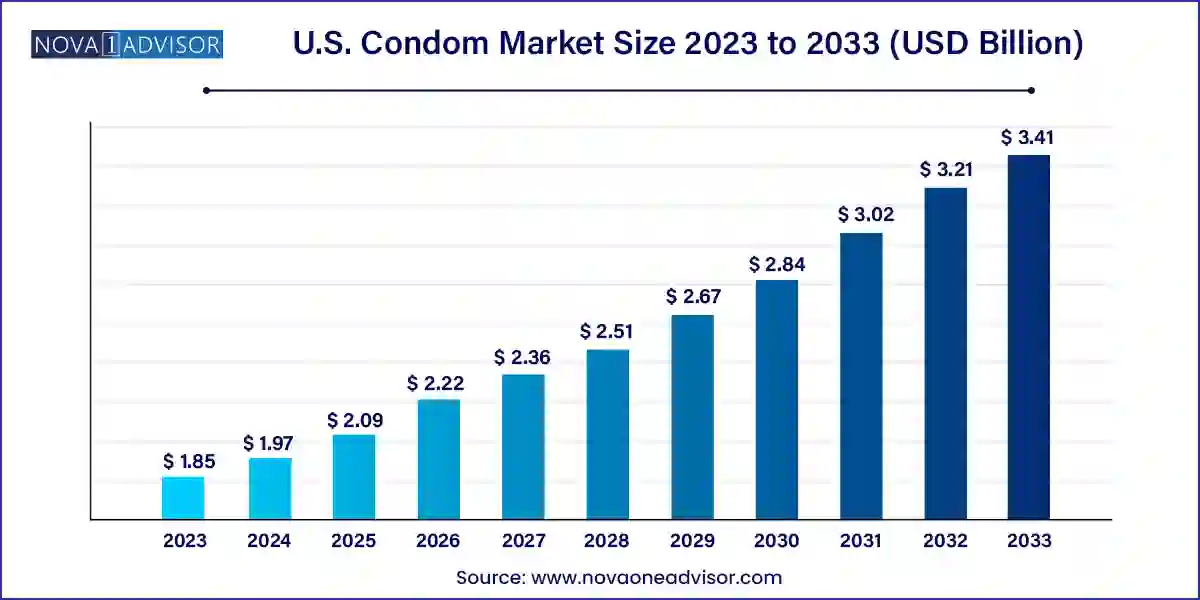

The U.S. condom market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.41 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

The U.S. condom market is a vital segment of the sexual wellness industry, characterized by continuous innovation, increasing awareness, and evolving consumer behavior. In recent years, condoms have transitioned from being merely contraceptive tools to becoming integral components of modern sexual wellness and reproductive health strategies. As societal attitudes shift toward open conversations about sexual health, the demand for both male and female condoms continues to gain momentum across diverse demographics.

The U.S. market is one of the most mature and regulated globally, with a strong presence of well-established brands, stringent FDA regulations, and a steadily increasing acceptance of sexual wellness products. The growing emphasis on safe sex practices among youth, coupled with efforts from public health bodies like the Centers for Disease Control and Prevention (CDC) and Planned Parenthood, has further fueled market growth.

Notably, the market has seen an uptick in demand not just in urban centers but also in rural areas, attributed to rising outreach programs and digital availability through e-commerce channels. Additionally, the growing LGBTQ+ community, increasing female participation in sexual wellness product discussions, and health concerns around sexually transmitted infections (STIs) have collectively contributed to a healthy and resilient market.

As of the latest estimates, the U.S. condom market reflects a robust valuation, with projections suggesting steady year-over-year growth through the forecast period. Brands are investing in innovation, sustainable manufacturing, and diversified marketing to target Gen Z and millennial consumers who prioritize both pleasure and responsibility.

Rise of Sustainable Condoms: Eco-conscious consumers are driving demand for biodegradable and vegan condoms made without animal byproducts, parabens, or harmful chemicals.

Increased Adoption of Female Condoms: Greater awareness and empowerment movements are promoting the use of female condoms, though still niche, this segment is growing steadily.

Celebrity and Influencer Endorsements: Prominent endorsements on social media platforms are normalizing condom purchases, especially among younger audiences.

Personalized Condom Subscriptions: Subscription-based condom services offering discreet, personalized delivery have gained traction, especially post-pandemic.

Integration with Health Apps: Some brands are exploring tech-integrated condoms or partnerships with health and wellness apps to track usage and offer educational insights.

Premiumization of Products: Consumers are showing increased willingness to pay for premium offerings with features such as ultra-thin design, flavor variants, and enhanced textures.

Targeted Campaigns for LGBTQ+ Communities: Companies are tailoring products and advertisements to inclusively represent LGBTQ+ individuals, addressing a previously underserved market segment.

E-commerce and Direct-to-Consumer Channels Surge: Online platforms are becoming dominant sales channels owing to privacy, convenience, and availability of broad product ranges.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.97 Billion |

| Market Size by 2033 | USD 3.41 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material Type, Product, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Church & Dwight Co., Inc.; Fuji Latex Co., Ltd.; Reckitt Benckiser Group; Karex Berhad; Lelo; LifeStyles Healthcare Pte. Ltd.; Veru, Inc.; Mayer Laboratories, Inc.; Okamoto Industries, Inc.; Cupid Ltd. |

One of the most significant drivers of the U.S. condom market is the growing public awareness of sexual health, primarily fueled by educational initiatives, media discourse, and governmental support. Organizations like the CDC and non-profits frequently run campaigns emphasizing the role of condoms in preventing STIs, including HIV/AIDS, gonorrhea, and chlamydia. This awareness is especially vital among younger populations, many of whom engage in sexual activity without understanding the risks involved. School-based sex education programs have also emphasized condom use as a key preventive measure, making them more acceptable and accessible.

Furthermore, the rise in casual dating facilitated by dating apps like Tinder, Bumble, and Grindr has heightened the need for effective protection. The conversations surrounding consent and safe sex practices have become more normalized, leading to increased product visibility on retail shelves and online stores. As a result, condom usage is becoming a natural part of conversations on sexual relationships, further bolstering market expansion.

Despite increasing normalization, stigma and embarrassment associated with purchasing condoms remain significant barriers in parts of the U.S. Many individuals, especially teenagers and people in conservative regions, still find it uncomfortable to buy condoms in physical stores. This cultural hesitation can limit potential sales volumes, especially among first-time or young users.

Although e-commerce channels provide more discreet purchasing options, the hesitation persists, particularly when privacy is a concern in shared living situations. Additionally, religious or moral opposition to contraception in certain communities curbs widespread acceptance. This cultural restraint poses a challenge for marketers and educators working to normalize condom usage across demographics.

Material and design innovation presents a lucrative opportunity in the U.S. condom market. Traditional latex condoms, while dominant, are associated with allergies in a notable portion of the population. In response, companies have invested in developing non-latex alternatives such as polyisoprene and polyurethane condoms, which are hypoallergenic and offer similar or better strength and comfort.

Moreover, design innovations—ranging from ultra-thin profiles to unique textures and warming or cooling sensations—are enhancing user experience. There is also a rising demand for condoms that promote mutual pleasure, address specific anatomical fits, and align with ethical consumerism trends (e.g., cruelty-free, sustainable packaging). These innovations enable manufacturers to target premium and health-conscious segments, opening new avenues for differentiation and brand loyalty.

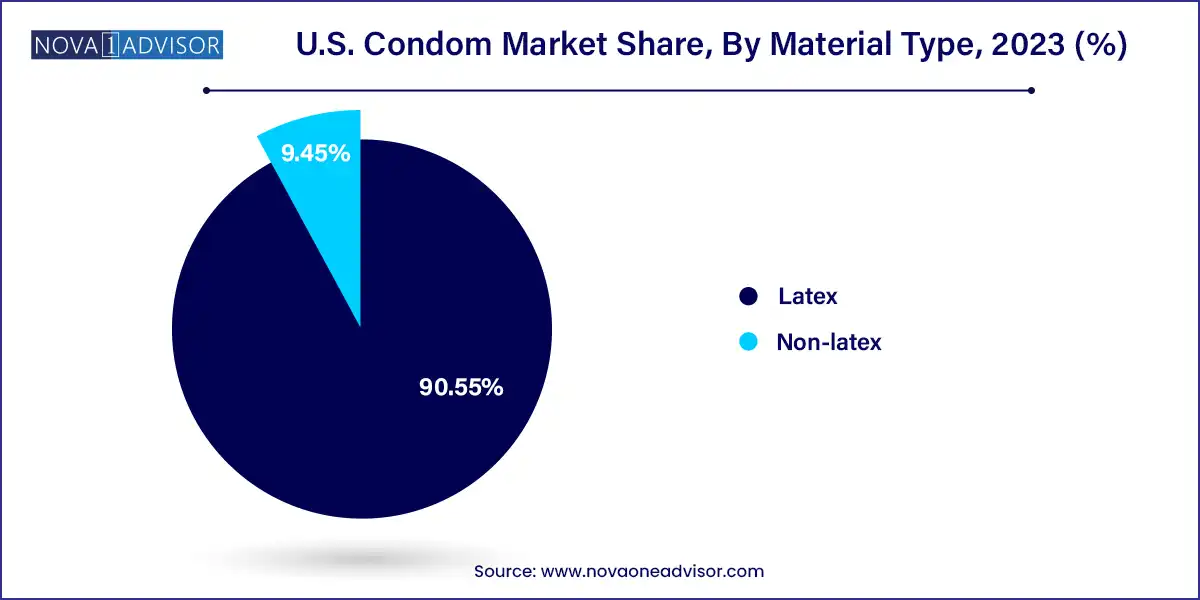

Latex condoms hold the largest market share by material type due to their affordability, elasticity, and high effectiveness. Latex has long been the standard material, and manufacturers have perfected the process of enhancing strength while retaining ultra-thin sensations. Brands such as Trojan, Durex, and Lifestyles continue to dominate this segment with diverse product lines. Latex condoms are widely accepted and available across all distribution channels, particularly mass merchandisers and drug stores. Their dominance is further aided by FDA approvals and favorable public health endorsements.

In contrast, non-latex condoms are gaining momentum, especially among users allergic to latex or seeking different material experiences. Polyurethane and polyisoprene condoms offer similar protective benefits while catering to specific consumer sensitivities. These condoms are marketed as hypoallergenic and suitable for users seeking odorless and more heat-conductive options. Although currently a niche, non-latex products represent the fastest-growing segment due to increasing demand for alternatives and innovations in material science.

Mass merchandisers such as Walmart and Target continue to dominate the distribution landscape, owing to their extensive retail footprint and accessible price points. These stores offer a wide array of condom products across brands and variants, making them the preferred choice for in-person shoppers. Similarly, drug stores such as CVS, Walgreens, and Rite Aid remain key players due to their prominence in urban areas and association with sexual wellness aisles. These traditional outlets offer discretion and immediate availability, especially for last-minute purchases.

However, e-commerce is rapidly gaining traction and is currently the fastest-growing distribution channel. The rise of digital retail platforms like Amazon, along with direct-to-consumer websites such as MyOne or Lovability, offers consumers unparalleled convenience, product variety, and discreet packaging. Post-pandemic behavioral shifts toward online shopping, coupled with increasing comfort in digital health and wellness, have accelerated this trend. Subscription models, personalized recommendations, and targeted marketing further enhance the e-commerce segment’s appeal.

Male condoms are the cornerstone of the U.S. condom market, accounting for a significant majority of sales. Their dominance is rooted in widespread availability, ease of use, and social familiarity. Male condoms are often the first contraceptive method introduced during sex education programs and are more frequently marketed than their female counterparts. Leading companies regularly launch new male condom products with features like enhanced lubrication, flavors, ribbed textures, and delay effects, further driving demand.

Female condoms, although less prevalent, are showing signs of growth driven by feminist health movements and gender-inclusive campaigns. Their usage is being promoted through public health organizations and women's health advocacy groups. Female condoms offer women more control over their sexual health and are especially relevant in communities where negotiating male condom use is difficult. As awareness increases and product designs improve, the female condom market is projected to be the fastest-growing sub-segment in the coming years.

Within the United States, several states and regions show varying dynamics in condom consumption. California stands out as the dominant market, owing to its large population, progressive sexual health policies, and strong retail presence. The state benefits from expansive awareness campaigns, liberal attitudes toward sexual wellness, and the widespread availability of products across diverse sales channels. High urbanization and a tech-savvy population also mean Californians are more likely to engage in online purchases and premium product experimentation.

Conversely, states like Texas and Florida are witnessing the fastest growth in condom usage. These states have younger populations and increasingly active sexual wellness campaigns led by both government bodies and non-profit organizations. The penetration of telehealth services, coupled with regional expansion of online retail infrastructure, is also making condoms more accessible in previously underserved or conservative areas. As stigma continues to diminish, sales in the southern and midwestern states are expected to grow exponentially.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. condom market

Material Type

Product

Distribution Channel

Regional