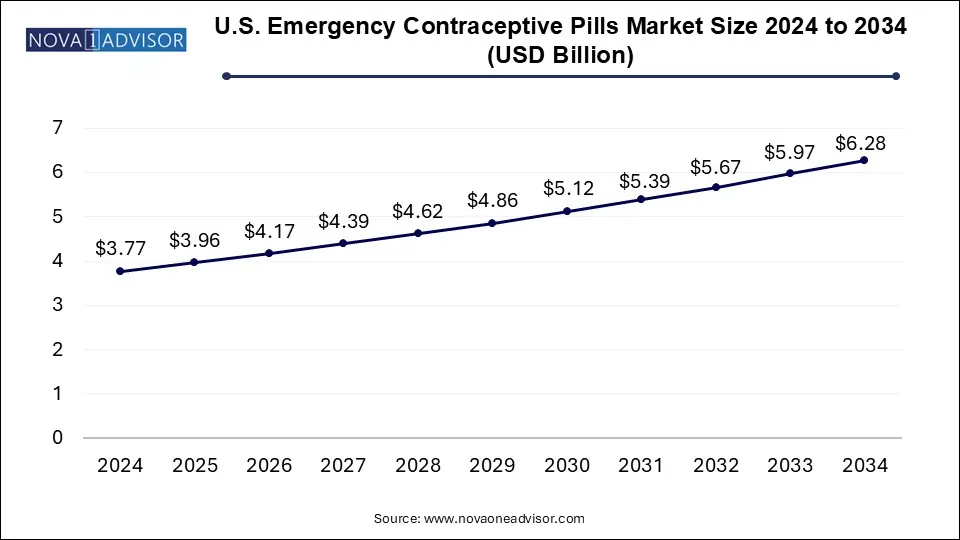

The U.S. emergency contraceptive pills (ECPs) market size was exhibited at USD 3.77 billion in 2024 and is projected to hit around USD 6.28 billion by 2034, growing at a CAGR of 5.25% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.96 Billion |

| Market Size by 2034 | USD 6.28 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.25% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Distribution Channel, Regional |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Purdue Pharma L.P.; Janssen Global Services, LLC; Hikma Pharmaceuticals PLC; Pfizer Inc.; AbbVie Inc.; Sanofi; Sun Pharmaceutical Industries Ltd.; Mallinckrodt Pharmaceuticals; Endo Pharmaceuticals; Teva Pharmaceutical Industries |

The market is witnessing growth due to the increasing awareness about contraception and family planning. Women widely use ECPs as a safe, convenient, and emergency contraception. Additionally, the market is driven by the widespread use of ECPs due to the rise in unintended pregnancies across the U.S. These factors contribute to the market's expansion and popularity among women seeking effective contraception options.

Women prefer Over-The-Counter (OTC) options that don't require prescriptions and can be easily accessed in emergencies. As abortion restrictions increased due to the overturning of the Roe v. Wade ruling, by the U.S. Supreme Court, the demand for morning-after pills has surged significantly. For instance, in June 2024, Wisp, a company that sells morning-after pills, experienced an incredible 3,000% surge in demand. These actions are positively influencing the market's growth.

Furthermore, the market is set to witness substantial growth driven by the increasing demand for OTC products. For instance, in 2019, around 15 million units of Plan B medication were sold, representing a remarkable 59% increase compared to 2018. This trend highlights the rising preference for accessible and reliable emergency contraception, further propelling the market's expansion.

The use of ECPs has significantly increased over the last two decades. The Kaiser Family Foundation analysis, from 2017 to 2019 revealed that 28% of sexually active women aged 15 to 44 have used ECPsat least once in their lives, marking a substantial rise from the 4% reported in 2002. This surge in adoption reflects growing awareness and acceptance of emergency contraception as a reliable option. As more women recognize its benefits, the market for ECPs is expected to expand further in the coming years.

The COVID-19 pandemic has negatively impacted the U.S. emergency contraceptive pills market. Reproductive health services, including the use of pre-coital contraceptives, experienced a decline due to disruptions caused by the pandemic. Supply chain disruptions in the pharmaceutical industry affected the production, distribution, and availability of emergency contraceptive pills, possibly leading to shortages or delays. Access to healthcare services, including family planning, was affected by lockdowns and overwhelmed healthcare systems, potentially limiting the availability of emergency contraceptive pills for some individuals.

The progesterone pills segment dominated the market, holding the largest revenue share of 45.3% in 2024. This segment’s growth is driven by the introduction of multiple products from various market players and their high efficacy rate of 85% when used perfectly. As a result, the Progesterone pills segment is expected to continue driving the market's growth, offering women a reliable and effective option for emergency contraception.

The combination pills segment is expected to witness the fastest CAGR during the forecast period. Combination pills, which include estrogen-progestin birth control pills, are the most used form of emergency contraception in the United States, with an efficacy rate of 75%. Its effectiveness is the key factor driving the increased demand for emergency contraception options among women. On the other hand, ulipristal acetate is expected to witness significant growth during the forecast period.

As an antiprogestin sold in the U.S. under the brand name ella, it offers emergency contraception when taken soon after intercourse, remaining effective for 120 hours. However, according to thestudy of pharmacy availability in southwestern Pennsylvania in 2021, only 5% of pharmacies had ulipristal acetate readily accessible, indicating the need for improved availability and awareness.

The retail store segment held the largest market share of 57.0% in 2024. According to the Journal of The American Pharmacists Association in 2024, around 61,715 pharmacies are operating in the U.S. These storesoffer a diverse range of products from different players, easy access to family planning services, and healthcare facilities. Additionally, factors such as the growing awareness and demand for emergency contraception are expected to fuel the segment's expansion.

The online store segment is anticipated to witness the fastest growth during the forecast period. The increasing internet accessibility and growing awareness among women about emergency contraceptives in the U.S. are driving segment growth. Despite the strong presence of e-commerce platforms, the 72-hour time constraint for consuming emergency contraceptive pills is expected to impact on online sales.

Hospital pharmacies are poised to play a significant role in providing emergency contraceptive pills, being key providers in the market. Its advantage lies in offering a comprehensive range of services under one roof, including medical prescriptions. This convenience and accessibility make them a preferred choice for women seeking emergency contraception.

The Southeast region dominated the U.S. emergency contraceptive pills market with the largest revenue share of 28.6% in 2024, primarily due to the abortion ban in the majority of the states in the region. This trend is expected to fuel the region's growth during the forecast period. According to a study published by the National Library of Medicine, Alabama has an estimated 48 per 1,000 unintended pregnancies, highlighting the need for effective contraception options.

Midwest is expected to witness the fastest growth rate during the forecast period, due to an increase in ban on abortion in the region, which has led to a greater need for accessible and effective emergency contraception options. As a result, the demand for emergency contraception in the region is expected to rise, which is expected to drive the market's expansion during the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. emergency contraceptive pills (ECPs) market

By Type

By Distribution Channel

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Market Definitions

1.2. Estimates and Forecast Timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. Nova one advisor Internal Database

1.4.3. Secondary Sources & Third-Party Perspectives

1.4.4. Primary Research

1.5. Information Analysis

1.5.1. Data Analysis Models

1.6. Market Formulation & Data Visualization

1.7. Model Details

1.7.1. Commodity Flow Analysis

1.8. List of Secondary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Trends and Outlook

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing awareness about emergency contraception methods

3.3.1.2. Rising prevalence of unintended pregnancies

3.3.1.3. Increased focus on women's health by the government and non-government organizations.

3.3.2. Market Restraint Analysis

3.3.2.1. Product recall

3.3.2.2. Adverse effects associated with the use of contraceptive drugs

3.4. Business Environment Analysis

3.4.1. PESTLE Analysis

3.4.2. Porter’s Five Forces Analysis

3.5. COVID-19 Impact Analysis

Chapter 4. Type Business Analysis

4.1. U.S. Emergency Contraceptive Pills Market: Type Movement Analysis & Market Share, 2023 - 2032

4.2. U.S. Emergency Contraceptive Pills Market: Segment Dashboard

4.3. Combination Pills

4.3.1. Combination Pills Market, 2020 - 2032

4.4. Progesterone Pills

4.4.1. Progesterone Pills Market, 2020 - 2032

4.5. Ulipristal Acetate

4.5.1. Ulipristal Acetate Market, 2020 - 2032

Chapter 5. Distribution Channel Business Analysis

5.1. U.S. Emergency Contraceptive Pills Market: Distribution Channel Movement Analysis & Market Share, 2023 - 2032

5.2. U.S. Emergency Contraceptive Pills Market: Segment Dashboard

5.3. Retail Store

5.3.1. Retail Store Market, 2020 - 2032

5.4. Online Store

5.4.1. Online Store Market, 2020 - 2032

5.5. Others

5.5.1. Others Market, 2020 - 2032

Chapter 6. Regional Business Analysis

6.1. U.S. Emergency Contraceptive Pills Market by Region, 2023 - 2032

6.2. Northeast

6.2.1. Northeast Market, 2020 - 2032

6.3. Southeast

6.3.1. Southeast Market, 2020 - 2032

6.4. Midwest

6.4.1. Midwest Market, 2020 - 2032

6.5. West

6.5.1. West Market, 2020 - 2032

6.6. Southwest

6.6.1. Southwest Market, 2020 - 2032

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Strategy Mapping

7.2.1. Expansion

7.2.2. Acquisition

7.2.3. Collaborations

7.2.4. New Product Launches

7.2.5. Others

7.3. Company Profiles/Listing

7.3.1. Afaxys Pharma LLC

7.3.1.1. Overview

7.3.1.2. Financial Performance

7.3.1.3. Product Benchmarking

7.3.1.4. Strategic Initiatives

7.3.2. Teva Pharmaceutical Industries Ltd.

7.3.2.1. Overview

7.3.2.2. Financial Performance

7.3.2.3. Product Benchmarking

7.3.2.4. Strategic Initiatives

7.3.3. Syzygy Healthcare, LLC

7.3.3.1. Overview

7.3.3.2. Financial Performance

7.3.3.3. Product Benchmarking

7.3.3.4. Strategic Initiatives

7.3.4. Gedeon Richter USA, Inc.

7.3.4.1. Overview

7.3.4.2. Financial Performance

7.3.4.3. Product Benchmarking

7.3.4.4. Strategic Initiatives

7.3.5. Rapha Pharmaceuticals, Inc.

7.3.5.1. Overview

7.3.5.2. Financial Performance

7.3.5.3. Product Benchmarking

7.3.5.4. Strategic Initiatives

7.3.6. Perrigo Company plc.

7.3.6.1. Overview

7.3.6.2. Financial Performance

7.3.6.3. Product Benchmarking

7.3.6.4. Strategic Initiatives

7.3.7. Foundation Consumer Healthcare LLC

7.3.7.1. Overview

7.3.7.2. Financial Performance

7.3.7.3. Product Benchmarking

7.3.7.4. Strategic Initiatives

7.3.8. Wockhardt USA

7.3.8.1. Overview

7.3.8.2. Financial Performance

7.3.8.3. Product Benchmarking

7.3.8.4. Strategic Initiatives

7.3.9. Pfizer Inc.

7.3.9.1. Overview

7.3.9.2. Financial Performance

7.3.9.3. Product Benchmarking

7.3.9.4. Strategic Initiatives

7.3.10. Bayer plc

7.3.10.1. Overview

7.3.10.2. Financial Performance

7.3.10.3. Product Benchmarking

7.3.10.4. Strategic Initiatives