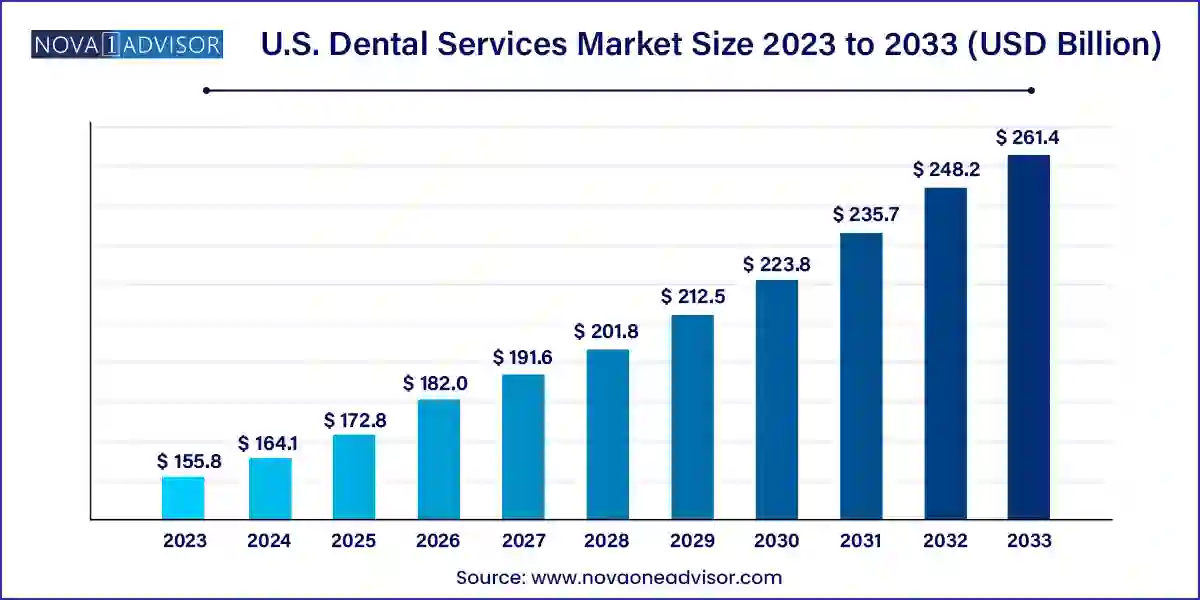

The US dental services market size was exhibited at USD 155.85 billion in 2023 and is projected to hit around USD 261.46 billion by 2033, growing at a CAGR of 5.31% during the forecast period 2024 to 2033.

The U.S. dental services market is a cornerstone of the national healthcare ecosystem, providing critical oral health care that spans preventive, therapeutic, cosmetic, and surgical services. With more than 200,000 active dentists in the country and over 180 million Americans visiting a dentist each year, the market is both expansive and diverse in its offerings. From routine cleanings and cavity fillings to complex orthodontics and full-mouth restorations, dental services cater to patients of all ages and backgrounds.

The market has witnessed remarkable transformation over the past decade. Shifts in consumer expectations, technological advancements, rising aesthetic consciousness, and healthcare policy reforms have collectively shaped a new era in dental care. Dentistry in the U.S. has evolved from a reactive model focused on treating disease to a proactive, prevention-driven model that emphasizes lifelong oral health.

Importantly, cosmetic and restorative dentistry has moved into the mainstream, supported by innovations in digital imaging, clear aligners, CAD/CAM technology, and minimally invasive techniques. Meanwhile, the consolidation of private practices into Dental Service Organizations (DSOs) such as Heartland Dental and Aspen Dental is changing the competitive landscape, bringing economies of scale and standardized patient care models to the forefront.

The COVID-19 pandemic disrupted the dental services industry temporarily, forcing clinics to close or limit services. However, the post-pandemic rebound has been swift, fueled by deferred demand and renewed consumer interest in oral health and appearance. Moreover, the increasing integration of dental care into general health insurance plans is contributing to market expansion by lowering cost barriers.

Rapid Growth of Cosmetic Dentistry Services: From teeth whitening to smile makeovers, aesthetic services are gaining immense popularity among millennials and Gen Z.

Expansion of Dental Service Organizations (DSOs): Corporate dental chains are consolidating the market, particularly in suburban and rural areas.

Adoption of Teledentistry and Digital Diagnostics: Virtual consultations, AI-powered radiology, and digital impressions are enhancing care accessibility and precision.

High Demand for Clear Aligners: Products like Invisalign have disrupted traditional orthodontics by offering a discreet and comfortable solution.

Rise in Laser Dentistry and Painless Treatments: Minimally invasive procedures are increasing in popularity among anxious and pediatric patients.

Greater Integration with General Healthcare Systems: Oral health is being increasingly linked to systemic health in U.S. healthcare policies.

Increasing Use of Subscription and Financing Models: Clinics offer installment payment plans and dental membership programs to improve affordability.

| Report Coverage | Details |

| Market Size in 2024 | USD 164.13 Billion |

| Market Size by 2033 | USD 261.46 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.31% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Services, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Smile Brands Inc., Aspen Dental, InterDent (Gentle Dental), Coast Dental, Pacific Dental Services, Heartland Dental, Affordable Care, Great Expressions Dental Centers, Western Dental, Dental Care Alliance |

A key driver in the U.S. dental services market is the booming demand for cosmetic and elective procedures, driven by social media influence, lifestyle aspirations, and the desire for a confident smile. Cosmetic dentistry is no longer considered a luxury for celebrities; it has become a cultural norm, especially among working professionals and younger generations.

The availability of minimally invasive, same-day treatments using CAD/CAM, laser, and 3D imaging technologies has increased accessibility. Clear aligners like Invisalign, tooth-colored veneers, and advanced whitening techniques are increasingly sought after. Patients are also more inclined to invest in composite bonding and full-mouth reconstruction for aesthetic enhancement. Clinics now market these services directly to consumers via social platforms, contributing to growing footfalls and revenue from aesthetic dental offerings.

According to surveys, nearly 60% of U.S. adults are willing to undergo cosmetic dental treatments, and over 80% consider a healthy smile an essential part of their personal and professional image. The cumulative impact is a steady stream of elective procedures, which command higher margins and require less insurance dependency, driving significant revenue growth for dental practices.

Despite growing awareness and technological advancements, cost remains a significant barrier to accessing dental services for a large portion of the U.S. population. Many dental procedures especially cosmetic, orthodontic, and implant-related are only partially covered by insurance or excluded altogether.

Even routine care such as cleanings, fillings, and X-rays can be prohibitively expensive for uninsured or underinsured individuals. According to the CDC, approximately one in four adults in the U.S. has untreated dental decay, with cost being cited as the primary reason for avoidance. This problem is especially pronounced in underserved rural areas and among low-income groups.

Additionally, while Medicare and Medicaid cover certain dental services in specific states, there is no uniform federal dental benefit, leaving many senior citizens and disabled individuals without adequate oral care access. These gaps lead to deferred treatment, complications, and wider healthcare costs highlighting the need for better integration of dental coverage in public and private health insurance plans.

One of the most promising opportunities in the U.S. dental services market lies in the adoption of digital workflows and AI-based tools. Digitization is streamlining diagnostics, treatment planning, and execution leading to faster, more accurate, and patient-friendly services.

From intraoral scanners that eliminate traditional impressions to AI-enabled radiographic analysis that detects cavities, bone loss, or lesions earlier than ever, digital transformation is redefining dental care delivery. Same-day crowns using CAD/CAM, virtual orthodontic assessments, and 3D-printed dentures are enabling high efficiency with improved patient satisfaction.

In parallel, tele-dentistry platforms are making it easier for patients in remote areas to access care and for providers to offer initial consultations, triage, or post-procedure follow-ups. AI-powered treatment planning for clear aligners or implant placement enhances precision and reduces human error. As the costs of digital equipment fall and adoption increases among mid-sized practices, this segment is poised for robust expansion.

Diagnostic and preventive services represent the largest segment of the U.S. dental services market. These include cleanings, oral exams, X-rays, fluoride treatments, and sealants—all of which are fundamental to maintaining long-term oral health and catching problems early. Most insurance plans cover these services, making them widely accessible. Additionally, national awareness programs like the ADA's “MouthHealthy” campaign have emphasized prevention as the best path to cost-effective oral care. Dental chains and DSOs also use preventive services as a gateway to build patient loyalty and recommend advanced procedures.

On the other hand, cosmetic dentistry is the fastest-growing service segment. Advancements in smile design, tooth-colored materials, and laser contouring have made cosmetic procedures more appealing, less painful, and more accessible than ever. Teeth whitening, porcelain veneers, and composite bonding are now common offerings in both general and specialty clinics. The marketing of “smile makeovers” and the influence of celebrities and social media influencers have normalized cosmetic dental procedures, particularly among young adults and urban professionals. Practices that invest in aesthetic services often see higher per-patient revenue and increased word-of-mouth referrals.

| By Services | 2020 | 2021 | 2022 | 2023 |

| Cosmetic Dentistry | 10.76 | 13.61 | 14.71 | 15.88 |

| Endodontic Procedures | 30.77 | 37.66 | 39.38 | 41.09 |

| Periodontal Dentistry | 12.30 | 15.21 | 16.07 | 16.95 |

| Orthodontic and Periodontic Services | 15.22 | 18.77 | 19.77 | 20.80 |

| Diagnostic and Preventive Services | 19.15 | 24.56 | 26.89 | 29.39 |

| Oral and Maxillofacial Surgery | 15.27 | 19.28 | 20.80 | 22.39 |

| Others | 5.82 | 7.32 | 7.87 | 8.45 |

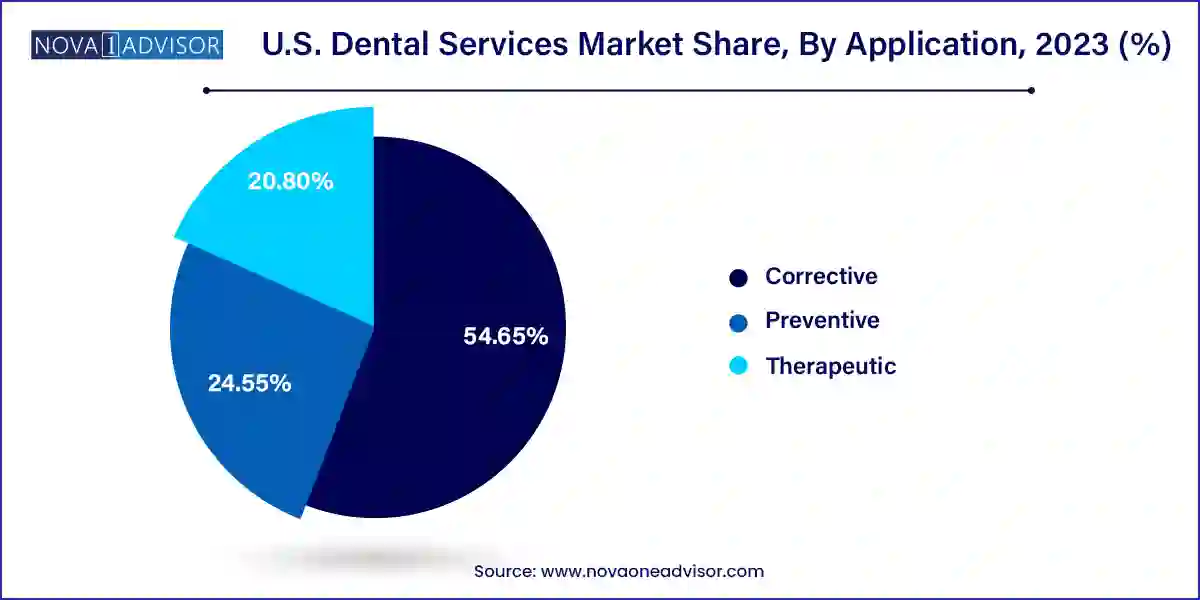

Preventive applications dominate the U.S. dental services market by volume. These services include dental check-ups, professional cleanings, sealants, and fluoride applications critical for children, adolescents, and older adults alike. Public health initiatives, school dental programs, and private insurance policies often cover preventive procedures at low or no cost. The ADA and CDC have been vocal advocates of early intervention, highlighting that a dollar spent on prevention can save several in restorative and emergency care. As a result, preventive dentistry continues to drive a steady stream of patient visits.

However, corrective applications are growing at the fastest pace. This category includes orthodontic treatments, dental implants, fillings, and bridges procedures aimed at correcting functional or structural dental issues. The increased demand for Invisalign and similar clear aligners, as well as full-mouth implant solutions for edentulous patients, are key contributors to the growth. Baby boomers seeking to replace lost teeth with permanent solutions and younger patients pursuing orthodontic correction for bite and alignment issues are driving corrective applications. As these procedures become more advanced, predictable, and accessible through financing plans, their growth trajectory is expected to accelerate.

| By Services | 2020 | 2021 | 2022 | 2023 |

| Preventive | 24.97 | 31.88 | 34.77 | 37.84 |

| Corrective | 61.26 | 75.71 | 79.95 | 84.29 |

| Therapeutic | 23.06 | 28.82 | 30.78 | 32.83 |

Within the United States, dental service utilization is not uniform across all states and demographics. Urban and suburban regions such as California, New York, Texas, and Florida have high concentrations of dental providers, advanced care facilities, and access to specialty services. These states also lead in cosmetic and implant dentistry due to their affluent populations and lifestyle-driven demand.

In contrast, rural states and underserved communities such as parts of Appalachia and the Deep South struggle with provider shortages, limited insurance coverage, and low oral health literacy. Initiatives like the Health Resources and Services Administration’s (HRSA) National Health Service Corps dental provider program aim to address these disparities by incentivizing dentists to work in rural areas.

Furthermore, pediatric oral health initiatives have gained traction in states like Vermont and Oregon, where early intervention programs in schools are helping reduce long-term dental complications. Meanwhile, states like Colorado and Arizona have emerged as hubs for dental tourism due to competitive pricing and high-quality care, particularly in border regions.

February 2025: Heartland Dental, one of the largest DSOs in the U.S., announced the opening of its 1,500th affiliated practice and launched a digital learning platform for clinician upskilling.

December 2024: SmileDirectClub expanded its partnership with Walmart to offer direct-to-consumer oral care products at over 4,000 locations nationwide.

November 2024: Aspen Dental introduced AI-assisted radiograph analysis across its clinics, improving diagnostics and case acceptance rates.

September 2024: Pacific Dental Services collaborated with Envista Holdings to implement 3D printing and same-day restoration technology in over 800 locations.

July 2024: Dental365, a fast-growing dental chain in the Northeast, raised $50 million in funding to expand its services to the Midwest and integrate teledentistry platforms.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the US dental services market

By Services

By Application