The U.S. consumer genomics market size was valued at USD 485.90 million in 2023 and is projected to surpass around USD 4,489.22 million by 2033, registering a CAGR of 24.9% over the forecast period of 2024 to 2033.

The U.S. consumer genomics market has undergone a transformative evolution over the past decade, transitioning from a niche scientific service to a widely accessible personal tool for health, ancestry, and lifestyle insights. Consumer genomics refers to the direct-to-consumer (DTC) application of genetic testing services, enabling individuals to access their genomic information without necessarily going through healthcare providers.

Initially popularized by services that offered ancestry mapping, the market has since expanded into wellness optimization, dietary planning, reproductive health, disease risk assessment, and even personalized medicine. The key differentiator in this segment is the consumer empowerment model, where genetic data is not confined to clinical environments but is actively interpreted by individuals to make personal health and lifestyle decisions.

Several macro factors fuel the growth of this market: a rising consumer interest in preventive health, increasing public awareness of genetic science, decreasing costs of genome sequencing technologies, and improved data visualization platforms. Companies like 23andMe and AncestryDNA have paved the way, but the ecosystem now includes a diverse range of startups and established biotech players offering specialized services in fitness genomics, pharmacogenomics, and fertility diagnostics.

The U.S., with its advanced digital infrastructure, regulatory environment, and tech-savvy population, is the largest and most dynamic consumer genomics market globally. Despite recent slowdowns due to data privacy concerns and market saturation in some areas, the segment is poised for further innovation, particularly at the intersection of AI, cloud genomics, and precision health.

Shift toward health-centric applications: From ancestry to disease prediction and wellness management.

Integration of genomics into digital health ecosystems, including fitness apps and wearable tech platforms.

Increased focus on personalized nutrition and sports performance based on genetic profiles.

Emergence of pharmacogenomic services enabling safer, more effective medication regimens.

Rising consumer awareness about reproductive health and fertility-related genetic testing.

Data ownership and privacy becoming major differentiation factors among providers.

Surge in AI-powered genomic interpretation tools and cloud-based bioinformatics platforms.

Bundling of genetic insights with telehealth consultations and subscription services.

Public-private collaborations to enhance genomic literacy and build ethical frameworks.

New business models exploring monetization of anonymized genetic data in research

| Report Attribute | Details |

| Market Size in 2024 | USD 606.89 million |

| Market Size by 2033 | USD 4,489.22 million |

| Growth Rate From 2024 to 2033 | CAGR of 24.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Ancestry; Gene By Gene, Ltd. (FamilyTree DNA); 23andMe, Inc.; Color Health, Inc; Myriad Genetics, Inc; Mapmygenome; Helix OpCo LLC; MyHeritage Ltd.; Pathway Genomics; Veritas; Amgen, Inc.; Diagnomics, Inc.; Toolbox Genomics; SomaLogic, Inc.; inui Health (formerly Scanadu); QuickCheck Health; Illumina, Inc. |

A powerful driver in the U.S. consumer genomics market is the escalating consumer demand for preventive, proactive, and personalized health management. Amid rising healthcare costs and growing awareness of genetic predispositions to chronic diseases, individuals are increasingly turning to genomics to understand their unique health risks and optimize their lifestyles accordingly.

From identifying risks for conditions like Type 2 diabetes, cardiovascular diseases, and certain cancers, to tailoring diet and fitness regimens, genetic testing offers consumers a sense of control over their health trajectory. The accessibility and affordability of at-home testing kits have accelerated this trend, supported by aggressive marketing and educational content by key market players.

The rise of “genetic wellness” influencers, integration of results into lifestyle apps, and user communities built around shared genetic markers have turned genomic data into a participatory health tool. Furthermore, increasing partnerships between consumer genomics companies and digital health platforms amplify these benefits, turning genetic testing into an entry point for longer-term engagement with health optimization programs.

Despite its rapid growth, the U.S. consumer genomics market faces a significant hurdle in the form of data privacy and ethical concerns. Consumers are increasingly wary of how their genomic data is stored, used, and shared—especially following high-profile cases where law enforcement accessed genetic databases to solve criminal investigations (e.g., the Golden State Killer case via GEDmatch).

These concerns are compounded by a lack of comprehensive federal legislation in the U.S. regulating consumer genetic data, unlike the GDPR in Europe. The prospect of data misuse by insurers, employers, or pharmaceutical firms raises fears of discrimination and breaches of individual autonomy.

In response, some companies have begun implementing privacy-first approaches, allowing consumers to opt out of data sharing, providing transparency dashboards, and adopting blockchain or decentralized models for data storage. However, overcoming consumer skepticism will require a broader effort involving regulators, ethicists, and industry leaders to develop trust-driven frameworks.

A major opportunity in the U.S. consumer genomics market lies in the intersection of genomics and pharmacology, particularly through pharmacogenetic testing that predicts an individual’s response to specific medications. This application holds immense potential in personalizing treatments for conditions such as depression, cardiovascular disease, cancer, and autoimmune disorders.

As the FDA continues to approve pharmacogenetic guidelines for various drug classes (e.g., SSRIs, anticoagulants), consumer interest in understanding how their DNA influences drug metabolism is growing. Companies offering consumer-accessible pharmacogenomic panels are enabling users to make informed decisions—sometimes in partnership with their physicians—about which drugs may be most effective or safest for them.

The growing availability of companion diagnostics, increased insurer reimbursement for genetic panels, and integration with digital health platforms (like electronic health records) will further enhance the market for personalized medicine testing at the consumer level. This emerging opportunity aligns with the broader shift toward precision healthcare in the U.S.

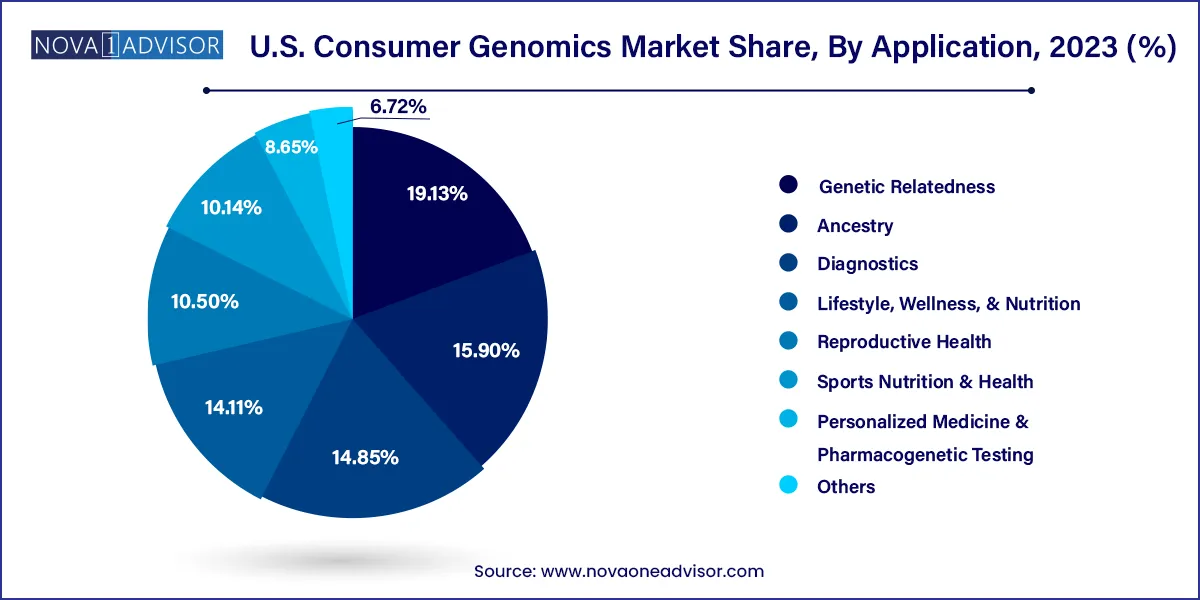

Ancestry testing has historically dominated the U.S. consumer genomics market, forming the cornerstone of early adoption. Companies like AncestryDNA and 23andMe popularized this application by enabling individuals to trace their ethnic origins, find relatives, and understand genetic migration patterns. The appeal of ancestry testing lies in its emotional and identity-driven nature, often leading to consumer engagement with genetic science for the first time.

Despite some market saturation, ancestry continues to be a foundational application. Providers are enhancing their offerings with more granular ethnic breakdowns, historical narratives, and family tree integrations. However, growth in this segment is slowing compared to others as repeat purchases are limited and novelty wears off.

Lifestyle, Wellness, and Nutrition is the fastest-growing segment, fueled by the consumer shift from curiosity to action. This category includes tests that analyze genes linked to metabolism, nutrient absorption, sleep patterns, and physical performance. As wellness culture permeates mainstream American life, consumers are seeking hyper-personalized insights to optimize their routines.

Innovative startups and DTC brands are bundling genetic tests with fitness coaching, diet plans, and app integrations that deliver actionable advice. For example, companies are offering reports on caffeine sensitivity, lactose intolerance, and susceptibility to injury based on genetic markers empowering consumers to tailor their nutrition and exercise with a genetic edge.

The United States leads the global consumer genomics market, supported by a mature digital infrastructure, strong biotech ecosystem, and consumer openness to adopting health and wellness technologies. Americans are generally more comfortable with DTC medical products compared to other markets, especially in a privatized healthcare environment where proactive health management is encouraged.

Furthermore, U.S. companies have pioneered the market, with brands like 23andMe and Ancestry.com based domestically. The presence of innovation hubs in California, Massachusetts, and North Carolina facilitates continuous development in genomic technologies, data analytics, and partnerships with healthcare institutions.

Insurance providers are slowly expanding coverage for certain genetic services, and the integration of genomics into mainstream medical practice such as pharmacogenetic reports in EHR systems is steadily increasing. At the federal level, initiatives like the All of Us Research Program reflect a national commitment to genomic inclusion and personalized medicine.

However, regulatory oversight from the FDA and the FTC remains a balancing act. While these agencies aim to ensure accuracy and consumer protection, they also seek to avoid stifling innovation. This dynamic regulatory environment continues to shape product offerings and business models within the U.S. consumer genomics market.

March 2025: 23andMe launched a new health + ancestry kit integrating pharmacogenomics modules, providing users with insights into drug metabolism based on CYP450 variants.

February 2025: AncestryDNA announced a partnership with MyHeritage to expand global ancestry tracing capabilities and offer customers dual-platform comparison tools.

January 2025: Veritas Genetics re-entered the U.S. market with its affordable whole genome sequencing service, priced under $400, significantly lowering the barrier to comprehensive testing.

December 2024: Nebula Genomics unveiled a blockchain-powered data ownership platform allowing users to monetize their anonymized genomic data for research.

November 2024: Orig3n Inc. launched a targeted wellness panel that includes genetic insights for mental performance, skin health, and sleep optimization, aimed at the lifestyle consumer segment.

The U.S. consumer genomics market is characterized by intense competition, with a major share being held by numerous manufacturers. Market players employ key business strategies such as product introductions, approvals, strategic takeovers, and innovations to sustain and expand their global presence. For instance, Grifols, in May 2023, introduced AlphaIDAt Home, enabling American consumers to self-test for genetic COPD.

U.S. Consumer Genomics Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Consumer Genomics market.

By Application