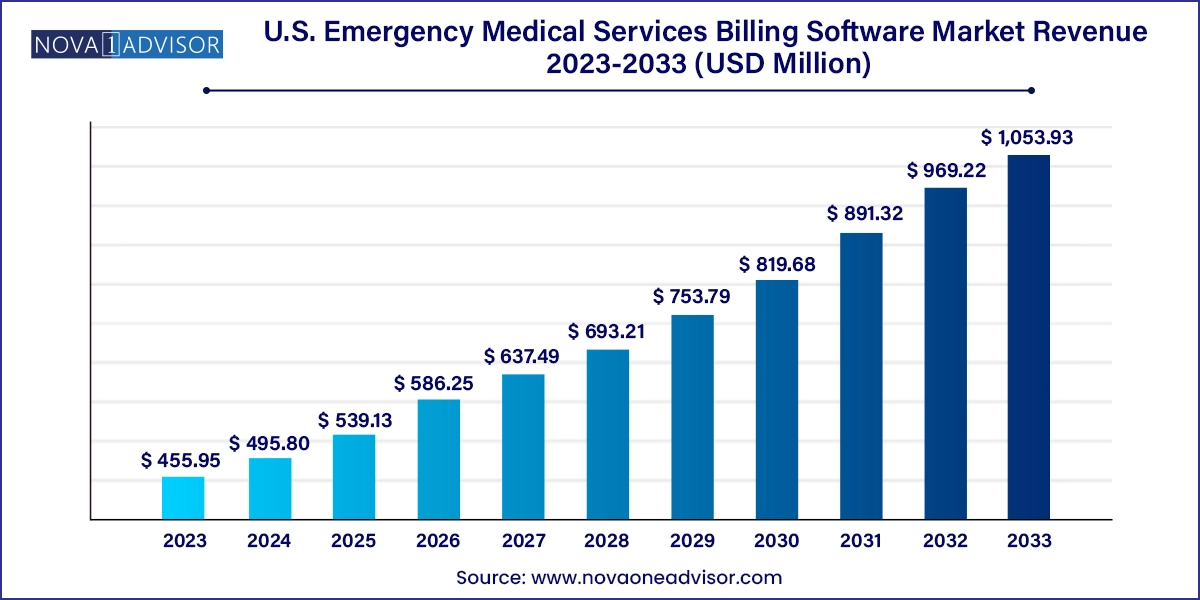

The U.S. emergency medical services billing software market size was exhibited at USD 455.95 million in 2023 and is projected to hit around USD 1,053.93 million by 2033, growing at a CAGR of 8.74% during the forecast period 2024 to 2033.

The U.S. Emergency Medical Services (EMS) Billing Software Market is a vital component of the nation’s healthcare revenue cycle ecosystem, serving as the financial backbone of emergency response services. EMS billing software is specifically designed to handle the complex and often fragmented reimbursement workflows associated with ambulance transportation and paramedic interventions. It ensures accurate coding, claims submission, documentation, compliance with government regulations (such as HIPAA and Medicare), and follow-up for payment collection.

As healthcare systems and EMS providers face increasing pressure to maximize revenue and minimize administrative overhead, the adoption of dedicated EMS billing platforms has accelerated. This demand is particularly high among municipal fire departments, private ambulance companies, and hospital-based EMS operations. These entities require specialized solutions that can handle multi-payer environments, integrate with electronic patient care reporting (ePCR), manage denial resolutions, and maintain compliance with ever-evolving billing codes like ICD-10, NEMSIS, and HCPCS.

In recent years, the digital transformation of EMS agencies has driven a transition from traditional paper-based billing or general-purpose medical billing systems to tailored EMS billing software that supports both in-house and outsourced workflows. Advanced platforms are now equipped with AI-powered analytics, real-time reporting, and cloud-based deployment, allowing providers to reduce claim denials and optimize collections.

The EMS billing software market in the United States is strategically important not only because of its role in ensuring financial sustainability for EMS agencies, but also due to the increasing cost burden of emergency services and the need to capture every billable aspect of care and transportation efficiently.

Adoption of Cloud-Based and SaaS Billing Platforms: Providers are moving away from on-premise systems toward flexible, scalable, and secure cloud billing environments.

Integration with ePCR and CAD Systems: Seamless data exchange between Computer-Aided Dispatch (CAD), Electronic Patient Care Reports (ePCR), and billing platforms improves coding accuracy and speeds up reimbursement.

AI and Automation in Claims Processing: Intelligent claim scrubbers, predictive denials, and auto-coding features are increasingly embedded in platforms to reduce manual effort and enhance accuracy.

Shift Toward Outsourced Billing Models: Agencies are outsourcing billing operations to specialized vendors to reduce costs and improve revenue cycle performance.

Enhanced Compliance and Audit Features: Built-in features to manage CMS compliance, NEMSIS standards, and support for HIPAA audit trails are becoming a must-have.

Use of Analytics for Revenue Optimization: Dashboards and business intelligence tools are being used to monitor KPIs like days in A/R, denial rates, and payment timelines.

Billing for Community Paramedicine and Mobile Integrated Health (MIH): New EMS models offering non-transport care are requiring software capable of tracking alternate care codes and billing structures.

Mobile-Friendly Interfaces for Field Access: Integration of billing insights and patient data into mobile apps is increasing to allow better communication between billing departments and field medics.

| Report Coverage | Details |

| Market Size in 2024 | USD 495.80 Million |

| Market Size by 2033 | USD 1,053.93 Million |

| Growth Rate From 2024 to 2033 | CAGR of 8.74% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component and Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | MEDAPOINT (MP CLOUD TECHNOLOGIES), eso, Ambubill - Ambulance Billing Service., AIM EMS SOFTWARE & SERVICES, ImagineSoftware, Technology Partners, LLC, Change Healthcare, Isalus Healthcare, Lexipol (EMS1), iTech Workshop Pvt Ltd, Kareo, Inc., AdvancedMD, Inc., Digitech Computer LLC, Intermedix (R1 RCM), Wittman Enterprises, LLC, Traumasoft, and ZOLL Medical Corporation |

One of the most significant drivers of the U.S. EMS billing software market is the increasing complexity of EMS reimbursement frameworks, especially within Medicare, Medicaid, and commercial insurance plans. Reimbursement now depends heavily on detailed documentation, appropriate code usage (such as A0429 or A0427), and transport justification, which must be captured accurately from the field to the backend billing system.

Further complicating matters are state-level Medicaid programs that vary in their billing rules, prior authorization requirements, and documentation standards. New CMS initiatives like the Emergency Triage, Treat, and Transport (ET3) model add further layers of reimbursement criteria, encouraging non-transport billing for specific encounters.

This multifaceted reimbursement landscape mandates the use of sophisticated software solutions that can streamline coding workflows, flag missing documentation, automate eligibility checks, and handle pre-bill audits. As billing errors can lead to compliance violations or denials, EMS agencies are increasingly investing in dedicated platforms like ZOLL Billing, Digitech, and ESO Billing to improve claim integrity and speed up revenue realization.

A critical restraint in the EMS billing software space is the heightened risk of data breaches and integration difficulties with legacy systems. EMS billing systems process sensitive patient data, insurance information, and financial records—all of which fall under HIPAA regulations. With the growing use of cloud-based platforms and remote access, the risk of cyberattacks, unauthorized access, and ransomware threats has increased.

Many EMS providers also operate with outdated or poorly integrated CAD and ePCR systems, making seamless billing integration a challenge. Lack of standardization in data fields, NEMSIS compliance levels, and incomplete or delayed patient data can delay the billing process or lead to denied claims. Smaller municipal EMS agencies may lack the in-house IT resources to implement secure, scalable platforms or maintain the necessary data protection infrastructure.

These factors pose a barrier to market penetration for new vendors and require ongoing investment in encryption, role-based access control, and interoperability standards to ensure secure and efficient system performance.

An emerging opportunity in the U.S. EMS billing software market lies in the rapid growth of outsourced billing services, particularly among small to mid-sized EMS agencies that lack internal billing expertise or infrastructure. The high fixed cost of hiring skilled billing professionals, training them on ever-changing payer rules, and maintaining compliance audits has pushed many providers toward third-party vendors.

Outsourced billing firms—such as Quick Med Claims, Change Healthcare, and Digitech—offer turnkey solutions that bundle software access with end-to-end billing, denial management, and analytics services. These models free up operational staff from administrative burdens and allow EMS agencies to focus more on patient care.

Outsourcing is especially appealing in rural and volunteer-based EMS environments, where agencies may handle a few thousand transports annually but still require accurate and timely reimbursement to sustain operations. Vendors that can offer modular pricing, real-time claim tracking, and transparent performance dashboards are well-positioned to capture this expanding segment.

Outsourced billing services dominate the market, accounting for a larger share of EMS billing due to the need for revenue maximization and reduced administrative overhead. Municipal agencies and mid-sized EMS providers in the U.S. often find it more efficient and cost-effective to partner with professional billing companies. These vendors specialize in navigating Medicare audits, complex payer rules, and denial appeals, leading to improved cash flow and reduced days in accounts receivable (A/R).

In contrast, in-house billing solutions are the fastest-growing segment, driven by larger EMS agencies, hospital-affiliated providers, and private ambulance companies looking to maintain tighter control over their revenue cycle. These organizations typically have dedicated billing departments and prefer integrated solutions like ZOLL AR Boost or ESO Revenue Services, which align seamlessly with their ePCR and dispatch systems. The in-house model offers customization, direct oversight, and data security—particularly appealing in high-volume urban EMS systems.

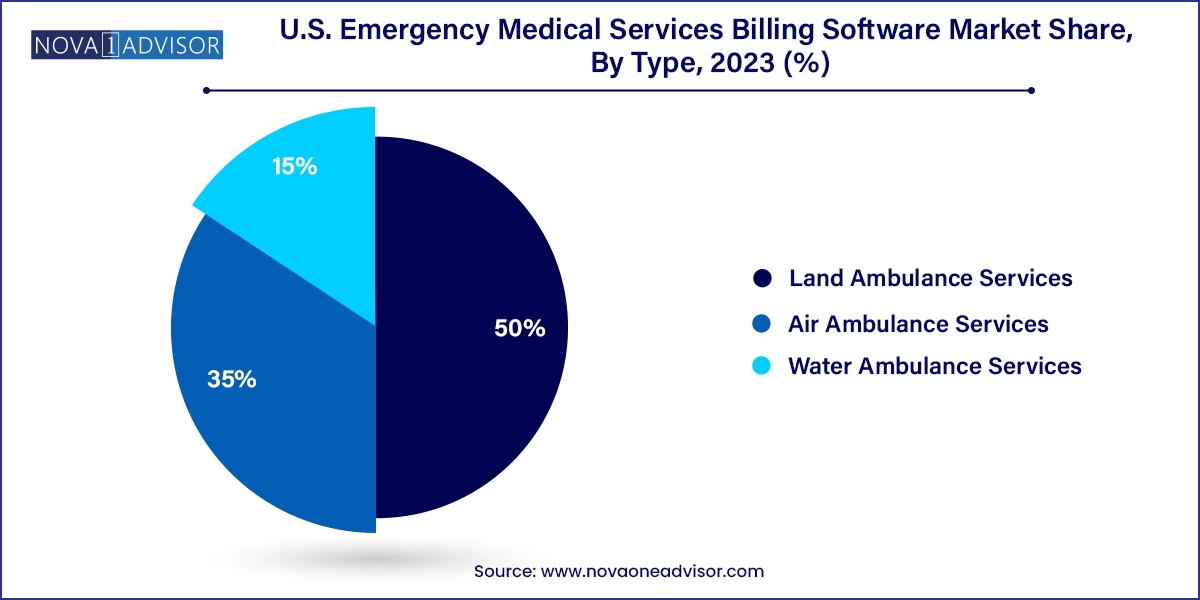

Land ambulance services represent the dominant segment, given that over 90% of EMS transports in the U.S. are conducted via ground ambulances. Billing software for land EMS must support various levels of service coding (BLS, ALS1, ALS2), mileage charges, medical necessity documentation, and prior authorization tracking. Urban areas like New York City, Los Angeles, and Chicago see thousands of daily transports that require automated, rules-based billing systems.

Air ambulance services are the fastest-growing sub-segment, particularly due to their higher cost, complex payer negotiations, and rising use in rural trauma scenarios. Air medical billing involves multiple billable components—flight crew, aircraft usage, specialty equipment—which often exceed $20,000 per transport. Vendors offering solutions tailored to air EMS billing, such as AIM EMS Software, are finding increased demand from helicopter and fixed-wing operators.

Water ambulance services remain niche but are relevant in coastal states like Florida, Louisiana, and Alaska, where specialized software is used to bill marine or island-based transports. These require adaptability to multi-agency data capture and marine transport regulations.

In the United States, the EMS billing software market is shaped by a patchwork of payer systems, regulatory frameworks, and operational models. The demand for automated billing tools is highest in metropolitan areas with large transport volumes, integrated dispatch systems, and government mandates for electronic documentation.

California, Texas, and Florida represent leading EMS markets, with thousands of agencies operating across public and private models. Major urban EMS systems like FDNY, Boston EMS, and Chicago Fire Department EMS utilize enterprise-level billing systems tightly integrated with their CAD and ePCR platforms.

States with Medicaid expansion (such as California and New York) see higher volumes of public payer claims, requiring software platforms to accommodate unique reimbursement criteria and documentation for low-income populations. Meanwhile, rural EMS agencies in states like Montana, North Dakota, and West Virginia rely on cloud-based or outsourced models to handle billing efficiently with limited staff.

Federal initiatives like ET3 and Surprise Billing Regulations under the No Surprises Act (2022) have also reshaped EMS billing practices, requiring software providers to offer cost transparency, consent management, and alternative care billing modules.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. emergency medical services billing software mark

Component

Type