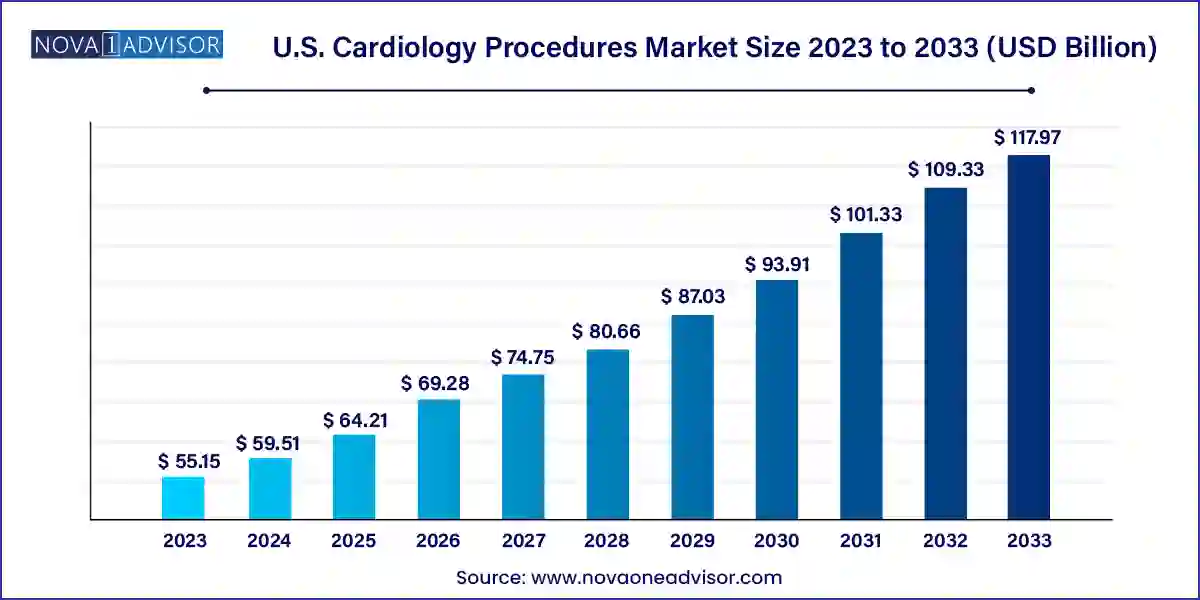

The U.S. cardiology procedures market size was exhibited at USD 55.15 billion in 2023 and is projected to hit around USD 117.97 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 59.51 Billion |

| Market Size by 2033 | USD 117.97 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Procedures |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Cleveland Clinic; Mayo Clinic; Johns Hopkins Hospital; Massachusetts General Hospital; Stanford Health Care; Cedars-Sinai Medical Center; and Northwestern Memorial Hospital. |

The expanding geriatric demographic, the rise in cardiovascular conditions, and the advancements in cardiology device technology propel the market's growth. The uptick in clinical research focusing on cardiovascular solutions presents an opportunity for further market expansion.

An increase in the prevalence of cardiovascular diseases (CVDs), such as coronary artery disease (CAD), heart arrhythmias, heart failure, heart valve disease, congenital heart disease, cardiomyopathy (heart muscle disease), and pericardial disease, is expected to boost the market growth over the forecast period. According to the CDC, in 2023, around 20.5 million adults in the U.S. suffered from CAD, making it the most prevalent form of heart disease. In addition, around 366,000 people in the U.S. died due to CAD. Currently, the CABG procedure is recommended by physicians to their patients for treatment. Thus, the rising prevalence of CAD is anticipated to drive market growth. Furthermore, the growing number of deaths and rising awareness about the benefits of early cardiovascular treatment among the general U.S. population are expected to boost the demand for cardiology procedures during the forecast period.

The growing geriatric population has a significant impact on U.S. healthcare systems. The growing geriatric population is increasing the prevalence of age-related conditions, such as heart disease. According to the U.S. Census Bureau, by 2033 around 82 million Americans will be aged 65 or older. In the U.S., the burden of cardiovascular disease is anticipated to grow with the rising geriatric population, which may necessitate advanced life support measures, such as surgical procedures. Aging can cause changes in the heart and blood vessels, which may increase a person’s chances of developing cardiovascular disease. Thus, the rising geriatric population is projected to fuel demand for cardiology procedures nationwide during the forecast period.

Based on procedure, the interventional procedures segment dominated the market and accounted for the largest revenue share of 53.85% in 2023. Moreover, this segment is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. The market is poised for growth driven by several factors, including new product launches, supportive government initiatives, and the increasing prevalence of conditions like peripheral artery disease, coronary artery disease (CAD), and cardiac valve disease. Additionally, the rising adoption of minimally invasive surgeries (MIS) is expected to contribute to market expansion.

According to the American College of Cardiology, approximately 1.2 million angioplasties were performed in the U.S. in 2023. Unhealthy lifestyles, obesity, and diabetes are significant factors driving the demand for angioplasties and contributing to the increase in CAD cases. Government and non-profit medical associations are also playing a role in fostering market growth by promoting early diagnosis and treatment of cardiac diseases. Organizations like the American Heart Association (AHA) are working towards reducing disabilities and fatalities caused by heart disease and stroke through various initiatives, including advocacy for cardiac care, consumer education on healthy living, and funding cardiovascular research.Moreover, leading healthcare facilities such as Cleveland Clinic, Cedars-Sinai Medical Center, Mayo Clinic-Rochester, Mount Sinai Hospital, and NYU Langone Hospitals provide safe and effective cardiac interventional procedures in the U.S.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cardiology procedures market

Procedures

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Procedures

1.1.2. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Procedures outlook

Chapter 3. U.S. Cardiology Procedures Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising number of cardiac procedures

3.2.1.2. Rapidly aging population and sedentary lifestyle

3.2.1.3. Increasing prevalence of cardiovascular disease

3.2.2. Market Restraint Analysis

3.2.2.1. High cost associated with cardiac procedures

3.2.2.2. Shortage of cardiologists

3.3. Regulatory Framework

3.4. U.S. Cardiology Procedures Market Analysis Tools

3.4.1. Industry Analysis - Porter’s Five Forces

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. U.S. Cardiology Procedures Market: Procedures Estimates & Trend Analysis

4.1. U.S. Cardiology Procedures Market: Procedures Dashboard

4.2. U.S. Cardiology Procedures Market: Procedures Movement Analysis

4.3. U.S. Cardiology Procedures Market Size & Forecasts and Trend Analysis, by Procedures, 2021 to 2033

4.4. Interventional Procedures

4.4.1. Market estimates and forecasts, 2021 to 2033

4.5. Peripheral Vascular Procedures

4.5.1. Market estimates and forecasts, 2021 to 2033

4.6. Heart Rhythm Management Procedures

4.6.1. Market estimates and forecasts, 2021 to 2033

4.7. Structural Heart Procedures

4.7.1. Market estimates and forecasts, 2021 to 2033

4.8. Electrophysiology Procedures

4.8.1. Market estimates and forecasts, 2021 to 2033

4.9. Others

4.9.1. Market estimates and forecasts, 2021 to 2033

Chapter 5. Competitive Landscape

5.1. Recent Developments & Impact Analysis, By Key Market Participants

5.2. Vendor Landscape

5.2.1. Cleveland Clinic

5.2.2. Mayo Clinic

5.2.3. Johns Hopkins Hospital

5.2.4. Massachusetts General Hospital

5.2.5. Stanford Health Care

5.2.6. Cedars-Sinai Medical Center

5.2.7. Northwestern Memorial Hospital