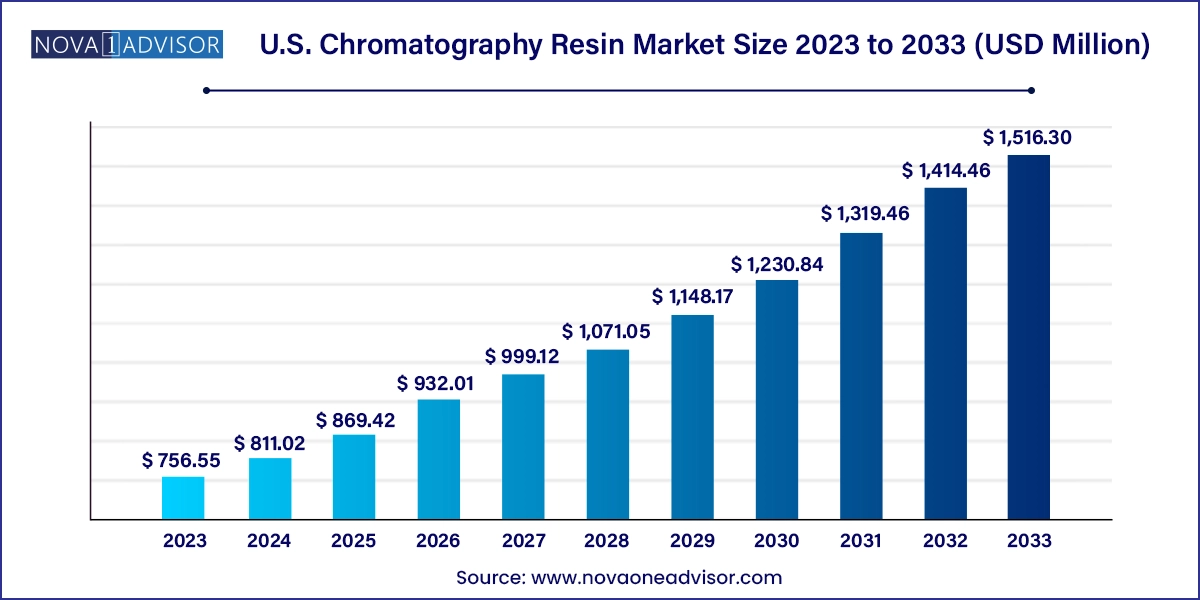

The us-chromatography-resin-market size was exhibited at USD 756.55 million in 2023 and is projected to hit around USD 1,516.30 million by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

The U.S. chromatography resin market stands as a cornerstone in the nation’s scientific and industrial infrastructure. Chromatography resins are pivotal in facilitating the separation, purification, and analysis of chemical compounds across diverse sectors such as pharmaceuticals, biotechnology, food and beverage, and environmental testing. The demand for chromatography resins in the U.S. is significantly influenced by the growth of biopharmaceutical manufacturing and rising regulatory standards requiring highly pure and safe end-products.

With increasing complexities in drug formulations, especially biologics, the need for high-performance purification processes has become essential. Chromatography resins, tailored for specific separation techniques like ion exchange, affinity, and size exclusion, provide the necessary selectivity, scalability, and efficiency for downstream processing. The bioprocessing boom, driven by advancements in monoclonal antibodies and gene therapies, has fueled the demand for robust, reproducible, and scalable resin systems.

Moreover, the U.S. is home to some of the largest pharmaceutical and biotechnology companies globally, making it one of the most mature and innovation-driven markets for chromatography technologies. As industries push for sustainability, automation, and precision, the chromatography resin market is evolving with novel synthetic resins, reusable formats, and single-use systems to meet emerging demands.

Growing demand for single-use chromatography systems to support faster and more sterile bioprocessing.

Increasing focus on process development for biosimilars and biologics, driving the need for specialized resins.

Integration of chromatography processes with automation and digital monitoring platforms.

Rising use of affinity chromatography in mAb and vaccine development.

Development of high-throughput screening (HTS) compatible resins to speed up research workflows.

Green chemistry trends promoting bio-based and recyclable chromatography resins.

Customization of resins for novel targets such as ADCs (antibody-drug conjugates).

Industry partnerships between resin manufacturers and contract manufacturing organizations (CMOs).

| Report Coverage | Details |

| Market Size in 2024 | USD 811.02 Million |

| Market Size by 2033 | USD 1,516.30 Million |

| Growth Rate From 2024 to 2033 | CAGR of 7.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, End-use, Technique |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Bio-Rad Laboratories, Inc.; GE Healthcare; W. R. Grace & Co.; Danaher Corporation; THERMO FISHER SCIENTIFIC INC.; Purolite Corporation; PerkinElmer Inc.; Agilent Technologies; Pall Corporation |

One of the most significant drivers propelling the U.S. chromatography resin market is the exponential growth in biopharmaceutical production. Biologics, including monoclonal antibodies, recombinant proteins, and vaccines, require high levels of purification to meet stringent regulatory standards. Chromatography is a preferred method for achieving such purity, especially when compared to traditional filtration methods.

The U.S. FDA’s accelerated approval pathways for breakthrough therapies and orphan drugs have prompted a surge in clinical pipelines involving complex biomolecules. For instance, the COVID-19 pandemic underscored the importance of rapid bioprocessing, leading to investments in advanced chromatographic techniques. As a result, the demand for affinity and ion-exchange resins soared due to their critical roles in separating immunoglobulins and viral vectors. Companies are increasingly scaling up production facilities, which further amplifies resin consumption. Additionally, modular biomanufacturing and single-use systems are being adopted to complement chromatographic operations, creating new avenues for innovation in resin design.

Despite its advantages, chromatography resins come with a high initial cost, especially those designed for affinity and mixed-mode applications. These costs can be particularly prohibitive for small-scale manufacturers and academic institutions, which may lack the capital expenditure required for high-end chromatography setups.

Another pressing issue is resin fouling, which occurs when impurities from the product stream bind irreversibly to the resin matrix, reducing its performance and lifespan. This leads to frequent replacement, adding to operational costs. The reusability of resins is often touted as a benefit, but only when proper cleaning-in-place (CIP) protocols are feasible, which isn’t always the case for sensitive bioproducts. In addition, process scalability challenges can arise when transitioning from bench-scale to manufacturing-scale operations due to variability in resin performance.

The rise of precision medicine and cell and gene therapies presents a substantial opportunity for the chromatography resin market in the U.S. These next-generation therapies often require unique and highly purified starting materials, intermediates, and final products. As each therapy may involve patient-specific or highly sensitive biomolecules, traditional purification techniques often fall short in ensuring required purity levels and recovery rates.

To address this, chromatography resin manufacturers are collaborating with therapy developers to co-create customized resin platforms optimized for niche applications. For instance, purification of exosomes or viral vectors for gene therapy demands novel resin types that can maintain product integrity while efficiently removing host cell proteins and DNA. This growing segment not only expands the demand for specialty resins but also fosters innovation in hybrid purification strategies, combining chromatography with tangential flow filtration or membrane-based technologies.

Synthetic resins dominated the U.S. chromatography resin market in 2024, owing to their superior consistency, mechanical strength, and chemical resistance. Synthetic polymer-based resins such as polystyrene-divinylbenzene (PS-DVB) and polyacrylamide have found widespread adoption in pharmaceutical and biotech applications due to their tailorability. These resins can be engineered with specific functional groups, making them ideal for use in ion exchange and hydrophobic interaction chromatography. The synthetic segment benefits from its adaptability to high-flow operations and resistance to cleaning solvents, which boosts longevity and operational efficiency. Their performance reliability has led to their widespread deployment in downstream processing pipelines in large-scale facilities across the U.S.

In contrast, the fastest-growing segment is inorganic media, which includes silica- and alumina-based resins. These are particularly valuable in analytical chromatography and in food safety laboratories, where high-resolution separations of small molecules and toxins are required. The robustness of inorganic media under extreme pH and temperature conditions makes them suitable for applications where organic resins may degrade. Their compatibility with HPLC and ultra-HPLC systems contributes to their rising use in research labs and quality control testing environments. As regulatory scrutiny on food adulteration and environmental contaminants intensifies, demand for inorganic media is expected to climb sharply.

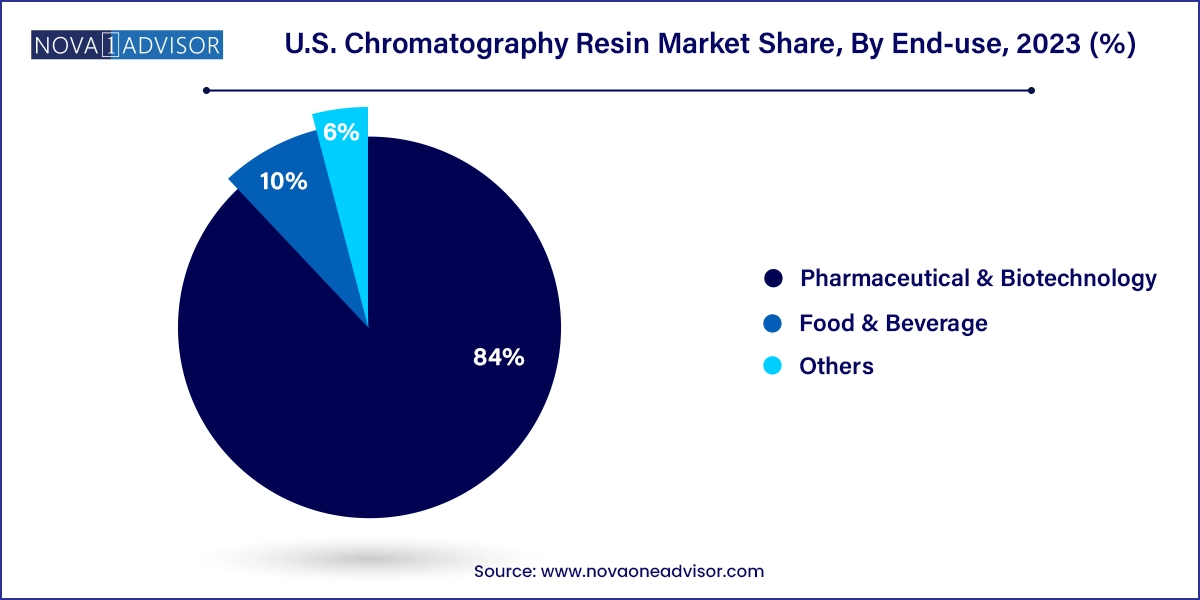

Pharmaceutical and biotechnology industries held the largest share in the U.S. chromatography resin market, due to their reliance on advanced separation technologies for both drug development and production. The rigorous purification requirements of biologics, particularly monoclonal antibodies and recombinant proteins, necessitate the use of high-performance chromatography systems. The surge in clinical trials involving protein-based therapeutics has placed added emphasis on scalable, GMP-compliant chromatography solutions. Many large U.S.-based biopharma players are investing in flexible manufacturing lines that use chromatography resins in modular purification setups, further cementing the dominance of this segment.

The food and beverage segment, however, is emerging as the fastest-growing end-use category. This growth is fueled by the increasing complexity of regulatory compliance, such as those enforced by the U.S. FDA and USDA. Chromatography resins are essential for analyzing contaminants, verifying ingredient authenticity, and monitoring additives. For example, ion-exchange chromatography is used to detect aflatoxins in dairy products, while affinity resins help identify trace allergens in packaged goods. The consumer shift toward organic and clean-label foods has further spurred testing needs, prompting investment in high-throughput chromatographic systems across food testing laboratories nationwide.

Ion exchange chromatography was the dominant technique in 2023, thanks to its versatility and cost-effectiveness across various industrial applications. This method is especially prominent in protein purification, where it is used for initial capture and intermediate purification. Its scalability from bench to production scale and compatibility with various buffer systems make it the first choice in large-scale bioprocessing. Both strong and weak ion exchangers have demonstrated excellent performance in mAb and vaccine production pipelines, making them indispensable in the pharmaceutical sector. Manufacturers in the U.S. frequently incorporate ion exchange steps in their multistage purification processes to enhance yield and minimize impurities.

Affinity chromatography is witnessing the fastest growth rate among the techniques, as it offers exceptional selectivity by targeting specific biomolecular interactions. This technique is indispensable for purifying recombinant proteins tagged with specific ligands or for separating antibodies using Protein A resins. In the context of gene therapy, affinity chromatography is used to isolate viral particles or nucleic acids. The increasing use of engineered affinity ligands and ligation chemistries in resin design has expanded the application scope of this technique. With the rise of targeted therapies and diagnostics, affinity chromatography is expected to become even more integral in the coming years.

The U.S. is at the forefront of chromatographic innovations due to its vast pharmaceutical R&D ecosystem, stringent quality standards, and a mature bioprocessing infrastructure. States like Massachusetts, California, and North Carolina are home to major biotechnology hubs that contribute heavily to chromatography resin consumption. Boston, for instance, houses research labs and manufacturing sites for giants such as Biogen and Moderna, where high-grade chromatography resins are routinely used.

In addition, the country’s expansive academic and government-funded research environment – including institutions like NIH and NSF – ensures continued exploration of novel chromatographic technologies. The country’s regulatory agencies, such as the FDA and EPA, further contribute by mandating comprehensive testing and purification standards that necessitate the use of chromatography resins in various industrial and environmental applications. The U.S. government’s commitment to pandemic preparedness and investments in biomanufacturing innovation hubs continues to boost demand for high-performance chromatography media.

Cytiva, a global leader in chromatography resins, announced in January 2025 the expansion of its resin production facility in Westborough, Massachusetts, aiming to increase supply chain resilience in the U.S. market.

In February 2025, Purolite, part of Ecolab, launched a new line of agarose-based affinity resins specifically optimized for mRNA purification, targeting the rapidly expanding nucleic acid therapeutics sector.

Bio-Rad Laboratories introduced a new high-capacity mixed-mode resin in December 2024, designed to reduce the number of purification steps in downstream bioprocessing, thereby improving throughput and yield.

Repligen Corporation, in March 2025, announced a strategic partnership with a leading CDMO in California to co-develop affinity resin platforms tailored for exosome isolation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the us-chromatography-resin-market

Type

End-use

Technique