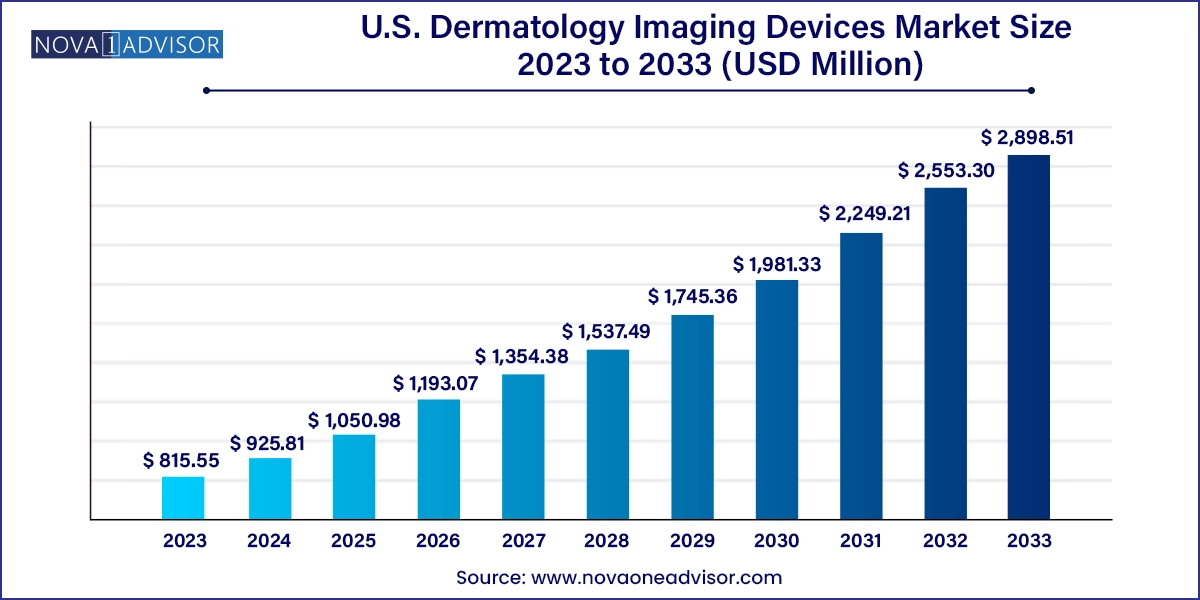

The U.S. dermatology imaging devices market size was exhibited at USD 815.55 million in 2023 and is projected to hit around USD 2,898.51 million by 2033, growing at a CAGR of 13.52% during the forecast period 2024 to 2033.

The U.S. dermatology imaging devices market is undergoing a significant transformation, driven by technological advancements in medical imaging, rising prevalence of skin diseases, and increasing consumer awareness about early diagnosis and aesthetic treatments. Dermatology imaging devices have become an integral part of clinical dermatology, aiding physicians in diagnosing, monitoring, and planning treatment strategies for various dermatological conditions ranging from skin cancer and inflammatory diseases to cosmetic and reconstructive surgeries.

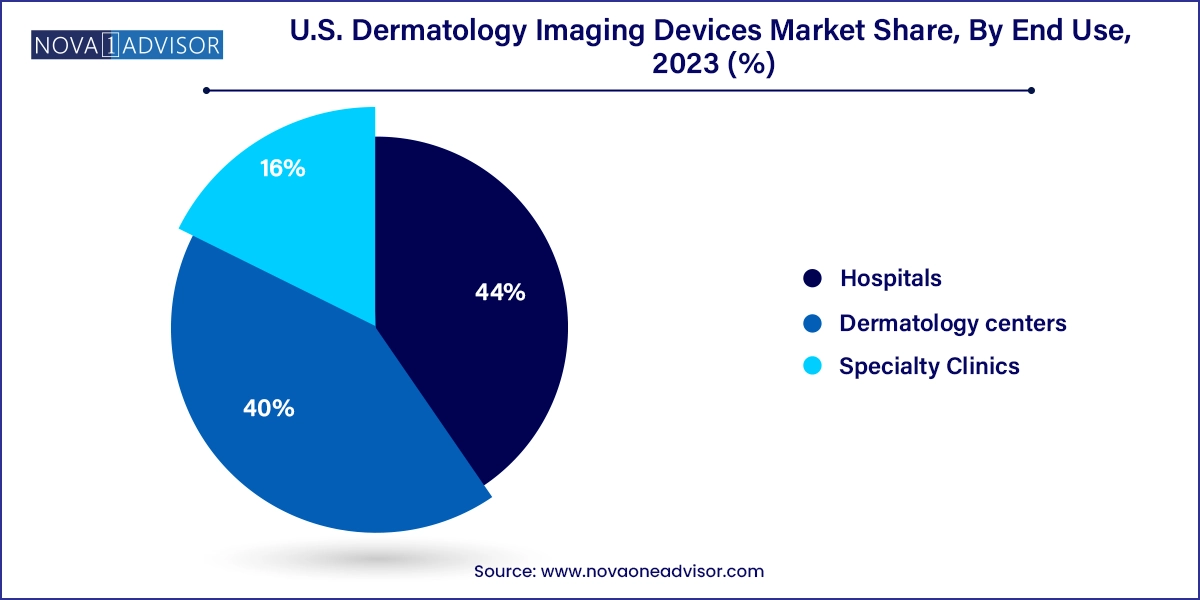

The market comprises several modalities including digital photographic imaging, dermatoscopy, optical coherence tomography (OCT), and high-frequency ultrasound. These devices provide non-invasive, high-resolution visualization of the skin, offering crucial insights into subsurface skin layers and enhancing diagnostic accuracy. With growing healthcare expenditures, aging population, and a rising number of dermatology visits in the U.S., the demand for dermatology imaging devices has surged across hospitals, dermatology centers, and specialty clinics.

Skin cancer remains one of the most commonly diagnosed cancers in the U.S., with melanoma cases rising steadily over the years. The American Cancer Society estimates that over 100,000 new cases of melanoma are diagnosed annually. Dermatology imaging devices, particularly dermatoscopes and OCT, have proven essential in early melanoma detection, improving patient outcomes and reducing healthcare costs. Moreover, the increasing use of digital imaging platforms integrated with artificial intelligence (AI) is reshaping the diagnostic landscape, offering real-time diagnostic support and remote consultation capabilities.

The COVID-19 pandemic further accelerated the shift toward teledermatology and digital imaging solutions, with healthcare providers investing in portable, high-resolution imaging systems for remote diagnosis. As a result, the U.S. dermatology imaging devices market has emerged as a dynamic, innovation-driven sector with considerable future potential.

AI-Driven Dermatological Imaging: Increasing integration of AI and machine learning algorithms into dermatology imaging platforms for automated lesion detection and malignancy classification.

Adoption of Portable Devices: Rising demand for compact, handheld imaging devices enabling point-of-care diagnosis and teledermatology services.

Cloud-Based Image Storage & Analysis: Growth of platforms offering cloud-based storage and analysis solutions, enabling secure access and multi-location collaboration for dermatologists.

Rise of Teledermatology: Expansion of remote consultation services leading to wider adoption of imaging devices compatible with telehealth platforms.

Multimodal Imaging Systems: Development of devices combining dermoscopy, OCT, and ultrasound to offer comprehensive imaging in a single unit.

Integration with Electronic Health Records (EHRs): Streamlined interoperability with EHRs for improved data management and documentation.

Focus on Pediatric Dermatology Imaging: Specialized imaging solutions tailored for pediatric dermatological disorders, offering non-invasive and child-friendly operation.

| Report Coverage | Details |

| Market Size in 2024 | USD 925.81 Million |

| Market Size by 2033 | USD 2,898.51 Million |

| Growth Rate From 2024 to 2033 | CAGR of 13.52% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Modality, Application, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Caliber Imaging and Diagnosis; Canfield Scientific, Inc.; Clarius; Cortex Technology; Courage+Khazaka electronic GmbH; DermLite; DRAMIŃSKI S. A.; e-con Systems Inc.; FotoFinder Systems GmbH; GE HealthCare; Koninklijke Philips N.V.; Longport, Inc.; Michelson Diagnostics Ltd (MDL); VisualSonics |

Rising Incidence of Skin Cancer in the U.S.

One of the most prominent drivers propelling the growth of the U.S. dermatology imaging devices market is the escalating prevalence of skin cancers, particularly melanoma. According to the Centers for Disease Control and Prevention (CDC), skin cancer is the most common cancer in the U.S., and early detection significantly improves treatment success. Dermatology imaging technologies like dermatoscopes and OCT devices facilitate early diagnosis by enabling visualization of pigmented lesions and tumor margins with remarkable precision.

Technological advancements have made these tools more accessible and affordable, promoting routine skin checks among patients and proactive diagnosis by healthcare providers. Imaging-assisted screening in primary care and dermatology settings has become the standard approach for evaluating suspicious skin lesions, helping to reduce unnecessary biopsies and enabling early intervention. The national focus on preventative healthcare, coupled with rising public awareness and dermatological education campaigns, further bolsters the market's growth momentum.

High Cost of Advanced Imaging Technologies

Despite promising growth prospects, the high initial cost and maintenance of dermatology imaging devices remain a major restraint. Advanced modalities such as OCT and high-frequency ultrasound are expensive, with system prices ranging from tens to hundreds of thousands of dollars. These cost barriers limit accessibility for small dermatology practices and rural clinics, where budget constraints are significant. Additionally, the lack of uniform reimbursement policies for dermatology imaging procedures further disincentivizes healthcare providers from adopting these technologies.

Training requirements, system calibration, and regular software updates also add to the operational burden. Although portable and digital imaging solutions are emerging as more affordable alternatives, the full capabilities of multimodal systems remain financially out of reach for many facilities, thereby slowing the adoption rate in underfunded regions and practices.

Integration of AI with Dermatology Imaging Devices

The integration of artificial intelligence (AI) with dermatology imaging devices presents a transformative opportunity for the market. AI-powered platforms can analyze thousands of dermoscopic images in seconds, aiding clinicians in detecting skin cancers, inflammations, or cosmetic abnormalities with higher accuracy and speed. AI algorithms trained on large datasets offer predictive analytics, risk stratification, and automatic lesion classification, dramatically improving diagnostic outcomes and reducing interobserver variability.

Startups and tech giants alike are investing in AI for dermatology. For instance, Google's AI research division has developed a skin condition classifier capable of identifying over 200 skin conditions. The application of AI extends to workflow automation, patient triaging, image enhancement, and clinical decision support. As regulatory approvals for AI-enabled systems increase, particularly from the FDA, these technologies are expected to witness widespread integration into U.S. dermatology practices over the coming years.

Digital photographic imaging dominated the U.S. dermatology imaging devices market by modality, due to its widespread adoption, cost-effectiveness, and compatibility with telemedicine platforms. These systems are frequently used in routine dermatological assessments and cosmetic consultations. Digital imaging offers standardized, high-resolution skin documentation, facilitating comparative analysis over time, which is crucial for tracking lesion changes or treatment outcomes. Moreover, photographic archives are vital for patient education, insurance documentation, and legal referencing. Healthcare providers prefer digital imaging for its user-friendliness, storage efficiency, and real-time sharing capabilities.

However, optical coherence tomography (OCT) is anticipated to emerge as the fastest-growing segment in the coming years. OCT provides cross-sectional images of skin layers without invasive procedures and is particularly valuable in diagnosing basal cell carcinoma, actinic keratosis, and inflammatory diseases. It has been gaining traction in both academic and clinical settings for its ability to guide biopsies and monitor non-melanoma skin cancers during non-surgical treatments. The ongoing miniaturization of OCT devices and AI-driven image analysis software is further accelerating adoption.

The skin cancer segment accounted for the largest share of the market, driven by the increasing burden of melanoma and non-melanoma skin cancers across the U.S. Advanced imaging devices are used not only for early detection but also for pre-surgical planning, therapeutic monitoring, and recurrence tracking. Imaging technologies help differentiate between benign and malignant lesions, allowing dermatologists to make informed biopsy decisions. As precision oncology becomes more prevalent, imaging is expected to play a pivotal role in early-stage cancer management, aligning with the U.S. Preventive Services Task Force's recommendations for regular skin checks in high-risk populations.

Meanwhile, the plastic and reconstructive surgery segment is expected to exhibit the fastest growth over the forecast period. With the growing popularity of aesthetic dermatology, including botox, fillers, scar removal, and skin rejuvenation procedures, imaging tools are increasingly used for planning and post-procedure evaluation. High-frequency ultrasound and photographic imaging systems assist in visualizing dermal layers and vascular structures before interventions. Moreover, patient engagement tools that use imaging for “before and after” comparisons are gaining popularity in cosmetic dermatology, supporting market expansion in this segment.

Hospitals held the dominant share of the market due to their comprehensive infrastructure, multidisciplinary teams, and capacity to invest in advanced imaging equipment. Large hospitals often have dedicated dermatology departments equipped with OCT, dermatoscopy, and digital imaging systems to support both diagnostic and surgical dermatology. Moreover, hospitals cater to a higher patient volume, including referrals for complex dermatological conditions requiring imaging-supported diagnosis. They also participate in clinical research, which necessitates the use of imaging modalities for data collection and validation.

The specialty clinics segment, however, is projected to witness the fastest growth. These facilities, often operated by board-certified dermatologists or plastic surgeons, focus specifically on dermatological conditions and cosmetic treatments. Specialty clinics are agile, quick to adopt cutting-edge technologies, and increasingly invest in portable and AI-integrated devices to differentiate themselves in the competitive landscape. With patients seeking specialized, tech-enabled care for both medical and aesthetic concerns, these clinics are becoming pivotal growth centers for imaging device manufacturers.

The U.S. market is characterized by high awareness, a mature healthcare infrastructure, and substantial R&D investments. There is a growing emphasis on early diagnosis and outpatient dermatology services, spurring demand for compact and affordable imaging devices. States like California, Florida, Texas, and New York report high volumes of dermatology visits due to their large populations, high sun exposure, and awareness campaigns promoting skin health. These regions also house several academic medical centers leading clinical trials involving dermatology imaging technologies.

Government initiatives such as the Skin Cancer Prevention Progress Report by the CDC and increasing reimbursements for digital skin evaluations through Medicare have further contributed to market penetration. Additionally, the rise in consumer-driven healthcare, including the growth of medispas and online dermatology platforms, is transforming how dermatological services are delivered. Urban regions are especially witnessing a boom in dermatology clinics equipped with advanced imaging setups to cater to both diagnostic and cosmetic demands.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. dermatology imaging devices market

Modality

Application

End Use

Regional