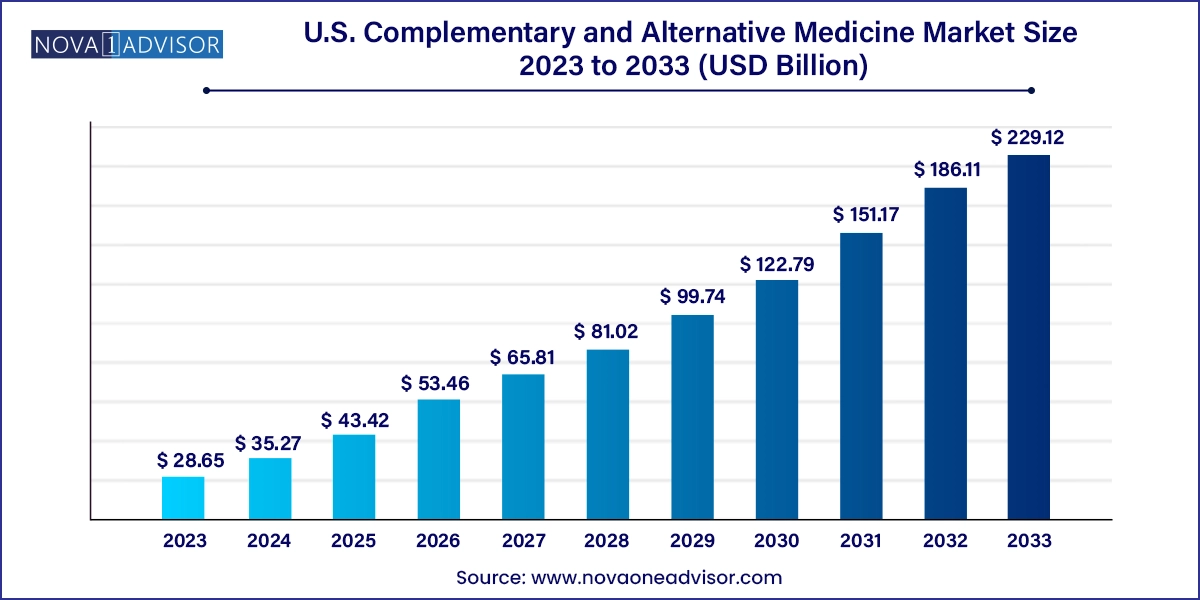

The U.S. complementary and alternative medicine market size was exhibited at USD 28.65 billion in 2023 and is projected to hit around USD 229.12 billion by 2033, growing at a CAGR of 23.11% during the forecast period 2024 to 2033.

The U.S. Complementary and Alternative Medicine (CAM) market represents a multifaceted and fast-evolving space that sits at the intersection of wellness, preventive care, and integrative medicine. CAM encompasses a broad range of therapeutic interventions and healing philosophies that fall outside the purview of conventional Western medical practice. These include traditional alternative systems like Ayurveda and Traditional Chinese Medicine, mind-body techniques such as meditation and hypnosis, body-based therapies including acupuncture and chiropractic, and energy and sensory-based practices like reiki and aromatherapy.

While once viewed with skepticism, CAM has gained mainstream acceptance in the U.S. over the past two decades. Factors such as rising healthcare costs, consumer demand for natural and holistic care, and a growing body of research validating CAM modalities have contributed to its surge in popularity. According to the National Center for Complementary and Integrative Health (NCCIH), nearly one in three Americans has used some form of CAM in the past year. The COVID-19 pandemic further fueled interest in wellness, immunity enhancement, stress reduction, and home-based healing, boosting demand for CAM products and services.

The U.S. market is supported by a robust ecosystem of practitioners, retail platforms, online distributors, holistic clinics, fitness studios, and specialized wellness brands. The scope of the CAM market now extends to chronic disease management, mental health, prenatal care, cancer support therapies, and even corporate wellness programs. As younger generations embrace integrative and preventive approaches, and as insurance companies begin offering limited reimbursements for select CAM therapies, the U.S. CAM market is poised for continued growth and formalization.

Integration of CAM into Mainstream Healthcare: Hospitals and clinics are increasingly incorporating CAM therapies such as acupuncture, chiropractic, and mindfulness into standard care pathways.

Digital Wellness and E-commerce Growth: CAM products and services are booming on digital platforms, with apps offering guided meditation, yoga, and virtual consultations.

Rise of Functional Medicine and Lifestyle Medicine Models: These models use CAM principles like dietary therapy, herbal support, and stress management in treating chronic conditions.

Increased Research and Clinical Trials: NIH and private institutions are funding studies on the efficacy of alternative therapies, improving credibility and adoption.

Growing Consumer Preference for Natural Products: Demand for herbal supplements, aromatherapy, and natural remedies is growing in response to concerns over synthetic drugs.

Insurance Reimbursement Expansion: Select CAM services like chiropractic care and acupuncture are now covered by some private insurance and Medicaid plans in various states.

Celebrity and Influencer Endorsements: Public figures promoting meditation, herbal medicine, and yoga are shaping cultural acceptance of CAM practices.

| Report Coverage | Details |

| Market Size in 2024 | USD 35.27 Billion |

| Market Size by 2033 | USD 229.12 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 23.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Intervention, Distribution, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Columbia Nutritional; Nordic Nutraceuticals; Ramamani Iyengar Memorial Yoga Institute; The Healing Company Ltd.; John Schumacher Unity Woods Yoga Centre; Pure encapsulations, LLC.; Herb Pharm; Mindset Health; MetaMe; The American Apitherapy Society Inc |

The most significant driver in the U.S. CAM market is the consumer-driven shift toward preventive, self-directed, and holistic health. With rising healthcare costs, increased chronic disease burden, and growing skepticism around over-medication, American consumers are seeking non-invasive, sustainable, and personalized wellness options. CAM therapies offer a spectrum of solutions that align with modern health values mind-body balance, minimal side effects, and lifestyle-centric healing.

The COVID-19 pandemic further accelerated this shift, increasing awareness about mental health, immunity, and stress management. As a result, practices like meditation, breathwork, herbal supplementation, and aromatherapy saw explosive growth. Integrative clinics and wellness centers offering multi-modality care are flourishing, reflecting a transformation in how Americans define health and healing. This demand for CAM is not a fad it reflects a paradigm shift toward whole-person health that is reshaping healthcare delivery and wellness innovation.

Despite growing adoption, a key restraint limiting CAM’s scalability is the lack of standardized protocols, variable practitioner qualifications, and in some cases, limited scientific validation. While modalities like acupuncture and chiropractic are well-regulated in many states, others such as energy healing or traditional herbal therapies vary widely in regulation, making it difficult to ensure consistent quality, safety, and efficacy.

Moreover, skepticism among segments of the medical community and regulatory hurdles often delay the integration of alternative practices into clinical workflows. Although research efforts are increasing, many CAM modalities lack large-scale, randomized controlled trials, hindering insurance reimbursement and broader physician endorsement. For the CAM market to mature, robust clinical data, professional licensure, and consensus on treatment standards will be essential.

The most promising growth opportunity lies in the integration of CAM with digital health platforms. The explosion in virtual health engagement especially post-COVID has unlocked new models for delivering CAM services. Mobile apps and telehealth platforms now offer virtual yoga sessions, meditation coaching, herbal consultations, and even remote Reiki therapy, making CAM accessible to rural, elderly, or mobility-limited populations.

Companies combining evidence-based CAM interventions with behavioral health tools and wearables are leading the way in digital CAM innovation. For example, a startup offering guided acupressure paired with symptom tracking through a mobile app could combine CAM principles with modern UX design. Additionally, subscription wellness kits, virtual herbology consults, and integrative telemedicine models are opening new revenue streams while meeting growing consumer interest in accessible holistic care.

Traditional Alternative Medicine/Botanicals dominated the U.S. CAM market, owing to widespread use of herbal supplements, traditional Chinese medicine (TCM), and naturopathic treatments. These interventions cater to a variety of ailments, including digestive issues, hormonal imbalances, stress, and sleep disorders. Herbal supplements like ashwagandha, turmeric, elderberry, and ginseng have become household staples. The U.S. dietary supplement industry—anchored in botanical medicine—is growing rapidly and is increasingly regulated by the FDA for safety and labeling compliance. Additionally, integrative physicians and naturopaths often use homeopathy, Ayurveda, and apitherapy as adjunct therapies, making this segment a central part of holistic care.

In contrast, mind healing modalities are the fastest-growing, particularly among younger populations and professionals facing burnout. Practices such as transcendental meditation, hypnotherapy, and neuro-linguistic programming (NLP) are being embraced not only for mental wellness but also to enhance productivity and self-regulation. Wellness centers, mental health apps, and virtual therapy platforms are integrating these approaches into mainstream care. Furthermore, public school programs, corporate wellness initiatives, and veteran PTSD rehabilitation centers are increasingly adopting mind-body techniques, reflecting strong institutional backing for this segment’s expansion.

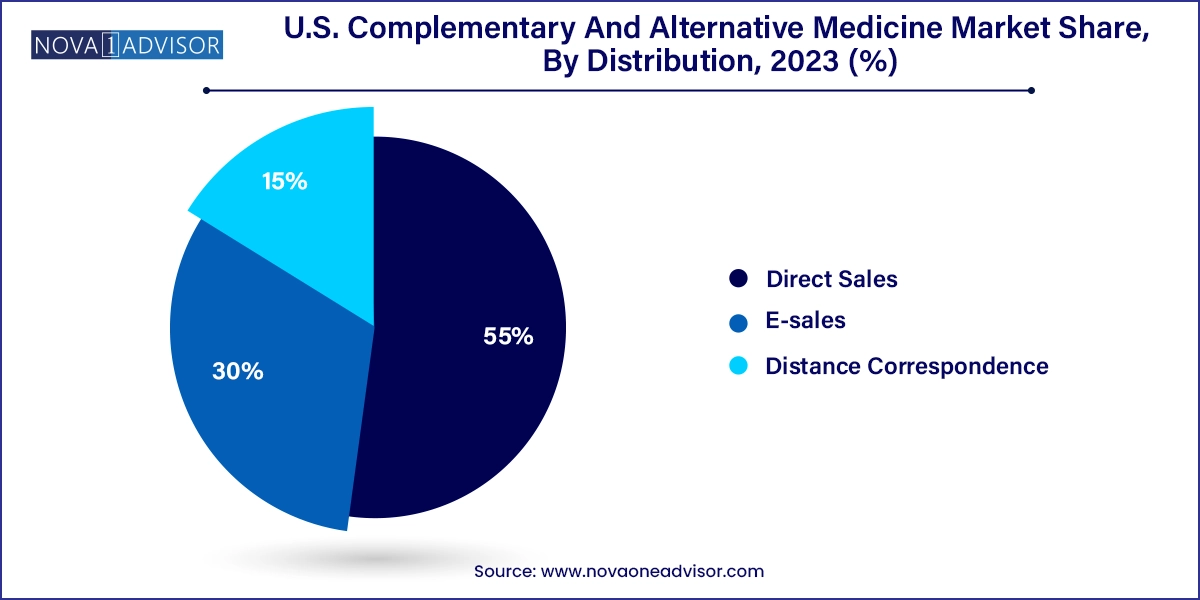

Direct sales continue to dominate the CAM market, especially in the sale of herbal products, essential oils, supplements, and in-person therapy services. Clinics, wellness spas, naturopathic physicians, and independent distributors play a crucial role in delivering both products and personalized consultations. These traditional channels foster trust and practitioner guidance, which are key to CAM’s relational and personalized nature.

However, e-sales are growing at the fastest pace, driven by the digital health boom and consumer demand for convenience. Major platforms like Amazon, Thrive Market, and iHerb offer an ever-expanding range of alternative medicine products with customer reviews and AI-powered suggestions. Subscription boxes and telewellness kits that combine supplements, sensory therapies (like aromatherapy), and instructional content are particularly appealing to millennials and Gen Z consumers. This online ecosystem is making CAM scalable in ways never previously possible, bridging the gap between ancient healing and modern delivery.

In the United States, CAM adoption varies across regions based on cultural acceptance, demographic trends, and healthcare infrastructure. The Northeast region dominates the market, bolstered by the presence of prestigious integrative medicine programs at institutions like Harvard, Yale, and Columbia. Urban centers such as New York and Boston have become hubs for yoga studios, acupuncture clinics, functional medicine providers, and luxury wellness retreats.

Conversely, the Southwest, particularly Arizona and New Mexico, is emerging as the fastest-growing region. Rich in Native American and Hispanic healing traditions, this region is known for herbal medicine, energy healing, and spiritual practices. Arizona is also home to leading CAM education institutions, like Southwest College of Naturopathic Medicine, and health resorts that integrate Reiki, sound therapy, and meditation into detox programs. The cultural openness and scenic geography make the Southwest fertile ground for CAM expansion and innovation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. complementary and alternative medicine market

Intervention

Distribution

Regional