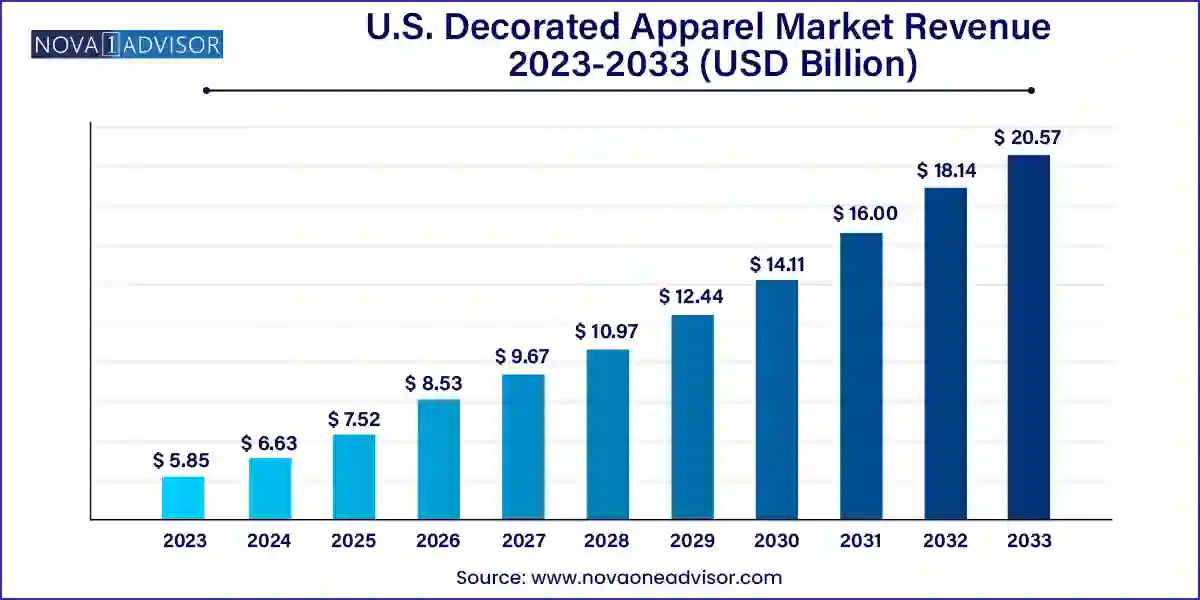

The U.S. decorated apparel market size was exhibited at USD 5.85 billion in 2023 and is projected to hit around USD 20.57 billion by 2033, growing at a CAGR of 13.4% during the forecast period 2024 to 2033.

The U.S. decorated apparel market has emerged as a dynamic and creative sector at the intersection of fashion, personalization, and branding. What was once a niche space dominated by promotional wear and custom t-shirts has evolved into a robust industry driven by innovation in textile printing, changing consumer fashion preferences, and the growing demand for customization. Decorated apparel refers to garments enhanced through printing, embroidery, or embellishment, making them visually distinct, expressive, or brand-specific.

From local sports teams and corporate uniforms to fashion-forward streetwear and e-commerce startups, the applications for decorated apparel are vast. Consumers today expect more than generic off-the-rack clothing; they seek unique pieces that reflect their identity, humor, affiliations, or style. This has encouraged the growth of businesses specializing in everything from screen printing and dye sublimation to embroidery and digital direct-to-garment (DTG) printing.

Technological advancements, such as automated embroidery machines, eco-friendly inks, AI-based design tools, and web-to-print interfaces, have dramatically enhanced product quality and turnaround time. Coupled with strong online retailing infrastructure and rising demand for sustainable, made-to-order fashion, the U.S. decorated apparel industry is poised for continuous expansion. The market is characterized by a diverse landscape, including small custom shops, large-scale fulfillment centers, fashion designers, and print-on-demand platforms, each playing a vital role in reshaping modern apparel experiences.

Rise of Personalized Fashion: Consumer desire for individual expression is driving growth in customized, made-to-order clothing for personal use, gifting, or events.

Athleisure and Streetwear Convergence: Decorated activewear and street fashion featuring bold prints, logos, and patches are gaining momentum, especially among millennials and Gen Z.

E-commerce-Driven Print-on-Demand Models: The proliferation of Shopify stores and integrations with platforms like Printful and Teespring has empowered independent creators to enter the market.

Sustainability in Decoration: Water-based inks, recycled textiles, and on-demand production models are increasingly favored by environmentally conscious consumers.

Corporate and Team Branding: Branded merchandise for companies, sports teams, and community groups remains a strong market segment, often ordered in bulk via screen printing and embroidery.

Celebrity and Influencer Collaborations: Apparel lines created in partnership with celebrities or influencers, featuring custom decorations, are widely popular through direct-to-fan platforms.

Innovation in Digital Printing: Advancements in DTG and dye sublimation technologies have improved the speed, resolution, and affordability of high-quality decorated apparel.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.63 Billion |

| Market Size by 2033 | USD 20.57 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-user |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Gildan, Fruit of Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Garment Graphics and Promotional Products, PRINTING United Alliance, New England Printwear |

One of the most significant drivers shaping the U.S. decorated apparel market is the growing consumer inclination toward personalized and identity-driven clothing. In a culture increasingly focused on self-expression and individuality, consumers seek unique garments that communicate who they are, what they believe in, and how they feel. Be it a humorous slogan on a t-shirt, a meaningful quote, or a company logo, decoration has become a medium for storytelling and self-branding.

Social media platforms like Instagram, TikTok, and Pinterest have accelerated this trend by showcasing fashion as a tool for engagement and self-promotion. In response, online stores and print-on-demand services offer consumers the ability to design, preview, and purchase custom products in a few clicks. Whether it’s for birthday parties, awareness campaigns, reunions, or niche fashion lines, the demand for one-of-a-kind apparel continues to rise, fueling steady growth across product types and user demographics.

While the decorated apparel industry presents lucrative opportunities, the high initial cost of equipment, inks, and raw materials remains a key barrier, particularly for small and medium-sized enterprises (SMEs). Professional-grade embroidery machines, DTG printers, and heat press equipment require significant capital investment, often exceeding several thousand dollars. Additionally, the cost of blank garments, specialized threads, eco-friendly inks, and maintenance further burdens new entrants.

Furthermore, achieving consistency in quality and scalability without substantial financial backing can be challenging. Customization often involves low-volume, high-variation orders, which require skilled labor, design tools, and efficient workflow management. The lack of access to affordable resources or financing can prevent small businesses from competing effectively against established players with automated and bulk printing capabilities. Without strategic investment, many small printers struggle to scale or modernize their production.

The creator economy has unlocked a tremendous opportunity for the decorated apparel market. As influencers, content creators, streamers, and micro-celebrities build devoted communities online, merchandise has become a valuable revenue stream and brand extension. Decorated apparel—especially graphic tees, hoodies, and caps—serves as a tangible connection between influencers and their audiences.

Platforms like Merch by Amazon, Printful, Teespring, and Redbubble allow creators to upload designs and sell apparel without holding inventory or managing logistics. These platforms handle everything from production to delivery in a seamless white-label fashion. The low barrier to entry, combined with high audience loyalty, allows even niche creators to launch successful merchandise lines. As the number of online creators in the U.S. grows, so does the addressable market for personalized, influencer-driven apparel, creating a vibrant sub-sector within the broader decorated apparel ecosystem.

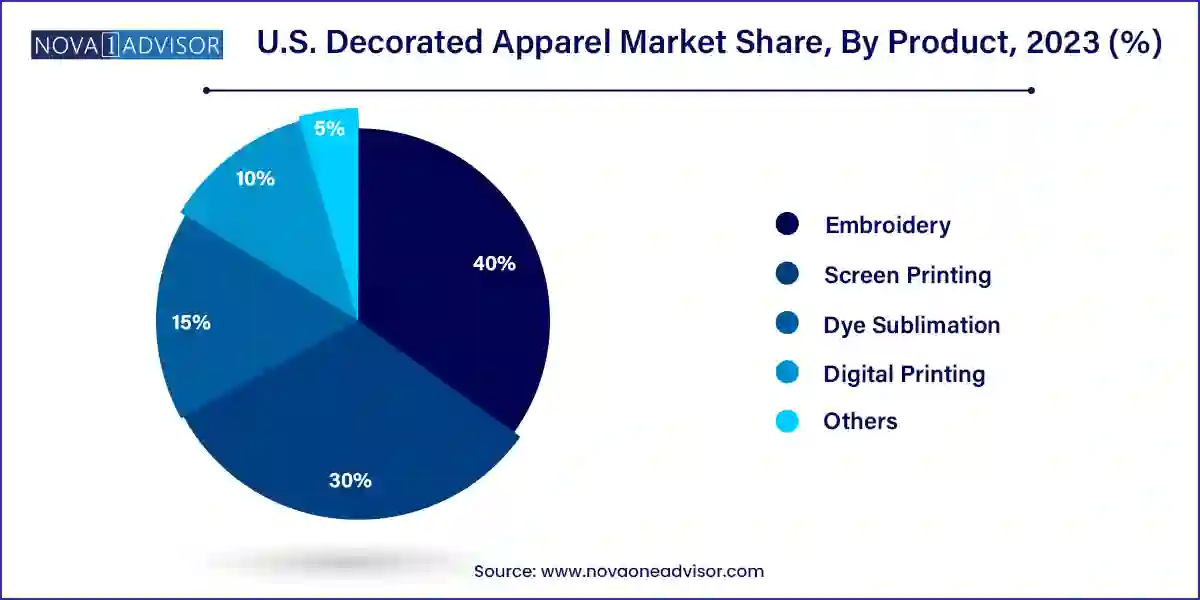

Screen printing remains the dominant method in the U.S. decorated apparel market due to its cost efficiency in bulk production and its long-standing legacy in promotional and branded clothing. It is particularly popular for large-volume orders for corporate uniforms, sports teams, schools, and event merchandise. With the ability to produce vibrant, durable designs, screen printing is often the preferred method when printing on cotton garments with limited color variations. Brands like Gildan and Hanes continue to offer screen-friendly blanks in large quantities, maintaining the segment’s stronghold in commercial applications.

On the other hand, digital printing—especially direct-to-garment (DTG)—is the fastest-growing product segment. With minimal setup time, no screen preparation, and superior resolution for complex and full-color designs, digital printing is ideal for on-demand production. This makes it particularly valuable for independent designers, e-commerce brands, and influencers who require flexibility and speed. The advancements in Kornit and Epson DTG machines, combined with eco-friendly ink technology, have improved image clarity and wash durability, closing the gap with traditional methods. As customization and sustainability take center stage, digital printing is set to revolutionize the decorated apparel landscape in the coming decade.

Men’s decorated apparel continues to dominate the U.S. market, largely due to high demand for branded t-shirts, hoodies, and caps in both casual and workwear categories. Male consumers, especially within younger demographics, frequently engage in purchasing clothing featuring band logos, sports teams, graphic designs, and tech branding. Screen printing and embroidery are heavily used for men’s merchandise, especially in fan-based clothing, promotional items, and event-centric apparel. Additionally, male-focused streetwear and hip-hop fashion further amplify the demand for decorated hoodies and oversized t-shirts with bold prints.

While men lead in volume, women’s decorated apparel is the fastest-growing segment, driven by the rise in athleisure, boutique fashion brands, and influencer-led merchandise. From personalized workout tops and tank tops to fashion-forward statement tees and embroidered denim, women’s apparel reflects broader trends in personalization and niche brand engagement. E-commerce platforms tailored to female shoppers, such as Etsy and Shein, are fostering small business growth in this category. Additionally, social activism and female-led movements have inspired apparel lines featuring slogans and advocacy messages, giving further momentum to women’s decorated clothing.

The U.S. decorated apparel market is one of the most mature and diversified globally, bolstered by strong consumer culture, advanced manufacturing capabilities, and a thriving retail ecosystem. With the U.S. being a hub for both established fashion brands and grassroots creators, decorated apparel serves not just a utilitarian or promotional function but plays a vital cultural and economic role.

Urban centers like Los Angeles, New York City, and Atlanta are design and production hotspots, home to both high-end fashion decorators and large-scale fulfillment centers. Educational institutions, corporate America, non-profits, music festivals, and political campaigns all contribute to sustained demand across printing methods and end-user groups. The nation’s digital-first consumer behavior and preference for DTC brands support the growth of custom apparel businesses. Additionally, the appetite for social identity, celebration of individuality, and creative entrepreneurship fuels steady demand for expressive apparel with personalized decoration.

Printful (March 2024): Printful announced the opening of a new fulfillment center in Texas, aiming to reduce delivery times for U.S. customers and enhance support for its growing base of Shopify and Etsy users.

Kornit Digital (February 2024): Kornit launched its Atlas MAX Plus DTG printer in the U.S. market, offering advanced resolution and support for 3D decorative effects, aimed at mid-size apparel manufacturers and creators.

Custom Ink (January 2024): Custom Ink expanded its decorated sports apparel line, including moisture-wicking embroidered team jerseys and digital print options for school spirit wear.

Gildan Activewear (December 2023): Gildan revealed a sustainable blank t-shirt line optimized for DTG printing, made from recycled cotton and polyester blends, targeting eco-conscious apparel decorators.

TeeSpring (November 2023): TeeSpring rebranded to "Spring" and introduced integrated TikTok shopping for creator merchandise, boosting engagement for social-media-based decorated apparel.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. decorated apparel market

Product

End-user