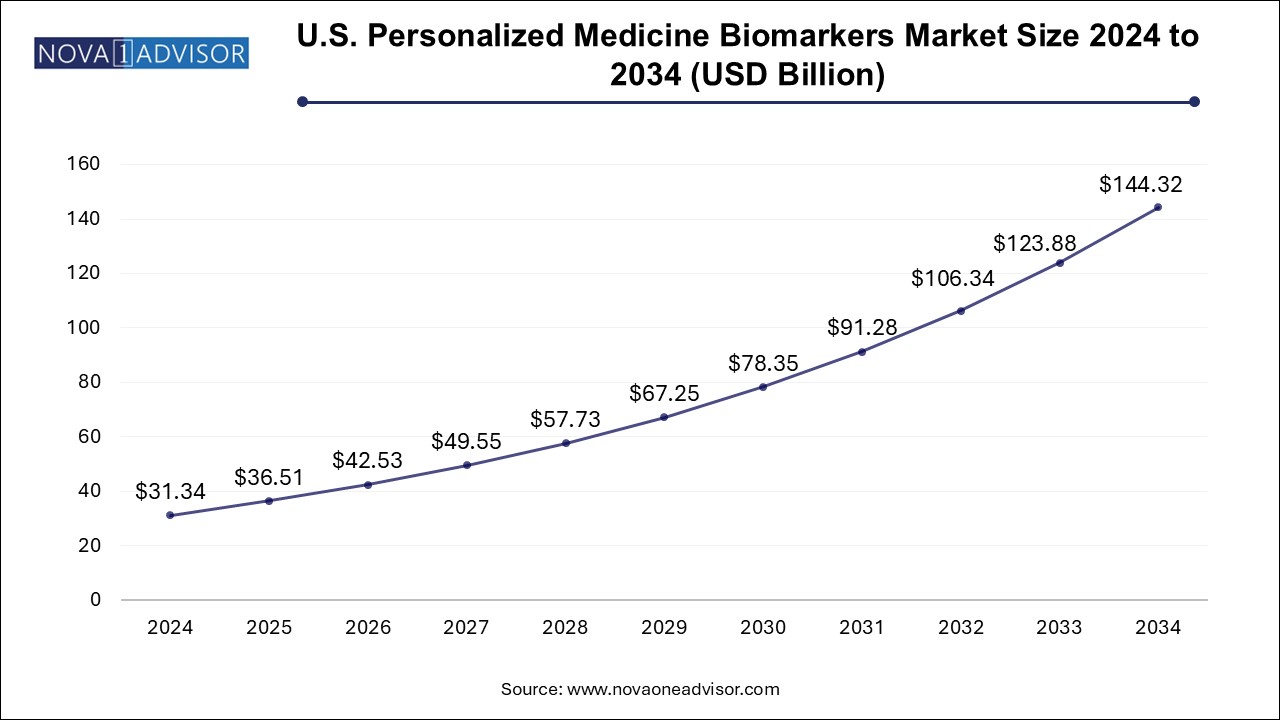

The U.S. dental service organization market size was exhibited at USD 31.34 billion in 2024 and is projected to hit around USD 144.32 billion by 2034, growing at a CAGR of 16.5% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 36.51 Billion |

| Market Size by 2034 | USD 144.32 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 16.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Pacific Dental; Heartland Dental; Aspen Dental; DentalCare Alliance; 42North Dental; Colosseum Dental Group; GSD Dental Clinics; Dentelia; MB2 DENTAL |

An increase in the number of patients with dental conditions, increasing expenditure on dental care, and improved efficiency in non-clinical business management by dental service organizations (DSOs) are some of the major factors driving the market growth.

Most dental practices are increasingly partnering with dental service organizations as they offload administrative burdens and provide access to top-tier technology, allowing the professionals to focus solely on patient care and achieve a better work-life balance. For instance, in December 2024, Heartland Dental, a dental service organization (DSO), partnered with VideaHealth made VideaAI available to support dental facilities to deliver better care through improved clinical operations.

The U.S. dental industry is experiencing significant growth, driven by factors such as increasing awareness of oral health, an aging population with more complex dental needs, and advancements in dental technology. This growth in the dental industry has led to an increased demand for dental services, contributing to the expansion of the dental service organization market. Moreover, these organizations provide dentists with an opportunity to focus on clinical work while benefiting from the business expertise and support offered by them. This partnership allows dentists to concentrate on their core competencies, leading to increased job satisfaction and improved patient care.

Advancements in dental technology have led to the development of new procedures, equipment, and software to improve patient outcomes and streamline dental practice management. Dental service organizations can facilitate the adoption of these technologies across their network of dental practices, providing a competitive advantage and driving growth in the market. According to an article published in November 2024, Dental Service Organization (DSO) University announced its opening in Arizona. This is done with the aim of releasing its new cutting-edge training management software platform and continue its education service for dental service organizations and their staff.

The drivers of the dental service organization market include the growing dental industry, increased dentist entrepreneurship, technology adoption, managed care and dental insurance, enhanced practice management, dental talent recruitment and retention, and the emergence of telehealth and remote dental service. These factors contribute to the continued growth and development of the market. Moreover, several steps are being taken to support and recognize the significant contributions to quality dental care and enhanced patient health. In March 2024, Pacific Dental Services (PDS), which is a dental support organization in the country, celebrated the annual Dental Assistants Recognition Week with the American Dental Assistants Association (ADAA).

The general dentists segment dominated the market in 2024 and is expected to grow at the fastest CAGR over the forecast period. General dentists often struggle with managing the administrative aspects of dental practice, such as accounting, human resources, and marketing. The dental service organization can provide such administrative support, allowing dentists to focus on patient care and clinical work, improving their overall job satisfaction. DSOs can also negotiate better prices for supplies, equipment, and insurance due to their size and purchasing power. The general dentists demand these organizations due to the administrative support, economies of scale, advanced technology, shared knowledge and expertise, access to specialty services, and succession planning benefits provided by DSOs.

Medical supplies procurement held a significant share in the market and accounted for a share of over 21.0% in 2024. Centralized procurement of medical supplies by DSOs allows for better price negotiations with suppliers, leading to cost savings. Moreover, efficient procurement of medical supplies helps DSOs maintain a consistent inventory of essential items across their affiliated practices. This streamlined approach reduces the risk of supply shortages, minimizes operational disruptions, and ensures that dental professionals have the necessary tools to provide quality care. As DSOs expand their network of dental practices, efficient procurement of medical supplies becomes crucial for maintaining consistent care standards and ensuring that new practices can quickly integrate into the organization.

The human resources segment is expected to register the fastest CAGR during the forecast period. The dental service organizations require a constant influx of skilled professionals, such as dentists, hygienists, assistants, and administrative staff. Human resources play a crucial role in attracting and selecting the right talent to ensure the delivery of high-quality dental care services and are responsible for fostering a positive work environment, promoting employee engagement, and addressing any workplace issues. Human resource is highly demanded in dental service organizations due to its crucial role in recruitment, selection, training, performance management, employee engagement, retention, benefits and compensation, compliance, labor relations, and employee wellness.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. dental service organization market

By Service

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Service

1.2.2. End-use

1.2.3. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Volume price analysis (Model 2)

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Service outlook

2.2.2. End-use outlook

2.3. Competitive Insights

Chapter 3. U.S. Dental Service Organization Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. U.S. Dental Service Organization Analysis Tools

3.3.1. Industry Analysis - Porter’s Five Forces

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. U.S. Dental Service Organization Market: Service Estimates & Trend Analysis

4.1. Service Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. U.S. Dental Service Organization by Service Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

4.4.1. Human resources

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2. Marketing and branding

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3. Accounting

4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4. Medical Supplies procurement

4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5. Others

4.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 5. U.S. Dental Service Organization Market: End-use Estimates & Trend Analysis

5.1. End-use Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. U.S. Dental Service Organization by End-use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the Following

5.4.1. Dental surgeons

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.2. Endodontists

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.3. General dentists

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.4. Others

5.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 6. U.S. Dental Service Organization Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. U.S. Dental Service Organization Market by Region Outlook

6.3. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.3.1. West

6.3.1.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

6.3.2. Midwest

6.3.2.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

6.3.3. Northeast

6.3.3.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

6.3.4. Southwest

6.3.4.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

6.3.5. Southeast

6.3.5.1. Market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company heat map analysis, 2023

7.4. Company Profiles

7.4.1. Pacific Dental

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Heartland Dental

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. Aspen Dental

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. DentalCare Alliance

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. 42North Dental

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. Colosseum Dental Group

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. GSD Dental Clinics

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Dentelia

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. MB2 Dental

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives