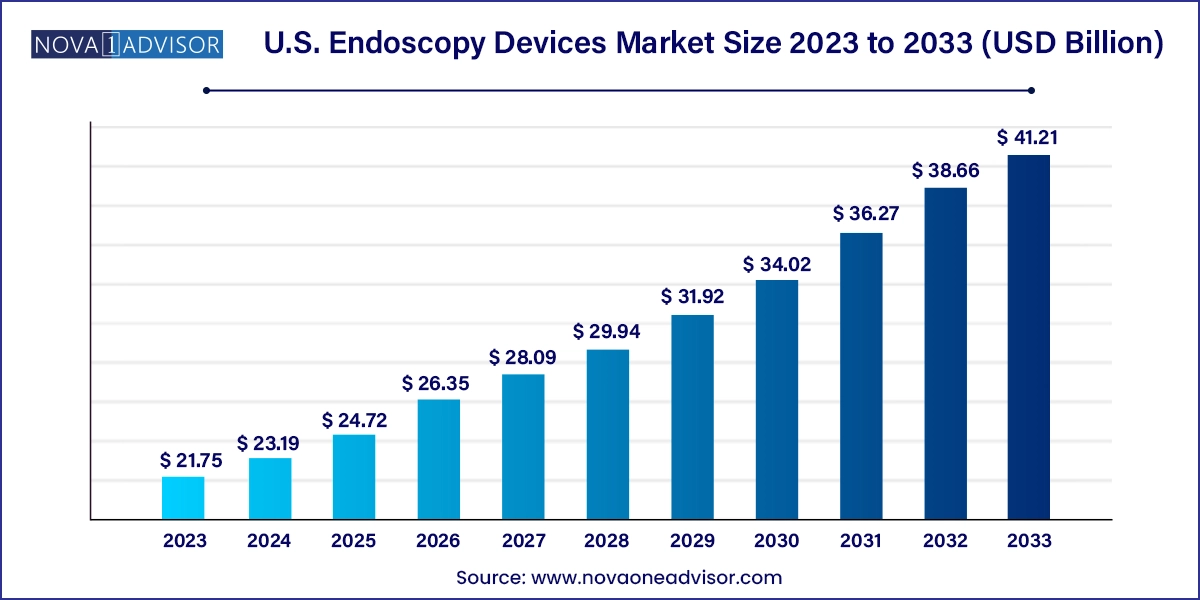

The U.S. endoscopy devices market size was exhibited at USD 21.75 billion in 2023 and is projected to hit around USD 41.21 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

The U.S. endoscopy devices market is a dynamic and essential component of the broader medical devices landscape, driven by rapid technological innovation, increasing procedural volumes, and a shift toward minimally invasive interventions. Endoscopic procedures are now considered standard in the diagnosis and treatment of gastrointestinal (GI), urological, gynecological, orthopedic, and respiratory conditions. As the U.S. healthcare ecosystem continues to emphasize cost-effectiveness, improved patient outcomes, and faster recovery times, demand for advanced and specialized endoscopic devices is surging.

Endoscopy involves inserting a thin, flexible or rigid tube equipped with a light and camera called an endoscope into the body to visualize internal organs and perform surgical interventions without large incisions. Devices in this market include the endoscopes themselves (rigid, flexible, capsule-based, and robot-assisted), endoscopic visualization systems, and operative tools such as insufflators, energy devices, and irrigation systems.

Within the United States, factors such as aging population demographics, rising incidence of chronic diseases like colorectal cancer and gastroesophageal reflux, and growing preference for outpatient procedures have significantly expanded the utility of endoscopic devices across hospitals and ambulatory surgical centers. The post-pandemic resurgence of elective procedures and increased investments in surgical infrastructure are further fueling market demand.

In addition, U.S.-based device manufacturers and healthcare providers are at the forefront of endoscopic innovation, leading global efforts in robotic integration, AI-powered image analysis, and single-use endoscopes to prevent cross-contamination. As regulatory bodies, including the U.S. FDA, increasingly support advanced device approvals and safety protocols, the endoscopy market is poised for sustained growth and disruption.

Surge in Adoption of Disposable Endoscopes: Hospitals and clinics are moving toward single-use endoscopes to minimize infection risk and reduce reprocessing costs.

Robot-Assisted Endoscopy Expansion: The integration of robotic arms and navigation systems is enhancing precision in endoscopic surgeries, particularly in urology and gastroenterology.

AI Integration in Visualization Systems: Artificial intelligence is being embedded in image processing units to assist with polyp detection, tissue characterization, and surgical planning.

Outpatient Shift of Endoscopic Procedures: More procedures are being conducted in outpatient and ambulatory surgical centers due to lower costs and faster patient turnover.

Growth of Capsule Endoscopy: Non-invasive diagnostic methods like swallowable capsules are becoming popular for small intestine imaging and colorectal screenings.

Emphasis on Ergonomics and Lightweight Devices: Manufacturers are designing lighter and more ergonomic scopes to reduce surgeon fatigue during lengthy procedures.

Miniaturization and Multi-Channel Scope Innovation: There is a push for slimmer scopes with multiple working channels to increase procedural versatility and access hard-to-reach anatomy.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.19 Billion |

| Market Size by 2033 | USD 41.21 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Johnson & Johnson (Ethicon Endo-Surgery, Inc.); Stryker Corporation; Boston Scientific Corporation; CONMED; Medtronic PLC; Fujifilm Holdings Corporation; Olympus Corporation; KARL STORZ SE & Co. KG; Richard Wolf GmbH; Cook Medical |

The strongest driver for the U.S. endoscopy devices market is the escalating demand for minimally invasive surgical (MIS) techniques, which offer significant benefits over traditional open surgeries. Endoscopic procedures typically result in reduced blood loss, shorter hospital stays, less postoperative pain, and faster recovery. This is particularly relevant in an aging population, where patients often have multiple comorbidities and require lower-risk surgical interventions.

As patient awareness about minimally invasive options increases and payers incentivize cost-effective care, hospitals and outpatient facilities are rapidly adopting endoscopic solutions across various specialties from laparoscopic cholecystectomy to arthroscopic knee repair and endoscopic sinus surgery. Technological advancements in HD/3D imaging, precision instruments, and integrated operative platforms are making these procedures more accessible and clinically effective, further driving market growth.

Despite growing adoption, a primary restraint in the U.S. endoscopy market is the high capital expenditure and ongoing maintenance associated with endoscopy equipment, particularly for high-definition and robotic systems. Hospitals must invest in endoscopes, visualization towers, camera heads, processors, monitors, and sterile reprocessing equipment, which collectively represent a significant financial commitment.

In addition, reusable endoscopes require rigorous reprocessing protocols to meet infection control standards, which adds operational complexity, labor costs, and potential liability in case of contamination. Smaller facilities or those with limited budgets may find it challenging to maintain a fully updated endoscopy suite or justify investment in newer robotic or AI-powered systems. While disposable endoscopes offer a solution, they often carry a higher per-unit cost, creating a cost-benefit dilemma for providers.

A major opportunity for market expansion lies in the rising volume of endoscopic procedures conducted in outpatient and ambulatory surgical centers (ASCs). These facilities offer cost-effective alternatives to hospitals, with streamlined scheduling, lower overheads, and quicker patient discharge. As regulatory frameworks such as CMS support reimbursement for more outpatient procedures, endoscopy providers are increasingly investing in portable, compact, and high-throughput devices suited for these settings.

Manufacturers have an opportunity to design integrated visualization towers, lightweight endoscopes, and bundled toolkits tailored for the ASC model. Innovations in single-use scopes, battery-operated insufflators, and wireless image transmission further enhance the potential for outpatient-friendly solutions. This trend aligns with the broader healthcare shift toward value-based care, and vendors that cater to the outpatient segment are likely to capture significant market share over the next decade.

Endoscopes represent the dominant product segment in the U.S. endoscopy devices market. Among these, flexible endoscopes hold the largest share, driven by their widespread application in gastrointestinal, pulmonary, and urological procedures. Flexible endoscopes such as bronchoscopes, colonoscopes, and ureteroscopes are favored due to their ability to navigate complex anatomical pathways, allowing for comprehensive diagnostic and therapeutic interventions. Additionally, continuous upgrades in imaging resolution, channel design, and distal tip articulation make flexible scopes a cornerstone of modern endoscopic practice.

In parallel, disposable endoscopes are the fastest-growing product segment, especially in infection-sensitive specialties such as urology and respiratory medicine. Disposable bronchoscopes and ureteroscopes are gaining traction in intensive care units (ICUs), outpatient clinics, and emergency settings. These single-use devices mitigate the risks associated with cross-contamination and reduce reliance on costly and time-consuming reprocessing infrastructure. The COVID-19 pandemic accelerated adoption, and ongoing innovations in imaging clarity and cost-efficiency are propelling this category into mainstream usage.

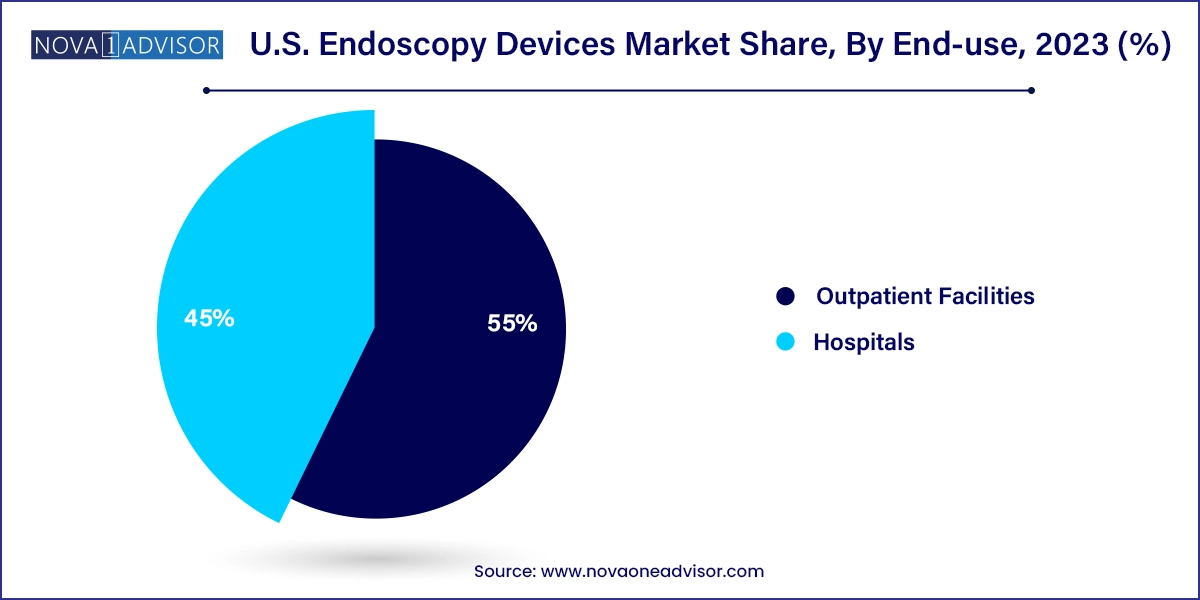

Hospitals dominate the end-use landscape, accounting for the majority of endoscopic procedures in the U.S. Large tertiary care centers and academic hospitals are equipped with advanced endoscopy suites and multidisciplinary teams capable of performing complex laparoscopic, gastrointestinal, neurological, and gynecological interventions. Hospitals also manage a high proportion of emergency procedures, inpatients with comorbidities, and high-risk patients, making them critical hubs for endoscopic technologies.

However, outpatient facilities and ambulatory surgical centers (ASCs) represent the fastest-growing end-use segment. As reimbursement models evolve and patients seek convenience, these facilities are increasingly preferred for elective and low-risk procedures such as colonoscopies, hysteroscopies, and diagnostic bronchoscopies. ASCs benefit from lower overhead costs and quicker turnover, creating demand for portable, easy-to-disinfect, and economically packaged endoscopy solutions. Vendors that provide modular systems, disposable tools, and training support for these centers are witnessing a significant uptick in adoption.

In the United States, the endoscopy devices market benefits from a sophisticated healthcare ecosystem, high procedure volumes, and a strong innovation pipeline. According to the American Cancer Society, colon cancer screenings alone account for millions of endoscopic procedures annually, supported by national campaigns such as the USPSTF colorectal screening guidelines. Similarly, growing awareness about GERD, obesity-related GI disorders, and lung cancer screening is expanding the pool of patients undergoing endoscopy.

State-of-the-art hospitals in New York, California, Texas, and Florida are investing in AI-guided image processors, robotic-assisted endoscopic systems, and real-time analytics. Moreover, the FDA’s streamlined approval pathways for medical devices, along with increasing Medicare and private insurer coverage for minimally invasive procedures, facilitate technology adoption across public and private healthcare providers.

Academic research centers and large health systems are also collaborating with device companies for clinical trials, further strengthening the U.S.'s leadership in global endoscopic innovation. As private equity and corporate healthcare entities invest in outpatient facilities and GI specialty groups, the demand for tailored endoscopy devices across care settings continues to grow.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. endoscopy devices market

Product

End-use