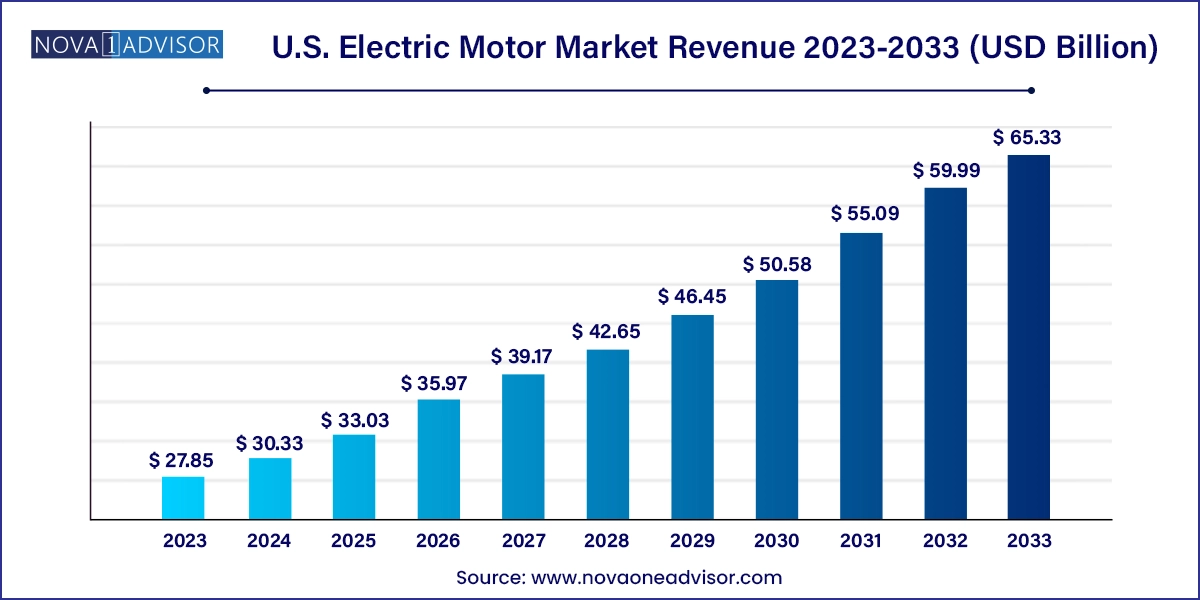

The U.S. electric motor market size was exhibited at USD 27.85 billion in 2023 and is projected to hit around USD 65.33 billion by 2033, growing at a CAGR of 8.9% during the forecast period 2024 to 2033.

The U.S. electric motor market represents a cornerstone of American industrial, transportation, and consumer applications. Electric motors—devices that convert electrical energy into mechanical motion—are fundamental components in a wide spectrum of equipment, ranging from household appliances and HVAC systems to electric vehicles (EVs), industrial machinery, and aerospace systems. As the U.S. economy becomes increasingly electrified and energy efficiency becomes a national priority, demand for advanced, efficient, and specialized electric motors is growing exponentially.

Electric motors are also gaining significance in sustainability agendas. Federal and state-level climate policies have placed considerable emphasis on decarbonization of transport and industrial sectors, where motors are key energy-consuming assets. The integration of smart technologies and the proliferation of electric mobility have transformed the electric motor landscape from basic mechanical devices to digitally optimized components. Furthermore, the push toward automation in manufacturing, the rise of EVs, and increased deployment of renewable energy systems are reshaping market demands and innovations.

With decades of engineering excellence, an established manufacturing base, and increasing investment in clean energy infrastructure, the U.S. is well-positioned to remain one of the largest and most technologically advanced markets for electric motors globally.

Electrification of Transportation: Rising EV production and adoption are fueling high demand for compact, high-torque electric motors with advanced cooling and control systems.

Shift Toward Energy-Efficient Motors: Regulations promoting high-efficiency standards like NEMA Premium and IE4 are pushing industrial sectors to upgrade motor fleets.

Surge in HVAC Retrofits: Demand for high-performance electric motors in energy-efficient HVAC systems is growing in response to carbon reduction targets in the building sector.

Integration of Smart and IoT-Based Motor Technologies: Intelligent motors capable of remote monitoring, predictive diagnostics, and performance analytics are seeing increased adoption.

Miniaturization in Consumer Appliances and Medical Devices: The trend toward smaller, quieter, and more precise motors is accelerating in portable medical, personal care, and kitchen appliances.

Uptake in Renewable Energy Applications: Wind turbines and solar tracking systems are increasingly using brushless motors for precision and reliability.

Reshoring of Manufacturing: Domestic production of motor components is increasing as supply chain resilience becomes a national priority, backed by federal incentives.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.33 Billion |

| Market Size by 2033 | USD 65.33 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Power Output, Motor Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | ABB Ltd.; Allied Motion Technologies, Inc.; Ametek Inc.; Johnson Electric Holdings Limited; Nidec Motor Corporation; Franklin Electric Co., Inc.; Regal Rexnord Corporation; Schneider Electric; Siemens; ORIENTAL MOTOR USA CORP; WorldWide Electric Corporation |

One of the most influential drivers of the U.S. electric motor market is the sweeping electrification of the transportation sector. Driven by federal mandates, automaker commitments, and consumer demand, electric vehicles (EVs) are becoming mainstream. Each EV uses one or more electric motors to drive propulsion systems, regenerative braking, power steering, and auxiliary systems.

The Biden administration’s goal to have 50% of all new vehicle sales be electric by 2030, coupled with funding from the Inflation Reduction Act and the Bipartisan Infrastructure Law, has led to rapid expansion in domestic EV manufacturing. This has, in turn, boosted the demand for high-performance electric motors, particularly brushless DC motors and advanced AC synchronous motors.

Major OEMs like Ford and GM, as well as EV-focused startups like Rivian and Lucid Motors, are either designing motors in-house or sourcing them from advanced suppliers. The shift from internal combustion engines (ICE) to electric propulsion systems is not only transforming vehicle design but also reshaping entire supply chains for magnet materials, motor control software, and thermal management.

A key restraint facing the U.S. electric motor market is the supply chain vulnerability associated with raw materials—especially rare earth elements (REEs) such as neodymium and dysprosium used in permanent magnets. These materials are critical for producing high-efficiency motors, particularly in EVs, industrial automation, and wind turbines.

Currently, China dominates the global supply of REEs, which creates strategic risks for U.S. manufacturers. Trade tensions, export restrictions, and geopolitical uncertainties can cause price volatility and threaten supply continuity. In response, U.S. companies are investing in magnet recycling, alternative motor technologies (e.g., switched reluctance motors), and sourcing diversification.

Moreover, price instability in copper and aluminum, which are essential for motor windings, affects the overall cost structure and profitability of electric motor production. These challenges highlight the importance of sustainable material sourcing, recycling initiatives, and innovation in motor design to reduce dependency on constrained resources.

An important opportunity lies in the modernization of industrial motor systems with energy-efficient technologies. Industrial electric motors consume roughly 70% of the electricity used in manufacturing facilities. Replacing older motors with high-efficiency models, like NEMA Premium or IE4-rated motors, can significantly reduce energy costs and carbon emissions.

The U.S. Department of Energy (DOE) and utilities are incentivizing such upgrades through rebates, grants, and energy performance contracts. Smart motors integrated with variable frequency drives (VFDs) and digital twins are becoming increasingly attractive, offering dynamic load adjustment, real-time diagnostics, and predictive maintenance.

Industries such as chemical processing, food and beverage, mining, and water treatment are adopting energy-efficient motor systems to meet sustainability targets and lower total cost of ownership (TCO). This shift represents a multi-billion-dollar retrofit and replacement opportunity across thousands of facilities nationwide.

Industrial machinery leads the U.S. electric motor market by application, owing to the vast scale of automation, manufacturing, and process industries across the country. From bottling plants and textile mills to food processing and CNC machining, electric motors are indispensable for driving mechanical operations. Regulatory pressure to improve energy efficiency, reduce downtime, and lower emissions has encouraged widespread motor upgrades. The emergence of smart factories, powered by IoT and real-time data analytics, is also driving demand for intelligent motor systems in this segment.

Motor vehicles are the fastest-growing application, particularly with the surge in electric vehicle adoption. Electric motors are the heart of EV propulsion systems, providing torque, acceleration, and regenerative braking. Beyond propulsion, motors are also used in electric power steering, window lifts, and HVAC components. Major automotive OEMs are ramping up domestic EV production, leading to increased investments in motor design, control algorithms, and advanced cooling solutions. The U.S. Department of Energy projects rapid growth in EV penetration through 2030, further validating this segment’s trajectory.

AC motors dominated the U.S. electric motor market, particularly in industrial, HVAC, and residential applications. Among AC motors, induction motors hold the lion’s share due to their robustness, simplicity, and cost-effectiveness. These motors are ideal for pumps, compressors, conveyor belts, and fans. Synchronous AC motors are gaining ground in high-precision applications such as robotics and automation, where constant speed is critical. AC motors are also favored in HVAC systems, contributing to energy conservation in both commercial and residential buildings.

Brushless DC motors (BLDC) are the fastest-growing segment, driven by their application in electric vehicles, drones, and modern home appliances. BLDC motors offer high torque-to-weight ratios, better efficiency, lower noise, and extended lifespan due to the absence of brushes. Their adoption in EVs, robotics, and medical devices underscores the growing trend toward compact, intelligent, and maintenance-free motor systems. Startups and established manufacturers alike are investing heavily in BLDC technologies for niche, high-performance applications.

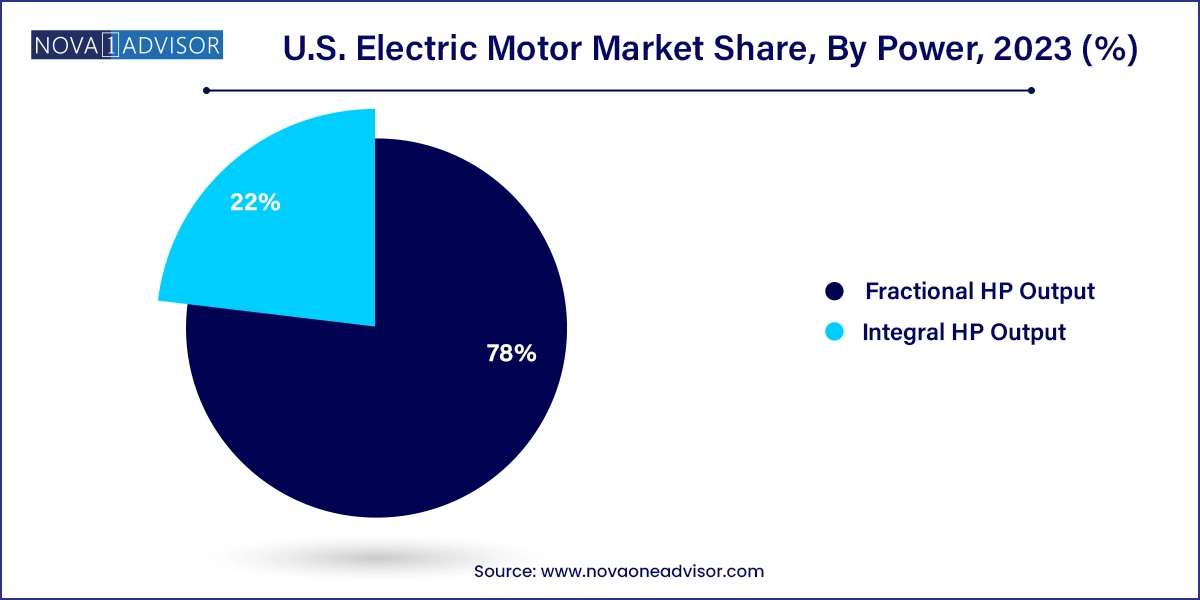

Integral horsepower (HP) motors account for the dominant market share, particularly in industrial and commercial sectors. These motors, typically rated above 1 HP, are used in elevators, heavy-duty HVAC systems, manufacturing machinery, and utility pumps. Integral HP motors are designed for continuous operation under demanding conditions, and their efficiency upgrades offer significant energy-saving potential. DOE regulations targeting motors between 1 and 500 HP have accelerated the adoption of high-efficiency integral HP models across U.S. industries.

Fractional HP motors are growing faster, especially in residential appliances, consumer electronics, and light-duty automation systems. Rated below 1 HP, these motors power fans, washing machines, electric toothbrushes, and garage door openers. The miniaturization of electronics and rising demand for quiet, energy-efficient home solutions are fueling innovation in fractional HP motors. Companies are increasingly deploying smart control systems in these motors to enhance user experience and optimize performance.

The United States stands as both a technology leader and one of the largest consumers of electric motors globally. With a strong emphasis on domestic manufacturing, energy independence, and environmental regulation, the U.S. market is seeing transformative changes. Federal investments in electrification, industrial modernization, and renewable energy are directly influencing the adoption of next-generation electric motors.

Key industrial states like Texas, California, Ohio, and Michigan drive motor demand across automotive, aerospace, and energy sectors. Meanwhile, coastal states with strong clean energy goals are pushing adoption in HVAC retrofits and smart grid infrastructure. The U.S. also hosts major R&D facilities and motor manufacturing plants operated by global companies like ABB, Siemens, and Regal Rexnord, in addition to native players like Rockwell Automation and AMETEK.

In addition, the rise of Industry 4.0 initiatives and U.S. re-industrialization policies are stimulating investment in digital motor platforms, robotics, and semiconductor-integrated drives. This positions the U.S. as a robust and innovative market for both traditional and emerging electric motor technologies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. electric motor market

Motor Type

Power Output

Application