabis-related offenses.

Consolidation Among Operators: Mergers and acquisitions are on the rise as cannabis companies seek scale, vertical integration, and access to new geographic markets.

Increased Focus on Sustainability: With growing scrutiny over the environmental impact of cannabis cultivation, there’s a shift toward eco-friendly practices like energy-efficient indoor grows and regenerative agriculture.

Financial Institutions Softening Stances: While federal banking restrictions remain, a growing number of financial service providers are cautiously entering the cannabis ecosystem through specialized services and fintech platforms.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.52 Billion |

| Market Size by 2033 | USD 55.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | End-use, Source, Derivative |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Canopy Growth Corporation; GW Pharmaceuticals, plc; Aurora Cannabis, Inc.; Aphria, Inc.; Cronos Group; Tilray |

The most pivotal driver in the U.S. cannabis market is the progressive wave of state-level legalization and rapidly evolving consumer attitudes. Public perception has shifted drastically in the past decade from associating cannabis with criminality to recognizing its therapeutic and economic potential. According to a 2024 Pew Research survey, over 88% of Americans support legalizing marijuana for either medical or recreational use.

This shift is mirrored in legislative action. With every election cycle, more states approve adult-use cannabis, and previously restrictive states are expanding their medical programs. This wave of legalization is not just unlocking new consumer markets but also driving regulatory clarity, encouraging capital investment, and legitimizing business operations. States like New York, Virginia, and Minnesota are building comprehensive frameworks to manage cultivation, retail, and social equity initiatives—setting standards that could eventually be mirrored at the federal level.

Despite surging demand and widespread state-level support, the lack of federal legalization remains a significant constraint. Cannabis is still classified as a Schedule I substance under the Controlled Substances Act, which places it in the same legal category as heroin and LSD. This federal status introduces a cascade of complications—banking restrictions, limited interstate commerce, and high operational risks.

Businesses often struggle with limited access to traditional banking services, forcing them to operate primarily in cash. The absence of standardized federal regulations also leads to a fragmented market, where compliance requirements vary drastically from state to state. For example, labeling, testing, and dosage regulations differ between California and Massachusetts, making it difficult for companies to scale operations across state lines. This inconsistency complicates product standardization, brand consistency, and logistics dampening the growth potential for multi-state operators.

An outstanding opportunity lies in the integration of cannabis into mainstream pharmaceutical and therapeutic domains. As more clinical research validates the efficacy of cannabinoids in treating a wide spectrum of conditions ranging from seizure disorders to neurodegenerative diseases opportunities are arising for pharmaceutical partnerships, drug development, and FDA-approved formulations.

For instance, the approval of GW Pharmaceuticals’ Epidiolex for epilepsy marked a milestone in the pharmaceutical validation of cannabis-derived treatments. Research is also advancing on synthetic cannabinoids and full-spectrum extracts for conditions such as PTSD, Alzheimer’s disease, and Parkinson’s. With Big Pharma now showing interest in cannabinoids as alternatives to opioids and antidepressants, the medical cannabis segment could soon intersect with traditional healthcare infrastructure. Furthermore, insurance coverage for cannabis-based treatments, once a distant hope, is slowly emerging as insurers begin exploring reimbursement models for clinically validated therapies.

Recreational cannabis dominated the market in terms of revenue share due to increased adult-use legalization and cultural normalization. States like California, Illinois, and Michigan have well-developed dispensary networks, supporting a diverse array of products including flowers, edibles, and vapes. Recreational users drive daily and repeat purchases, making this segment a steady revenue generator. The appeal of cannabis for relaxation, creativity, and social use has helped position it as a mainstream lifestyle product, comparable to alcohol. Marketing campaigns, celebrity endorsements, and product innovation (e.g., low-dose edibles) have further fueled adoption.

The medical cannabis segment is expected to be the fastest growing over the coming years, driven by an aging population and increasing prevalence of chronic illnesses. Medical cannabis is now being prescribed for over 15 distinct conditions including epilepsy, cancer, arthritis, and multiple sclerosis. The Alzheimer’s and PTSD segments are showing promising research-led growth, particularly for veterans and senior populations. The cannabis-for-pain segment also continues to expand as physicians explore alternatives to opioids. As more patients and physicians gain access to reliable dosage formats such as capsules, oils, and sprays, this segment will likely witness strong upward momentum.

Marijuana-derived products, particularly flowers, have historically dominated the market, largely due to their established user base and ease of production. Smoking and vaping cannabis flower remains the most common method of consumption among both recreational and medical users. This segment benefits from lower production costs and immediate consumer recognition. Within marijuana products, THC-rich oil and tinctures have gained traction for their discrete application and higher potency, particularly in therapeutic use cases.

However, hemp-derived products are emerging as the fastest growing category, particularly in the wellness and nutraceutical space. Hemp CBD is widely accepted across the country due to its non-psychoactive profile and has found applications in skincare, pain relief, and mental wellness. Industrial hemp is also gaining popularity in textiles, biodegradable plastics, and construction materials (hempcrete). Supplements containing hemp-derived cannabinoids are now common in e-commerce and retail channels. The flexibility of hemp regulations compared to marijuana further encourages innovation and investment.

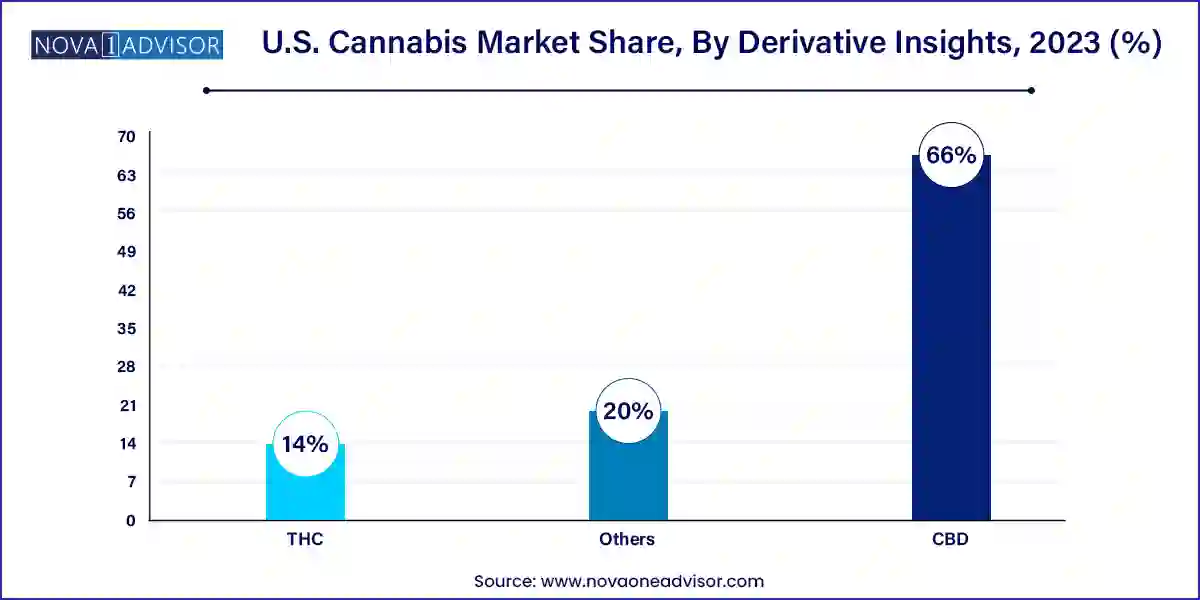

THC-based derivatives led the market, fueled by consumer demand for psychoactive effects and therapeutic benefits. High-THC products, including edibles, vape cartridges, and dabs, are especially popular among recreational users seeking specific effects like relaxation, euphoria, or sleep aid. Medical users also rely on THC-rich options for chronic pain, appetite stimulation, and neuropathy. The ongoing development of nanoemulsion technology is enhancing THC bioavailability and enabling faster onset times, broadening consumer appeal.

CBD is the fastest-growing derivative segment, driven by increased awareness of its non-intoxicating benefits. Consumers are increasingly turning to CBD for anxiety relief, sleep disorders, and inflammation without the high associated with THC. The 2018 Farm Bill, which legalized hemp-derived CBD products federally, opened up massive opportunities in food, beverages, cosmetics, and pet care. Now featured in everything from bath bombs to energy drinks, CBD is becoming a staple in American health and beauty routines. Ongoing clinical trials and growing acceptance in pharmacies and wellness stores underscore its rising influence.

The U.S. cannabis market landscape is marked by a patchwork of state regulations. States like California, Oregon, and Colorado represent mature markets with well-established infrastructure and retail channels. On the East Coast, New York and New Jersey have recently launched adult-use programs with robust social equity frameworks and growing investor interest. Southern states like Florida and Texas are expanding their medical cannabis programs and are potential hotspots for future adult-use legalization.

The federal landscape remains uncertain, but shifts are underway. Bills like the MORE Act and SAFE Banking Act have gained traction in Congress, signaling a potential loosening of federal restrictions. Meanwhile, industry advocacy groups are lobbying for cannabis descheduling, tax reforms, and equitable licensing. This gradual convergence of state-level liberalization and federal momentum could unlock the U.S. cannabis market’s full potential, enabling cross-state commerce, institutional investment, and mainstream pharmaceutical integration.

April 2024 – Curaleaf Expands into Georgia: Curaleaf Holdings opened its first dispensary in Georgia after receiving regulatory clearance, expanding its footprint in the southeastern U.S. market and introducing low-THC medical products.

March 2024 – Trulieve Launches Edibles in West Virginia: Trulieve Cannabis Corp. began selling cannabis-infused edibles in West Virginia, marking the first time such products were made available in the state’s medical market.

February 2024 – Cresco Labs and Columbia Care Merger Terminated: The long-awaited merger between Cresco Labs and Columbia Care was called off due to “prolonged regulatory delays,” highlighting the ongoing challenges of consolidation under fragmented regulations.

January 2024 – Tilray Enters U.S. Beverage Market: Canadian cannabis company Tilray Brands acquired several craft beverage brands in the U.S. to enter the cannabis-infused drinks space pending full federal legalization.

December 2023 – Canopy USA Formally Established: Canopy Growth established Canopy USA to house its American assets and prepare for full market entry upon regulatory reform, following a series of strategic acquisitions including Wana Brands and Jetty Extracts.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cannabis market.

End-use

Source

Derivative