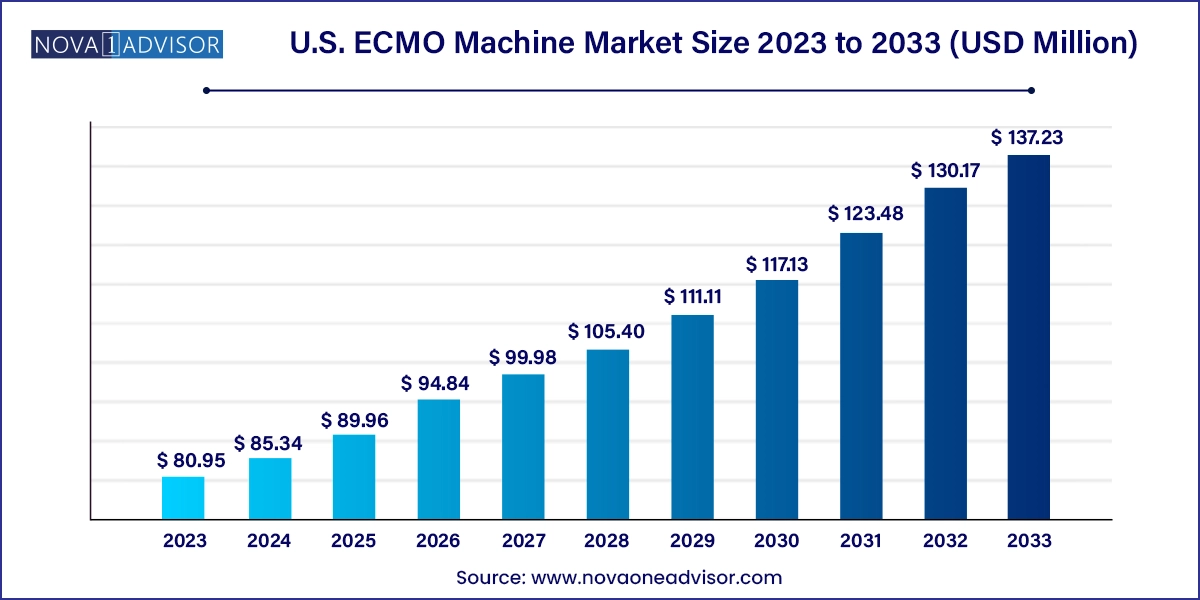

The U.S. ECMO machine market size was exhibited at USD 80.95 million in 2023 and is projected to hit around USD 137.23 million by 2033, growing at a CAGR of 5.42% during the forecast period 2024 to 2033.

The U.S. ECMO machine market has evolved into a vital sector within the critical care and cardiovascular device industry. ECMO (Extracorporeal Membrane Oxygenation) machines serve as a life-sustaining bridge for patients with severe cardiac and/or pulmonary dysfunction when conventional support therapies such as mechanical ventilation or pharmacologic interventions prove insufficient. By oxygenating the blood externally and removing carbon dioxide, ECMO devices temporarily take over the function of the heart and lungs, enabling organ rest and potential recovery.

In the United States, ECMO technology has witnessed a significant uptick in demand, driven by rising cases of cardiac arrest, acute respiratory distress syndrome (ARDS), septic shock, and complications following major surgeries. The COVID-19 pandemic was a defining moment for ECMO adoption in the U.S., as healthcare institutions relied on the technology to support critically ill patients with severe lung failure. Since then, clinical awareness, institutional readiness, and procedural expertise have accelerated rapidly, embedding ECMO into mainstream critical care protocols.

The U.S. is home to a highly developed healthcare infrastructure, leading academic hospitals, and a robust research environment—all of which contribute to the growth and technological innovation of ECMO systems. Leading medical device manufacturers have introduced portable, user-friendly ECMO systems with integrated safety features and modular designs, making it feasible to deploy ECMO beyond tertiary centers into community hospitals and even during patient transport.

With an increasing number of trained ECMO specialists and expanding indications including post-cardiotomy shock, bridge to transplant, and extracorporeal cardiopulmonary resuscitation (ECPR) the market is expected to witness sustained growth. Federal funding for advanced critical care research, favorable reimbursement for ECMO procedures, and strategic collaborations between hospitals and medtech firms further reinforce this growth trajectory.

Miniaturization and Portability: ECMO machines are becoming more compact and mobile, enabling deployment in emergency departments, ambulances, and during patient transfers.

Integration of AI and Automation: Next-gen ECMO systems now feature smart controllers with built-in alarms, predictive analytics, and closed-loop oxygenation adjustments.

Rising Use in Pediatric and Neonatal ICUs: Increasing survival rates and improved circuit designs have made ECMO a routine consideration in treating congenital defects and neonatal ARDS.

ECPR Expansion: The application of ECMO during cardiac arrest events (extracorporeal CPR) is gaining traction in major trauma centers and is supported by growing clinical evidence.

Single-Use Cannula and Disposable Kits: To mitigate infection risk and simplify circuit assembly, disposable ECMO components are being increasingly adopted.

Growing Awareness and Training Initiatives: ECMO training programs by ELSO (Extracorporeal Life Support Organization) and academic institutions are driving competence across more U.S. hospitals.

Reimbursement Advancements: CMS and private insurers are increasingly including ECMO in their billing codes, ensuring better financial feasibility for hospitals.

| Report Coverage | Details |

| Market Size in 2024 | USD 85.34 Million |

| Market Size by 2033 | USD 137.23 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.42% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Modality, Patient Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Inspira; Abbott; Terumo Cardiovascular Systems Corporation CytoSorbents Corporation; Cyberonics, Inc; OriGenGOHIBIC™; Agilent Technologies; Soma Tech Intl; Mott Corporation |

A critical driver of the U.S. ECMO market is the growing incidence of severe heart and lung failures across age groups, necessitating interventions beyond mechanical ventilation or inotropes. According to the CDC, cardiovascular diseases remain the leading cause of death in the United States, while ARDS and sepsis continue to account for high ICU morbidity. With the onset of COVID-19, the incidence of ARDS surged, placing ECMO at the center of attention for clinicians managing critical respiratory failure.

ECMO has increasingly become the intervention of choice in refractory cardiogenic shock, particularly in post-myocardial infarction, myocarditis, and post-cardiotomy contexts. Simultaneously, its success in pediatric and neonatal care for meconium aspiration, congenital diaphragmatic hernia, and sepsis has created a broader and more complex patient population benefiting from ECMO therapy. With protocols evolving and awareness increasing, more hospitals are investing in ECMO capabilities, supported by multidisciplinary teams that include intensivists, perfusionists, cardiac surgeons, and nurses.

Despite its clinical value, the high capital and operational costs of ECMO systems remain a significant restraint in broader adoption across U.S. healthcare institutions. A complete ECMO setup, including the machine, oxygenator, pumps, cannulae, heat exchanger, and monitoring accessories, can cost anywhere from $150,000 to $300,000. This is exclusive of recurring costs related to disposable components, sterile environments, and backup power.

Additionally, ECMO is labor-intensive and requires a 1:1 or 1:2 nurse-to-patient ratio along with continuous supervision by a trained perfusionist or ECMO specialist. The training, salaries, and logistics associated with maintaining ECMO readiness further increase the cost burden. Smaller community hospitals or underfunded institutions may lack the capacity to initiate or maintain ECMO programs, limiting access to high-end life support in rural or economically constrained regions.

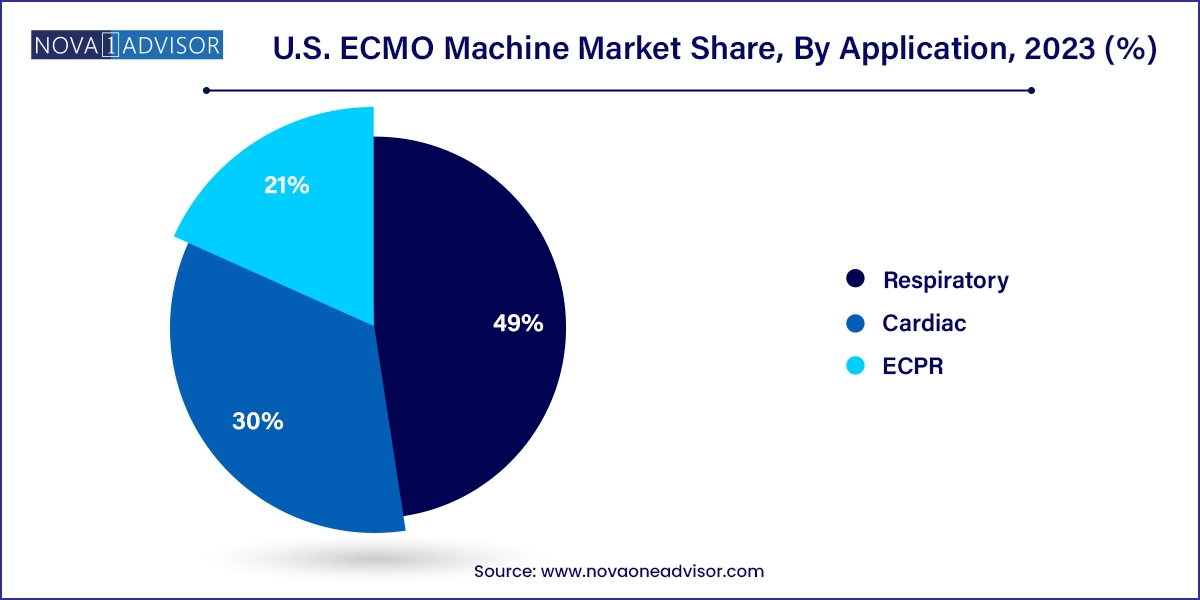

The emerging application of ECMO in ECPR offers a compelling opportunity for market growth. ECPR refers to the use of ECMO during cardiac arrest events when conventional CPR fails to restore circulation. Clinical studies have shown that ECPR, when rapidly initiated, can significantly improve survival and neurological outcomes in refractory cardiac arrest cases.

As a result, large academic centers and trauma hospitals are now implementing ECMO response teams that can be activated in the emergency department, catheterization lab, or even en route during ambulance transport. Portable ECMO systems, combined with rapid-deployment protocols, enable clinicians to initiate circulatory support within minutes. The increasing availability of data supporting ECPR outcomes, coupled with investments in mobile ECMO units and tele-ECMO command centers, is expected to revolutionize emergency cardiac care, creating new avenues for ECMO manufacturers and service providers.

Pumps dominate the ECMO component market, being the central driver of blood circulation in the extracorporeal circuit. Centrifugal pumps have largely replaced roller pumps due to their reduced hemolysis and higher reliability. They are designed to maintain continuous blood flow with minimal mechanical trauma, making them essential for prolonged ECMO support. Advanced models now offer magnetically levitated impellers, enhancing performance and reducing thrombogenic risks.

Oxygenators are the fastest-growing component, driven by the need for efficient gas exchange, reduced priming volumes, and durability over extended ECMO runs. Technological advancements in polymethylpentene (PMP) membrane oxygenators have significantly improved biocompatibility, enabling extended support with lower plasma leakage and inflammation. As ECMO runs now frequently extend beyond two weeks, demand for high-performance oxygenators with built-in heat exchangers is on the rise.

Veno-Arterial (VA) ECMO is the most widely used modality, especially in cardiac surgery units and ICUs. It provides both circulatory and respiratory support, making it the standard in cases of cardiogenic shock, cardiac arrest, and post-cardiotomy failure. Its utility as a bridge to decision, recovery, or transplant has made it indispensable in tertiary cardiac centers across the U.S.

Veno-Venous (VV) ECMO is the fastest-growing modality, particularly after the COVID-19 pandemic highlighted its effectiveness in managing severe ARDS. VV ECMO provides respiratory support without directly assisting cardiac function and is commonly used in adult respiratory failure, pneumonia, trauma, and pulmonary embolism. Its lower risk profile compared to VA ECMO and fewer vascular complications contribute to its rapid adoption in both academic and community hospitals.

Adult patients account for the largest share of ECMO utilization, owing to the higher prevalence of cardiovascular diseases, ARDS, and septic shock in this population. The adult ECMO market also benefits from better-developed reimbursement pathways and a larger pool of transplant candidates or post-surgical patients who might require ECMO bridging.

Neonates are the fastest-growing patient segment, particularly with improvements in neonatal intensive care and prenatal diagnostics. Neonatal ECMO is used to manage persistent pulmonary hypertension, congenital diaphragmatic hernia, and meconium aspiration syndrome. Advances in miniaturized circuits, small-volume oxygenators, and size-specific cannulae are making ECMO safer and more effective for neonates.

Respiratory applications dominate the ECMO market, particularly following the post-COVID surge in ARDS cases. ECMO is now a cornerstone in managing hypoxic respiratory failure unresponsive to conventional ventilation. Adult patients account for most cases, but pediatric and neonatal respiratory ECMO use is steadily increasing due to better outcome protocols.

ECPR is the fastest-growing application, with increasing evidence supporting its use in cardiac arrest. U.S. hospitals are now trialing ECMO-assisted resuscitation programs that integrate pre-hospital care with emergency department ECMO initiation. Survival rates and neurologic outcomes continue to improve with faster deployment and better patient selection, ensuring that ECPR will be a pivotal application in future market expansion.

The U.S. leads the global ECMO market, owing to its advanced medical infrastructure, large critical care population, and robust funding for clinical research. Major metropolitan hospitals such as those in New York, Boston, Chicago, and Los Angeles maintain full-scale ECMO programs with dedicated teams, mobile deployment protocols, and tele-ECMO support systems.

U.S. agencies like the FDA and the NIH have been instrumental in approving and funding ECMO technologies, particularly during the pandemic. The Extracorporeal Life Support Organization (ELSO), based in the U.S., continues to provide standardized training, certification, and data-driven benchmarks that guide ECMO use nationally.

With greater emphasis on expanding ECMO access to underserved regions, rural hospitals are forming partnerships with urban centers for tele-supervised ECMO initiation and patient transport. Meanwhile, public and private insurers are revising reimbursement criteria to support ECMO usage in both emergent and planned interventions. The U.S. ECMO landscape is characterized by a synergy between clinical leadership, policy reform, and technological innovation.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. ECMO machine market

Component

Modality

Patient Type

Application