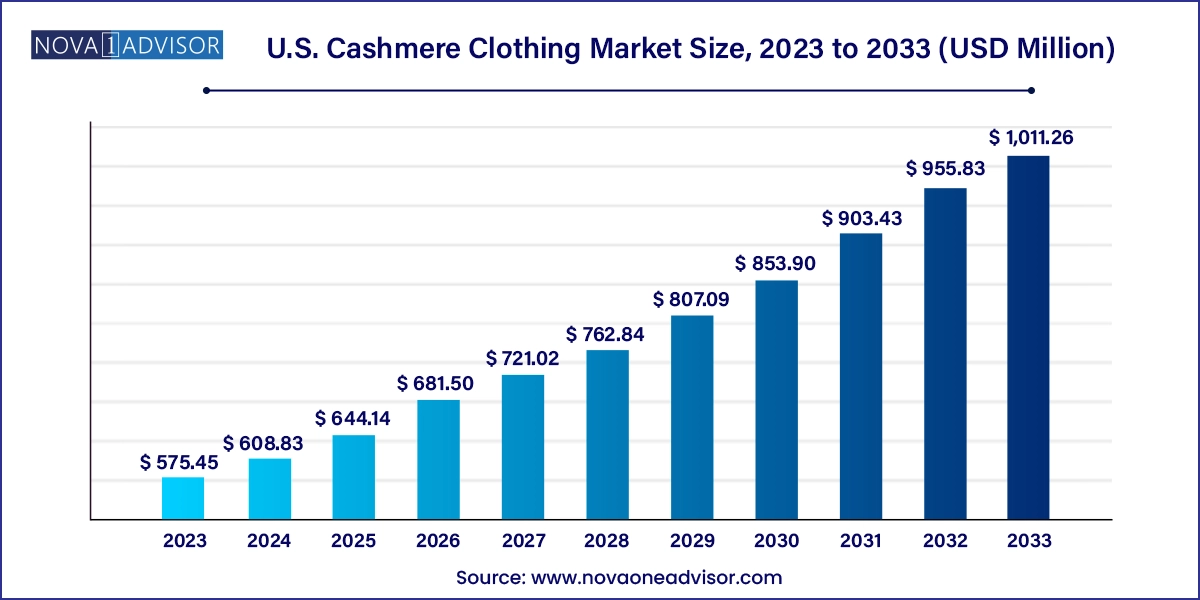

The U.S. cashmere clothing market size was exhibited at USD 575.45 million in 2023 and is projected to hit around USD 1,011.26 million by 2033, growing at a CAGR of 5.8% during the forecast period 2024 to 2033.The cashmere clothing market is expected to expand due to the rising popularity of products such as fine and ideal woolen clothing, which is driving the demand and supporting market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 608.83 Million |

| Market Size by 2033 | USD 1,011.26 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-user, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Loro Piana S.P.A.; Brunello Cucinelli S.p.A.; Maison Cashmere; NAKEDCASHMERE; SofiaCashmere; Autumn Cashmere; TSE Cashmere; 360CASHMERE; WHITE + WARREN; LISA TODD |

The U.S. cashmere clothing market accounted for a share of 20.5% of the global cashmere clothing market in 2023. Products that exude exclusivity and originality appeal to luxury buyers. Cashmere clothing is a popular choice for luxury garment buyers who value unique and uncommon pieces. It is renowned for its limited editions, custom designs, and fine craftsmanship. Due to its scarcity and complex manufacturing methods, cashmere is perceived as being exclusive, which makes it a sought-after option for luxury shoppers.

The perceived worth of cashmere apparel is increased due to its link with luxury. Luxury clothing buyers are investing in a way of life, an experience, and a refined statement in addition to buying garments. Because of its remarkable softness and insulating qualities, cashmere is a favourite material for people looking for stylish yet comfortable clothes.

Since ethically and sustainably produced materials are becoming more and more popular among American consumers, cashmere clothing that is ethically obtained from other exporting nations is in high demand among ethical shoppers.

Experts in cashmere production and animal welfare work together with autonomous standardization agencies to establish norms for good grazing practices and herd management. The goal is to create a healthier environment in the United States, better working conditions for farmers, and welfare of cashmere goats. This factor is crucial in promoting the moral manufacture of cashmere apparel for the environmentally and fashion-conscious public.

For instance, the Aid by Trade Foundation (AbTF), a nonprofit committed to improving the welfare of cashmere goats, farmers, farming communities, and the environment, created the Good Cashmere Standard (GCS). U.S. omni-channel retailers are embracing GCS-certified cashmere in order to meet ethical and sustainable requirements and create cashmere apparel with transparent sourcing. For example, J. Crew announced in February 2021 that starting with the Spring 2021 collection, all cashmere sweaters and non-apparel products would be made entirely of cashmere that has been verified by the Good Cashmere Standard. This was the first time American retailers had made a promise of this type.

The sweaters and coats product segment accounted for a share of 54.0% in the year 2023. The outstanding insulating qualities, lightweight lightness, and extraordinary softness of cashmere are well-known. Because of these qualities, cashmere jackets and sweaters are very popular, particularly in colder regions where they offer warmth without the bulk that is sometimes associated with other materials.

The tees and polo product type segment is projected to register a CAGR of 7.3% during the forecast period. The segment foresees growth due to the high demand for tees and polo, as they are cheaper as compared to premium coats, jackets, and sweaters.

The women's cashmere clothing market accounted for a market share of 59.8% in 2023. This is mostly because cashmere scarves and shawls are becoming more and more popular in the United States. A number of manufacturers, which will accelerate growth, is introducing innovative patterns and designs. Additionally, businesses are about to release distinctive accessories crafted from this cloth, which is anticipated to promote market expansion.

The men's cashmere clothing market is expected to witness a CAGR of 6.0% during the forecast period. The growth is attributed to the improving standards of living, and increasing demand for cashmere clothing, such as coats and trousers, as fashion apparel.

Sales of cashmere clothing through channels accounted for a market share of 63.0% in 2023. Offline channels offer potential buyers the chance to feel the extraordinary quality and softness of cashmere directly, in contrast to internet sales where purchasers are unable to physically touch and feel the material. After feeling the opulent texture of cashmere apparel in person, buyers are more inclined to invest in the material, therefore this sensory experience is quite important in influencing purchase decisions.

Online sales of cashmere clothing are expected to grow at a CAGR of 7.1% during the forecast period. Online shopping's convenience has been a major factor in the expansion of the sector. There's no reason for customers to leave the comforts of their homes to peruse a large selection of cashmere products. Due to its accessibility, a wider range of customers-including those from areas where access to luxury goods may be restricted-have been drawn to the brand.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cashmere clothing market

Product

End user

Distribution Channel