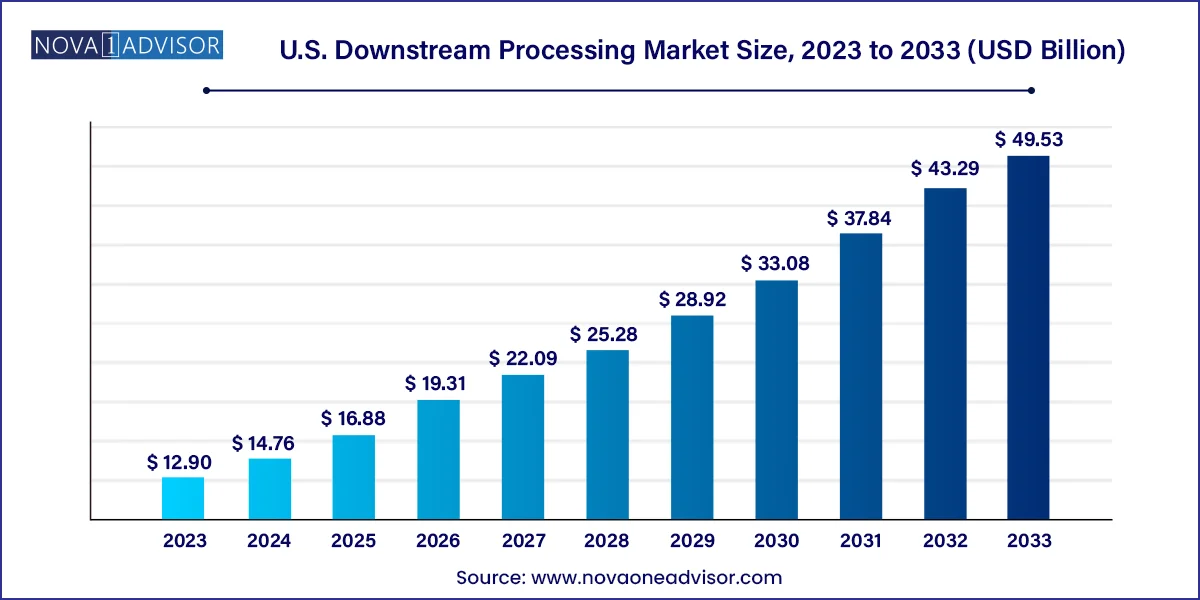

The U.S. downstream processing market size was estimated at USD 12.90 billion in 2023 and is expected to be worth around USD 49.53 billion by 2033, poised to grow at a compound annual growth rate (CAGR) of 14.4% during the forecast period 2024 to 2033.

The U.S. downstream processing market plays a crucial role in the biopharmaceutical manufacturing value chain, comprising all the processes that occur after fermentation or cell culture to isolate, purify, and prepare biologic products for final formulation and packaging. As the U.S. remains the epicenter of biopharmaceutical innovation, downstream processing technologies are increasingly critical in translating high-value biologics into commercial therapeutics that meet regulatory standards and clinical demand.

With the rise of monoclonal antibodies, vaccines, cell therapies, and recombinant proteins, the U.S. has experienced a surge in demand for highly efficient, scalable, and cost-effective downstream processing equipment and services. Traditional bottlenecks in purification and filtration stages are being addressed through innovation in chromatography systems, single-use filters, and membrane technologies, improving overall throughput and reducing processing time.

A robust regulatory framework led by the FDA, coupled with expansive R&D activity, accelerates innovation and technology adoption. Companies are investing heavily in automation, continuous processing, and digital monitoring systems to enhance yield, quality, and compliance. The emergence of personalized medicine and mRNA-based platforms has added urgency to downstream processing advancements, especially in areas such as vaccine and antibody production. With its mature biomanufacturing ecosystem and global leadership in drug development, the U.S. downstream processing market is poised for sustained growth over the coming decade.

Adoption of Single-Use Technologies (SUTs): Filters, membrane chromatography, and disposable bioreactors are gaining momentum in small-batch and multiproduct facilities.

Continuous Manufacturing Integration: Shift from batch to continuous downstream processing for real-time product output and reduced footprint.

Automation and Digitalization: Use of AI and IoT to monitor performance, predict maintenance, and enhance yield during purification steps.

Process Intensification: Multi-column chromatography and integrated membrane systems streamline workflow and reduce time-to-product.

Modular Facility Design: Portable and scalable downstream modules for biologics and vaccine production are gaining popularity.

Rise in Biologics and Biosimilars: Biopharmaceutical pipelines are increasingly reliant on downstream solutions to scale up new protein therapeutics.

High-Throughput Chromatography: Robotic and high-speed column systems designed to accommodate growing biologics demand.

Hybrid Purification Methods: Combinations of filtration, centrifugation, and chromatography used for novel biologics like cell and gene therapies.

Advanced Prefiltration and Clarification Systems: For reducing particulates and host cell proteins before main purification.

Demand for GMP-compliant Process Solutions: Equipment and services are aligned with FDA and EMA compliance for global product approval.

| Report Attribute | Details |

| Market Size in 2024 | USD 14.76 Billion |

| Market Size by 2033 | USD 49.53 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, technique, application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Merck KGaA; Sartorius Stedim Biotech S.A; GE Healthcare; Thermo Fisher Scientific Inc.; Danaher Corporation; Repligen; 3M Company; Boehringer Ingelheim International GmbH; Corning Corporation; Lonza Group Ltd; Dover Corporation; Ashai Kasei; Ferner PLC; Eppendorf AG |

A key driver of the U.S. downstream processing market is the surge in biologic drug development and production, particularly monoclonal antibodies, cell therapies, and vaccines. According to industry reports, biologics now account for over 40% of all new drug approvals in the U.S., with over 100 monoclonal antibodies approved by the FDA. These biologics are complex and require precise purification, separation, and formulation steps making downstream processing indispensable.

Companies such as Amgen, Pfizer, Genentech, and Moderna rely heavily on downstream processing platforms to scale up production, reduce impurities, and ensure batch consistency. In vaccine manufacturing especially with the development of mRNA vaccines efficient downstream processing of lipid nanoparticles and RNA payloads is essential to meet both safety and efficacy standards. The rapid development of COVID-19 vaccines demonstrated the need for agile, scalable downstream solutions, reinforcing their central role in U.S. biomanufacturing.

Despite growth opportunities, a major restraint for downstream processing in the U.S. is the high initial investment and operational complexity associated with purification technologies. Chromatography columns, ultrafiltration membranes, and centrifugal systems involve significant capital expenditure, especially in facilities requiring GMP compliance. This is particularly challenging for emerging biotech firms and CDMOs operating under constrained budgets.

Moreover, the complexity of biologics leads to long validation cycles and requires highly skilled labor. Maintenance, cleaning, and process optimization for batch or continuous systems further add to operational costs. Integration of digital monitoring tools and AI platforms also involves IT infrastructure upgrades, creating additional financial and technical barriers for mid-sized manufacturers. While single-use systems reduce cleaning burdens, their recurring consumable costs can also limit long-term scalability in high-volume production.

One of the most significant opportunities lies in the growing demand for vaccine and antibody production, particularly driven by infectious diseases, chronic illnesses, and cancer immunotherapies. The U.S. is a global hub for clinical trials and commercial launches of therapeutic antibodies, with several blockbuster monoclonal antibodies such as Keytruda, Humira, and Opdivo already generating billions in revenue.

Downstream processing plays a pivotal role in ensuring that these complex molecules are free from host cell proteins, viral contaminants, and aggregates. The demand for COVID-19 vaccines in 2020–2024 catalyzed a wave of investments into modular, automated purification systems. Even beyond the pandemic, the emergence of mRNA vaccines, combination vaccines, and personalized oncology vaccines underscores a long-term need for flexible and scalable downstream processing solutions.

With multiple new vaccine candidates under development for diseases like RSV, dengue, and influenza, as well as antibody-drug conjugates (ADCs) advancing through clinical pipelines, downstream processing systems must evolve to support next-generation biologics efficiently.

Chromatography systems dominate the product landscape, as they are the cornerstone of biologic purification. Affinity, ion-exchange, hydrophobic interaction, and size-exclusion chromatography methods are widely employed in downstream workflows, especially for monoclonal antibodies and protein-based biologics. Leading manufacturers like Cytiva, Sartorius, and Bio-Rad offer advanced column-based systems that support multi-step purification with minimal product loss.

Filters represent the fastest-growing product segment, particularly in the single-use format. These include depth filters, sterilizing-grade filters, and ultrafiltration membranes. In biomanufacturing setups where agility and contamination control are essential, filters offer a low-footprint, high-efficiency solution. Additionally, they are increasingly used in pre-chromatography clarification and in vaccine processing to handle large volumes of biological material.

Purification by chromatography is the most dominant technique, owing to its unparalleled selectivity and scalability. Chromatographic purification ensures the removal of process-related impurities, product-related variants, and endotoxins—requirements for FDA approval. It remains irreplaceable in the production of antibodies, hormones, and therapeutic enzymes.

Concentration techniques, particularly membrane filtration, are the fastest-growing, driven by continuous bioprocessing trends. Technologies such as tangential flow filtration (TFF) and ultrafiltration/diafiltration (UF/DF) are widely used to concentrate protein solutions and exchange buffers post-cell culture. The compactness and ease of integration of these techniques into single-use systems further enhance their appeal in modern downstream platforms.

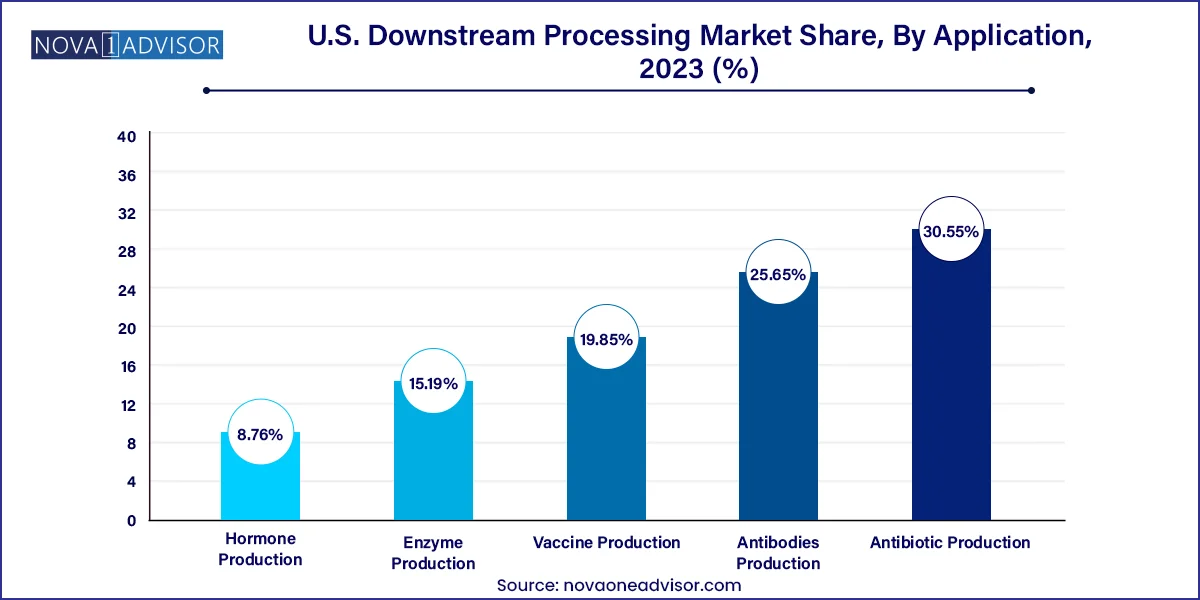

Antibodies production is the largest application segment, due to the rising demand for targeted immunotherapies and chronic disease management. Purifying monoclonal antibodies requires robust and multi-step downstream processes involving protein A affinity chromatography and virus filtration. With many biosimilars also entering the U.S. market, there’s consistent demand for efficient downstream systems that ensure product consistency and regulatory compliance.

Vaccine production is emerging as the fastest-growing application, driven by the success of COVID-19 vaccines and ongoing development for flu, RSV, and cancer vaccines. Whether traditional protein subunit vaccines or modern mRNA-based ones, downstream purification plays a vital role in removing unencapsulated components, DNA, or impurities while maintaining vaccine potency. This segment is expected to experience sustained growth as new public health initiatives push for national vaccine stockpiling and fast-track development of novel immunizations.

The United States stands as the global leader in downstream processing innovation and adoption, backed by its dominant biopharmaceutical industry, regulatory strength, and robust academic ecosystem. Home to biomanufacturing giants such as Amgen, Genentech, Merck, and Pfizer, the U.S. has established world-class production capabilities across California, Massachusetts, and the Midwest biotech corridors.

Federal support for domestic vaccine production, pandemic preparedness, and biosecurity has accelerated investments in downstream infrastructure. NIH and BARDA have funded multiple initiatives to improve biomanufacturing scalability, including modular bioprocessing facilities and advanced purification technologies.

Further, with nearly 50% of the world’s active cell and gene therapy trials located in the U.S., there is rising demand for tailored downstream solutions capable of handling viral vectors, nucleic acids, and engineered cells. The regulatory framework provided by the FDA supports innovation while maintaining stringent product quality, making the U.S. market attractive to global equipment and solution providers.

March 2025: Sartorius announced the expansion of its manufacturing facility in New Hampshire to meet growing U.S. demand for single-use filtration and chromatography systems.

February 2025: Repligen Corporation introduced its next-gen XCell™ ATF system with integrated process analytics for continuous bioprocessing applications.

January 2025: Thermo Fisher Scientific unveiled a fully automated downstream purification platform, POROS™ CaptureSelect™, targeting high-throughput mAb workflows.

December 2024: Cytiva launched a new range of pre-packed chromatography columns designed for rapid changeovers in multiproduct facilities.

November 2024: 3M Health Care completed the acquisition of a U.S.-based membrane filtration startup to strengthen its bioprocessing product portfolio.

Key U.S. downstream processing companies include Danaher Corporation, GE Healthcare, and Thermo Fisher Scientific Inc. among others. Companies are expanding their global footprint by establishing collaborations, partnerships, and acquisitions to tap in new markets and countries. Collaborations with healthcare providers and research institutions, such as the Mayo Clinic and academic medical centers, are opportunistic to access expertise and assess their technologies.

U.S. Downstream Processing Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Downstream Processing market.

By Product

By Technique

By Application