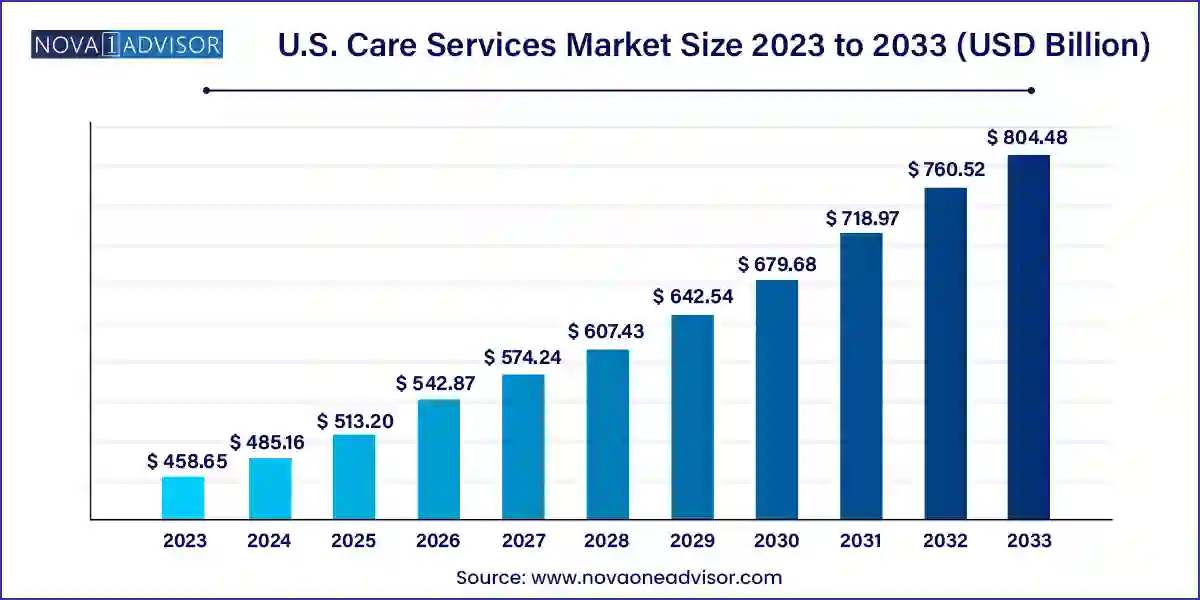

The U.S. care services market size was exhibited at USD 458.65 billion in 2023 and is projected to hit around USD 804.48 billion by 2033, growing at a CAGR of 5.78% during the forecast period 2024 to 2033.

The U.S. care services market is undergoing a significant transformation driven by a rapidly aging population, changing healthcare delivery models, technological advancements, and evolving patient preferences. Traditionally centered around institutional settings like nursing homes and hospitals, care delivery is increasingly shifting towards patient-centric, home-based, and technologically enabled models. The demand for long-term care services is climbing, catalyzed by the rising prevalence of chronic conditions such as Alzheimer’s, diabetes, and cardiovascular diseases. This growing demand is compounded by workforce shortages and budget constraints, pushing providers to innovate and prioritize cost-efficiency without compromising quality.

The care services industry in the U.S. encompasses a wide spectrum of offerings, ranging from highly medicalized post-acute and skilled nursing care to home-based primary services and hospice care. The market is also becoming increasingly dynamic due to the incorporation of remote patient monitoring (RPM), telehealth, and AI-enabled predictive tools, enabling better resource management and patient outcomes. Despite its complexity, the U.S. care services market offers promising growth opportunities for providers, tech companies, and payers alike.

Regulatory frameworks such as the Affordable Care Act and value-based care initiatives have further catalyzed the shift toward home-based care. With Medicare and Medicaid policies promoting home-based recovery and palliative care, providers are compelled to adapt and restructure services. Furthermore, investments in care innovation, the emergence of integrated care networks, and the prioritization of patient autonomy are redefining service delivery standards in the industry.

Shift Toward Home-Based Care: There is a significant migration from institutional to home-based and community-centered care, supported by cost-saving incentives and improved patient outcomes.

Adoption of Remote Patient Monitoring (RPM): Integration of wearables, smart devices, and real-time monitoring platforms is enabling proactive health management.

Rising Popularity of Hospice and Palliative Care: There is a growing recognition of the importance of quality end-of-life care, leading to expanded service networks and investment.

Technological Integration in Elder Care: AI, IoT, and telehealth platforms are being used for predictive analytics, emergency response, and virtual consultations.

Increased Focus on Integrated and Coordinated Care Models: Health systems are forming alliances across services for holistic, seamless patient journeys.

Labor Shortage and Workforce Training Innovations: With ongoing caregiver shortages, the market is seeing new training programs, digital assistive tools, and workforce automation.

Retail Giants Entering the Care Market: Companies like Amazon and CVS Health are venturing into home care and primary care services.

| Report Coverage | Details |

| Market Size in 2024 | USD 485.16 Billion |

| Market Size by 2033 | USD 804.48 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.78% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Kindred Healthcare, LLC; Amedisys, Inc ; Sunrise Senior Living, LLC; National Healthcare Corporation; Brookdale Senior Living, Inc; Capital Senior Living Corporation; Home Instead; Inc Genesis Healthcare, Inc; Diversicare Healthcare Services, Inc; LHC Group, Inc. |

One of the most potent drivers of the U.S. care services market is the rapidly aging population. According to the U.S. Census Bureau, by 2030, all baby boomers will be older than 65, making up more than 20% of the U.S. population. This demographic shift results in a growing demand for both acute and long-term care services, particularly for chronic conditions and cognitive impairments such as dementia and Alzheimer’s disease. The aging population also desires to maintain independence and dignity in familiar surroundings, accelerating the need for accessible, in-home services. This demographic trend presents not only a volume surge in patient intake but also a qualitative transformation of care delivery, driving providers to adopt flexible and scalable care models.

A critical restraint hindering the market’s optimal growth is the persistent shortage of skilled healthcare professionals, including registered nurses, home health aides, and caregivers. This shortage, intensified by pandemic burnout and competitive job markets, limits care availability and adversely affects service quality. The American Health Care Association (AHCA) reported in 2023 that 94% of nursing homes experienced staffing challenges, with many facilities forced to limit admissions. The scarcity of personnel increases operational strain, affects patient outcomes, and limits the scaling of innovative care models like home-based services and RPM. Resolving this challenge requires policy changes, better compensation structures, and investment in workforce development.

The expansion of RPM presents a major opportunity in the U.S. care services market. With CMS (Centers for Medicare & Medicaid Services) continuing to update reimbursement models for remote monitoring, providers now have greater incentive to invest in connected health solutions. The COVID-19 pandemic normalized virtual care, and RPM has emerged as a cost-effective solution for chronic care management. Companies that integrate wearable devices and IoT-enabled sensors into care plans can track vital health metrics, detect abnormalities early, and reduce hospital readmissions. This opportunity is particularly attractive in rural and underserved areas, where traditional care infrastructure is sparse. The ongoing development of 5G and cloud computing further enhances the scalability and efficacy of RPM platforms.

The skilled nursing facility (SNF) segment holds a dominant position in the U.S. care services market due to its comprehensive offerings of round-the-clock medical supervision and rehabilitation services. These facilities are essential for patients recovering from surgery, serious illness, or hospitalization who require higher medical attention than that provided in assisted living or home care. The segment is especially crucial in the management of complex post-operative recovery and high-acuity chronic care cases. As Medicare and private insurance often cover SNF services for short-term stays, utilization rates remain high. Furthermore, continuous upgrades in therapy equipment, infection control, and quality assurance protocols have reinforced their indispensable role in transitional care.

On the other hand, the fastest-growing segment within this category is Home-based Primary Care/House Calls. This model has been revitalized due to technology, patient preference, and payer policy evolution. A 2024 report from the National Academy for State Health Policy revealed that states piloting home-based models observed improved patient satisfaction and cost savings. Providers such as Heal and DispatchHealth have rapidly scaled operations, leveraging telehealth and mobile units to reach patients. With the potential to reduce ER visits and rehospitalizations, this segment is attracting significant investment and innovation.

Assisted living facilities (ALFs) have carved a substantial share in the U.S. care services market by offering a hybrid model that balances autonomy and care. These facilities cater to elderly individuals who need assistance with daily activities but do not require intensive medical attention. The appeal lies in their community-like environment, social integration, and personalized support services. Many ALFs offer memory care wings, physical therapy access, and emergency support systems. Market leaders such as Brookdale Senior Living and Sunrise Senior Living continue to expand footprint and amenities to attract baby boomers.

However, Hospice and Palliative Care is the segment witnessing the most rapid expansion. With rising awareness around end-of-life dignity, patient rights, and emotional-spiritual well-being, more families are opting for palliative care pathways. According to the National Hospice and Palliative Care Organization, over 1.7 million Medicare beneficiaries received hospice care in 2023. The integration of counseling, pain management, and bereavement support makes this model holistically appealing. Growth is further supported by faith-based and nonprofit organizations expanding their service base into culturally diverse communities.

The U.S. care services market demonstrates regional disparities influenced by population aging rates, healthcare infrastructure, and Medicaid policy variations. States such as Florida, California, and Texas are the frontrunners due to high concentrations of retirees and well-established networks of long-term care providers. Florida, in particular, serves as a microcosm of care delivery transformation, with rapid adoption of tech-integrated assisted living and RPM. Meanwhile, northeastern states like New York and Massachusetts are investing in care workforce training and post-acute care facility modernization, supported by robust Medicaid funding.

Rural states face unique challenges, with a sparse care infrastructure and limited workforce availability. However, these gaps are becoming focal points for innovation. For instance, Minnesota and Iowa have piloted community health worker programs and telecare hubs to compensate for facility limitations. Moreover, federal initiatives such as the Better Care Better Jobs Act (2022–2023) aim to address these inequalities by channeling funds into care delivery modernization and worker incentives across underserved regions.

March 2025 – Amedisys, Inc., a leading home health and hospice care provider, announced a strategic expansion of its palliative care services across five new states, aiming to address rising end-of-life care needs with hybrid virtual-in-person teams.

January 2025 – CVS Health completed the acquisition of primary care provider Oak Street Health for $10.6 billion, reinforcing its position in value-based home and senior care.

February 2025 – LHC Group, a significant player in home health and hospice services, rolled out a remote care management platform integrating AI alerts to monitor congestive heart failure and COPD patients.

December 2024 – Brookdale Senior Living launched a nationwide telehealth initiative across its assisted living properties in partnership with Teladoc Health, enhancing access to primary and mental health services.

October 2024 – Kindred Healthcare unveiled a new transitional care hospital in Dallas, Texas, aimed at post-acute patients requiring longer recovery windows before returning to home care or assisted living.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. care services market

Type