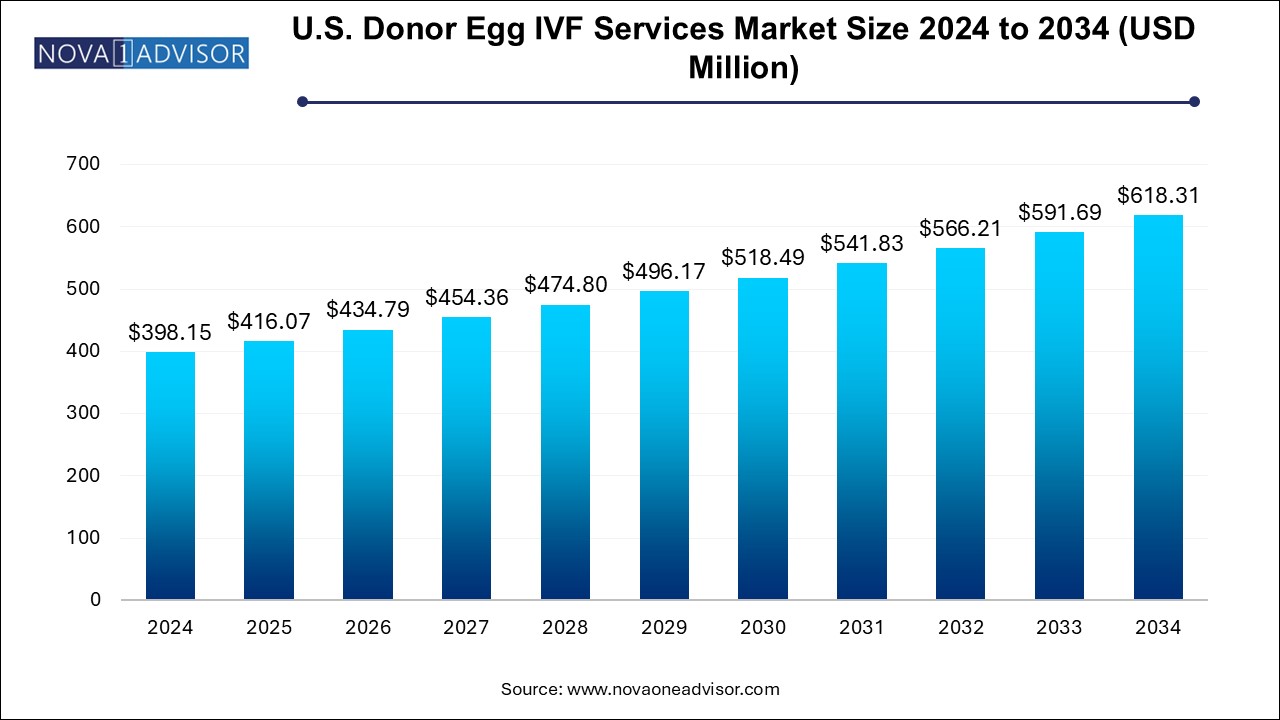

The U.S. donor egg IVF services market size was exhibited at USD 398.15 million in 2024 and is projected to hit around USD 618.31 million by 2034, growing at a CAGR of 4.5% during the forecast period 2024 to 2034.

The U.S. Donor Egg In Vitro Fertilization (IVF) Services Market is evolving rapidly, shaped by a confluence of medical advancements, socio-demographic changes, and increasing awareness about fertility treatments. As infertility affects a significant portion of the reproductive-age population in the U.S., donor egg IVF has emerged as a critical intervention for individuals and couples unable to conceive using their own eggs. This includes women with diminished ovarian reserve, advanced maternal age, same-sex couples, and those with a history of failed IVF cycles.

With more than 8 million babies born globally through IVF and related techniques, the procedure has become not only scientifically sophisticated but also socially acceptable. In the United States, the Centers for Disease Control and Prevention (CDC) reported that over 330,000 Assisted Reproductive Technology (ART) cycles were performed in 2022, with a notable share involving donor eggs. The acceptance of donor egg IVF in the U.S. is fueled by the country’s regulatory clarity, availability of advanced healthcare infrastructure, and access to top-tier fertility specialists.

Key metropolitan areas such as New York, Los Angeles, Chicago, and Boston host some of the most renowned fertility clinics globally. These centers not only provide access to cutting-edge technology but also offer a wide range of donor profiles, extensive screening protocols, and personalized treatment options. Donor egg IVF services have become increasingly patient-centric, leveraging genetic matching, egg banks, and digital platforms to improve transparency and convenience for patients.

Moreover, societal shifts, including delayed parenthood due to career focus and financial planning, have significantly contributed to the market's expansion. Women in their late 30s and 40s now constitute a large segment of the IVF user base. Egg donation, whether from fresh or frozen donors, has offered a ray of hope to these individuals. Insurance coverage for fertility services, though still limited, is also gradually improving in several U.S. states, further supporting market growth.

Rising Demand for Frozen Donor Eggs: Increased convenience, cost-efficiency, and wider donor selection are making frozen eggs the preferred choice.

Genetic and Ancestry Matching Services: Growing importance of personalized medicine and heritage-based donor matching is transforming donor selection processes.

Telehealth Integration: Virtual consultations and remote coordination between clinics, labs, and patients are becoming mainstream in IVF planning.

Growing LGBTQ+ Acceptance: Inclusive services and legal recognition for same-sex couples are fueling demand from non-traditional families.

Increase in Cross-State and International Egg Donation: Patients are traveling across state lines to access favorable legal frameworks or high-ranked clinics.

Advanced Embryo Screening (PGT-A): Preimplantation Genetic Testing for Aneuploidy is becoming standard to increase success rates.

Rise in Employer-Sponsored Fertility Benefits: Tech and corporate giants like Google, Amazon, and Apple offer egg donation IVF coverage, supporting market accessibility.

Growing Use of Artificial Intelligence in IVF: AI is assisting in embryo selection and improving treatment personalization.

| Report Coverage | Details |

| Market Size in 2025 | USD 416.07 Million |

| Market Size by 2034 | USD 618.31 Million |

| Growth Rate From 2024 to 2034 | CAGR of 4.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Shady Grove Fertility.; Hamilton Thorne; Seattle Reproductive Medicine, Inc. Fertility Centers of Illinois; New Hope Fertility Clinic; Weill Cornell Medicine.; CCRM Fertility.; RMA Network.; RADfertility; Pinnacle |

Delayed Parenthood and Age-Related Fertility Decline

One of the most potent drivers of the U.S. donor egg IVF services market is the trend toward delayed parenthood, particularly among urban, educated populations. With more women pursuing higher education, advanced degrees, and career aspirations, many are choosing to start families later in life. According to the CDC, the average age of first-time mothers in the U.S. has increased to nearly 30 years. However, fertility begins to decline significantly after the age of 35 due to diminished ovarian reserve and egg quality.

Donor egg IVF has become a clinically validated solution for women in this demographic. It offers higher success rates compared to autologous IVF in older age groups. For example, women using donor eggs often experience pregnancy success rates exceeding 50%, compared to significantly lower rates in those using their own eggs after age 40. Fertility clinics actively promote donor programs to meet this growing demand, with personalized consultations and advanced reproductive technologies enhancing patient outcomes and satisfaction.

Ethical and Emotional Complexities of Egg Donation

Despite its benefits, the donor egg IVF market in the U.S. faces significant restraints due to ethical, psychological, and legal complexities surrounding egg donation. Donors and recipients often face emotional challenges, including questions of genetic lineage, parental identity, and disclosure to offspring. Many potential parents grapple with the idea of raising a child not genetically related to one or both partners.

Moreover, regulatory inconsistencies across states can complicate matters, especially concerning anonymity, parental rights, and donor compensation. While the American Society for Reproductive Medicine (ASRM) provides ethical guidelines, they are not enforceable laws. Some recipients may also face social stigma or personal hesitation, particularly in communities with cultural or religious sensitivities. These emotional barriers and the absence of a unified national regulatory framework can hinder the expansion of the donor egg IVF segment, particularly among hesitant first-time users.

Expansion of Fertility Preservation and Egg Banking Services

The growing popularity of elective egg freezing among younger women presents a significant opportunity for the donor egg IVF market. With more women freezing their eggs in their 20s and early 30s for future use, egg banks are growing both in inventory and sophistication. This trend not only creates a broader pool of high-quality eggs for donation but also supports egg sharing programs, where women undergoing IVF can donate some of their retrieved eggs in exchange for cost discounts or compensation.

In addition, fertility preservation is becoming more common among cancer patients undergoing chemotherapy and radiation. With proactive egg retrieval and storage before treatment, these patients can access IVF services using their own or donor eggs later in life. Clinics and egg banks that integrate genetic screening, cryopreservation, and donor-matching algorithms can capitalize on this evolving demand. Companies such as Donor Egg Bank USA and Fairfax EggBank are expanding partnerships with clinics nationwide to scale their services and improve access to frozen donor egg programs.

Frozen donor eggs dominated the U.S. donor egg IVF services market and continue to be the most preferred option due to their logistical and clinical advantages. Frozen eggs offer the convenience of immediate availability, eliminating the need to synchronize donor and recipient cycles. This reduces overall treatment timelines and allows greater flexibility in scheduling, a crucial factor for busy professionals and couples planning treatment around work or travel. Additionally, frozen egg banks maintain large inventories, allowing recipients to browse donor profiles online and select candidates based on detailed genetic, physical, and ethnic attributes. Clinical studies have shown comparable pregnancy success rates between frozen and fresh eggs, further validating their utility.

Fresh donor eggs are projected to witness relatively slower but stable growth, driven by their continued use in high-end clinics where personalized protocols are emphasized. Despite the increasing reliance on frozen eggs, fresh donations are still preferred in cases requiring higher fertilization potential or for patients concerned about cumulative embryo development rates. Some clinics report marginally higher success in live births from fresh cycles, and certain recipients feel more comfortable knowing the exact timeline of retrieval and fertilization. The fresh donation process also fosters a closer connection between the donor and recipient in directed donation settings, particularly among family or close acquaintances.

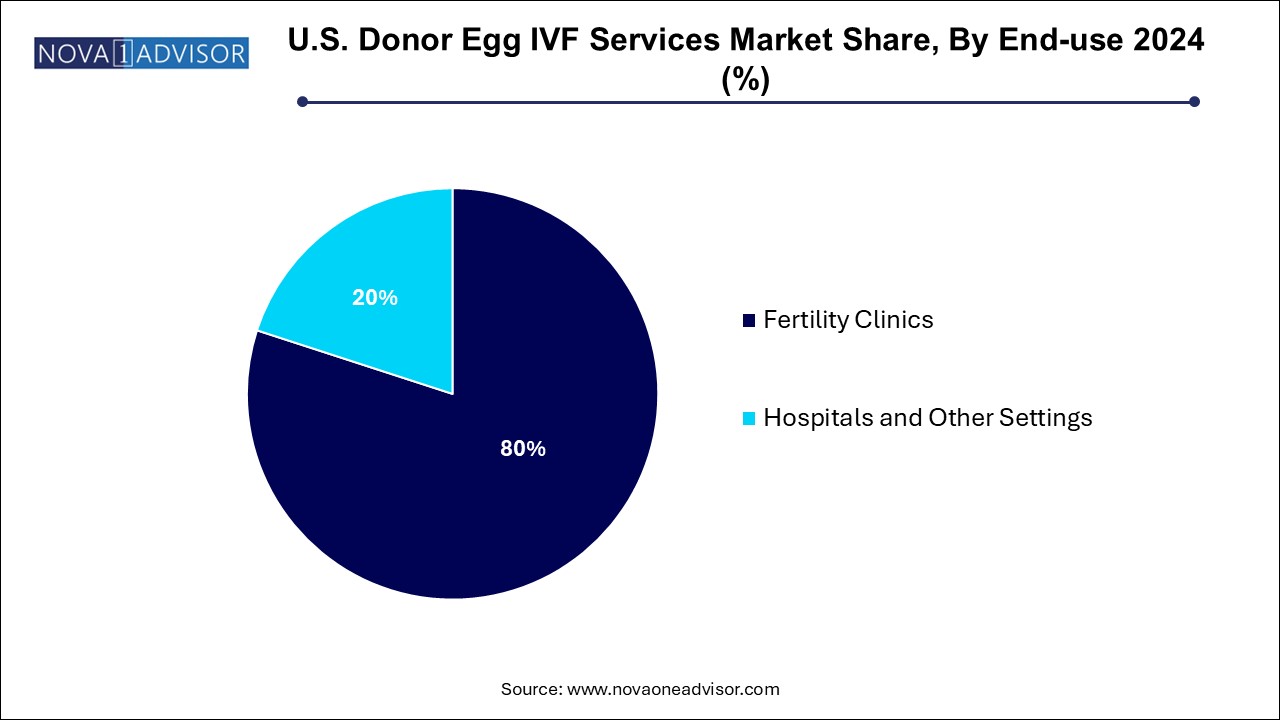

The fertility clinics segment dominated the U.S. donor egg IVF services industry with the largest revenue share of 80.0% in 2024 and is projected to witness the highest CAGR over the forecast period, Accounting for a majority of the procedures conducted nationwide. These specialized centers offer comprehensive services, including donor matching, medical screening, egg retrieval, fertilization, embryo culture, transfer, and storage. Clinics such as Shady Grove Fertility, CCRM, and RMA New Jersey have established strong reputations and multi-state networks, driving patient volume and trust. Fertility clinics often work in partnership with third-party egg banks to offer a wider donor pool and integrate genetic screening into their services. They also employ reproductive endocrinologists and embryologists with specialized expertise, enhancing patient confidence in outcomes.

Hospitals and other settings, including OB-GYN practices and specialty women’s health centers, are witnessing faster growth in donor egg IVF services. This growth is primarily due to the integration of fertility services into broader women’s healthcare. Hospitals are increasingly recognizing the value of offering ART services under one roof, particularly in metropolitan regions with a high concentration of patients requiring advanced fertility care. Furthermore, hospital-affiliated programs are often more likely to be covered under insurance plans or employer health benefits, making them an attractive choice for cost-conscious patients. These institutions also benefit from access to multidisciplinary medical teams, which is particularly useful for patients with comorbidities or complex reproductive histories.

Across the U.S., access to donor egg IVF services varies significantly based on geographic location, healthcare infrastructure, and state-level legislation. States like California, New York, and Massachusetts are home to some of the highest-performing fertility centers, with robust egg donor programs and established legal frameworks supporting both anonymous and directed donations. These states also have progressive mandates requiring insurers to cover infertility diagnosis and treatment, increasing patient access to donor egg services.

In contrast, more conservative states may impose stricter regulations or lack insurance mandates for fertility treatments, which can limit accessibility. However, digital platforms and telehealth consultations are bridging this gap, enabling patients from under-served regions to connect with out-of-state clinics and coordinate cross-border treatments. Nationally, the Society for Assisted Reproductive Technology (SART) continues to standardize practice guidelines and provide outcome transparency, which helps patients make informed decisions about where and how to pursue treatment.

Additionally, major employers in urban hubs are driving demand through inclusive fertility benefit programs. Companies in the tech, finance, and consulting sectors are covering the cost of egg donation cycles and IVF as part of employee wellness packages. This has normalized donor egg IVF not only among women with infertility but also among those proactively planning for future parenthood or exploring alternative family-building paths.

January 2025: Shady Grove Fertility announced the launch of a new AI-powered embryo selection tool designed to enhance IVF outcomes by identifying the most viable embryos for implantation.

February 2025: Donor Egg Bank USA reported a 20% increase in donor registrations compared to the previous year, citing growing awareness and improved compensation programs.

March 2025: CCRM Fertility expanded its national footprint by opening new centers in Phoenix and Miami, aimed at improving access to donor egg IVF services in high-demand regions.

April 2025: Fairfax EggBank launched a genetic matching platform for patients to find donor eggs based on extended ancestry and medical history compatibility, enhancing personalization in donor selection.

April 2025: The American Society for Reproductive Medicine (ASRM) released new guidelines recommending routine counseling and informed consent for donor-conceived children disclosure.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. donor egg IVF services market

By Type

By End-use