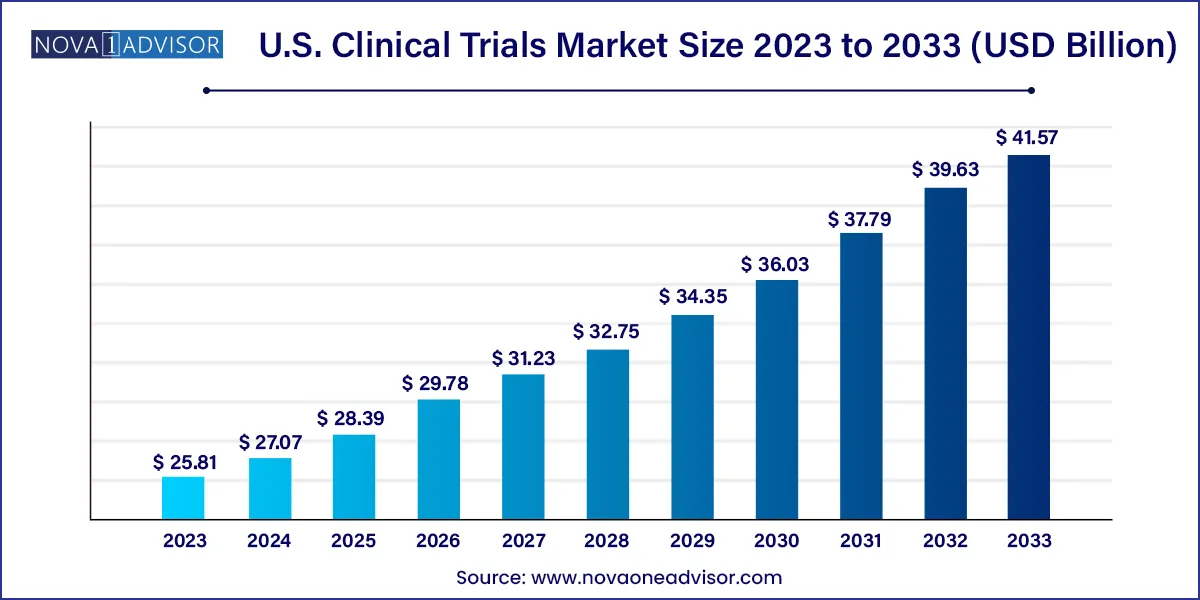

The U.S. clinical trials market size was valued at USD 25.81 billion in 2023 and is projected to surpass around USD 41.57 billion by 2033, registering a CAGR of 4.88% over the forecast period of 2024 to 2033.

The U.S. clinical trials market is characterized by its robust infrastructure, advanced technological capabilities, and stringent regulatory framework. With a large pool of skilled researchers, state-of-the-art medical facilities, and diverse patient populations, the United States remains a premier destination for conducting clinical trials. The market is driven by factors such as increasing investments in healthcare research and development, growing prevalence of chronic diseases, and rising demand for innovative treatments. Furthermore, the adoption of novel trial designs, such as adaptive and decentralized trials, is revolutionizing the landscape by enhancing efficiency and reducing costs. However, challenges such as complex regulatory processes, rising operational costs, and patient recruitment issues persist. Despite these challenges, the U.S. clinical trials market is expected to witness sustained growth, fueled by ongoing advancements in medical science, increasing collaborations between industry stakeholders, and a growing emphasis on personalized medicine.

| Report Attribute | Details |

| Market Size in 2024 | USD 27.07 Billion |

| Market Size by 2033 | USD 41.57 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.88% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Phase, study design, indication |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Parexel International Corp.: IQVIA Holdings Inc.; LabCorp; Thermo Fisher Scientific (Pharmaceutical Product Development); Charles River Laboratory; ICON plc; Wuxi AppTec; Eli Lilly and Company; SGS SA; Novo Nordisk A/S; Clinipace; Syneos Health Inc.; Pfizer Inc. |

The growth is majorly driven by a rise in R&D activities, increasing vaccine trials, the need for personalized medicine, and the growing use of new technologies across clinical research. The ongoing COVID-19 pandemic is driving the industry to change the way of conducting existing and upcoming clinical trials. As the COVID-19 pandemic has disrupted clinical trials, adopting direct-to-patient (DTP)/direct-from-patient (DFP) services can help overcome increasing challenges of performing clinical trials such as site closings, travel bans, quarantines, and protecting site staff and patients.

The outbreak of the COVID-19 pandemic has significantly hampered growth. The market witnessed a major drop in its revenues in the year 2020. However, the adoption of virtual technologies such as decentralized clinical trials, remote monitoring, etc. has significantly supported the market to rebound its revenues from 2021 till the forecast years.

Regulatory agencies such as the U.S. FDA, the European Medicines Agency (EMA), the National Institutes of Health (NIH), and China’s National Medical Products Administration, and several other countries have issued guidelines related to the conduct of clinical trials during the outbreak of coronavirus, and are in complete support of incorporating virtual services.

A virtual trial follows a patient-centered approach, allowing for a more conventional trial experience for the participant together with enhanced data collection, increased diversity of patients, and time savings from the perspective of the trial duration.

With the help of this approach, a large population can be considered for the trial, which improves the study, engagement, recruitment, and retention. Virtual trials can remarkably decrease the effort, time, and burden on participants, investigators, and clinical research coordinators. Thus, making it a very effective and efficient approach for the U.S. clinical trials market.

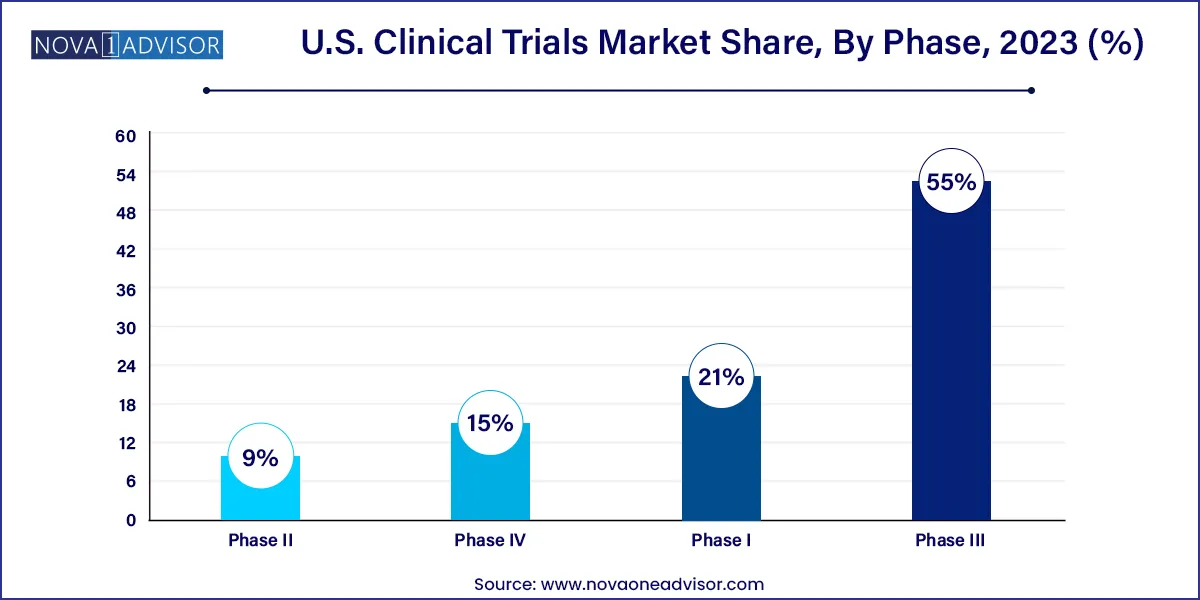

The phase III segment held the lion’s share of 55% in 2023. This is primarily because of the fact that the phase III clinical trials are most crucial as they involve 300 to 3000 participants and have a longer treatment period. Thus, it is the most expensive phase. Although the number of drugs in this phase is relatively low, the complexity associated with this phase is the highest.

The failure rate in this phase is the highest as the sample size and study design require complex dosing at an optimum level. The loss associated with failure is both human and financial and the majority of the failures occur due to non-compliance with safety and efficacy standards. Only one-third of drugs that enter clinical trials make it to phase III trials.

Phase I studies are anticipated to register the fastest CAGR growth of 7.2% during the forecast period. These studies assess the safety of a device or drug and involve the evaluation of the tolerability and pharmacokinetics of molecules. It determines the effect of a device or drug on humans including the way it is absorbed, metabolized, and excreted.

It also examines the side effects of the drug in case of increased dosage levels. The stage includes 20 to 100 healthy volunteers or people with the disease. The high growth of the segment is majorly due to the increasing drug pipeline of pharmaceutical as well as biopharmaceutical companies.

The interventional study design segment accounted for the largest market share of 48.9% in 2023. The segment is also anticipated to register the second-fastest growth during the forecast period. Interventional studies are categorized based on the intervention that is to be studied which includes drug or biologic, behavioral, surgical procedure, and devices.

There has been a significant rise in the number of interventional studies carried out over time. The interventional studies comprise 83.4% of total registered studies in the U.S. as of September 2021, out of which the majority of studies are on drug or biologics, followed by behavioral, clinical procedure, and device intervention studies.

The expanded access trials segment is projected to grow at a CAGR of 5.7% during the forecasted period in the U.S. clinical trials market. It would be a prospective approach for patients having a serious disease or condition, which is life-threatening. In this, a patient is allowed to carry out treatment outside of a clinical trial when no satisfactory therapies are available.

The main factor driving the growth of this segment is increasing innovation. For instance, HUTCHMED, in collaboration with Surufatinib, has started an Expanded Access Program (EAP) in the U.S. for Neuroendocrine Tumors for patients having life-threatening conditions that can’t be treated with available medications or clinical trials.

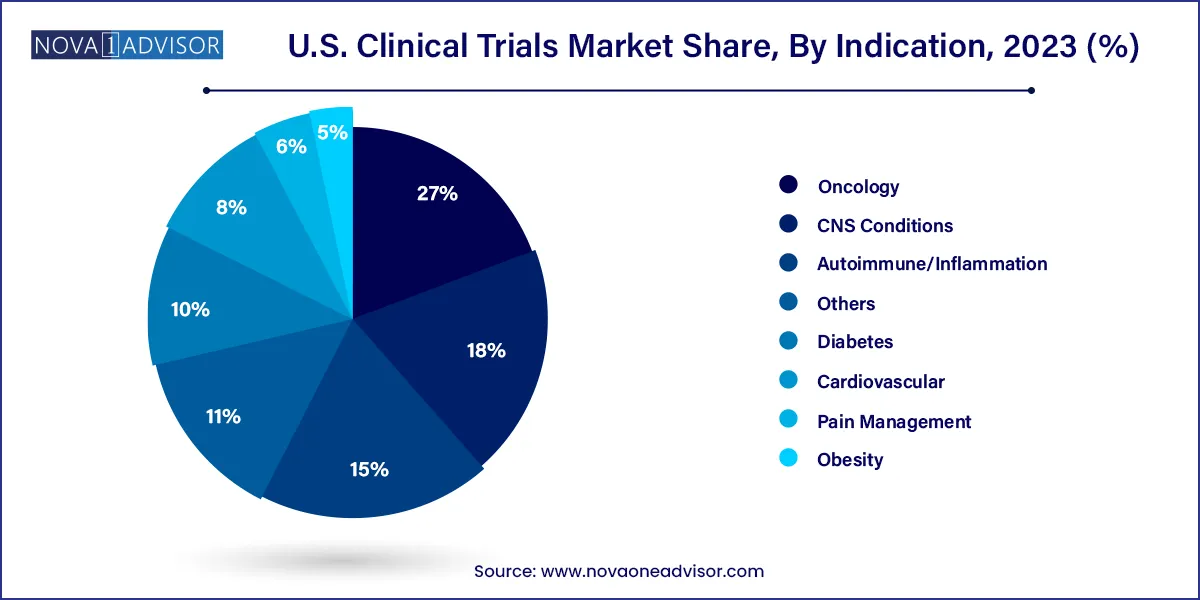

The oncology segment accounted for the maximum revenue share of 27% in 2023 & is also anticipated to register the fastest CAGR over the forecast period. The increasing prevalence of cancer and the need for effective treatments against various types of cancer is the key factor driving the growth of the segment. Investment in R&D is expected to grow owing to the disease prevalence across the U.S. thereby fueling the market’s growth.

In 2018, there were 1,120 oncology medicines & vaccines in development by America’s biopharmaceutical firms. These include 137 for various types of leukemia, 135 for lymphoma, 132 for lung cancer, 108 for breast cancer & other medicines for ovarian cancer, prostate cancer, colorectal cancer, childhood cancer, and solid tumours.

The autoimmune segment of the U.S. clinical trials market is expected to be the second most lucrative segment with a CAGR of 5.6% in 2023 due to significant growth in the prevalence of the autoimmune disease, owing to the changing lifestyle and aging population. The autoimmune diseases affect one in 15 Americans including 18 million women & 5 million men.

They are among the top 10 causes of death in women & female children in all age groups up to 64 years of age. There has been a notable increase in R&D spending on autoimmune diseases. As per the NIH’s estimate autoimmune costs approximately USD 100 billion a year in medical care.

The market is highly competitive due to the presence of several international companies. The most important factors that are affecting the competitive nature are the quick adoption of advanced technology for improved healthcare. Moreover, players are acquiring, partnering, and collaborating with other firms to gain a higher market share.

For instance, in May 2020, Concave formed an alliance with Medable to offer decentralized and hybrid trials. This alliance is helpful in the current scenario as it will reduce the risk of infection and the patient’s progress can be monitored virtually without hampering the clinical trial.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Clinical Trials market.

By Phase

By Study Design

By Indication