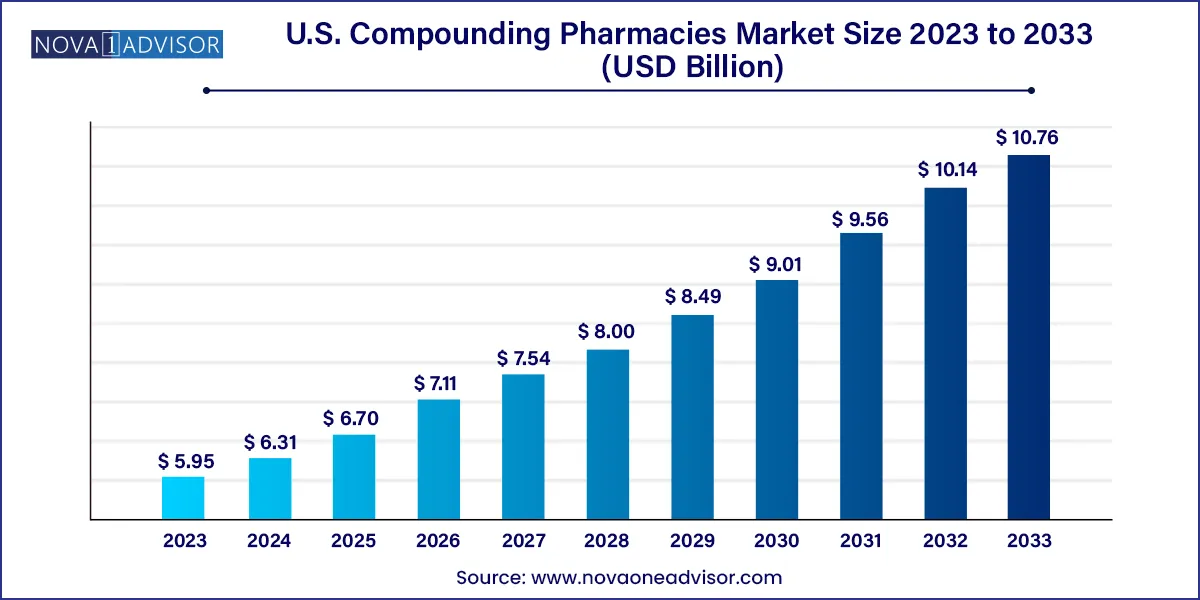

The U.S. compounding pharmacies market size is projected to be worth around USD 10.76 billion by 2033 from USD 6.31 billion in 2024, at a CAGR of 6.1% from 2024 to 2033.

The U.S. compounding pharmacies market represents a vital segment of the nation's pharmaceutical landscape, catering to a growing demand for personalized, patient-specific medications. Compounding pharmacies create customized formulations that are not commercially available, addressing the unique needs of individuals for whom off-the-shelf drugs may be ineffective, unsafe, or unsuitable. These needs may arise due to allergies, dosing constraints, or therapeutic gaps.

As the population ages and chronic disease burdens increase, the importance of compounding services has risen. Physicians are turning to compounding pharmacies to help tailor hormone replacement therapies, pain management solutions, pediatric doses, dermatological formulations, and drugs for patients with dysphagia or rare metabolic conditions. Additionally, veterinary medicine, oncology, and ophthalmology are also seeing increased integration of compounded drugs.

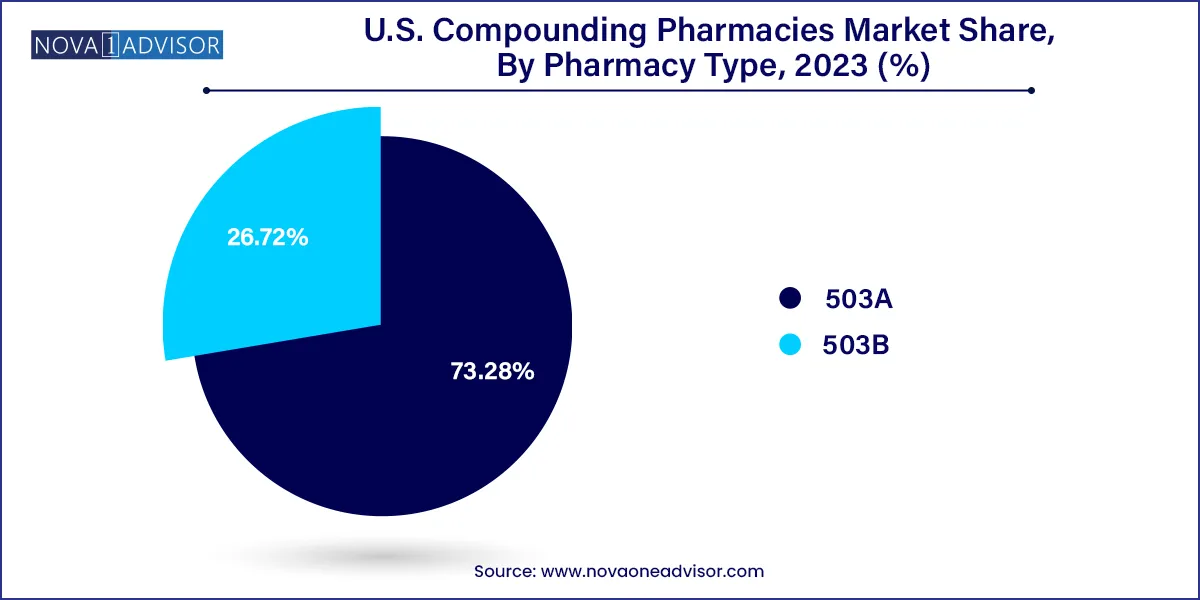

The U.S. Food and Drug Administration (FDA) classifies compounding pharmacies into two broad categories: 503A and 503B. While 503A facilities compound medications pursuant to individual prescriptions, 503B outsourcing facilities are allowed to produce medications in larger batches under current Good Manufacturing Practices (cGMP) for use in healthcare institutions. As healthcare providers and hospitals continue to seek reliable partners for sterile and non-sterile drug formulations, the demand for high-quality, compliant compounding facilities has grown significantly.

With technological advancements in automation, regulatory emphasis on sterility and traceability, and evolving patient needs, the compounding pharmacies market in the United States is positioned for sustained growth in both the retail and institutional settings.

Rise in 503B Outsourcing Facilities: Hospitals and healthcare providers are increasingly sourcing sterile compounding services from cGMP-compliant 503B facilities to mitigate in-house contamination risks.

Growth in Bioidentical Hormone Replacement Therapy (BHRT): Demand for compounded HRT formulations continues to rise among menopausal and andropausal populations.

Technology Integration and Automation: Robotics, software for traceability, and automated dispensing systems are streamlining workflow and reducing errors.

Expansion in Pediatric and Geriatric Dosing: Customized dosage strengths and delivery formats are meeting the diverse needs of age-specific cohorts.

Focus on Regulatory Compliance and Audits: Enhanced scrutiny by FDA and state boards is driving investment in facility upgrades and documentation systems.

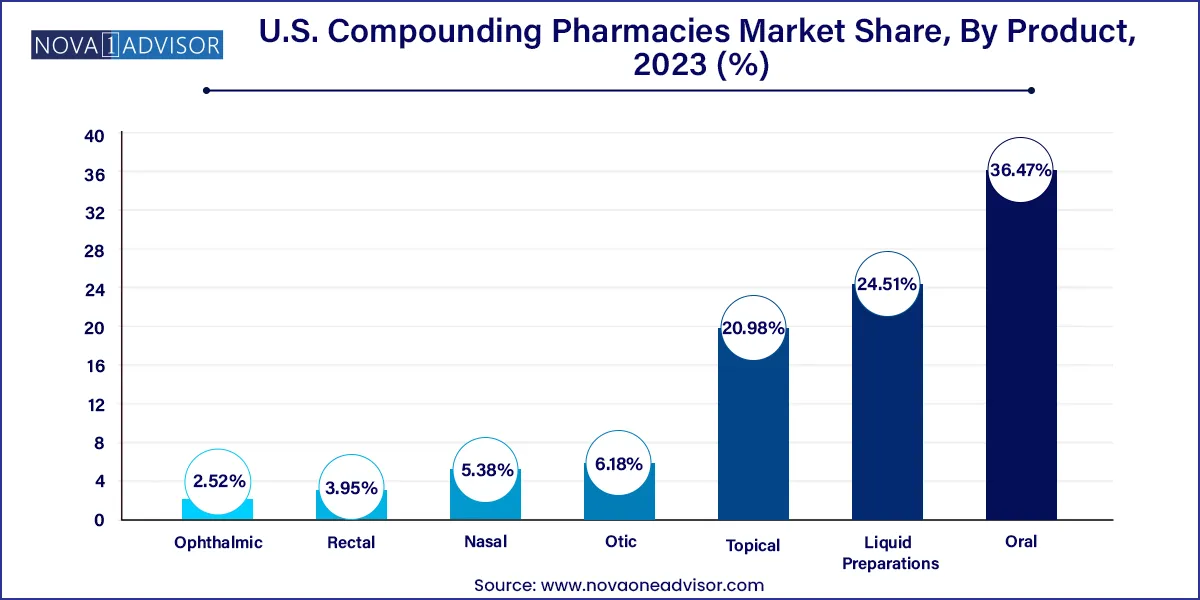

Increased Use of Alternative Dosage Forms: Topical creams, transdermal patches, nasal sprays, and troches are replacing conventional oral routes for many therapies.

Rising Need for Allergen-Free and Preservative-Free Medications: Patients with sensitivities or chronic autoimmune conditions are driving demand for tailored ingredients.

Veterinary Compounding: Companion animal health is an emerging driver, especially for small mammals, exotic pets, and equines with niche pharmaceutical needs.

Chronic Pain and Opioid Alternative Management: Custom formulations, including topical analgesics and combination therapy gels, are gaining popularity as alternatives to opioids.

Digital Pharmacy Platforms: Telehealth integration and online prescription fulfillment are expanding access to compounded medications.

| Report Attribute | Details |

| Market Size in 2024 | USD 5.95 Billion |

| Market Size by 2033 | USD 10.76 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered |

By Pharmacy Type, By Product, By Sterility, By Compounding Type, By Therapeutic Area, By Age Cohort and By End-User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | TAvella Specialty Pharmacy; Central Admixture Pharmacy Services, Inc.; Clinigen Limited; Fagron; Fresenius Kabi USA; ImprimisRx (Harrow Health, Inc.); PenCol Pharmacy; Sixth Avenue Medical Pharmacy; Triangle Compounding; Vertisis Custom Pharmacy. |

One of the most powerful drivers of growth in the U.S. compounding pharmacies market is the increasing demand for personalized medicine. Modern healthcare is shifting from a one-size-fits-all model toward personalized treatment regimens tailored to genetic profiles, lifestyle, comorbidities, and patient preferences. Compounding pharmacies are uniquely positioned to support this shift.

Patients who cannot tolerate excipients like lactose, dyes, or gluten found in commercial medications often rely on compounded alternatives. Moreover, dose customization is especially relevant for children, seniors, or those requiring non-standard therapeutic regimens. For example, a pediatric cardiologist may prescribe a custom oral suspension with specific flavoring and concentration for a child unable to swallow pills.

Additionally, compounding supports the reintroduction of discontinued or unavailable formulations, ensuring continuity of care for patients dependent on legacy drugs. This trend is particularly prominent in hormone therapy, dermatology, pain management, and fertility care. As practitioners and patients become more aware of customized medicine's benefits, compounded formulations are becoming mainstream across outpatient, hospital, and specialty care settings.

A primary restraint on the compounding pharmacies market is the regulatory complexity and variability that governs the industry. While the Drug Quality and Security Act (DQSA) established clearer guidelines in 2013, enforcement remains fragmented between the FDA and state pharmacy boards. 503B outsourcing facilities are subject to cGMP requirements and rigorous inspections, which can be capital-intensive for operators.

Smaller 503A pharmacies face compliance challenges when scaling their operations or trying to serve institutional clients. Issues related to sterility assurance, contamination risks, and documentation lapses have, in the past, led to high-profile recalls and regulatory actions. These incidents have affected public trust and heightened compliance costs.

Furthermore, compounded drugs are exempt from FDA premarket approval, which occasionally raises concerns among physicians about the consistency and efficacy of formulations. While these issues can be mitigated through investment in training, quality control, and audit readiness, the regulatory environment remains a significant hurdle particularly for new entrants and independently operated pharmacies.

A major growth opportunity exists in the expansion of compounded therapies for hormone replacement and chronic care management. Hormone-related conditions such as menopause, andropause, thyroid imbalances, and adrenal insufficiency affect millions of Americans. Bioidentical hormone replacement therapy (BHRT) offers patients a more personalized alternative to synthetic hormones, and compounding pharmacies are key enablers of this therapy.

Unlike mass-produced hormone therapies, compounded BHRT allows practitioners to prescribe customized combinations of estradiol, progesterone, DHEA, and testosterone tailored to lab values and symptom profiles. These formulations are often delivered in transdermal creams, sublingual troches, or vaginal inserts—formats not readily available in commercial products.

Beyond HRT, chronic pain management, dermatology, and gastroenterology are therapeutic areas where compounded medications are gaining ground. For instance, custom topical analgesics combining ketamine, lidocaine, and diclofenac offer targeted relief with fewer systemic side effects. As the focus of healthcare shifts toward long-term condition management and quality-of-life improvements, compounding pharmacies can position themselves as partners in multidisciplinary care.

Oral formulations dominate the product segment, particularly capsules and solutions. Compounded oral medications remain popular for patients requiring dose adjustments, excipient modifications, or flavored preparations. Capsules with modified-release profiles are also used in psychiatric, hormonal, and pain management treatments. Pediatric and geriatric patients frequently benefit from oral suspensions tailored to taste and tolerability.

Topical products are the fastest-growing subsegment, driven by increased usage in dermatology, pain relief, and hormone therapy. Gels, creams, and transdermal patches offer advantages in localized action and avoidance of first-pass metabolism. These formats are particularly effective in conditions like eczema, localized nerve pain, and bioidentical HRT applications.

503A pharmacies dominate the market, providing personalized prescriptions directly to patients based on individual needs. These community-based or clinic-affiliated pharmacies remain the backbone of the compounding sector. They offer flexibility in formulations, flavoring, and dosing, particularly for pediatric, geriatric, and dermatologic populations. Their accessibility and physician-pharmacist collaboration enable highly tailored treatments that large pharmaceutical manufacturers cannot deliver.

503B outsourcing facilities are the fastest-growing segment, especially as hospitals, surgery centers, and infusion clinics seek GMP-compliant, ready-to-administer sterile medications. The growth of these facilities is driven by increased demand for bulk supply of sterile injectables, compounded IV bags, and ophthalmic solutions. These pharmacies also alleviate in-house compounding burdens in healthcare institutions that may lack resources for full compliance with USP <797> or <800> standards.

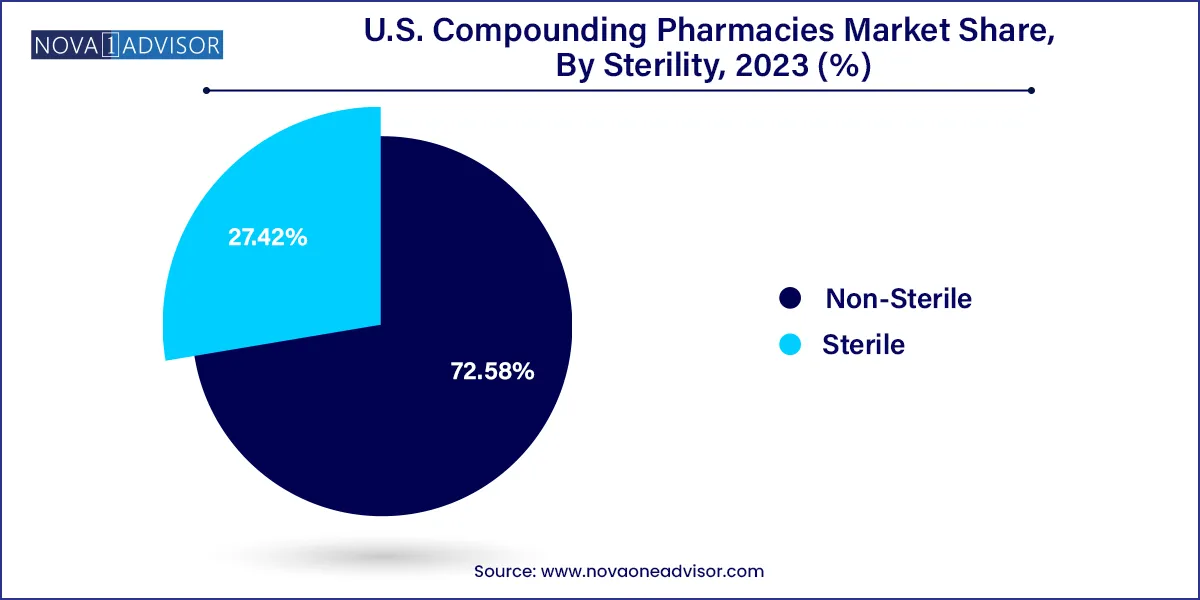

Non-sterile compounding leads the sterility segment, encompassing topical, oral, rectal, and nasal preparations. These products are relatively easier to produce and involve less regulatory oversight than sterile injectables. They serve the bulk of retail pharmacy clientele and support high-prescription-volume therapeutic areas such as dermatology, urology, and endocrinology.

Sterile compounding is the fastest-growing category, with increasing demand from surgical centers, hospitals, and specialty infusion clinics. Compounded sterile preparations (CSPs) include ophthalmic drops, IV antibiotics, parenteral nutrition, and oncology injectables. The rise of 503B facilities has enabled more institutions to outsource sterile compounding with confidence in safety and regulatory compliance.

Hormone replacement therapy (HRT) dominates therapeutic use, due to widespread use in managing menopausal symptoms, thyroid imbalances, and male hypogonadism. Customized doses and delivery formats make compounding essential in this area.

Dermatology and pain management are among the fastest-growing therapeutic segments. Topical analgesics, wound care creams, and combination acne treatments are driving growth, particularly with insurance companies and clinics favoring custom blends over multiple prescriptions.

U.S. Compounding Pharmacies Market, By Therapeutic Area, 2021-2023 (USD Billion)

| By Therapeutic Area | 2021 | 2022 | 2023 |

| Hormone Replacement | 1.02 | 1.08 | 1.15 |

| Pain Management | 0.84 | 0.89 | 0.94 |

| Dermatology | 0.47 | 0.50 | 0.53 |

| Pediatrics | 0.33 | 0.35 | 0.37 |

| Urology | 0.28 | 0.30 | 0.32 |

| Others | 2.25 | 2.36 | 2.47 |

Adult patients represent the largest user base, accounting for chronic disease management and wellness-focused formulations. Hormone replacement, dermatological therapy, and cardiovascular care dominate this group.

Pediatric compounding is growing rapidly, offering custom doses and palatable formulations for children who require accurate dosing not available commercially. Liquid suspensions with flavoring, lollipops, and mini-tablets are popular innovations in this space.

The United States leads the global compounding pharmacy market, both in volume and regulatory complexity. With a population increasingly focused on wellness, functional medicine, and chronic disease management, the need for patient-centric pharmaceutical solutions is surging.

The FDA and U.S. Pharmacopeia (USP) provide the regulatory frameworks for compounding practice, with enforcement shared by state pharmacy boards. Growth in compounding is also influenced by the U.S. healthcare system’s preference for personalized, cost-effective, and integrated care pathways.

Leading states such as Texas, Florida, and California have emerged as hubs for both retail compounding pharmacies and 503B outsourcing facilities, backed by robust healthcare infrastructures and dense patient populations. Continued federal funding for healthcare innovation and regulatory modernization further supports market expansion.

March 2025: Empower Pharmacy opened its second 503B facility in Houston, TX, increasing its sterile compounding capacity by over 150%, with advanced automation and robotics.

February 2025: Fagron launched a new software platform integrating compounding workflow management with patient outcome tracking, targeting 503A operators.

January 2025: Pencol Compounding Pharmacy announced collaboration with telehealth provider HRTDirect to deliver custom hormone prescriptions nationwide.

December 2024: Innovation Compounding began construction of an expanded facility in Georgia to meet demand in dermatology and pain management.

November 2024: Wells Pharmacy Network received cGMP re-certification for its 503B operations, with expanded capabilities in ophthalmics and veterinary compounding.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Compounding Pharmacies market.

By Pharmacy Type

By Product

By Sterility

By Compounding Type

By Age Cohort

By Therapeutic Area

By End-User