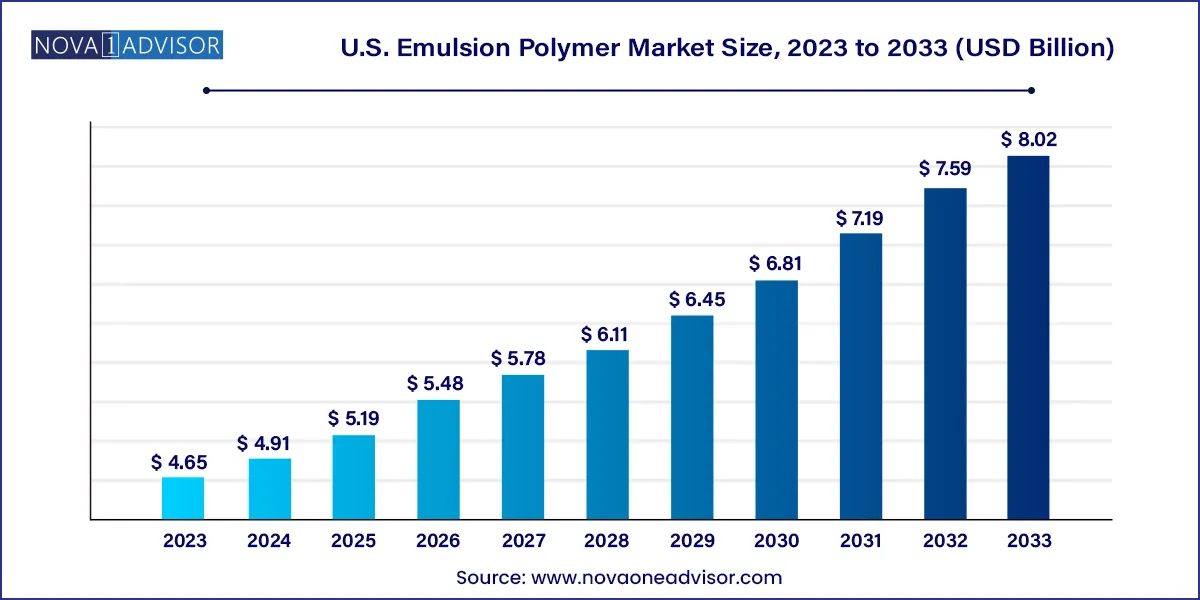

The U.S. emulsion polymer market size was exhibited at USD 4.65 billion in 2023 and is projected to hit around USD 8.02 billion by 2033, growing at a CAGR of 5.6% during the forecast period 2024 to 2033.

The U.S. Emulsion Polymer Market represents a critical segment within the broader polymer and chemical industry, underpinning a wide range of applications such as paints and coatings, adhesives, sealants, paper, textiles, and construction materials. Emulsion polymers are colloidal dispersions of synthetic or natural polymers in water and are typically formed via emulsion polymerization, an environmentally friendly and cost-efficient process that allows for the creation of polymers with controlled molecular weights and particle sizes.

The demand for emulsion polymers in the United States has steadily increased, driven by their essential role in the formulation of low-VOC (Volatile Organic Compounds) products, aligning with the country's stringent environmental regulations. Unlike solvent-based systems, emulsion polymer systems provide comparable, and often superior, performance with minimal environmental impact. This makes them particularly valuable in sectors like construction and automotive, where regulatory compliance and sustainability are paramount.

The U.S. is a major global innovator in emulsion polymer chemistry, benefiting from robust R&D capabilities, advanced production infrastructure, and strong linkages with downstream industries. Innovations in green chemistry, nanotechnology, and functional coatings are expected to further elevate the role of emulsion polymers across emerging applications, including flexible electronics, smart textiles, and advanced adhesives.

Surge in Water-Based Coating Applications: Emulsion polymers are the backbone of water-based paints, which are seeing a boom in both residential and commercial construction.

Growing Preference for Low-VOC and Green Materials: Demand for environmentally safe and non-toxic formulations is pushing manufacturers toward waterborne emulsion systems.

Innovation in Smart Coatings: Functional polymers with self-healing, antimicrobial, or conductive properties are gaining traction, especially in high-tech and healthcare applications.

Adoption in Sustainable Packaging Solutions: Paper & paperboard packaging incorporating emulsion polymers is replacing plastic films in line with ESG goals.

Integration of Renewable Feedstocks: Bio-based acrylics and styrene alternatives are entering the U.S. market as replacements for petroleum-derived monomers.

Advancements in High-Solids and Hybrid Emulsions: These enable superior durability and performance in harsh environments such as industrial flooring or marine coatings.

Digital Printing and Textile Market Expansion: Emulsion polymers are increasingly used in ink binders and textile coatings for durable, washable, and colorfast finishes.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.91 Billion |

| Market Size by 2033 | USD 8.02 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End-use, |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | OMNOVA Solutions; Trinseo; Mallard Creek Polymers, Inc.; Specialty Polymers Inc.; STI Polymer; Engineered Polymer; Solutions; Celanese Corporation; The Dow Chemical Co.; 3M; Arkema Group.; Asahi Kasei Corporation; Solvay Chemicals, Inc. |

A key driver of the U.S. emulsion polymer market is the push for environmentally safer and low-emission formulations, particularly in coatings and adhesive systems. Federal and state-level regulatory bodies such as the Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) have implemented strict limits on the use of VOCs in industrial and consumer products.

As a result, waterborne emulsion polymers especially acrylics and vinyl acetate copolymers have become the preferred choice for formulators looking to meet compliance without compromising performance. In industries like construction, automotive refinishing, and interior décor, manufacturers are replacing solvent-based products with emulsion-based alternatives to avoid penalties, reduce hazardous waste, and support sustainability certifications such as LEED (Leadership in Energy and Environmental Design).

Furthermore, public and corporate demand for greener products is growing. U.S. consumers are becoming more conscious of health risks associated with VOC exposure, prompting brands to reformulate with emulsion polymers to maintain market credibility and customer trust.

Despite robust demand, the U.S. emulsion polymer market is vulnerable to fluctuations in raw material availability and pricing, particularly for key monomers such as styrene, butadiene, acrylates, and vinyl acetate. These petrochemical-derived inputs are subject to global supply chain volatility, geopolitical factors, and refinery shutdowns.

The market has also been impacted by logistics challenges, especially during and following the COVID-19 pandemic. Port congestion, trucking labor shortages, and container backlogs have led to inconsistent supply and increased costs. For smaller manufacturers, this can lead to reduced margins or production delays, making them less competitive.

While some companies are turning to bio-based or alternative feedstocks, the commercial-scale availability of such inputs in the U.S. is still nascent, and pricing remains a barrier for widespread substitution.

A significant opportunity in the U.S. emulsion polymer market lies in their growing application across specialty and high-performance markets, particularly in smart coatings, automotive sealants, 3D printing inks, and wearable electronics. These emerging applications require customized emulsion polymers with properties such as conductivity, elasticity, flame retardancy, or UV stability.

In the construction sector, for instance, emulsion polymers are being formulated into elastomeric coatings for energy-efficient roofing systems and into advanced adhesives for modular and prefab construction materials. Similarly, in the automotive sector, they are being used in lightweight composite parts, underbody coatings, and interior components that reduce weight and improve fuel efficiency.

In healthcare and biotech, emulsion polymer-based coatings are used on medical textiles, antimicrobial surfaces, and even controlled drug delivery systems. The ability of emulsion polymers to be tailored to niche performance specifications, while maintaining a water-based, low-emission profile, positions them as versatile candidates for future innovations across sectors.

Paints and coatings held the dominant share, accounting for a substantial portion of emulsion polymer consumption in the U.S. market. This segment is fueled by strong demand from the residential, commercial, and industrial construction sectors, where emulsion polymers are used in interior and exterior paints, roof coatings, floor finishes, and protective coatings. Water-based paints using acrylic and vinyl acetate emulsions have become the norm, replacing traditional solvent-based systems due to environmental concerns and application safety.

Adhesives and sealants represent the fastest-growing application, thanks to rising demand in automotive manufacturing, electronics, medical devices, and green construction materials. Emulsion polymers such as vinyl acetate-ethylene (VAE) and acrylic copolymers offer excellent adhesion on a variety of surfaces and are being adopted in flooring systems, wall panels, and modular housing assemblies. The U.S. push for energy-efficient homes and buildings has also increased demand for emulsion-based sealants with low thermal conductivity and high elasticity.

Building and construction remained the leading end-use segment, benefiting from renewed infrastructure spending, increased housing starts, and growing interest in green building materials. Emulsion polymers are used in tile adhesives, moisture barriers, EIFS systems (Exterior Insulation and Finish Systems), and decorative coatings. Their compatibility with substrates like concrete, wood, drywall, and even composite materials gives them a firm foothold in a sector looking for flexible, safe, and sustainable solutions.

Automotive is emerging as the fastest-growing end-use, due to lightweighting initiatives, enhanced interior comfort standards, and the rise of electric vehicles (EVs). Emulsion polymers are used in underbody coatings, interior trim adhesives, acoustic insulation, and high-durability paint systems. As EVs continue to reshape vehicle design, the demand for waterborne, non-toxic materials that perform under thermal stress will open new frontiers for emulsion polymers.

Acrylic polymers dominated the market, holding the largest share due to their excellent weatherability, transparency, UV resistance, and adhesive strength. These characteristics make acrylic-based emulsion polymers ideal for paints and coatings, construction adhesives, pressure-sensitive adhesives (PSAs), and nonwoven applications. In the U.S., acrylic emulsions are also widely used in elastomeric wall coatings that withstand freezing and thawing cycles, a key need in northern climates. Furthermore, the proliferation of clear, non-yellowing coatings in consumer goods and automotive interiors has solidified acrylics’ leadership.

Styrene-butadiene latex (SBL) is the fastest-growing type, driven by its expanding use in paper coatings, carpeting, and construction sealants. The rebound in commercial printing and packaging demand, along with the growing popularity of sustainable, paper-based solutions, has revived interest in SBL for high-gloss, ink-receptive surfaces. Additionally, SBL’s cost-effectiveness and flexibility are gaining attention in concrete and asphalt modification for infrastructure projects supported by federal investments under initiatives like the Infrastructure Investment and Jobs Act (IIJA).

As the sole focus of this analysis, the U.S. emulsion polymer market is characterized by high technical sophistication, regulatory enforcement, and demand diversity. States like California, Texas, Illinois, and New York serve as major production and consumption hubs, driven by their industrial activity, population density, and construction volume.

California’s stringent VOC regulations and sustainability mandates make it a leader in green coatings and adhesives. Meanwhile, states with strong manufacturing footprints—such as Michigan and Ohio—are expanding use in automotive and industrial applications.

The U.S. market is also supported by robust academic-industry collaboration, government funding for sustainable chemistry, and a growing network of pilot plants and test facilities that facilitate commercial scaling of next-generation emulsion polymer technologies.

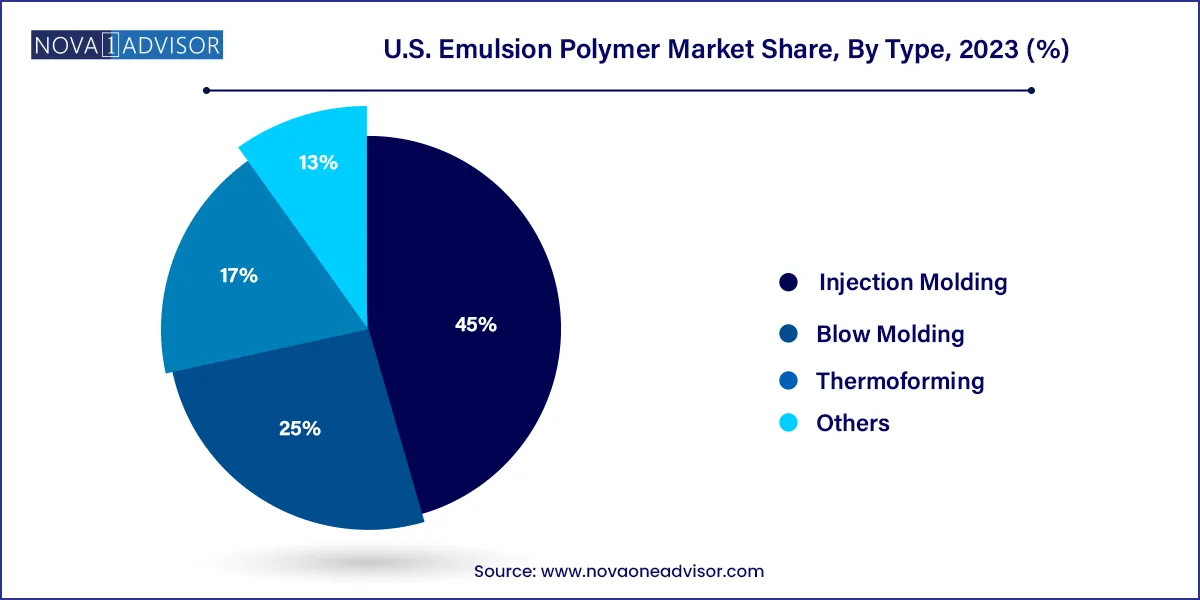

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. emulsion polymer market

Type

Application

End-use