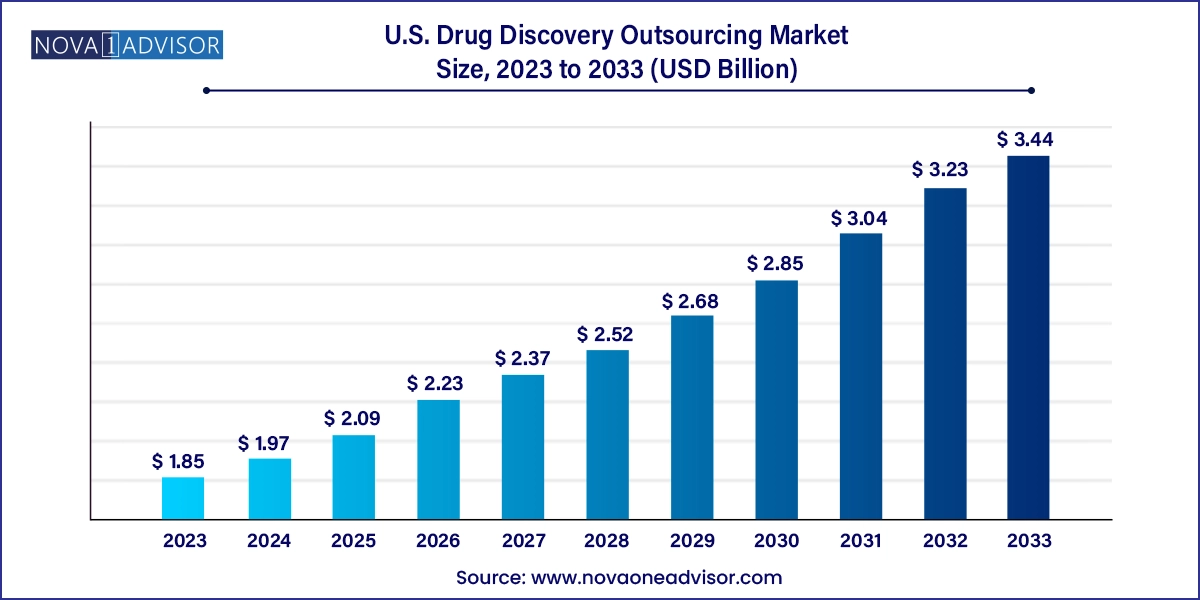

The U.S. drug discovery outsourcing market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.44 billion by 2033, growing at a CAGR of 6.39% during the forecast period 2024 to 2033.

The U.S. drug discovery outsourcing market is witnessing a significant transformation, marked by the growing strategic shift among pharmaceutical companies toward external collaborations for research and development (R&D) activities. This outsourcing trend is a response to increasing R&D costs, complex regulatory requirements, and the need for faster time-to-market for novel therapeutics. Outsourcing partners, particularly contract research organizations (CROs), offer specialized services across the drug discovery value chain, encompassing everything from target identification to preclinical testing. As a result, drug discovery outsourcing has become an essential business model rather than a supplementary one.

Pharmaceutical and biopharmaceutical firms in the U.S. are allocating substantial portions of their R&D budgets to external service providers. The COVID-19 pandemic also contributed to the surge in outsourcing, as it exposed vulnerabilities in in-house R&D infrastructure and highlighted the flexibility and scalability offered by CROs. Today, outsourcing in drug discovery is not limited to cost-saving motives; it also allows companies to tap into innovative technologies such as artificial intelligence (AI), high-throughput screening, and bioinformatics — capabilities that may not be feasible to develop in-house.

The U.S. market is particularly attractive due to its strong academic and industrial research ecosystem, a large number of biotech startups, and the presence of some of the world's largest pharmaceutical companies. Additionally, stringent regulatory guidelines set by the FDA encourage companies to ensure high-quality, compliant drug discovery practices — often best achieved through expert outsourcing partnerships.

Growing Integration of Artificial Intelligence (AI): AI is revolutionizing early-phase drug discovery by enhancing data analysis, molecular modeling, and target identification, reducing time and cost.

Strategic Collaborations and Partnerships: Increasing alliances between biotech companies and CROs are streamlining drug discovery timelines and fostering innovation.

Focus on Precision Medicine: Outsourcing partners are developing capabilities in genomics and proteomics to support the personalized medicine movement, particularly in oncology.

Shift Toward Fragment-Based Drug Discovery (FBDD): CROs are increasingly investing in FBDD tools, accelerating the development of novel drug candidates.

Rising Preference for Virtual Pharma Models: Small- to mid-sized biopharmaceutical companies are functioning virtually by outsourcing most of their discovery and development tasks.

Increasing Use of CRISPR and Gene Editing Tools: The emergence of gene-editing technologies is prompting new service demands within the outsourcing domain.

Surge in Biologics and Biosimilars R&D: Demand for outsourcing services related to large molecule development is rising, especially in immunotherapy and monoclonal antibodies.

Expansion of Integrated Drug Discovery (IDD) Services: End-to-end platforms offered by CROs are gaining popularity among pharma firms looking for a single vendor to manage the entire discovery cycle.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.97 Billion |

| Market Size by 2033 | USD 3.44 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.39% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Workflow, Therapeutic Area, Drug Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Albany Molecular Research Inc.; EVOTEC; Laboratory Corporation of America Holdings; GenScript; Pharmaceutical Product Development, LLC; Charles River Laboratories International, Inc.; WuXi AppTec; Merck & Co., Inc.; Thermo Fisher Scientific Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; DiscoverX Corp.; QIAGEN; Eurofins SE; Syngene International Limited; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.; Domainex Ltd. |

One of the most significant drivers behind the growth of the U.S. drug discovery outsourcing market is the ever-increasing cost of R&D in the pharmaceutical industry. It is estimated that bringing a new drug to market can cost over $2 billion and take more than a decade. These staggering figures have compelled companies to look for ways to reduce costs while maintaining quality and compliance. Outsourcing offers a feasible solution by enabling access to cost-effective, scalable, and specialized services without the need for building expensive infrastructure or hiring large in-house research teams.

Moreover, the growing complexity of diseases, especially in areas like oncology, CNS disorders, and rare diseases, has made drug discovery more sophisticated, requiring interdisciplinary expertise. CROs are evolving to offer these capabilities under one roof, supporting faster lead identification, optimization, and preclinical testing. Thus, outsourcing has become a strategic necessity for achieving efficiency, risk mitigation, and faster market entry.

Despite the numerous advantages of outsourcing, concerns around data security and intellectual property (IP) rights remain a significant challenge. When pharmaceutical companies collaborate with external partners, sensitive proprietary data, including molecular structures, biological targets, and genomic information, must be shared across organizational boundaries. Any breach, misuse, or unauthorized disclosure of such data can result in substantial financial losses, reputational damage, and legal liabilities.

In particular, biopharmaceutical startups that depend heavily on innovation and novel molecular entities often hesitate to outsource core R&D processes due to fear of IP theft. Even though most established CROs in the U.S. comply with stringent confidentiality and data protection protocols, the inherent risk of cyber threats and legal ambiguities in data-sharing agreements can act as a deterrent. This limitation continues to pose a barrier to full-scale adoption of outsourcing across all therapeutic and workflow segments.

The growing focus on rare and orphan diseases presents a lucrative opportunity for the U.S. drug discovery outsourcing market. These diseases, often genetically driven, affect a small percentage of the population but require highly specialized research approaches. Due to the limited patient pool, pharmaceutical companies often find it economically unviable to develop treatments in-house. Outsourcing these discovery projects to CROs with expertise in niche indications allows companies to leverage domain-specific knowledge, reduce investment risks, and fast-track the development process.

CROs in the U.S. are increasingly tailoring their services to support such high-risk, high-reward discovery pipelines. By integrating advanced platforms in genomics, proteomics, and patient-derived models, outsourcing firms can provide valuable insights into disease mechanisms and drug response. This trend aligns with the growing emphasis on personalized medicine and targeted therapies — both of which are gaining regulatory and commercial traction in the U.S. pharmaceutical market.

Target Identification & Screening dominated the workflow segment in the U.S. drug discovery outsourcing market owing to its foundational role in the early stages of drug development. This process involves understanding disease biology and identifying molecular targets that can be modulated to treat specific conditions. CROs provide robust capabilities in high-throughput screening, computational biology, and molecular profiling that enhance the accuracy and speed of target identification. These services are increasingly in demand as pharmaceutical firms seek to minimize failures in downstream drug development by ensuring that only well-validated targets proceed to subsequent stages.

On the other hand, Lead Identification & Candidate Optimization is the fastest-growing workflow segment, driven by the rising complexity of drug candidates and the need for precision engineering of molecular structures. With growing reliance on fragment-based screening, computational chemistry, and structure-based drug design, pharmaceutical firms are outsourcing more advanced tasks to CROs that possess state-of-the-art platforms and skilled chemists. Additionally, the use of AI-driven predictive modeling is transforming lead optimization, improving the quality of candidates while reducing time and costs. This trend is particularly visible in the development of oncology and CNS-targeted therapies.

Oncology emerged as the dominant therapeutic area in the U.S. drug discovery outsourcing market due to the high volume of cancer-related R&D projects and the complexity of cancer biology, which necessitates advanced technological capabilities. With cancer being the second leading cause of death in the U.S., pharmaceutical companies are investing heavily in novel immunotherapies, small molecule inhibitors, and biologics targeting various cancer types. CROs offer capabilities such as cell line development, animal models, and high-content screening, enabling rapid evaluation of drug efficacy and toxicity. Outsourcing in oncology drug discovery is further spurred by the need for biomarker discovery and patient stratification models.

Meanwhile, Central Nervous System (CNS) diseases represent the fastest-growing therapeutic area, propelled by the rising burden of neurological disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. These conditions are notoriously difficult to treat due to the blood-brain barrier and complex pathophysiology. As a result, pharmaceutical companies are increasingly relying on CROs with niche expertise in CNS pharmacology, neuroimaging, and behavioral testing. The integration of 3D brain organoids and in silico modeling platforms is also boosting CRO capabilities in this segment, accelerating the pace of novel CNS-targeted drug discovery.

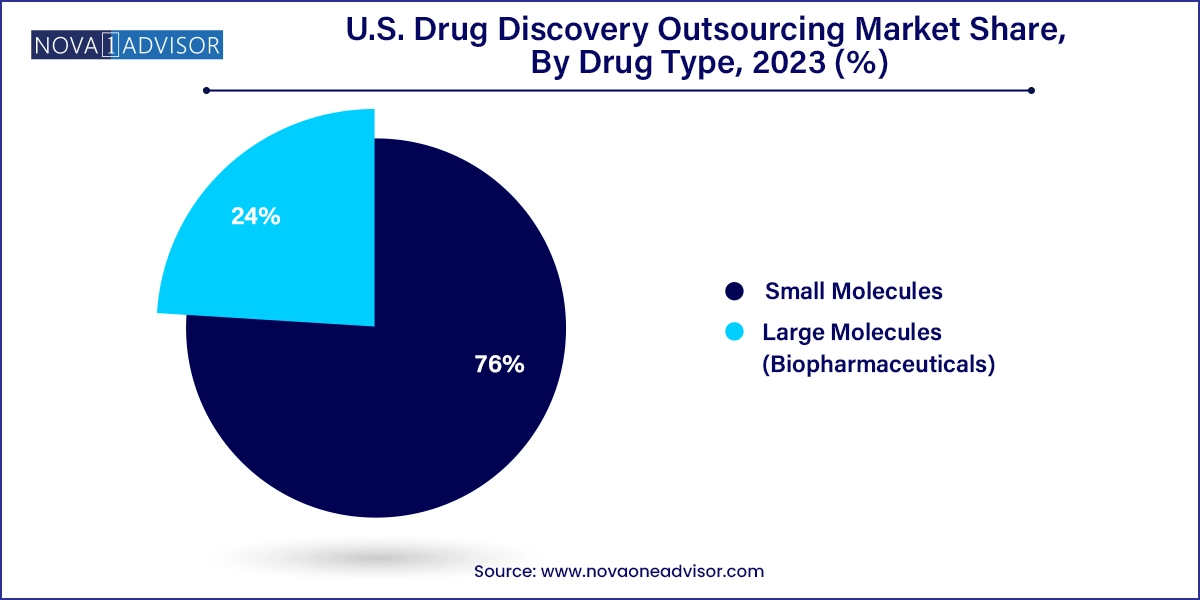

Small molecules are pivotal in fostering innovative treatments, accounting for over 76.0% of the market revenue share in 2023, These compounds have been the cornerstone of therapeutic development for decades and continue to hold significant commercial appeal due to their oral bioavailability, cost-effectiveness, and established regulatory pathways. CROs offer extensive services for small molecule discovery, including compound library screening, hit-to-lead optimization, and pharmacokinetics profiling. Their deep expertise in organic synthesis and analytical chemistry ensures efficient and reproducible workflows, making them a preferred partner for both established pharma and emerging biotech firms.

In contrast, Large molecules (biopharmaceuticals) are expected to witness the fastest growth, largely driven by the increasing demand for biologics such as monoclonal antibodies, vaccines, and gene therapies. The complexity of these molecules requires specialized bioanalytical methods, expression systems, and bioprocess development expertise — areas where CROs have made significant investments. Moreover, the growing focus on personalized medicine and the emergence of RNA-based therapies post-COVID-19 have amplified interest in outsourcing large molecule discovery. CROs with integrated capabilities in protein engineering, cell line development, and immunogenicity testing are witnessing high demand across the U.S

The U.S. is the epicenter of global drug discovery innovation, and outsourcing in this space has become both strategic and indispensable. Major pharmaceutical companies, such as Pfizer, Merck, and Johnson & Johnson, as well as hundreds of agile biotechs across Boston, San Diego, and the Bay Area, are increasingly relying on specialized CROs to accelerate early-stage R&D. The U.S. government’s push to promote life sciences innovation through funding initiatives, such as the NIH and the Cancer Moonshot, is further augmenting the demand for outsourced drug discovery services.

Additionally, academic research institutions like Harvard Medical School, Stanford University, and the Broad Institute play a pivotal role by collaborating with industry players and outsourcing certain aspects of their translational research to private CROs. The regulatory environment, though rigorous, is conducive to innovation, with initiatives like the FDA’s Breakthrough Therapy Designation and Accelerated Approval Pathways supporting faster drug development timelines. In this environment, outsourcing providers with compliance expertise, robust infrastructure, and data integrity systems are strongly positioned for growth.

March 2024: Charles River Laboratories announced a partnership with Valo Health to integrate AI-driven analytics into its early discovery services, enhancing hit identification and preclinical modeling capabilities.

February 2024: Eurofins Discovery launched its new high-throughput screening platform in its San Diego facility, enabling rapid assessment of over 1 million compounds in a single run.

January 2024: Labcorp Drug Development expanded its preclinical neuroscience capabilities through a strategic collaboration with a leading academic neuroscience lab, reinforcing its CNS outsourcing services.

December 2023: Syngene International opened a new U.S.-based discovery biology center to serve North American clients, signaling increased localization of global CROs.

October 2023: Thermo Fisher Scientific unveiled a $200 million investment into its drug discovery services segment, focusing on cell and gene therapy support platforms.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. drug discovery outsourcing market

Workflow

Therapeutic Area

Drug Type