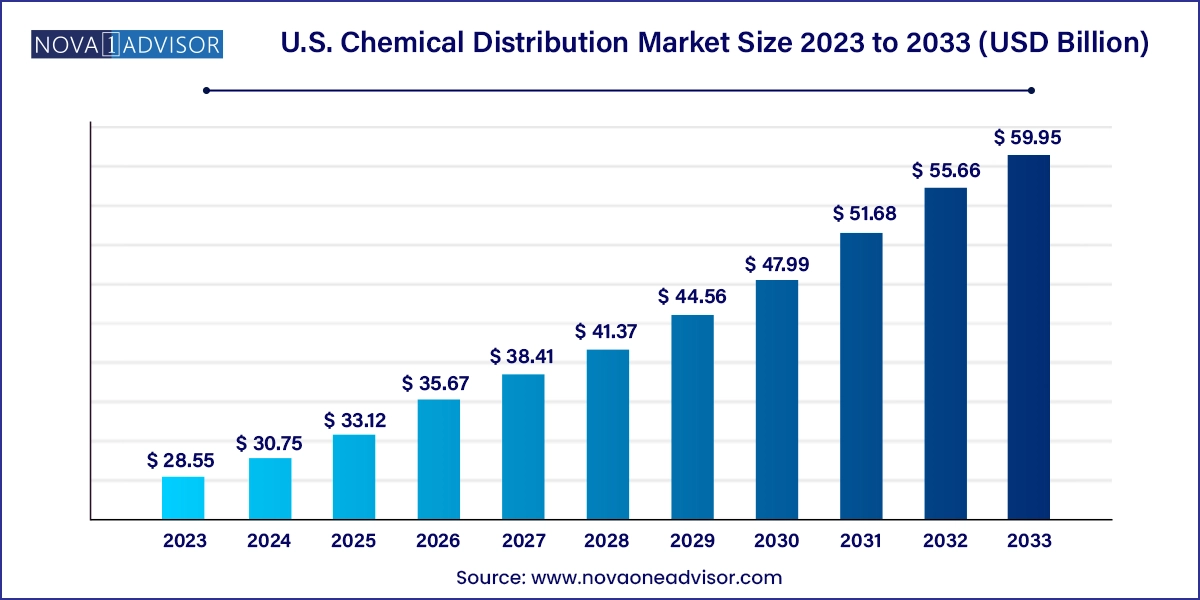

The U.S. chemical distribution market size was exhibited at USD 28.55 billion in 2023 and is projected to hit around USD 59.95 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2024 to 2033.

The U.S. chemical distribution market serves as a vital link between chemical manufacturers and end-use industries, offering not just logistics and storage but also formulation, repackaging, safety compliance, and technical services. As the United States is one of the largest producers and consumers of both commodity and specialty chemicals globally, its distribution market is characterized by complexity, scale, and innovation.

Chemical distributors play a pivotal role in ensuring efficient, safe, and compliant delivery of products ranging from petrochemicals and agrochemicals to advanced specialty ingredients used in pharmaceuticals, construction, and electronics. The distribution ecosystem supports a vast network of small and medium-sized manufacturers by providing access to global chemical suppliers, while also helping large-scale producers to manage inventory and fulfill just-in-time (JIT) demands across industrial hubs.

Over the years, the landscape has undergone significant transformations driven by digitization, consolidation through mergers and acquisitions, a shift toward value-added services, and a growing demand for sustainable practices. Distributors today are no longer passive intermediaries but strategic partners offering tailored solutions, regulatory expertise, and diversified product portfolios.

Digital transformation of distribution networks: The adoption of ERP systems, e-commerce platforms, and digital inventory tracking is revolutionizing procurement and customer engagement in the U.S.

Increased focus on sustainability and green chemicals: Demand for eco-friendly, biodegradable, and low-toxicity chemicals is influencing portfolio diversification.

Consolidation and strategic acquisitions: Key players continue to expand through M&A to enhance regional presence and strengthen product portfolios.

Growth of third-party logistics (3PL) providers: Outsourcing of transportation and warehousing services is on the rise, allowing distributors to focus on value-added services.

Customization and formulation services: Distributors are investing in blending, repackaging, and technical support labs to cater to niche demands across sectors like personal care and coatings.

Demand from end-use innovation hubs: Industries such as electronics, automotive, and biopharma in innovation clusters like California and the Midwest are fueling the need for advanced chemical supply chains.

Supply chain resilience strategies: Events like global pandemics and geopolitical disruptions have increased the emphasis on local sourcing, supplier diversification, and contingency planning.

Regulatory alignment and safety: Compliance with EPA, OSHA, and DHS guidelines continues to shape operational investments, especially in the storage and transportation of hazardous materials.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.75 Billion |

| Market Size by 2033 | USD 59.95 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Univar Solutions Inc.; Helm AG; Brenntag AG; Barentz; Azelis; Safic Alan; Ashland; Biesterfeld AG; ICC Industries, Inc. |

One of the most compelling growth drivers for the U.S. chemical distribution market is its wide applicability across diverse industrial verticals. From automotive and construction to healthcare and agriculture, chemical products are intrinsic to the value chains of multiple sectors. This cross-industry relevance ensures stable and resilient demand, shielding distributors from volatility in any single segment.

Take, for example, the burgeoning electric vehicle (EV) market. It demands advanced specialty chemicals for battery systems, lightweight composites, and electronic components. Similarly, growth in the construction sector increases the need for construction additives, coatings, and sealants. Distributors with the capacity to serve multiple end-uses efficiently benefit from sustained business and operational synergies. This broad base of downstream consumers gives U.S. distributors a significant edge, particularly those equipped with decentralized distribution centers and local expertise.

The U.S. chemical distribution market operates under one of the world’s most rigorous regulatory frameworks. Compliance with the Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), Department of Transportation (DOT), and the Department of Homeland Security (DHS) adds layers of complexity and cost to operations.

For instance, hazardous materials (hazmat) regulations demand specialized handling, training, documentation, and transport protocols. Additionally, chemical labeling, storage, and disposal practices must align with standards like the Globally Harmonized System (GHS). For distributors managing a vast product range, maintaining compliance across federal, state, and local jurisdictions can be resource-intensive. This acts as a barrier for new entrants and constrains rapid scalability for smaller firms, while also prompting significant investment in legal and safety departments for larger players.

The growing demand for specialty chemicals in high-growth industries such as biopharmaceuticals, electronics, and personal care presents a golden opportunity for U.S. chemical distributors. These industries require precise, high-purity, and often customized chemical formulations—conditions that fit well within the service capabilities of modern distributors.

For example, in the healthcare industry, the need for pharmaceutical excipients and solvents is growing as the country ramps up drug development and biotechnology research. Likewise, the electronics industry requires photoresists, etchants, and ultra-pure solvents, all of which are complex to handle and best delivered through specialized distribution channels. Distributors that can provide formulation support, analytical testing, and dedicated storage for these niche products stand to capture significant market share.

Commodity chemicals, while traditionally lower in margin, are experiencing strong growth due to high volume consumption and their indispensable role in basic manufacturing. Among them, plastic and polymers dominate especially polyethylene, polypropylene, and PVC used extensively in packaging, construction materials, and automotive parts. Petrochemicals and synthetic rubber are also in demand, bolstered by the resilience of industrial manufacturing and the automotive supply chain recovery post-pandemic. Distributors handling commodities gain from economies of scale and long-standing logistics networks, especially in the Gulf Coast region.

.webp)

Specialty chemicals dominated the U.S. chemical distribution market due to their high-margin, application-specific nature and increasing demand across value-added sectors. Within specialty chemicals, the CASE (coatings, adhesives, sealants, and elastomers) segment commands a substantial share, especially driven by the U.S. construction and automotive sectors. Construction chemicals such as waterproofing agents, sealants, and concrete admixtures—are in high demand in urban redevelopment projects across states like New York, Texas, and California.

Agrochemicals also form a strong pillar within the specialty segment, supported by the U.S.'s robust agricultural infrastructure and the shift toward precision farming. Specialty polymers and resins are seeing traction in the electronics and healthcare sectors, thanks to their role in packaging, insulation, and lightweight components. Flavors and fragrances, though smaller in share, are growing steadily in the personal care and food processing industries, where tailored sensory profiles drive consumer preferences.

Industrial manufacturing represents the largest end-use segment across both specialty and commodity chemical distribution. This includes machinery production, equipment assembly, and intermediate goods manufacturing. Distributors support this sector with lubricants, cleaning agents, polymers, and metal treatment chemicals. The resurgence in U.S. manufacturing—spurred by the “Made in America” sentiment and infrastructure investment bills—is reviving localized chemical demand.

In the specialty domain, healthcare and electronics are emerging as the fastest-growing segments. The healthcare sector needs sterile, pharmaceutical-grade solvents, reagents, and additives, while electronics manufacturers require highly pure chemicals for semiconductors, printed circuit boards (PCBs), and display technologies. Distributors catering to these industries invest in compliance systems, ultra-clean storage environments, and dedicated handling protocols. Similarly, agriculture and construction continue to be key contributors due to ongoing urban development and the push for agricultural productivity through nutrient and pesticide delivery systems.

In commodity end-use, automotive and transportation lead due to their consumption of synthetic rubber, fuels, and plastic parts. Meanwhile, the textile and electrical & electronics sectors are increasingly relying on bulk chemicals for dyeing, finishing, and electronic insulation applications.

The chemical distribution market in the United States is deeply influenced by its industrial geography, regulatory frameworks, and transport infrastructure. The Gulf Coast, home to major petrochemical complexes and ports, remains the distribution backbone for commodity chemicals, particularly in Texas and Louisiana. This region benefits from pipeline access, rail connectivity, and port facilities for import/export.

The Midwest with its strong manufacturing base in states like Illinois, Michigan, and Ohio represents high demand for both commodity and specialty chemicals, especially in automotive, agriculture, and coatings applications. California, on the other hand, is a hotbed for specialty chemical usage, driven by tech manufacturing, pharmaceuticals, and agriculture.

The Northeast and Southeast are characterized by their consumption of industrial and construction chemicals. Distributors operating nationwide often establish regional distribution centers (RDCs) to cater to diverse customer bases, comply with zoning and safety regulations, and reduce delivery times. Innovations such as mobile tank solutions, local blending services, and e-commerce ordering are becoming increasingly popular in both urban and rural markets.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. chemical distribution market

Product

U.S. Chemical Distribution End-use