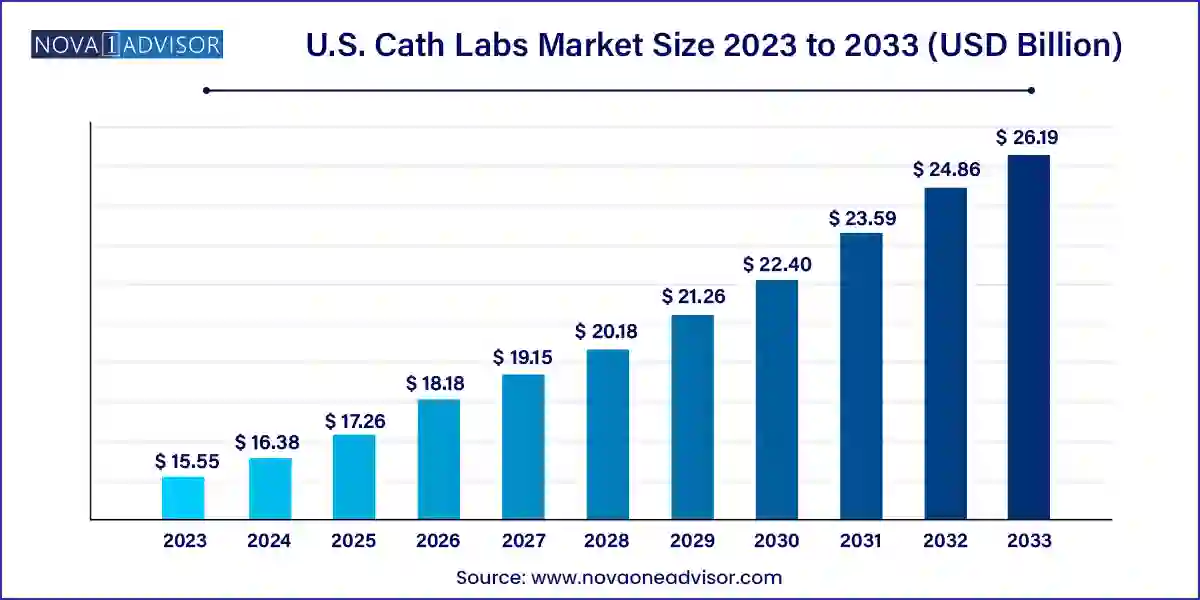

The U.S. cath labs market size was exhibited at USD 15.55 billion in 2023 and is projected to hit around USD 26.19 billion by 2033, growing at a CAGR of 5.35% during the forecast period 2024 to 2033.

The U.S. Catheterization Laboratories (Cath Labs) market is a dynamic and integral segment of the country’s cardiovascular care landscape. Cath Labs serve as specialized hospital rooms equipped with diagnostic imaging equipment used to visualize the arteries and chambers of the heart, and treat any stenosis or abnormality found. These facilities are crucial for conducting both diagnostic and therapeutic procedures, especially for patients suffering from coronary artery disease, heart failure, and structural heart disorders. The U.S. healthcare system, known for its rapid adoption of advanced medical technologies, has played a pivotal role in driving the sophistication and expansion of Cath Labs nationwide.

As heart disease remains the leading cause of death in the United States, the demand for advanced cardiovascular interventions continues to grow. Consequently, the number of cardiac catheterization procedures, including angioplasty, stent placements, and electrophysiological studies, is increasing across the country. Furthermore, innovations in imaging technologies, minimally invasive surgeries, and integration of artificial intelligence (AI) in diagnostics have enhanced the precision and safety of procedures performed in Cath Labs. The U.S. Cath Labs market is further propelled by government initiatives, private investments, and the continuous development of infrastructure in both independent and hospital-based settings.

With increasing emphasis on early detection of cardiovascular conditions, diagnostic services in Cath Labs have also seen a significant uptick. The rise in outpatient procedures and the growing preference for minimally invasive techniques are reshaping how Cath Labs operate, focusing on reducing hospital stays and improving patient outcomes. At the same time, healthcare providers are investing heavily in upgrading equipment and expanding services to meet the surge in demand and regulatory requirements.

Growth in Minimally Invasive Cardiovascular Procedures: Increasing preference for less invasive approaches has led to a surge in procedures like angioplasty and TAVR within Cath Labs.

Integration of AI and Machine Learning: Advanced analytics are being used to interpret imaging results more accurately and guide interventional procedures.

Rise in Outpatient and Ambulatory Cardiac Care: Independent labs and outpatient centers are gaining traction as cost-effective and convenient alternatives to hospital-based labs.

Expansion of Transcatheter Therapies: Procedures such as TAVR and MitraClip are witnessing higher adoption, enabling high-risk patients to receive treatment without open-heart surgery.

Improved Imaging and Diagnostic Tools: Innovations in intravascular ultrasound, FFR, and 3D angiography are enhancing diagnostic precision.

Value-Based Healthcare and Reimbursement Shifts: Emphasis on outcome-based care models is pushing providers to improve operational efficiency and patient management in Cath Labs.

Customized Equipment and Modular Lab Designs: Demand for flexible, scalable Cath Lab setups is rising among hospitals and specialty centers.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.38 Billion |

| Market Size by 2033 | USD 26.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.35% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Facility Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Koninklijke Philips N.V.; Shimadzu Corporation; GE Healthcare; Johnson & Johnson; B. Braun Melsungen AG; Siemens Healthineers; Medtronic; Cardinal Health, Inc.; Boston Scientific Corporation; Abbott Laboratories |

One of the most significant drivers of the U.S. Cath Labs market is the increasing prevalence of cardiovascular diseases (CVDs), including coronary artery disease, heart failure, and arrhythmias. According to the CDC, nearly 697,000 people in the U.S. died from heart disease in 2020, representing about 1 in every 5 deaths. This staggering statistic underscores the growing need for rapid and accurate cardiac diagnostics and interventions, which Cath Labs are uniquely positioned to provide.

The demographic shift toward an aging population is further exacerbating the burden of CVDs. With age being a primary risk factor for heart conditions, the demand for procedures like angiography, stent placement, and TAVR is projected to climb significantly. Additionally, lifestyle-related risk factors—such as obesity, diabetes, smoking, and sedentary behavior—are prevalent in the U.S. and contribute to the rising caseload of Cath Lab procedures. The ability of these labs to perform timely interventions significantly improves survival rates and quality of life, making them indispensable in the healthcare continuum.

While the technological advancement in Cath Labs has revolutionized cardiovascular care, it also brings along a substantial financial burden. Setting up a fully functional Cath Lab involves considerable capital expenditure, often ranging from $1 million to $3 million per lab, depending on the sophistication of equipment and facility design. The cost includes imaging systems, diagnostic tools, surgical instruments, and sterilization equipment—each requiring maintenance and regular upgrades.

For smaller hospitals and standalone diagnostic centers, especially in rural or underfunded regions, these costs can be prohibitive. Additionally, regulatory requirements, staff training, and the need for continuous accreditation add to the financial strain. These barriers can limit the expansion of Cath Labs and restrict access to advanced cardiac care in less urbanized or economically disadvantaged areas, thereby impacting market growth.

A significant opportunity emerging in the U.S. Cath Labs market lies in the expansion of independent labs and outpatient care centers. These facilities offer an alternative to traditional hospital-based settings, providing quicker access, reduced costs, and shorter patient wait times. The shift toward ambulatory care aligns with the broader healthcare trend of decentralizing services to improve patient convenience and efficiency.

Regulatory support for same-day discharge post-intervention and improvements in procedural safety have made it feasible to perform even complex interventions in outpatient settings. Independent labs also offer flexibility in scheduling and cater to niche specialties, making them attractive to both patients and physicians. Companies and investors are increasingly targeting this segment, leading to more customized lab setups, modular equipment packages, and partnership models with cardiologists and healthcare systems. This trend is expected to significantly contribute to the growth and diversification of the U.S. Cath Labs market.

Services segment dominated the U.S. Cath Labs market due to the extensive demand for diagnostic and therapeutic cardiovascular procedures. The services category encompasses both diagnostic and therapeutic services, which together form the core functional output of Cath Labs. Diagnostic procedures like angiography and ECG/EKG are often the initial steps in identifying cardiovascular conditions, while therapeutic services such as angioplasty and stent placements offer life-saving interventions. With the increasing burden of cardiovascular disease, hospitals and cardiac centers are performing these services at unprecedented rates. Therapeutic interventions, especially angioplasty and TAVR, are also evolving with better stent technologies and catheter-based techniques, leading to a consistent surge in procedural volume.

Meanwhile, the fastest-growing segment within services is Transcatheter Aortic Valve Replacement (TAVR). TAVR has revolutionized the treatment landscape for aortic stenosis, especially in elderly and high-risk surgical candidates. Its minimally invasive nature, along with high success rates, has made it a preferred alternative to traditional open-heart surgery. As clinical guidelines continue to expand eligibility criteria, more patients are being considered for TAVR, leading to its exponential growth. Additionally, ongoing trials and product launches related to transcatheter technologies indicate that the TAVR segment will continue to witness high growth in the foreseeable future.

Equipment also constitutes a critical segment of the market, supporting diagnostic and interventional activities. The equipment category includes essential imaging and monitoring systems such as fluoroscopy units, contrast injectors, electrophysiology systems, and advanced catheter technologies. The demand for high-definition imaging and real-time monitoring solutions is increasing, as physicians seek better visualization and accuracy during complex procedures. AI integration into imaging systems and the development of portable Cath Lab units have also expanded the scope of this segment. Hospitals are actively investing in hybrid Cath Labs that combine surgical and imaging functionalities in a single unit, thereby driving equipment sales.

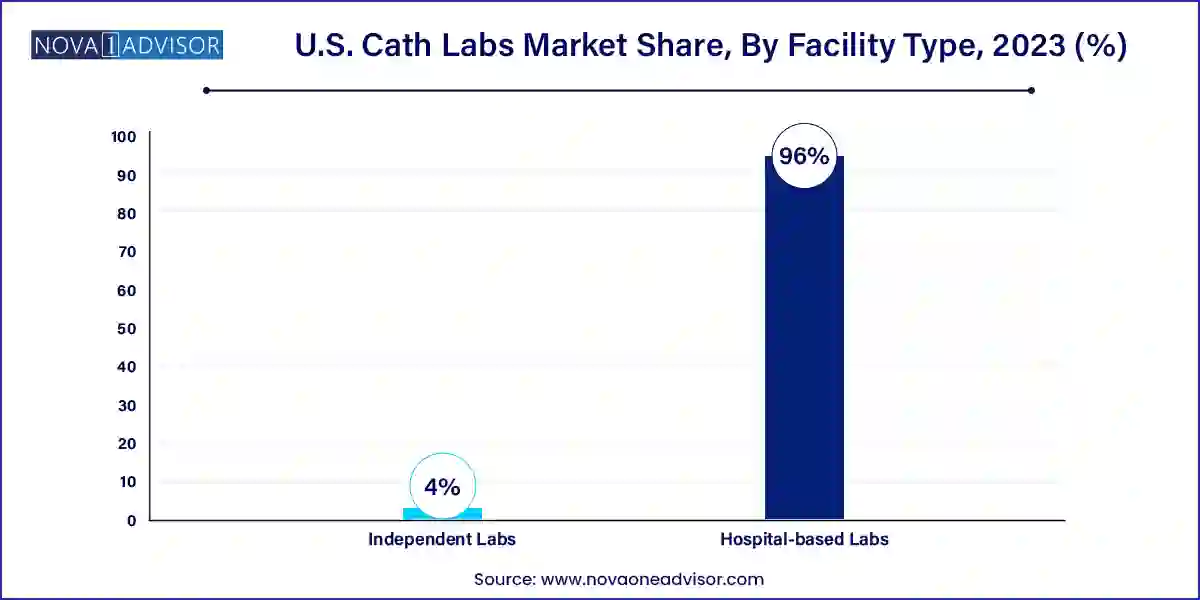

Hospital-based labs currently dominate the U.S. Cath Labs market, driven by the presence of comprehensive care ecosystems, integrated electronic health records (EHRs), and access to multidisciplinary teams. Hospitals are often the first point of care for cardiovascular emergencies, and having an in-house Cath Lab ensures faster diagnosis and intervention. Furthermore, these labs are well-equipped with ICU backup, surgical suites, and post-operative care units. This level of infrastructural support allows hospitals to handle high-risk cases and perform complex interventions with greater safety. Academic medical centers and large urban hospitals, in particular, are investing heavily in expanding their cardiovascular departments, including the addition of hybrid Cath Labs.

On the other hand, independent labs are emerging as the fastest-growing segment in terms of facility type. These labs offer a lower-cost alternative with greater procedural throughput and shorter recovery times, aligning well with the outpatient trend in U.S. healthcare. Ambulatory cardiac care centers have begun to offer a range of diagnostic and interventional services with a high degree of specialization. Many cardiology practices are either setting up their own labs or partnering with management companies to launch independent facilities. With the growing emphasis on value-based care and personalized treatment plans, the flexibility and efficiency of independent labs make them an increasingly attractive option for both providers and patients.

Within the United States, the Cath Labs market exhibits significant activity across both metropolitan hubs and suburban areas. Large states such as California, Texas, and Florida have seen major investments in cardiac care infrastructure, with numerous hospitals expanding their Cath Lab capabilities. Cities like Houston, Los Angeles, and New York are leading the way in adopting robotic-assisted and AI-integrated Cath Lab technologies. Academic institutions and research hospitals in these cities are also conducting groundbreaking trials in interventional cardiology.

In contrast, rural regions face challenges related to access and affordability. Although government grants and telemedicine initiatives are helping bridge the gap, more investment is needed to ensure uniform access to Cath Lab services. Efforts are underway to introduce mobile Cath Labs and expand the reach of outpatient centers in less urbanized regions. Furthermore, initiatives by the Centers for Medicare & Medicaid Services (CMS) to reimburse outpatient procedures are fueling the growth of non-hospital Cath Labs, particularly in mid-sized cities across the Midwest and Southeast.

Abbott Laboratories (February 2025): Abbott launched its next-generation coronary imaging platform "Ultreon™ 2.0" in the U.S., integrating AI-guided diagnostics for intravascular ultrasound (IVUS) and OCT, aimed at Cath Lab environments.

Medtronic (January 2025): Received FDA approval for its Evolut FX+ valve system, designed for use in transcatheter aortic valve replacement (TAVR) procedures, expected to boost its presence in advanced Cath Lab settings.

Philips (December 2024): Partnered with several U.S.-based hospitals to deploy its "Azurion" image-guided therapy system across newly built hybrid Cath Labs.

Boston Scientific (November 2024): Announced the expansion of its coronary stent product portfolio with the launch of the Synergy XD drug-eluting stent, tailored for use in high-volume Cath Labs.

GE HealthCare (October 2024): Unveiled a modular Cath Lab suite solution aimed at smaller hospitals and independent labs, featuring scalable design and integrated software for diagnostics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cath labs market

Component

Facility Type