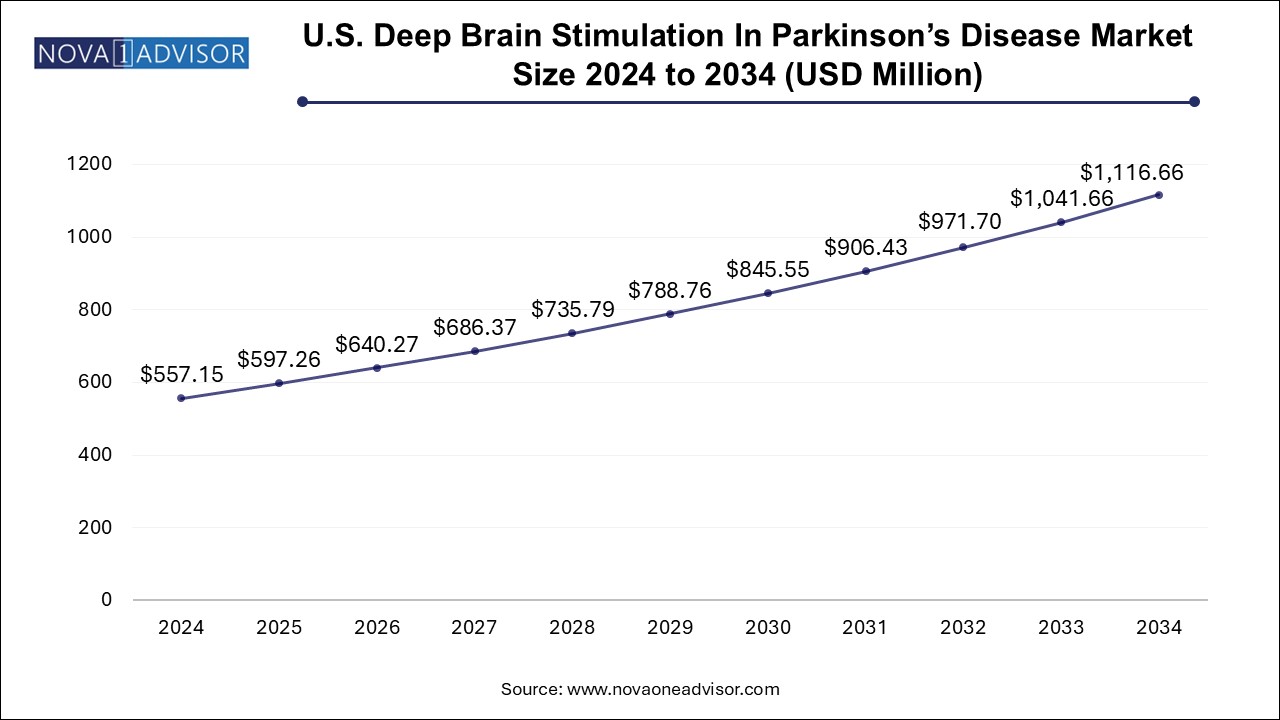

The U.S. deep brain stimulation in Parkinson's disease market size was exhibited at USD 557.15 million in 2024 and is projected to hit around USD 1116.66 million by 2034, growing at a CAGR of 7.2% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 597.26 Million |

| Market Size by 2034 | USD 1116.66 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | ABBOTT; Medtronic; Boston Scientific Corporation |

The market is driven by numerous factors, such as technological advancements in deep brain stimulation (DBS) devices, increasing prevalence of Parkinson’s disease (PD), and government funding for research and development. Through the allocation of funds to research initiatives, the governments actively support groundbreaking discoveries, foster technological innovations, and promote the development of more effective DBS technologies.

For instance, In October 2024, the National Institute of Neurological Disorders and Stroke (NINDS) received funding through the National Advisory Neurological Disorders and Stroke (NANDS) Council. The NANDS Council comprises scientists, clinicians, and public members who advise the NINDS on research priorities, policies, and program planning. As per the data published in December 2023 by the National Institute of Neurological Disorders and Stroke (NINDS), PD research received support from NINDS with a contribution of approximately USD 125 million to the total funding of USD 259 million provided by the National Institutes of Health (NIH). This substantial financial support from NINDS highlighted the commitment to advancing research & understanding of PD, aiming to make strides in its diagnosis, treatment, and overall management.

Increasing government funding propels scientific advancements and encourages collaboration between researchers, medical professionals, and technology developers. The aim is to improve the lives of individuals suffering from PD by advancing the development of DBS therapies. In addition, government support can contribute to making DBS technology more accessible to a broader patient population. This may include initiatives to reduce costs, improve insurance coverage, or subsidize expenses associated with DBS procedures. It plays a pivotal role in catalyzing this progress, propelling market growth, and creating a vibrant landscape for research & development endeavors.

Technological advancements in DBS, which acts as abrainpacemaker for the treatment of PD, are anticipated to propel the market growth in the forecast period. Innovations, such as robot-assisted implantation, enhanced microelectrode designs, multi-target stimulation, rechargeable Implantable Pulse Generators (IPGs), personalized directed programming, and integration of Magnetic Resonance Imaging (MRI), are opening new possibilities. These breakthroughs not only enhance the precision and efficiency of DBS procedures but also pave the way for personalized & more effective treatments. Ongoing advancements in technology enhance DBS treatments, offering enhanced prospects for patients in search of neurostimulation therapies.

For instance, in January 2024, The FDA approved new deep brain stimulation (DBS) systems and software designed to treat movement disorders, including Parkinson's disease. Abbott's Liberta RC and Medtronic's Percept RC are among these systems, both of which offer advanced options for managing these conditions. Additionally, innovative software and algorithms are being developed to enhance the effectiveness and personalization of Parkinson's disease treatments, further advancing the field of neurostimulation.

These new DBS systems provide more precise stimulation and advanced algorithms, improving motor control and reducing symptoms such as tremors, rigidity, and bradykinesia. Advanced software integration enables real-time monitoring and adaptive programming, tailoring the treatment to individual patient needs and response patterns. Systems such as Liberta RC and Percept RC are designed with rechargeable capabilities, reducing the frequency of surgeries required for battery replacement and enhancing patients' convenience. Advanced algorithms and software simplify programming and maintenance, improving the overall experience for patients and healthcare providers.

Moreover, the growing incidence of Parkinson’s disease plays a significant role in driving the market for DBS devices. This condition results from a combination of genetic factors, such as mutations in the alpha-synuclein gene, and environmental influences, including repeated head injuries. Age remains a primary risk factor for the development of PD, highlighting the importance of addressing this health concern. For instance, As of May 2024, Parkinson's Europe estimated that approximately 10 million people worldwide have Parkinson's disease. The number of cases is increasing due to longer life expectancy. According to Parkinson's Foundation's 2022 estimates, number of individuals living with PD was projected to reach 1.2 million by 2030. In the U.S., 90,000 people received PD diagnosis, surpassing numbers for muscular dystrophy, multiple sclerosis, and amyotrophic lateral sclerosis combined. Furthermore, approximately 60,000 new cases of PD are identified each year in the U.S. Rising incidence of Parkinson's Disease (PD) has led to an increased need for DBS as a viable treatment option. DBS has proven essential in providing effective solutions for managing and relieving PD symptoms.

The dual-channel segment led the market with the largest revenue share of 60.0% in 2024 and is expected to register at the fastest CAGR from 2025 to 2034. Dual-channel systems can target multiple brain regions simultaneously. This can be beneficial for patients with complex movement disorders or those experiencing a range of symptoms that may require separate stimulation parameters. Dual-channel DBS offers greater flexibility in adjusting and optimizing therapy for patients with diverse & evolving symptoms. As compared to single-channel systems, dual-channel DBS allows for personalized treatment approaches. Flexibility to stimulate different brain regions independently can be valuable in tailoring therapy to the specific needs of each patient. Moreover, the growing adoption of double-channel DBS for treating Parkinson’s disease is one of the key factors driving segment growth.

The new product launches and technological advancements are facilitating segment growth. For instance, in January 2024, Medtronic Plc announced the U.S. FDA confirmation for its Percept RC DBS system. As the latest addition to Medtronic Percept portfolio, comprising BrainSense technology, Percept PC neurostimulator, and SenSight directional leads, this rechargeable neurostimulator sets a new standard in sensing-enabled DBS systems. Uniquely personalized for patients with movement disorders like PD, essential tremor, dystonia, and epilepsy, the Percept portfolio empowers physicians to tailor treatments. The Percept RC is the most compact and delicate dual-channel neurostimulator in this market. The product is readily available across the U.S., and it is further supported by obtaining CE Mark approval for distribution in Europe. In addition, it is accessible in the Japanese market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. deep brain stimulation in Parkinson's disease market

By Product

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Deep Brain Stimulation In Parkinson’s Disease Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Technological Advancements In Deep Brain Stimulation Devices

3.2.1.2. Increasing Prevalence Of Parkinson’s Disease

3.2.1.3. Government Funding For Research And Development

3.2.2. Market Restraint Analysis

3.2.2.1. Complex Regulatory Framework

3.2.2.2. Risk And Complications Associated With DBS Surgery

3.2.3. Market Opportunities Analysis

3.2.3.1. Increasing Clinical Studies On DBS Assessments For Parkinson's Disease

3.2.4. Market Challenge Analysis

3.2.4.1. Alternatives For DBS System

3.3. U.S. Deep Brain Stimulation In Parkinson’s Disease Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political & Legal Landscape

3.3.2.2. Economic and Social Landscape

3.3.2.3. Technological landscape

Chapter 4. U.S. Deep Brain Stimulation In Parkinson’s Disease Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Deep Brain Stimulation In Parkinson’s Disease Market Movement Analysis

4.3. U.S. Deep Brain Stimulation In Parkinson’s Disease Market Size & Trend Analysis, by Product, 2021 to 2034 (USD Million)

4.4. Single-Channel

4.4.1. Single-Channel U.S. Deep Brain Stimulation In Parkinson’s Disease Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Dual-Channel

4.5.1. Dual-Channel U.S. Deep Brain Stimulation In Parkinson’s Disease Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Competitive Landscape

5.1. Market Participant Categorization

5.2. Key Company Profiles

5.2.1. ABBOTT

5.2.1.1. Company Overview

5.2.1.2. Financial Performance

5.2.1.3. Service Benchmarking

5.2.1.4. Strategic Initiatives

5.2.2. Medtronic

5.2.2.1. Company Overview

5.2.2.2. Financial Performance

5.2.2.3. Service Benchmarking

5.2.2.4. Strategic Initiatives

5.2.3. Boston Scientific Corporation

5.2.3.1. Company Overview

5.2.3.2. Financial Performance

5.2.3.3. Service Benchmarking

5.2.3.4. Strategic Initiatives

5.3. Heat Map Analysis/ Company Market Position Analysis

5.4. Estimated Company Market Share Analysis, 2024

5.5. List of Other Key Market Players