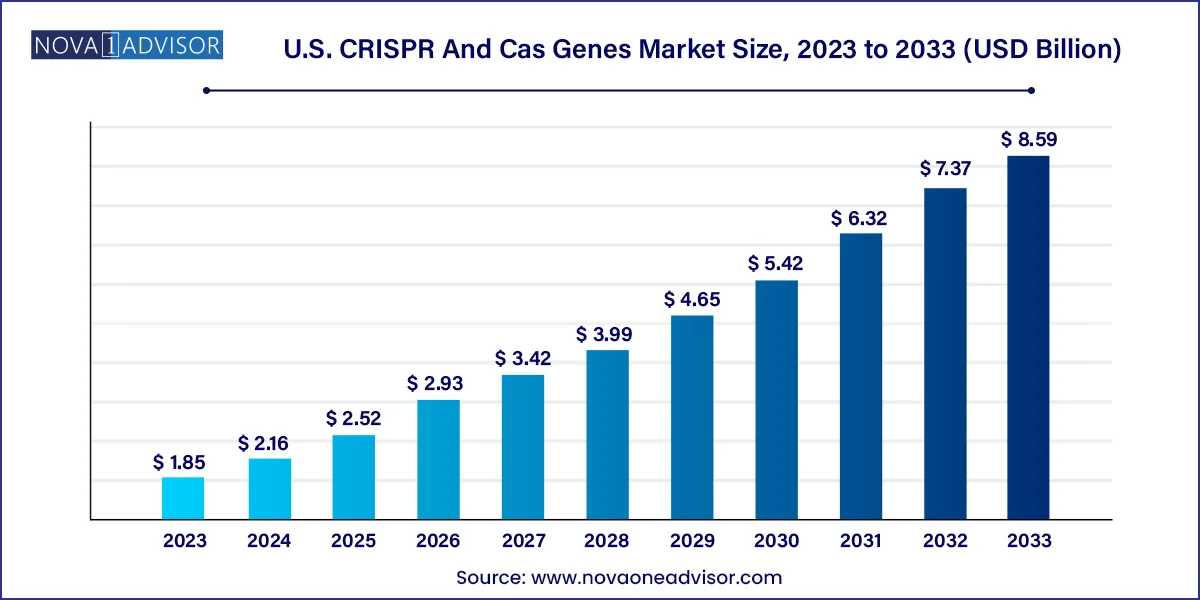

The U.S. CRISPR and Cas genes market size was estimated at USD 1.85 billion in 2023 and is expected to be worth around USD 8.59 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 16.6% during the forecast period 2024 to 2033.

The U.S. CRISPR and Cas genes market is emerging as one of the most dynamic and transformative segments in the biotechnology industry. CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) associated with Cas (CRISPR-associated) enzymes represents a powerful gene-editing platform capable of precisely modifying DNA sequences in living organisms. Since its discovery, the CRISPR-Cas system has revolutionized genetic engineering, enabling researchers and clinicians to explore novel treatments for genetic diseases, develop agricultural solutions, and advance biomedical research at an unprecedented pace.

In the U.S., the demand for CRISPR-Cas tools is being driven by a strong innovation ecosystem, leading academic institutions, robust funding from public and private sectors, and supportive regulatory pathways. Applications of CRISPR technology range from gene therapy and regenerative medicine to the development of disease models and functional genomic studies. Moreover, agricultural biotechnology companies in the U.S. are employing CRISPR tools for developing drought-resistant and high-yield crops, signaling its expansive potential beyond human health.

Companies such as Editas Medicine, CRISPR Therapeutics, and Intellia Therapeutics are headquartered in the U.S. and have been at the forefront of leveraging CRISPR for therapeutic pipeline development. Additionally, growing interest from pharmaceutical giants in partnerships and licensing agreements indicates rising commercial confidence in this domain. With technological advancements such as base editing, prime editing, and epigenetic modulation being integrated into CRISPR frameworks, the U.S. market is positioned to lead global advancements in gene editing.

Therapeutic Pipeline Expansion: U.S. biotech firms are rapidly moving CRISPR-based therapies into Phase 1 and Phase 2 clinical trials for conditions such as sickle cell anemia, Leber congenital amaurosis, and beta-thalassemia.

Rise of CRISPR as a Service (CaaS): Specialized providers are offering end-to-end CRISPR services including gRNA design, vector delivery, and gene synthesis to academic and corporate labs.

CRISPR in Agriculture and Food Tech: U.S. agritech companies are deploying CRISPR to create gene-edited crops with traits like pest resistance and increased shelf life.

AI Integration in CRISPR Design: Machine learning is being used to enhance guide RNA accuracy, off-target prediction, and gene-editing outcome modeling.

Ethical and Regulatory Debates: Policy discussions on the ethical boundaries of germline editing are shaping regulatory frameworks in the U.S.

Growth in Functional Genomics: High-throughput CRISPR screens are enabling comprehensive gene-function analyses in oncology, neurology, and immunology research.

Advances in Delivery Mechanisms: Lipid nanoparticles and viral vectors are being optimized for precise CRISPR component delivery in vivo.

Increased Academic-Industrial Collaborations: U.S. universities and research institutes are partnering with biotech firms for translational CRISPR research.

Investment Surge in Synthetic Biology Startups: Startups leveraging CRISPR-Cas9 for synthetic biology applications are receiving substantial venture capital.

Biosecurity and Dual-Use Considerations: Federal agencies are evaluating CRISPR’s potential dual-use risks in bioengineering and defense.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.16 Billion |

| Market Size by 2033 | USD 8.59 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 16.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product & service, application, end-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Genscript ; Mammoth Biosciences, Inc; Editas Medicine, Inc.; Calyxt, Inc.; Caribou Biosciences, Inc; Addgene, Thermofisher Scientific, Inc; Integrated DNA Technologies, Inc; Egenesis; Danaher Corporation; Synthego; Recombinetics, Inc; Origene Technologies, Inc.;Inscripta, Inc.; Intellia Therapeutics, Inc. |

One of the most powerful drivers of the U.S. CRISPR and Cas genes market is the growing application of CRISPR-based solutions in the treatment of genetic diseases. Conditions like sickle cell disease, Duchenne muscular dystrophy, and hereditary blindness are rooted in well-characterized genetic mutations, making them ideal candidates for CRISPR-mediated correction.

In December 2023, the FDA approved the first-ever CRISPR-based therapy for sickle cell anemia developed by Vertex Pharmaceuticals and CRISPR Therapeutics. This landmark event validated gene editing as a viable and safe clinical tool, opening the door for a new wave of in vivo and ex vivo therapies. U.S.-based companies and institutions are investing heavily in translating gene-editing innovations into real-world treatments.

Furthermore, the NIH’s Somatic Cell Genome Editing (SCGE) program and other federal initiatives have allocated billions in funding to develop safe and efficient CRISPR delivery platforms. With over 75% of rare diseases in the U.S. being genetic in origin, CRISPR presents a scalable solution for targeted therapeutic intervention.

Despite its enormous potential, one of the main restraints in the U.S. CRISPR market is the risk of off-target effects and ongoing ethical debates surrounding gene editing. Although CRISPR-Cas9 is highly precise, unintended genetic modifications can occur, potentially leading to harmful mutations or oncogenesis. These concerns are particularly critical in therapeutic applications where edited cells are reintroduced into patients.

The FDA and institutional review boards (IRBs) in the U.S. demand rigorous safety data, which can slow down clinical trial initiation and regulatory approval. Ethical concerns, especially related to germline editing (which would affect future generations), have also sparked public debates. In 2024, discussions around the “CRISPR baby” scandal resurfaced, leading to renewed calls for a ban on heritable genome editing in humans in the U.S.

This regulatory caution and public scrutiny create uncertainty and delay commercialization, particularly for companies aiming to move into germline or embryo editing despite their potential to treat intractable genetic disorders.

A key opportunity lies in integrating CRISPR tools with personalized medicine and oncology pipelines. CRISPR-based gene editing can be tailored to individual genetic profiles, enabling patient-specific therapies with greater efficacy and fewer side effects. In oncology, this could mean reprogramming T-cells using CRISPR to target patient-specific tumor antigens or disabling genes that confer drug resistance.

The U.S. is home to leading cancer centers such as MD Anderson, Memorial Sloan Kettering, and Dana-Farber, all of which are conducting CRISPR-based trials in hematologic and solid tumors. Several biotech firms are collaborating with these institutions to engineer CAR-T cells with enhanced tumor-targeting capabilities using Cas9 or Cas12 systems.

Additionally, CRISPR’s role in creating precise disease models helps accelerate drug discovery and repurposing—allowing pharmaceutical companies to match therapies with genetic markers. As companion diagnostics become standard in oncology, CRISPR will likely play a central role in therapeutic customization.

Kits and enzymes dominate the U.S. CRISPR market by product, particularly vector-based Cas9 systems used for R&D purposes. These kits are widely used across university laboratories, biotech startups, and pharmaceutical companies for genome editing experiments, functional genomics, and transgenic cell line development. The U.S. market’s deep academic infrastructure ensures consistent demand for CRISPR tools, especially from NIH-funded research labs.

DNA-free Cas systems and services like cell line engineering are the fastest-growing segments, driven by safety concerns and clinical translation. DNA-free systems, which use pre-assembled Cas-gRNA ribonucleoproteins (RNPs), reduce off-target activity and avoid genomic integration. Services such as microbial gene editing and synthetic gRNA design are in high demand among startups and contract research organizations lacking in-house capabilities.

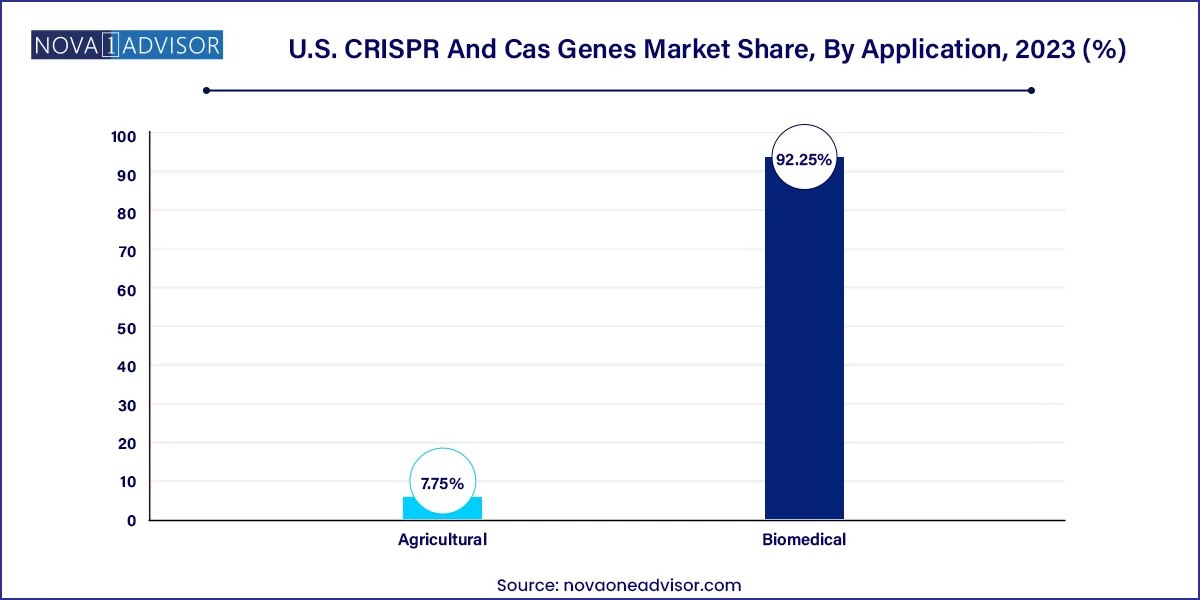

Biomedical applications are the dominant use case, especially for genome editing, disease modeling, and drug target validation. Functional genomics research using CRISPR knockout/knock-in technologies is enabling scientists to uncover gene function in cancer, neurology, and immunology. The rapid expansion of CRISPR-based screening tools is also facilitating high-throughput identification of therapeutic targets.

Agricultural applications represent the fastest-growing area, particularly in crop genome editing. U.S.-based agri-biotech companies are using CRISPR to engineer herbicide-tolerant crops, enhance nutrient content, and develop drought-resistant varieties. In March 2024, the USDA approved a CRISPR-edited soybean strain resistant to blight, indicating increasing regulatory openness toward agricultural gene editing.

Biotechnology and pharmaceutical companies dominate the end-use landscape, primarily because they drive therapeutic development and drug discovery. These firms leverage CRISPR for preclinical model development, high-throughput screening, and novel pipeline innovation. With increasing partnerships between pharma giants and CRISPR tech startups, the commercial end-user segment is expected to maintain its leadership position.

Contract Research Organizations (CROs) are the fastest-growing end-users, due to the outsourcing trend in pharmaceutical R&D. CROs offer cost-effective CRISPR-based solutions, including custom guide RNA design, off-target analysis, and in vivo model development. Their ability to deliver rapid, scalable, and regulatory-compliant services is attracting both small biotech and large pharma clients.

The United States holds a global leadership position in the CRISPR and Cas genes market, thanks to its advanced research infrastructure, regulatory engagement, and vibrant biotech ecosystem. The U.S. is home to several of the world’s foremost CRISPR pioneers, including Jennifer Doudna (UC Berkeley) and Feng Zhang (MIT), whose institutions continue to innovate in base editing and prime editing techniques.

Government funding, including from the NIH and Department of Energy, continues to support basic and translational CRISPR research. Additionally, the FDA has developed guidance for gene therapy products, including genome editing applications, creating a clear pathway for regulatory submissions.

In 2024, the U.S. led the world in CRISPR clinical trials, with over 70 active studies across oncology, rare diseases, and infectious diseases. The country also has favorable intellectual property protections, venture capital access, and incubators that support CRISPR startups. As the industry matures, the U.S. is expected to remain the epicenter of CRISPR innovation and commercialization.

March 2025: Editas Medicine received FDA clearance to initiate a Phase 1 trial for EDIT-301, a CRISPR-edited therapy for beta-thalassemia using its proprietary AsCas12a enzyme.

February 2025: CRISPR Therapeutics and Vertex Pharmaceuticals submitted a joint Biologics License Application (BLA) for exa-cel, their CRISPR-based sickle cell therapy, marking a major regulatory milestone.

January 2025: Intellia Therapeutics published interim results from its NTLA-2002 trial for hereditary angioedema, showing significant reduction in attack frequency using in vivo CRISPR editing.

December 2024: Caribou Biosciences expanded its CRISPR-Cas12a patent portfolio and announced preclinical data for its next-gen CAR-T cell therapy targeting solid tumors.

November 2024: AgBiome received USDA approval for a CRISPR-edited maize variant with enhanced resistance to drought and fungal infections.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. CRISPR And Cas Genes market.

By Product & Service

By Application

By End-use