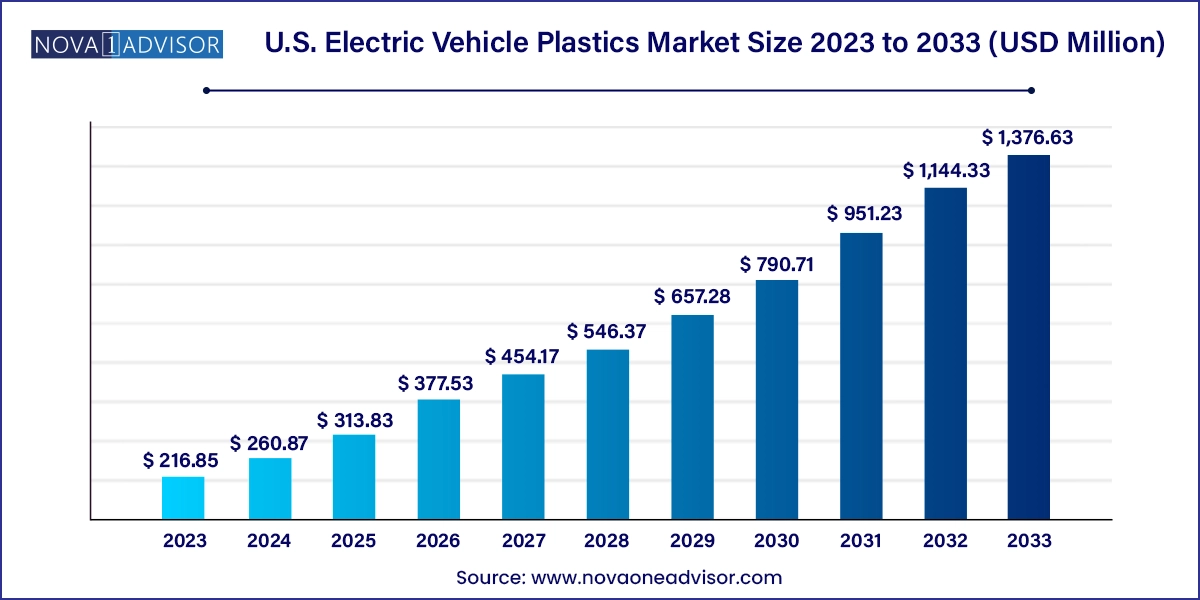

The U.S. electric vehicle plastics market size was exhibited at USD 216.85 million in 2023 and is projected to hit around USD 1,376.63 million by 2033, growing at a CAGR of 20.3% during the forecast period 2024 to 2033.

The U.S. Electric Vehicle (EV) Plastics Market has emerged as a crucial enabler of innovation and sustainability within the EV ecosystem. As the country accelerates its transition toward clean mobility, automotive manufacturers are increasingly turning to high-performance plastics to meet evolving demands for vehicle efficiency, weight reduction, design flexibility, and cost optimization. EV plastics are now central to the structural, functional, and aesthetic aspects of electric vehicles, encompassing components ranging from battery casings to dashboards and connectors.

With an increasing number of states adopting aggressive zero-emission vehicle (ZEV) mandates and consumers showing a clear preference for environmentally responsible transport options, U.S. EV manufacturers are leveraging engineered plastics to optimize vehicle range and enhance safety and durability. The light weighting potential of plastics directly contributes to better energy efficiency and longer battery life factors critical to the EV value proposition.

Moreover, the U.S. federal government has played a pivotal role in stimulating EV market growth through subsidies, tax credits, and large-scale investments in EV infrastructure. This policy momentum, coupled with rising raw material innovation and advanced polymer processing techniques, has fueled the integration of plastics in complex applications, including thermal management systems, under-hood components, and high-voltage electrical insulation. The increasing production of Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) in the U.S. is expected to significantly elevate the demand for specialized plastic materials over the coming decade.

Surging demand for lightweight materials to extend EV range: OEMs are increasingly using plastics to reduce vehicle weight, improving battery efficiency and extending driving range.

Shift toward recyclable and bio-based plastics: Sustainability concerns have triggered a growing preference for recyclable and renewable-source polymers in EV manufacturing.

Plastics replacing metal in structural components: Engineered plastics are being used in place of metal for high-stress applications like battery enclosures and structural frames.

Integration of plastics in advanced interiors: The move toward minimalistic, futuristic EV interiors has increased the use of plastics in dashboards, trims, and infotainment housing.

Plastics enabling thermal management and insulation: Specialized polymers with high thermal resistance are used in powertrain systems and high-voltage wiring.

Collaboration between automakers and polymer companies: Joint R&D initiatives between automotive OEMs and chemical manufacturers are pushing material innovation.

Growth in plastic 3D printing and injection molding for EVs: Additive manufacturing is playing a larger role in prototyping and producing custom-fit plastic components.

Increased automation and smart plastics in EVs: Electrification and digitization in vehicles are driving demand for sensor-compatible and EMI-shielding plastics.

| Report Coverage | Details |

| Market Size in 2024 | USD 260.87 Million |

| Market Size by 2033 | USD 1,376.63 Million |

| Growth Rate From 2024 to 2033 | CAGR of 20.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Resin, Component, Vehicle Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | BASF; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; LANXESS |

A major driver for the growth of the U.S. electric vehicle plastics market is the continuous industry emphasis on vehicle lightweighting as a means to improve battery efficiency and driving range. Unlike internal combustion engine (ICE) vehicles, the efficiency of EVs is tightly linked to the vehicle’s weight, as every kilogram saved translates into longer battery life or reduced battery size both critical economic and performance factors.

Advanced polymers such as polypropylene, polyamide, and polycarbonate offer superior strength-to-weight ratios and corrosion resistance compared to traditional metals like steel or aluminum. For example, Tesla’s Model 3 and Ford’s Mustang Mach-E use a significant proportion of plastic in their interiors, exteriors, and battery housing, reducing vehicle mass without compromising on performance or aesthetics. These materials not only lower overall weight but also support complex geometries and integration of multiple functions into a single part, further streamlining manufacturing and reducing costs.

Despite their advantages, plastics face scrutiny due to environmental concerns, particularly regarding their end-of-life recyclability and dependence on fossil fuels. While many engineered plastics used in EVs are durable and high-performance, they are often thermoset or thermoplastic composites that are difficult to separate and recycle effectively. As regulatory bodies and consumers push for circular economy models, the limited recyclability of mixed plastics becomes a restraint on their usage.

The automotive sector, especially in the U.S., is being held to increasingly strict sustainability standards. Without scalable solutions for the recycling of complex EV plastics especially those used in under-the-hood and electronic applications manufacturers may face increased scrutiny, legal challenges, and reputational risk. Furthermore, recycling infrastructure in the U.S. remains underdeveloped relative to the size and complexity of plastic waste streams generated by the auto industry.

A promising opportunity lies in the development and commercialization of bio-based and easily recyclable plastic materials tailored for electric vehicles. These next-generation materials are not only aligned with environmental regulations but also meet performance specifications for high-stress applications such as battery casings, powertrain systems, and structural interiors.

U.S.-based innovators and chemical giants are actively exploring biodegradable polyesters, bio-polyamides, and recyclable thermoplastic composites that can substitute traditional plastics without compromising quality. For instance, Ford has partnered with McDonald’s to use coffee chaff to create headlamp housings, showcasing the potential of agricultural waste in automotive plastic applications. As more EV manufacturers seek to align with ESG (Environmental, Social, Governance) goals, offering bio-based plastic components could become a key differentiator for suppliers and manufacturers alike.

Polypropylene (PP) held the dominant share in the U.S. electric vehicle plastics market due to its cost-effectiveness, chemical resistance, and versatility in interior and exterior applications. PP is widely used for bumpers, interior trim, door panels, and dashboards. Its lightweight nature and high impact resistance make it ideal for mass production in electric vehicles like the Chevrolet Bolt and the Nissan Leaf. Additionally, PP can be easily blended with other polymers or reinforced with fibers to enhance its structural capabilities, making it a staple material for various non-load-bearing components.

Polyamide (PA), or nylon, is among the fastest-growing resins owing to its superior thermal stability, mechanical strength, and resistance to wear. It is increasingly used in under-the-hood components, including electrical connectors, battery modules, and cable insulation. As the electrification of powertrains advances, demand for heat-resistant, high-voltage compatible plastics like PA is expected to surge. High-temperature nylons are especially vital in high-current EV charging systems, where safety and thermal management are paramount. Innovations in bio-based polyamides and PA composites further contribute to its rising adoption in next-generation EVs.

Battery-related components dominated the market due to the centrality of battery systems in EVs and the need for plastic materials that can provide insulation, flame retardancy, and mechanical stability. Polymers like PBT and PC/ABS are commonly used in battery housings, modules, and trays. Tesla’s battery enclosures, for example, utilize engineered plastics that protect against moisture ingress, thermal spikes, and vibration. Plastics are also used to integrate thermal management channels directly into the battery pack, optimizing performance and safety while reducing complexity.

Connectors and cables are among the fastest-growing components in the EV plastics market, as EVs require sophisticated wiring architectures for power electronics, infotainment, and autonomous features. These systems use plastic-insulated cables and fiber-reinforced connectors capable of withstanding high voltages and temperature variations. With EVs becoming more connected and intelligent, demand for lightweight, EMI-shielded, and flexible wiring components made from specialty plastics such as fluoropolymers and thermoplastic elastomers (TPE) is expanding rapidly.

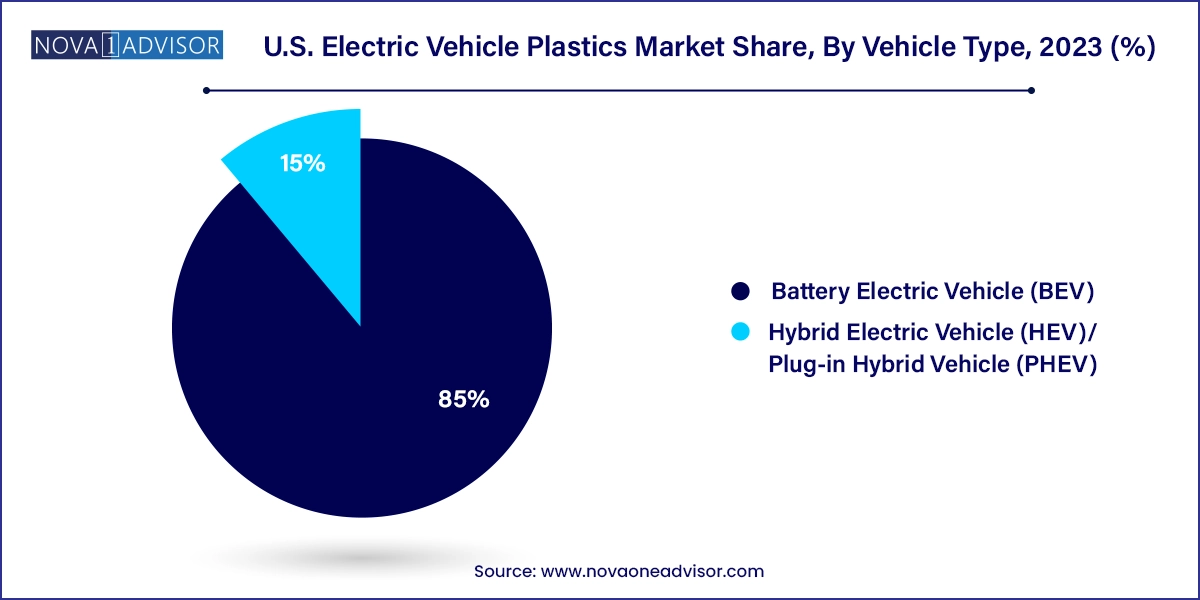

Battery Electric Vehicles (BEVs) are the dominant vehicle type in the U.S. EV plastics market, driven by aggressive policy incentives, widespread consumer adoption, and mass production models by leading automakers. BEVs, which rely entirely on electric power, require more plastic integration than HEVs or PHEVs to ensure optimal battery insulation, weight management, and modular design. Popular BEVs like the Tesla Model Y and Rivian R1T feature extensive use of plastics in interior modules, thermal management units, and chassis components to meet performance and aesthetic goals.

Plug-in Hybrid Electric Vehicles (PHEVs) are the fastest-growing segment due to their dual powertrain configuration, which presents a unique challenge for component integration and heat dissipation. These vehicles demand tailored plastic materials for battery cooling systems, electric motor housing, and hybrid control units. As brands like Toyota and Ford continue to launch new PHEV models to bridge the gap between ICEs and full-electric powertrains, the demand for multipurpose, durable plastic materials is rising swiftly in this sub-segment.

Interior applications dominated the market as EV manufacturers prioritize ergonomics, aesthetics, and functional innovation. Plastics are essential in dashboards, steering columns, infotainment panels, seat structures, and upholstery reinforcements. The minimalist and futuristic cabin designs seen in Tesla and Lucid Motors models utilize high-quality polymers that offer not just appearance but also sound absorption and fire retardancy. Plastic materials provide the flexibility needed for seamless integration of digital interfaces, ambient lighting, and other smart features in EV interiors.

Powertrain systems and under-bonnet applications are the fastest-growing application areas due to increasing technical complexity in electric drivetrains. Plastics such as PA, PBT, and PP are now being employed for motor brackets, thermal insulation components, and electronic housing within the powertrain. These materials must meet stringent requirements related to heat resistance, vibration damping, and electrical insulation. As EV architectures become more integrated and compact, plastics offer the design freedom and multifunctionality essential to next-gen powertrain systems.

The U.S. EV plastics market is heavily shaped by the country’s aggressive clean energy targets, technological leadership, and industrial base. States like California, Texas, and Michigan are driving the adoption of EVs and consequently, the consumption of EV-specific plastic materials. California leads in EV registrations and mandates, prompting OEMs and plastic suppliers to develop regional R&D and production hubs.

The U.S. automotive supply chain is undergoing a transformation with the rise of gigafactories and localized parts production. EV OEMs like Tesla, Rivian, Ford, and General Motors are investing in vertical integration, partnering with domestic and international polymer suppliers to create a reliable, high-performance, and sustainable plastic ecosystem. The infrastructure bill passed in 2021, with funds disbursed through 2024 and beyond, is catalyzing demand for localized plastic manufacturing capabilities to serve the booming EV industry.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. electric vehicle plastics market

Resin

Components

Vehicle Type

Application