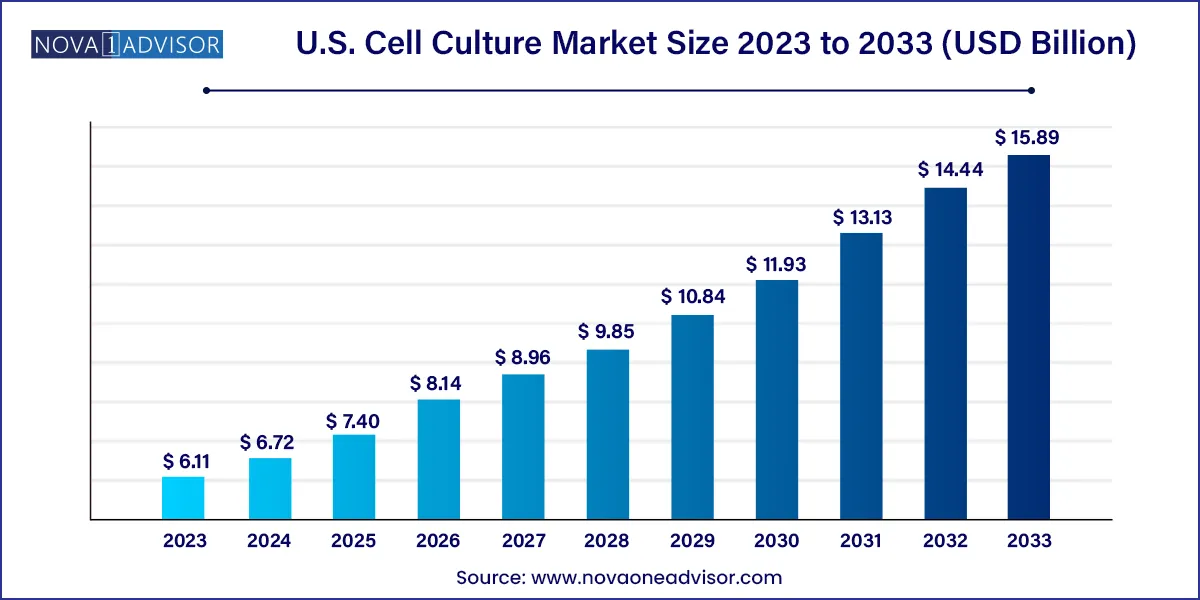

The U.S. cell culture market size was valued at USD 6.11 billion in 2023 and is projected to reach around USD 15.89 billion by 2033, registering a CAGR of 10.03% from 2024 to 2033.

The U.S. cell culture market is at the forefront of biomedical innovation, driving critical advancements across biopharmaceutical production, regenerative medicine, and diagnostic technologies. Cell culture—the process of growing cells under controlled conditions outside their natural environment—is foundational to a vast range of scientific and clinical applications, from developing vaccines and monoclonal antibodies to supporting stem cell research and personalized therapy development.

In recent years, the demand for cell culture technologies has surged in the United States, supported by robust research funding, strong pharmaceutical pipelines, and the country’s role as a global biotechnology hub. As of 2025, the U.S. is home to hundreds of biotech firms, research institutions, and academic laboratories actively using advanced cell culture platforms to develop biologics, investigate cellular mechanisms of disease, and assess drug safety.

COVID-19 further underscored the critical importance of cell culture systems, particularly in the rapid development of viral vaccines and therapeutic antibodies. Since then, the scope has expanded even more into mRNA platforms, gene editing, and CAR-T cell therapy. Cell culture systems are no longer confined to Petri dishes in research labs; they are now deeply embedded in large-scale biomanufacturing, personalized medicine, and disease modeling.

Backed by high investments in life sciences, an advanced regulatory ecosystem, and a growing trend toward precision health solutions, the U.S. cell culture market is poised for sustained long-term growth.

Adoption of Serum-Free and Chemically Defined Media: Regulatory and ethical concerns are pushing the shift from serum-based to defined, animal-free culture media.

Expansion in Cell & Gene Therapy Manufacturing: Cell culture is essential to ex vivo cell modifications and vector development, supporting exponential growth in CGT pipelines.

Rise of 3D Cell Cultures and Organoids: Researchers are shifting to more physiologically relevant 3D systems for drug screening and tissue engineering.

Automation and AI Integration: High-throughput screening, robotic culture systems, and AI-based optimization are transforming lab workflows.

Increased Use of Human-Derived Media: Alternatives to fetal bovine serum (FBS) are gaining traction, especially in regenerative medicine.

Biopharmaceutical Dominance in Cell Culture Demand: mAbs, recombinant proteins, and vaccine production are driving large-scale cell culture adoption.

Growing Demand for Stem Cell Culture Media: As clinical trials in regenerative medicine expand, so does the need for specialized culture conditions.

Cryopreservation and Cold Chain Infrastructure Growth: With sensitive biologics and cell lines, storage solutions are becoming more advanced and standardized.

Ethical Sourcing and Quality Compliance: Regulatory scrutiny is increasing on sourcing of sera and reagents, prompting traceability and quality upgrades.

Miniaturization and Microfluidic Culture Systems: Labs are adopting lab-on-a-chip and organ-on-chip platforms for more efficient drug testing.

| Report Attribute | Details |

| Market Size in 2024 | USD 6.72 Billion |

| Market Size by 2033 | USD 15.89 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; Corning Inc.; Avantor, Inc.; BD; Eppendorf SE; Bio-Techne; PromoCell GmbH |

A key growth driver in the U.S. cell culture market is the increased demand for biopharmaceuticals, particularly monoclonal antibodies (mAbs), vaccines, and other therapeutic proteins. The United States is a global leader in biologic drug development, with a large share of its pharmaceutical R&D investments dedicated to cell-based therapeutic manufacturing.

The production of these complex biologics relies heavily on mammalian cell lines such as Chinese Hamster Ovary (CHO) cells, HEK 293 cells, and others, which must be maintained in sterile, highly regulated cell culture environments. Innovations in upstream processing, such as high-yield CHO media and perfusion systems, have enabled large-scale manufacturing while maintaining product integrity.

Companies like Genentech and Amgen routinely use cell culture technologies to produce blockbuster biologics, and the pipeline for biosimilars and next-generation biologics is stronger than ever. With new approvals and a favorable FDA regulatory stance, this demand continues to expand, fueling investment in both consumables and instrumentation in the U.S. market.

Despite rapid expansion, the U.S. cell culture market faces a notable restraint in the form of high costs and technical challenges, particularly related to advanced and scalable systems. Establishing sterile environments, ensuring consistent nutrient delivery, and preventing contamination require sophisticated infrastructure and skilled technicians, which drives up operational costs.

Consumables such as specialized serum-free media, growth factors, and recombinant proteins can be expensive, and scaling up from bench research to biomanufacturing introduces additional costs associated with validation, quality control, and regulatory compliance. Smaller academic institutions or early-stage biotech startups may struggle to invest in state-of-the-art bioreactors, incubators, or automated culture platforms.

Furthermore, transitioning from traditional 2D cultures to more complex 3D systems or organoids presents technical challenges in reproducibility, data interpretation, and integration with existing protocols. These barriers may slow adoption rates among smaller market players.

An exciting opportunity in the U.S. cell culture market lies in the rapidly growing field of regenerative medicine and cell-based therapies. With FDA approvals of multiple CAR-T cell therapies and the emergence of mesenchymal stem cell (MSC) and induced pluripotent stem cell (iPSC)-based clinical trials, demand for highly controlled and scalable cell culture environments is soaring.

Cell therapy development requires culturing patient-derived or donor cells under precise conditions to ensure expansion, purity, and functionality before reinfusion. This creates substantial demand for specialized serum-free or stem cell-specific media, xeno-free reagents, and automated systems that can support Good Manufacturing Practice (GMP) compliance.

Moreover, new use cases such as 3D bioprinting, tissue engineering for skin grafts, and organ regeneration initiatives rely heavily on cell culture technologies. This has opened the door for companies like Thermo Fisher Scientific and Corning to develop culture systems optimized for clinical-grade regenerative therapies.

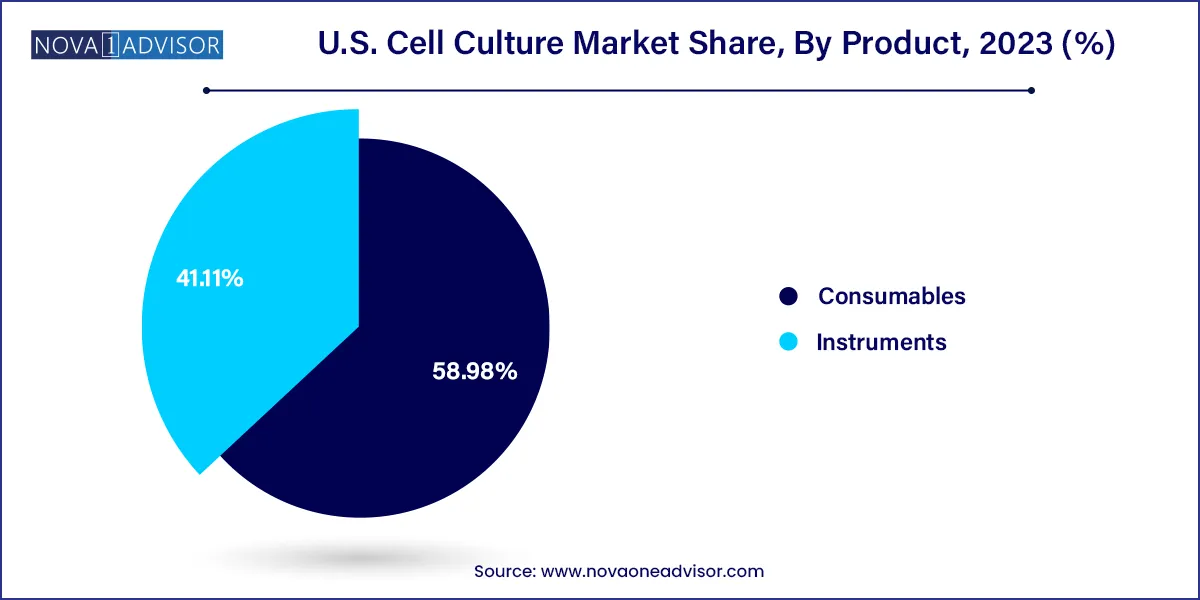

Consumables dominate the U.S. cell culture market, accounting for the majority of recurring revenue due to the constant need for fresh media, reagents, and sera. Within consumables, media—particularly CHO-specific and serum-free formulations—hold a dominant share, driven by their use in biomanufacturing and gene therapy production. Fetal bovine serum (FBS), although facing ethical scrutiny, continues to be used in many research labs for its growth-promoting properties. Companies are also innovating specialty media tailored for unique applications such as stem cell culture and organoid development.

At the same time, instruments represent the fastest-growing product category, driven by automation trends and the need for scalable manufacturing solutions. High-throughput culture systems, cryopreservation equipment, and real-time monitoring incubators are increasingly adopted by commercial biopharmaceutical firms to meet GMP standards. The shift from manual to automated pipetting and centrifugation systems is also helping reduce contamination risks and improve reproducibility, particularly in clinical trial and large-batch production environments.

Biopharmaceutical production is the leading application segment, owing to the widespread use of cell culture in producing monoclonal antibodies, vaccines, and recombinant therapeutic proteins. CHO and HEK 293 cell lines are extensively used for the expression of complex proteins, and with the explosion of biosimilars and targeted therapies, this segment continues to experience strong growth. Media and serum technologies are increasingly tailored to these production needs, offering enhanced yields and lower impurity levels.

Cell and gene therapy is the fastest-growing application area, fueled by the success of personalized cell-based treatments and CRISPR-based gene editing techniques. These applications require not only robust culture environments but also specialized reagents and instruments to support genetic manipulation and expansion of patient-specific cells. The complexity and promise of these therapies are driving significant investments into developing media free from animal components, as well as new protocols for maintaining pluripotency and differentiation potential in stem cells.

The U.S. dominates the global cell culture market, driven by a unique convergence of scientific, regulatory, and commercial infrastructure. Major biopharma hubs like Boston, San Francisco, and San Diego host leading players in biologics manufacturing, cell therapy development, and translational research. The NIH and BARDA continue to fund large-scale projects involving cell line development and vaccine research, reinforcing the national focus on biomedical innovation.

Additionally, the FDA’s accelerated approval programs for cell-based therapies and regenerative medicine advanced therapies (RMAT) create a favorable regulatory environment for innovation. Academic institutions such as MIT, Harvard, and UCSF are key contributors to fundamental and applied research in cell biology, often collaborating with industry to bring laboratory insights into commercial pipelines.

The U.S. also benefits from a mature contract research and manufacturing ecosystem that supports both early-stage development and large-scale production, making it a global leader in cell culture technology deployment.

March 2025: Thermo Fisher Scientific launched a new line of stem cell-specific serum-free media, designed to enhance expansion and maintain pluripotency in iPSCs for clinical applications.

February 2025: Corning Inc. introduced a microcarrier-based 3D culture system aimed at improving yield and surface area efficiency for vaccine producers using Vero and HEK 293 cell lines.

January 2025: Eppendorf released a next-generation benchtop bioreactor platform with AI-driven control systems for real-time culture condition monitoring.

December 2024: Sartorius and UCSF announced a partnership to co-develop advanced cell culture automation systems for stem cell therapy production.

November 2024: Cytiva (a Danaher company) expanded its Logan, Utah facility to increase production of single-use cell culture media bags to support growing CGT manufacturing demand in the U.S.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cell Culture market.

By Product

By Application