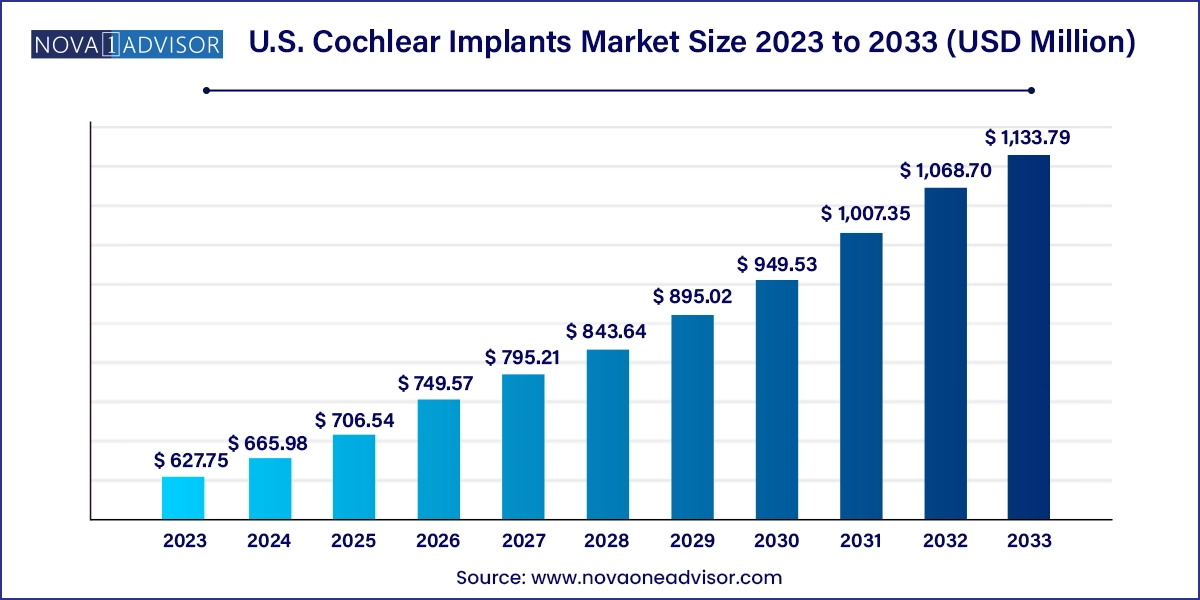

The U.S. cochlear implants market size was exhibited at USD 627.75 million in 2023 and is projected to hit around USD 1,133.79 million by 2033, growing at a CAGR of 6.09% during the forecast period 2024 to 2033.

The U.S. cochlear implants market stands as a vital sector within the audiological and otolaryngology landscape, playing a transformative role in restoring hearing capabilities to individuals suffering from profound sensorineural hearing loss. Cochlear implants differ from traditional hearing aids by directly stimulating the auditory nerve, bypassing damaged parts of the inner ear. These surgically implanted electronic devices have enabled countless adults and children with severe hearing impairments to regain meaningful auditory perception and speech understanding.

In the U.S., where hearing impairment affects over 48 million people to varying degrees, cochlear implants provide a life-changing solution for patients unresponsive to conventional hearing aids. As the country’s population ages and the awareness of hearing loss-related cognitive decline rises, demand for cochlear implantation is surging. Technological improvements, such as smaller processors, better speech recognition software, wireless connectivity, and MRI-compatible devices, are also boosting adoption.

Additionally, strong advocacy by organizations such as the American Cochlear Implant Alliance (ACIA), improved insurance reimbursement, and educational campaigns on pediatric hearing loss screening are accelerating acceptance. The U.S. market is also driven by significant clinical innovation, involving artificial intelligence, bimodal hearing solutions (cochlear implant in one ear, hearing aid in the other), and patient-specific fitting algorithms. With both public and private sector participation increasing, the cochlear implant market in the United States is poised for continuous expansion.

Bilateral Cochlear Implantation Gaining Momentum: More healthcare providers now recommend bilateral implants, especially in children, to improve spatial awareness and speech comprehension in noisy environments.

Rise in Early Pediatric Intervention: Universal newborn hearing screening programs have resulted in early diagnosis and early cochlear implantation in infants, improving language acquisition outcomes.

Miniaturization and Aesthetic Designs: Cochlear implant components are becoming smaller, more discreet, and ergonomically designed for enhanced user comfort and social acceptance.

Integration with Smart Devices: Wireless streaming of audio from smartphones, TVs, and microphones is becoming standard, offering users greater independence and convenience.

Personalized Fitting through AI Algorithms: Machine learning is being integrated to adapt signal processing in real time based on the user’s listening environment and preferences.

Expansion of Medicare/Medicaid and Private Insurance Coverage: Broader reimbursement policies are allowing more low-income and elderly patients to access cochlear implantation services.

Multichannel Hospital and Outpatient Networks: Major hospital chains and cochlear implant centers are expanding outpatient services, increasing procedural efficiency and accessibility.

Emphasis on Cognitive Health in Seniors: Studies showing the correlation between untreated hearing loss and dementia are prompting earlier interventions among the elderly population.

| Report Coverage | Details |

| Market Size in 2024 | USD 665.98 Million |

| Market Size by 2033 | USD 1,133.79 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.09% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Age group, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Cochlear Ltd; MED-EL Medical Electronics; Oticon Medical; Advanced Bionics Corporation,; Sonova Holding AG; Medtronic, Nurotron Biotechnology Co., Ltd.; ZPower; LLC & Widex A/S |

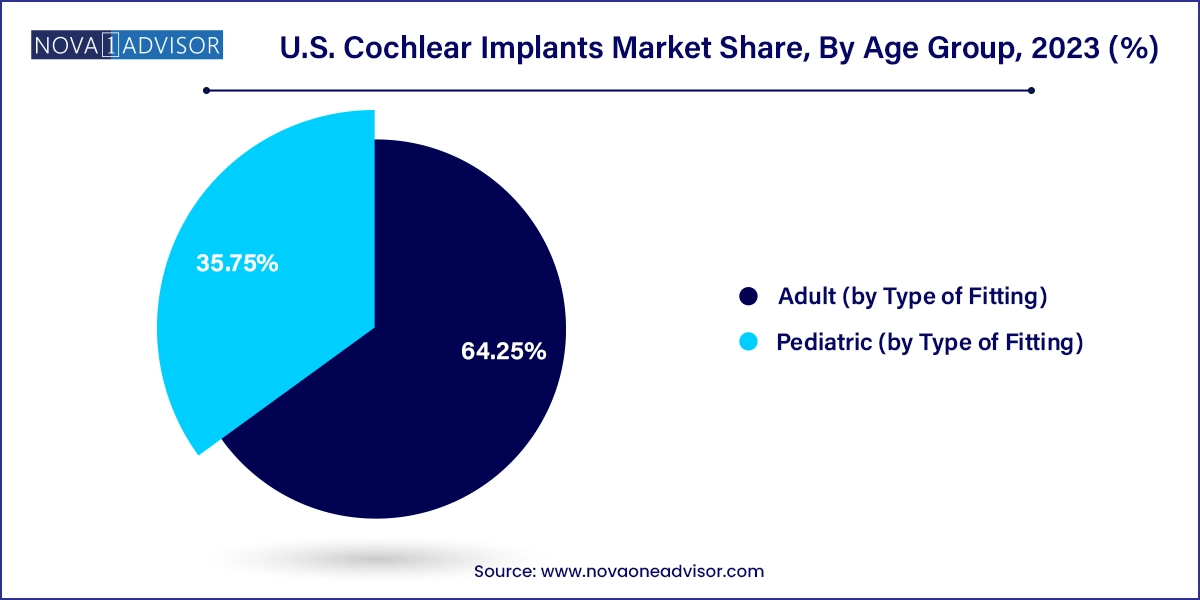

The adult segment dominated the U.S. cochlear implants market, both in terms of procedure volume and revenue generation. Adults with progressive hearing loss, especially due to noise exposure, ototoxic medications, or aging, represent a vast and growing patient base. Within the adult category, unilateral implants are more commonly used, as most patients initially seek assistance for their worse ear. Hospitals and clinics are observing increased adoption among working-age individuals and seniors who want to stay socially and professionally active. The growing body of evidence linking untreated hearing loss to cognitive decline has also encouraged more adults to seek early intervention.

However, bilateral adult implantation is emerging as the fastest-growing subsegment, as patients and providers increasingly recognize the benefits of binaural hearing such as better localization of sound and improved understanding in noisy environments. Bilateral fittings, previously reserved for pediatric patients or those with profound bilateral hearing loss, are now being offered to adult patients who may not have responded optimally to unilateral fittings. As insurance coverage broadens for second-ear implantation and manufacturers offer bilateral discounts, this segment is likely to witness sustained growth.

The pediatric cohort is witnessing strong growth, supported by the success of universal newborn hearing screening programs and early intervention guidelines. Bilateral pediatric implants dominate this space, as studies show children with early bilateral fittings develop better language, speech, and cognitive skills compared to those fitted later or unilaterally. With many U.S. states implementing mandatory hearing tests for newborns and infants, early diagnosis has become commonplace, resulting in implantation procedures before the age of two. These early interventions enable children to develop on par with hearing peers, enhancing educational and social outcomes.

Unilateral pediatric implants, though less common, continue to serve children who may not meet the criteria for bilateral fittings due to anatomical or neurological considerations. Technological enhancements in pediatric implant designs—such as soft-surgery electrodes and child-specific processors are improving outcomes and safety. Further growth is supported by educational accommodations, therapy services, and strong parental advocacy in the United States, driving long-term adoption.

Hospitals emerged as the dominant end-use segment, primarily due to their infrastructure for surgical implantation, audiological diagnostics, and post-operative care. Major teaching hospitals and tertiary care centers across the U.S. have dedicated otology or cochlear implant programs staffed with otolaryngologists, audiologists, and rehabilitation specialists. These multidisciplinary facilities are well-equipped to handle complex cases, offer bilateral implant procedures, and provide pediatric care. Hospitals are also more likely to be covered by insurance networks and offer in-house payment counseling, facilitating better access for a wider population.

Clinics, on the other hand, represent the fastest-growing segment, particularly outpatient ENT and audiology clinics specializing in cochlear implantation and rehabilitation. These centers offer convenient pre-surgical assessments, post-implant mapping, and speech therapy sessions in community settings. As surgical procedures become less invasive and follow-up protocols more standardized, more cochlear implant services are shifting from inpatient to outpatient models. Moreover, clinics often provide a more personalized and less intimidating experience, especially for children and the elderly, leading to higher patient satisfaction and adherence to therapy.

In the United States, regional disparities in cochlear implant access and adoption are influenced by demographic trends, healthcare infrastructure, and policy frameworks. The Northeast region, including states like New York, Massachusetts, and Pennsylvania, dominates the cochlear implant market. These states are home to top-tier academic hospitals such as Massachusetts Eye and Ear, NYU Langone, and Johns Hopkins, all of which offer advanced cochlear implant programs. The Northeast also benefits from higher healthcare spending per capita, robust insurance coverage, and greater public health outreach.

Conversely, the Southwest region, encompassing Texas, Arizona, and New Mexico, is emerging as the fastest-growing market. Texas, with its large and diverse population, is experiencing a surge in cochlear implant surgeries, driven by improved access in both urban and suburban areas. Public initiatives, Hispanic community outreach, and expansion of insurance coverage under Medicaid waivers are enabling more families to consider cochlear implantation. In addition, outpatient surgery centers and mobile audiology units are improving rural access, setting the stage for rapid regional growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cochlear implants market

Age Group

End-use

Regional