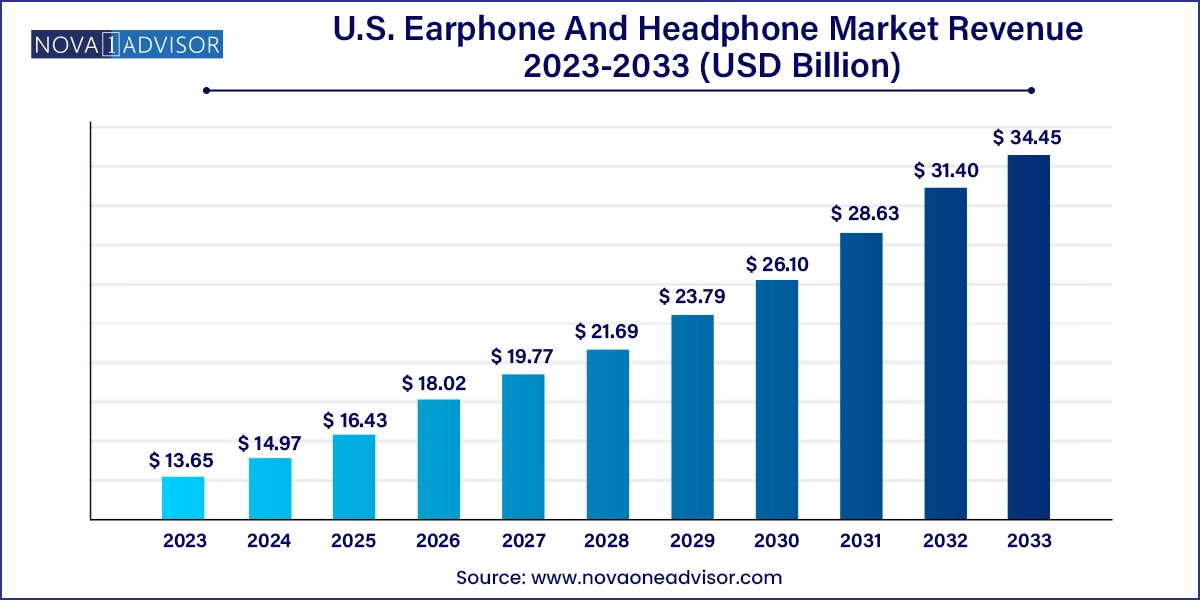

The U.S. earphone and headphone market size was exhibited at USD 13.65 billion in 2023 and is projected to hit around USD 34.45 billion by 2033, growing at a CAGR of 9.7% during the forecast period 2024 to 2033.

The U.S. earphone and headphone market is one of the most mature yet dynamically evolving segments in the consumer electronics space. Driven by technological innovation, lifestyle changes, and the convergence of audio hardware with digital ecosystems, this market continues to flourish across both premium and budget categories. Earphones and headphones are no longer mere accessories—they are integral to daily routines involving communication, entertainment, fitness, gaming, and remote work.

The proliferation of smartphones, laptops, smart TVs, and tablets, combined with an increasingly mobile and media-consumption-oriented lifestyle, has ensured consistent demand for personal audio products. More recently, the work-from-home (WFH) model, virtual learning, and the rise of fitness culture have significantly expanded the usage base of headphones and earphones in both professional and recreational settings.

Moreover, manufacturers are leveraging cutting-edge technologies like active noise cancellation (ANC), voice assistant integration, gesture control, spatial audio, and AI-driven adaptive sound to differentiate products and create premium experiences. With U.S. consumers displaying a strong affinity toward both high-end innovations and value-driven wireless audio, the market offers diverse growth opportunities for legacy brands and emerging players alike.

Rapid Shift to True Wireless Stereo (TWS): Cord-cutting behavior has accelerated the demand for truly wireless earbuds across price segments.

Integration of Smart Features: Headphones and earphones now offer built-in AI, biometric sensors, voice assistants, and real-time language translation.

Rise of Active Noise Cancellation (ANC): Premium and mid-tier models increasingly offer ANC features for immersive listening and call clarity.

Fitness and Wellness Tracking via Earbuds: Earphones equipped with heart-rate monitors, motion sensors, and sweat detection are becoming popular among health-conscious consumers.

Gaming Headset Growth: Gaming and VR-compatible headphones with spatial audio and low latency are surging in demand.

Sustainable Materials and Eco-friendly Packaging: Consumers are showing preference for brands offering recyclable components and minimalistic packaging.

Personalized Audio Experiences: Adaptive EQ and sound profiles that adjust to individual hearing patterns are being marketed as premium enhancements.

Luxury Audio Collaborations: High-end brands are collaborating with fashion designers and luxury automakers for exclusive product lines (e.g., Master & Dynamic x Lamborghini).

| Report Coverage | Details |

| Market Size in 2024 | USD 14.97 Billion |

| Market Size by 2033 | USD 34.45 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Price Band, Technology, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Alclair Audio, Inc.; Apple, Inc.; Bose Corporation; Grado Labs; JBL; JVC Kenwood Corporation; Koninklijke Philips N.V. (Philips); Logitech, Inc. (Including Ultimate Ears, LLC.); Panasonic Corporation;Plantronics, Inc. (Acquired by HP Inc.); Pioneer Corporation; SAMSUNG (Including Harman International Industries, Incorporated); Shure Incorporated; Skullcandy, Inc. (Acquired by Mill Road Capital); Sony Corporation |

A key driver behind the U.S. earphone and headphone market is the growing consumer need for mobility and multifunctionality in audio consumption. As people seek seamless transitions between work, leisure, exercise, and commuting, earphones and headphones have evolved into personal hubs of communication, entertainment, and productivity.

The adoption of wireless technologies such as Bluetooth 5.0 and beyond has drastically improved connection stability and battery life, allowing for uninterrupted use across scenarios. Whether it’s attending virtual meetings with ANC-enabled over-ear headphones, running with sweat-proof earbuds, or gaming with spatial audio headsets, consumers demand versatility without compromising sound quality or comfort.

Brands like Apple, Sony, and Bose have successfully capitalized on this trend with products such as AirPods Pro, WH-1000XM5, and QuietComfort Ultra, which deliver high fidelity and robust performance across use cases. The ability of modern headphones to double as hearing aids, fitness trackers, or digital assistants is redefining consumer expectations and driving repeat purchases.

One significant restraint in the U.S. earphone and headphone market is the intense saturation and price competition in the USD 50–100 range. While this price band caters to mass-market consumers, it is also crowded with products from dozens of global and domestic players offering similar features—wireless connectivity, IPX rating, and basic ANC.

As a result, brands face challenges in creating meaningful differentiation, and customer loyalty in this segment is often weak. Additionally, the influx of low-cost, white-label imports from Asia has put downward pressure on margins for domestic sellers. For instance, budget brands like Anker’s Soundcore have carved out significant market share by offering solid value propositions, making it harder for traditional audio firms to maintain premium positioning without substantial R&D investment.

Frequent discounting during retail events like Black Friday and Amazon Prime Day further erodes pricing power. For long-term sustainability, players must either innovate substantially or focus on niche targeting (e.g., fitness-specific models, children’s headphones, or enterprise headsets).

The rise of gaming and virtual reality ecosystems offers a lucrative opportunity for headphone and earphone manufacturers in the U.S. With over 200 million gamers across platforms and an increasing shift toward immersive experiences, the demand for high-fidelity, spatially aware, and low-latency audio devices is soaring.

Gaming headphones, often equipped with virtual surround sound, boom microphones, and noise isolation, are becoming indispensable for competitive gaming and esports. Furthermore, with the development of VR environments (e.g., Meta Quest, Sony PlayStation VR2), audio is no longer just entertainment—it is a vital navigational and interaction tool.

The metaverse trend amplifies this further. As users engage in virtual meetings, events, and social spaces, headphones with enhanced comfort, haptic feedback, and spatial sound mapping become necessary. Companies that can offer cross-platform compatibility, seamless switching between AR/VR and standard gaming interfaces, and extended battery life stand to gain significantly from this growing segment.

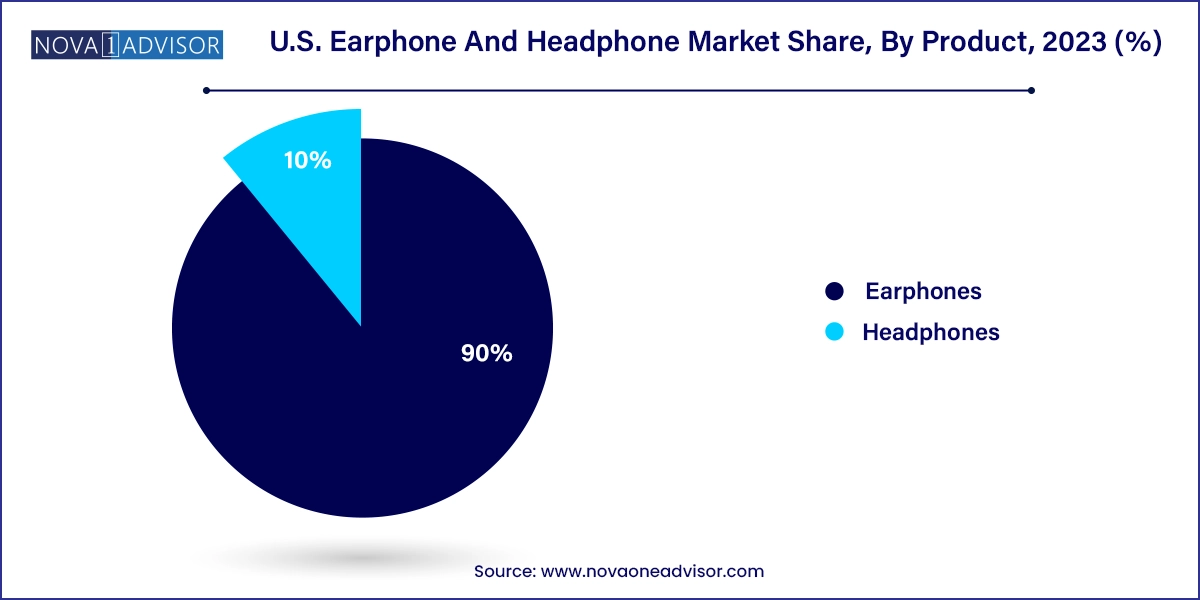

Headphones dominate the U.S. earphone and headphone market, especially in premium and enterprise-grade categories. Over-ear and on-ear headphones continue to see strong demand from professionals, audiophiles, gamers, and remote workers seeking immersive audio and comfort during long usage. Products like the Sony WH-1000XM5 and Bose QuietComfort Ultra have set benchmarks in audio clarity, ANC, and ergonomic design. These headphones are often preferred for activities such as podcast editing, business conferencing, and air travel due to their superior soundstage and battery longevity.

Earphones are growing faster, particularly true wireless stereo (TWS) models, thanks to their compactness, portability, and rapid innovation. The launch of AirPods Pro, Galaxy Buds, and Beats Studio Buds has made in-ear wireless products highly desirable for casual listening, fitness routines, and short calls. The popularity of streaming apps and audiobooks has further cemented earphones as an everyday essential. Fast pairing, customizable fit, and improved mic quality are making earphones a go-to device for younger and active demographics.

Products priced above USD 100 dominate in terms of revenue, driven by strong demand for premium features such as adaptive ANC, multi-device pairing, spatial audio, and luxury branding. Consumers in this segment are brand loyal and willing to invest in sound quality and durability. Apple, Bose, Sennheiser, and Sony dominate this category, frequently updating their flagship products with meaningful innovations. These headphones often become status symbols, making them highly aspirational purchases.

The USD 50–100 price band is the fastest-growing, fueled by younger consumers and budget-conscious buyers seeking value-for-money features. Brands like JBL, Skullcandy, and Jabra are expanding product portfolios in this range, offering impressive ANC, Bluetooth 5.2 support, and companion apps. Seasonal promotions and bundling with smartphones or subscriptions have also expanded this segment’s reach.

Wireless headphones dominate the market, representing the industry's shift toward portability and convenience. Bluetooth-enabled devices now support multipoint connections, enhanced codecs (like aptX and LDAC), and fast charging. ANC wireless models are becoming the norm rather than the exception, with battery life extending to 40+ hours on flagship models. Apple’s ecosystem-optimized products (e.g., AirPods with the H1 chip) and Qualcomm-powered Bluetooth platforms for Android users have fueled this growth.

Smart headphones are the fastest-growing technology segment, equipped with AI, voice assistants, touch controls, and sensors for real-time health tracking or environmental adaptation. These headphones blur the line between audio gear and wearable tech. Google Assistant, Alexa, and Siri are now standard integrations. Features like voice-activated commands, location-aware playback, and hearing aid functionalities are broadening the scope of use and creating differentiation.

Music and entertainment applications dominate the market, as music streaming, video consumption, and podcasting continue to be integral to American lifestyles. The surge in on-demand content and the normalization of content consumption during work, workouts, or commuting has driven the use of both headphones and earphones for entertainment purposes. Audiophile-grade headphones also serve hobbyists and musicians who demand uncompressed, lossless sound fidelity.

Gaming is the fastest-growing application segment, reflecting the rise of online multiplayer, esports, and console gaming in the U.S. Headphones with Dolby Atmos, surround sound, and 3D audio are in demand, especially as titles like "Call of Duty" and "Fortnite" become social hubs. Additionally, VR gaming requires spatially aware headphones for immersion and navigation. Compatibility with gaming consoles and cloud gaming platforms like Xbox Cloud and NVIDIA GeForce NOW is becoming a product requirement.

The United States continues to be a global leader in demand, innovation, and revenue for the earphone and headphone market. High consumer spending on electronics, fast adoption of new technologies, and a robust ecosystem of streaming, gaming, and productivity platforms fuel growth.

The prevalence of remote work and hybrid offices has led to increased corporate spending on communication headsets and high-end noise-canceling headphones for productivity. Simultaneously, the U.S. fitness boom—fueled by brands like Peloton and apps like Strava—has made TWS earbuds a gym staple. Cities like New York, Los Angeles, Austin, and San Francisco serve as major hubs for high-end consumer audio consumption.

Furthermore, the U.S. is home to many of the most influential audio brands and developers—Apple, Bose, Beats, JBL, and others—who drive global trends in design, innovation, and marketing. The market’s responsiveness to branding, lifestyle alignment, and retail partnerships makes it a critical testing ground for global product rollouts.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. earphone and headphone market

Product

Price Band

Technology

Application